Energy

Russian Sanctions Force Exxon to Pull Out of Arctic Project

Published:

Last Updated:

Under the latest round of sanctions, foreign oil companies are barred from providing equipment, technology, or assistance to Russian firms to support deepwater, offshore, or shale projects. Because Russia has not developed significant expertise in these areas yet, the ban effectively brings such projects to a grinding halt.

Another new sanction against the Russian oil companies — Gazpromneft, Transneft, and Rosneft — forbids European banks from lending to the companies on maturities of more than 30 days. Russia’s five state-controlled banks, which have been allowed to raise funds on maturities up to 90 days, will also see their maximum maturities cut to 30 days.

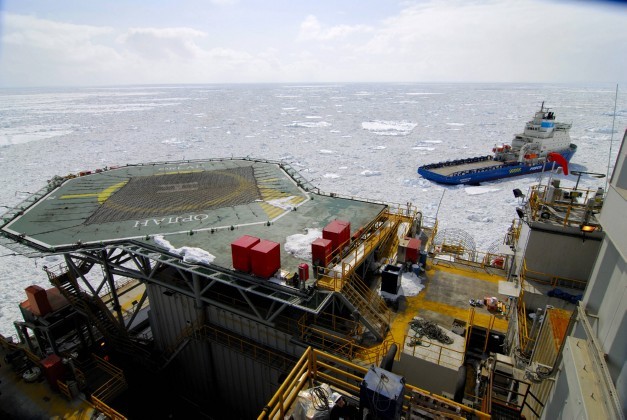

Exxon Mobil Corp. (NYSE: XOM) formed an alliance with Russia’s state-controlled oil giant OAO Rosneft in 2011 to develop the potentially huge and so-far untapped reserves on Russia’s Arctic Shelf and in Western Siberia’s shale oil deposits. The deal could eventually be worth as much as $500 billion. Part of the deal included exploration work in the Black Sea, but the big prize is the Arctic. Exxon was able to persuade Russian President Vladimir Putin to cancel taxes on oil exports from the Arctic for up to 15 years in exchange for its investments in the country.

Here’s the text of Exxon’s announcement:

The U.S. Treasury Department, recognizing the complexity of the University-1 well and the sensitive Kara Sea arctic environment, has granted a license to ExxonMobil and other U.S. contractors and persons involved to enable the safe and responsible winding down of operations related to this exploration well. The license recognizes the need to protect the safety of the individuals involved in these operations as well as the risk to the environment. All activities related to the wind down will proceed as safely and expeditiously as possible.

Because the project is in its early stages, Exxon loses no revenue. However it does lose time, and time will end up costing the company money down the road.

ALSO READ: 5 Top Energy Stocks to Own When Oil Pullback Ends

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.