The International Energy Agency (IEA) issued its 2020 World Energy Outlook (WEO) Tuesday. It outlines the changes people can expect to see over the next 10 years in the global demand for energy and which fuels will meet those demands. Demand for energy over the next decade depends on how quickly the COVID-19 pandemic is controlled and how quickly energy policy accelerates a transition away from fossil fuels.

The WEO offers two scenarios: a stated policies scenario that assumes current energy policies, along with control of the coronavirus pandemic in 2021, and a delayed recovery scenario, in which the same energy policies lead to different outcomes as the effects of the pandemic cause “deeper and longer lasting economic and social impacts.”

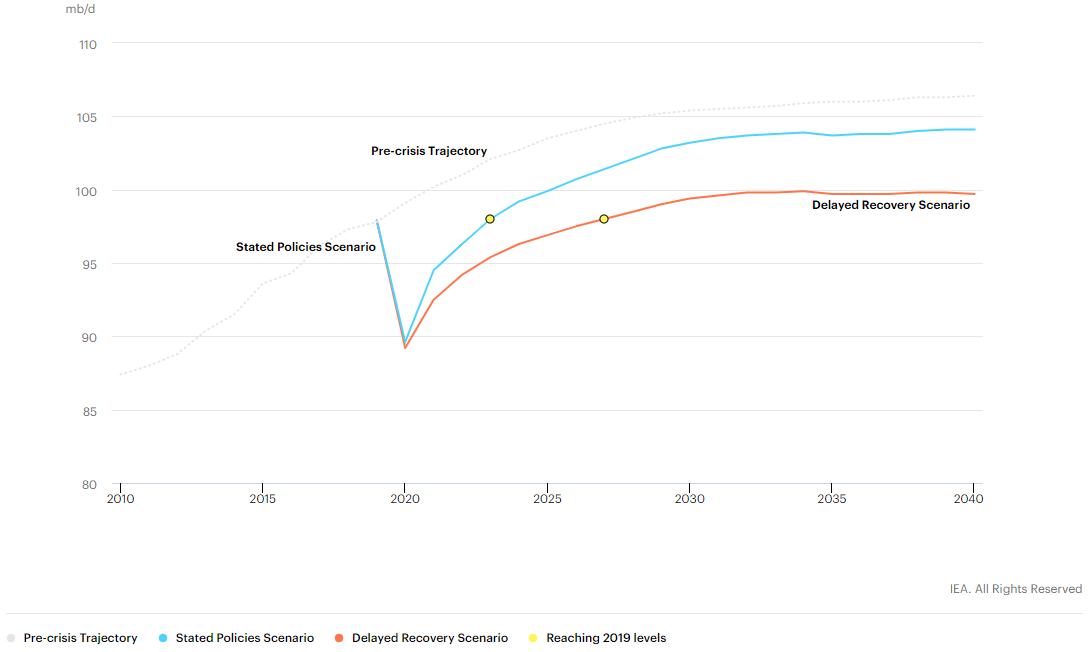

In the first scenario (stated policies), global gross domestic product returns to pre-COVID-19 levels by next year and global energy demand returns to pre-crisis levels early in 2023. Global crude demand totaled between 98 and 100 million barrels a day in 2019 and is expected to decline by 8% this year. The IEA estimates that by 2030, demand for oil will rise to around 104 million barrels a day, about 2 million barrels less than expected growth had the pandemic not occurred.

Under the delayed response scenario, global GDP does not recover to pre-pandemic levels until 2023 and global energy demand does not recover to pre-crisis levels until 2025. For the remainder of the decade, demand for oil never reaches 100 million barrels a day.

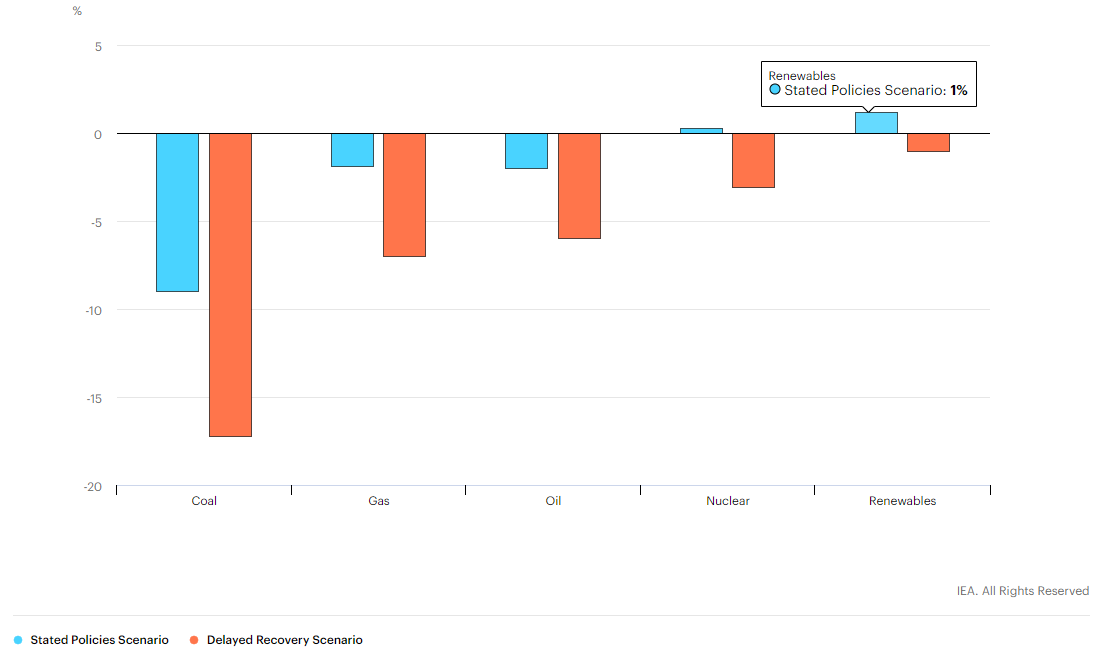

The following chart from the WEO shows the energy demand outlook by fuel type in 2030. The blue bars indicate the percentage gain or loss of demand under the stated policies scenario and the orange bars indicate gains and losses under the delayed response scenario.

Demand growth for renewable energy, while only a modest 1% by 2030 under the first scenario, is the only fuel source to post a gain over the current decade. Demand for nuclear energy is expected to remain flat in the stated policies scenario. In the delayed response scenario, demand growth remains below pre-crisis levels for all fuels.

Dr. Fatih Birol, IEA’s managing director, commented: “I see solar becoming the new king of the world’s electricity markets. Based on today’s policy settings, it is on track to set new records for deployment every year after 2022.”

Here’s how the IEA sees oil demand growth out through 2040:

While global carbon emissions “do not deliver a decisive break” in a gradual trend higher, the second (delayed recovery) scenario flattens out at around 33 billion metric tons, a level the IEA expects to see in 2024. The bad news is that the decline is due almost entirely to reduced economic activity.

Under the first (stated policies) scenario, carbon emissions grow to more than 36 billion metric tons by 2030. In either case, however, emissions are below a pre-pandemic level of 37.5 billion metric tons.

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.