Oil may have bounced this week — last seen at $50.05 late on Friday — but the count of U.S. and North American drilling rigs is still declining. Baker Hughes Inc. (NYSE: BHI) has released its Weekly Rig Count report, and the numbers just are not very good at all: down 21 to 1,048 rigs.

The breakdown in the number of oil rigs was down 12 to 813 rigs. The gas rigs were down by nine to 233, with miscellaneous rigs unchanged at two.

This is a trend that has continued to decline. Year-over-year is where the news gets real bad. Baker Hughes showed that the U.S. rig count is down a whopping 761 from last year’s count of 1,809. On a year-over-year basis, the oil rigs count was down by 674 and the gas rigs count was down 85, with miscellaneous rigs down two.

The U.S. Offshore rig count is down three from last week to 34. That is 16 fewer rigs than a year ago.

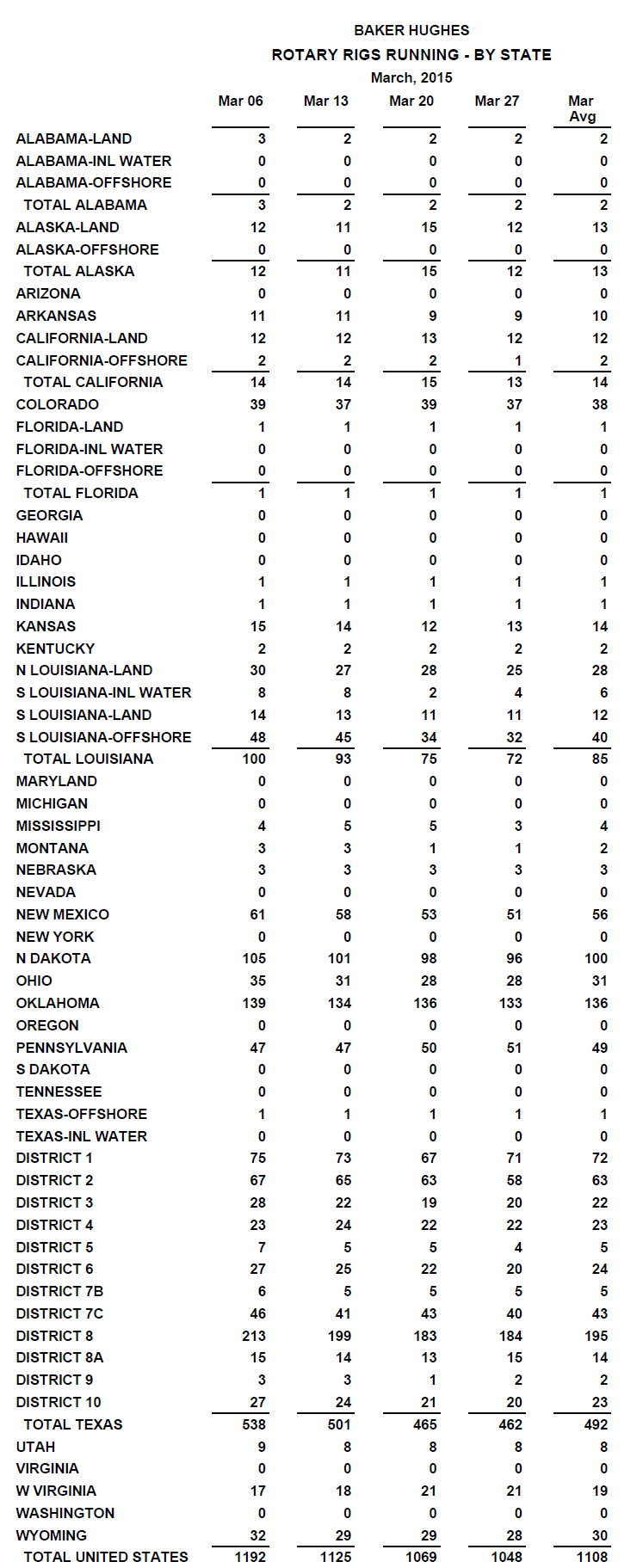

24/7 Wall St. has included a table of states below that is also from the Baker Hughes data. This shows the state-by-state drop over the past four weeks. North Dakota is now under 100 rigs for two weeks in a row. Texas fell off the cliff in the last month, dropping from 538 total rigs on March 6 down to 462 rigs on March 27. Louisiana was at 100 on March 6, but that is now down to 72 rigs.

ALSO READ: Cowen Raises Estimates on 6 Top Refining Stocks to Buy Now

As Baker Hughes always says:

The Baker Hughes Rig Counts are an important business barometer for the drilling industry and its suppliers. When drilling rigs are active they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.