Energy

Hub Price for Permian Basin Natural Gas Briefly Turned Negative Monday

Published:

Last Updated:

If you’ve been following the U.S. energy business at all over the past several months, one of the persistent problems for oil and gas producers in the Permian Basin of Texas and New Mexico is the lack of takeaway (pipeline) capacity to transport crude oil or natural gas to market. On Monday, natural gas at the Waha Hub in north Pecos County Texas traded at one penny below zero.

If a producer has to pay a buyer to take production, that producer is in trouble. And in the case of Permian Basin gas producers, the trouble could last until the end of 2019 when Kinder Morgan is expected to complete its Gulf Coast Express (GCX) pipeline to the Texas coast. Unfortunately, the solution is only temporary.

Because drilling for oil also produces what’s known as “associated gas,” pipeline capacity for natural gas out of the Permian has not kept pace with production. The gas has no way to get to market, so either the gas must be burned off (flared) or the wells must be shut in. Because the state of Texas has set limits on how much gas can be flared, that leaves producers with just one course of action.

The quoted price of natural gas on the New York Mercantile Exchange (NYMEX) is the price paid at the Henry Hub in northern Louisiana and is far higher than the price at regional hubs that feed the Henry Hub. Over the Thanksgiving holiday weekend, producers were paid $1.29 per million BTUs at Waha Hub, more than $3.00 below the price at Henry Hub.

Analysts at RBN Energy attribute the low price, and Monday’s dive below zero, to a major expansion to an oil pipeline from the Permian to the Gulf Coast. The Sunrise Expansion recently put into service by Plains All-American added 500,000 barrels a day of crude oil pipeline capacity. That amount of oil generates about 750 million cubic feet per day of associated gas.

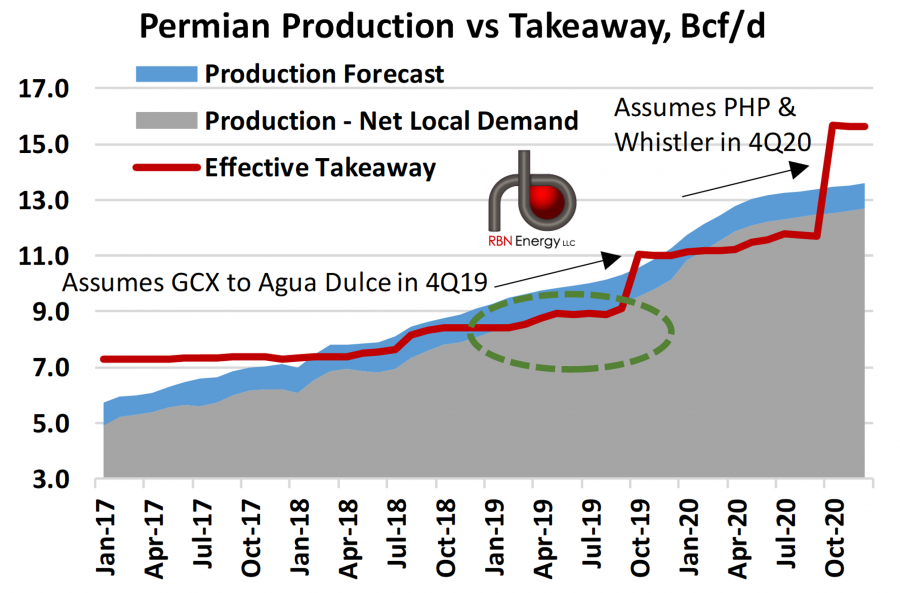

Here’s a chart from RBN Energy that illustrates the severity of the problem of natural gas takeaway capacity in the Permian Basin. Takeaway capacity fell behind production in January of this year and won’t rise above production until October of next year. But the interval until capacity is once again overtaken by production is brief and producers will have to hold on until mid-2020 before natural gas takeaway capacity exceeds expected production. That’s a long time to be forced to give away your product.

Natural gas for January delivery traded down about 0.2% Tuesday morning at around $4.29 per million BTUs.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.