Capital spending in 2014 totaled $38.5 billion and that will fall to $34 billion in 2015. For 2016 and 2017, the company said only that average capital expenditures (capex) will be less than $34 billion. Capex totaled $42.49 billion in 2013.

Following the forecast of 2% production growth in 2015, Exxon expects 2016 and 2017 growth to rise to 3% in each year. Liquids (oil, natural gas liquids and condensates) production is projected to rise by 7% in 2015 and 4% in each of 2016 and 2017. Gas production is forecast to be down 2% in 2015 and 2016, and up 4% in 2017. Liquids and liquids-linked gas production are forecast to become 71% of total production by 2016, up from 67% in 2014 and 70% in 2015.

ALSO READ: How Low Crude Prices Affect Nations, States and Companies

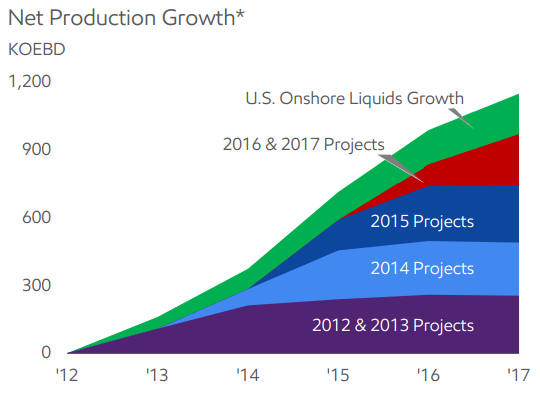

Exxon’s 2015 production growth is expected to come from the deepwater Gulf of Mexico, the Alberta oil sands, a new conventional field in Indonesia and expanded deepwater projects in Nigeria and Angola. Exxon does plan to raise production in its Bakken, Permian Basin and Ardmore/Marietta onshore shale plays, but production growth onshore in the United States looks to be about half the growth of major projects around the world, even though U.S. liquids production will double by 2017. See the production growth chart below.

Also note that Exxon planned its budget on a price of $55 per barrel of Brent crude. Brent traded at around $60 a barrel on the ICE Wednesday afternoon in London.

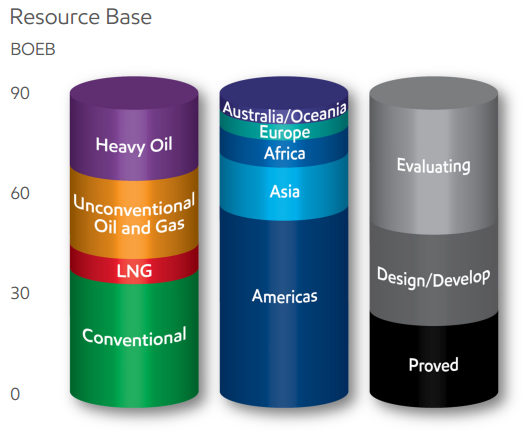

The company also provided a nice graphic depicting its 92 billion oil equivalent barrel (BOEB) resource base divided by type of resource, location and classification. The company’s proved reserve base of 25.3 billion is the company’s money in the bank. The remainder could or could not materialize, and in any event is probably years down the road. The resource base chart is also available below.

Exxon is now beginning to reap the benefits of the investments it made years ago, before the shale revolution hit the United States and the supermajor oil companies all thought they would be commanding prices for produced oil that would offer nice margins and healthy returns when the multibillion projects were operating.

The shale revolution changed the calculus, but as the saying goes, “In for penny, in for a pound.” Exxon and its peers could not just stop work because they had contracts with sovereign nations and national oil companies that required them to meet certain goals. In 2014 Exxon added 250,000 barrels of oil equivalent production a day, and the company expects to add another 300,000 barrels a day in 2015. Projects scheduled for 2016 and 2017 are expected to add an additional 400,000 barrels a day.

One place where Exxon has seen solid growth and where it expects to see more is in its downstream refining and chemicals businesses. Return on capital invested in downstream operations has fallen from a peak of around 40% in 2012 to around 16% last year, about equal to Exxon’s overall return on capital.

ALSO READ: 5 Clean Energy Stocks Are Potential Buyout Candidates

One last note: Exxon sold $8 billion in new debt on Tuesday, its biggest bond offering ever. The company’s AAA debt rating is based on the value of its proved reserves. Those reserves are now worth $95 a barrel, based on the formula the U.S. Securities and Exchange Commission requires companies to use to compute the value of their reserves. In the first quarter that number dropped to just over $51 a barrel.

*Production outlook excludes impact from future divestments and OPEC quota effects. Based on $55 Brent.

ALSO READ: 12 Companies Expected to Raise Their Dividends Very Soon

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.