Energy

Why $2 Billion Impairment Charge Isn't Hurting Halliburton Stock

Published:

Last Updated:

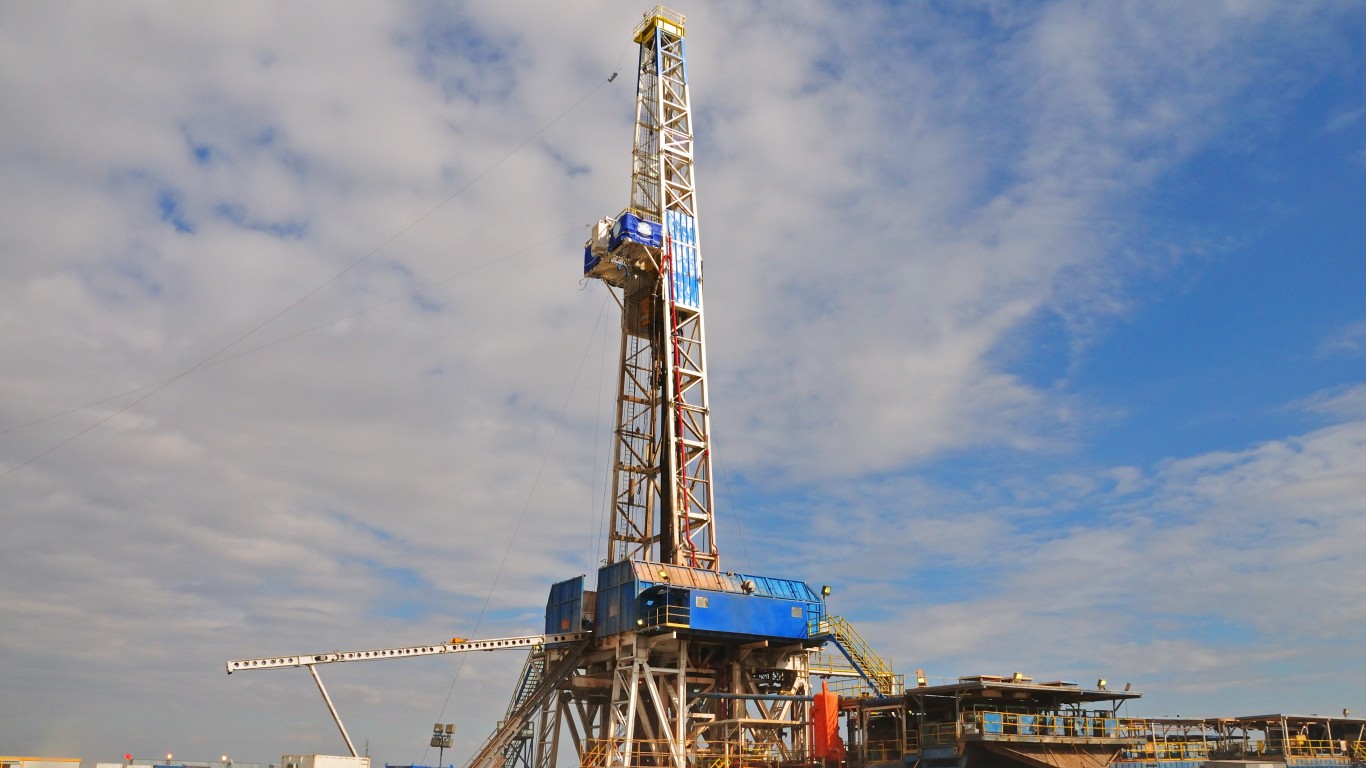

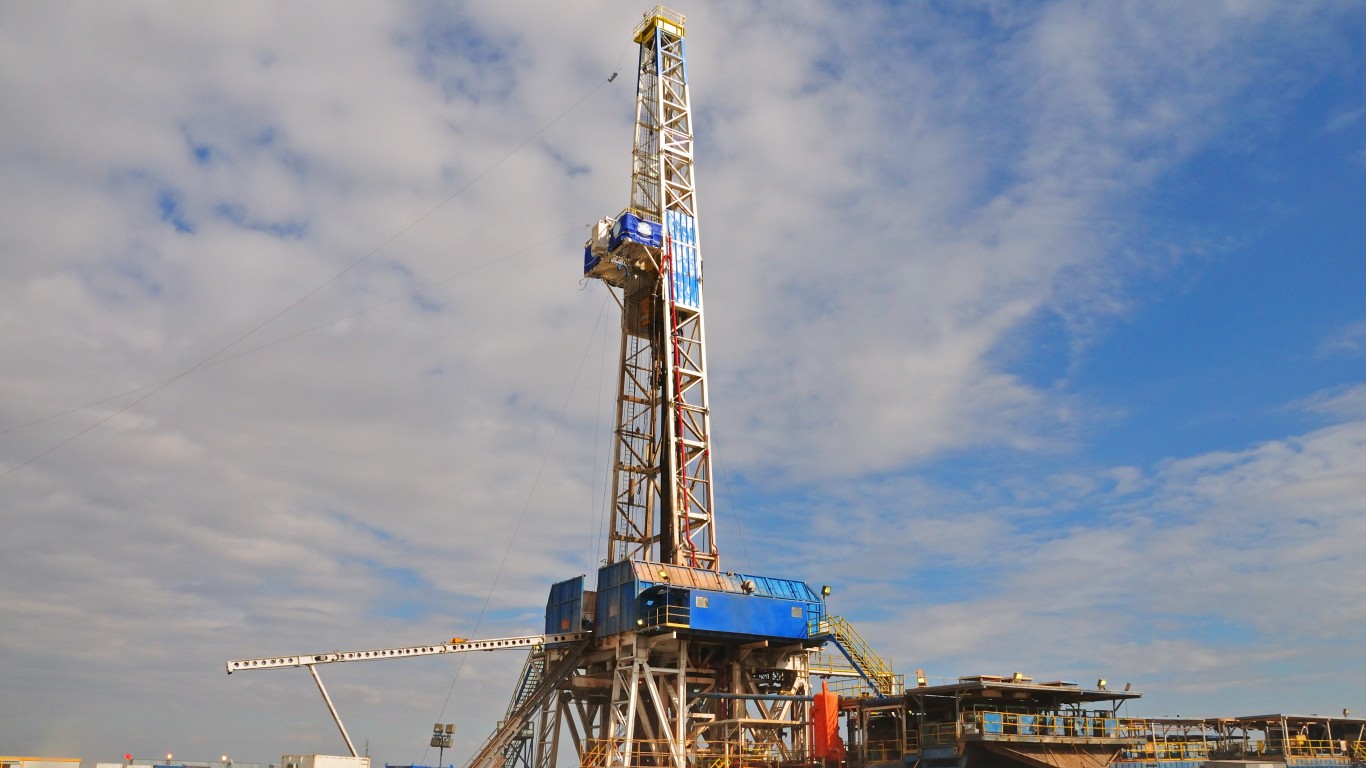

Halliburton Co. (NYSE: HAL) reported fourth-quarter 2019 results before markets opened Tuesday. For the quarter, the oil and gas services company posted adjusted diluted earnings per share (EPS) of $0.32 on revenues of $5.2 billion. In the same period a year ago, the company reported EPS of $0.41 on revenues of $5.94 billion. Fourth-quarter results also compare to consensus estimates for EPS of $0.29 per share and $5.15 billion in revenues.

For the full year, Halliburton reported EPS of $1.24 and revenues of $22.41 billion, compared with 2018 EPS of $1.90 and $23.63 billion in revenues. Analysts had been looking for $1.21 in EPS and revenues of $22.35 billion.

The company took a $2.2 billion impairment charge in the fourth quarter (totaled $2.5 billion for the fiscal year) “to further adjust its cost structure to market conditions.” Charges totaling $1.47 million came “primarily” in the form of noncash asset impairments related to pressure pumping and old drilling equipment. Severance costs $172 million were also included. On a GAAP basis, Halliburton posted a quarterly net loss of $1.88 per share and $1.29 per share for the full fiscal year.

Chair and CEO Jeff Miller said:

I am pleased with how Halliburton executed for the fourth quarter and the full year. We optimized our performance in North America as the market softened, and our international business grew for the second year in a row. … In 2020, we expect our international growth to continue. Increased activity, disciplined capital allocation, pricing improvements, and our ability to compete for a larger share of high-margin services should lead to improvement in our international margins in 2020. … [W]e expect customer spending in North America to be down again this year, we will continue executing our playbook, implementing our service delivery improvement strategy, and focusing on maximizing our returns.

North American revenue fell by 21% sequentially and by 18% year over year. International revenue rose sequentially and annually by 10%.

The company offered no guidance. The consensus analyst estimates for the first quarter call for EPS of $0.24 and revenues of $5.03 billion. For the fiscal year, analysts are looking for EPS of $1.27 and revenues of $21.14 billion.

In Tuesday’s premarket session, Halliburton stock traded up about 3% at $24.70, after closing Friday at $23.96. The stock’s 52-week range is $16.97 to $32.71, and the consensus 12-month price target is $27.23.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.