U.S. benchmark West Texas Intermediate (WTI) crude oil has added nearly a third to its price over the third quarter of this year. The price driver is generally put down to production cuts by Russia and Saudi Arabia.

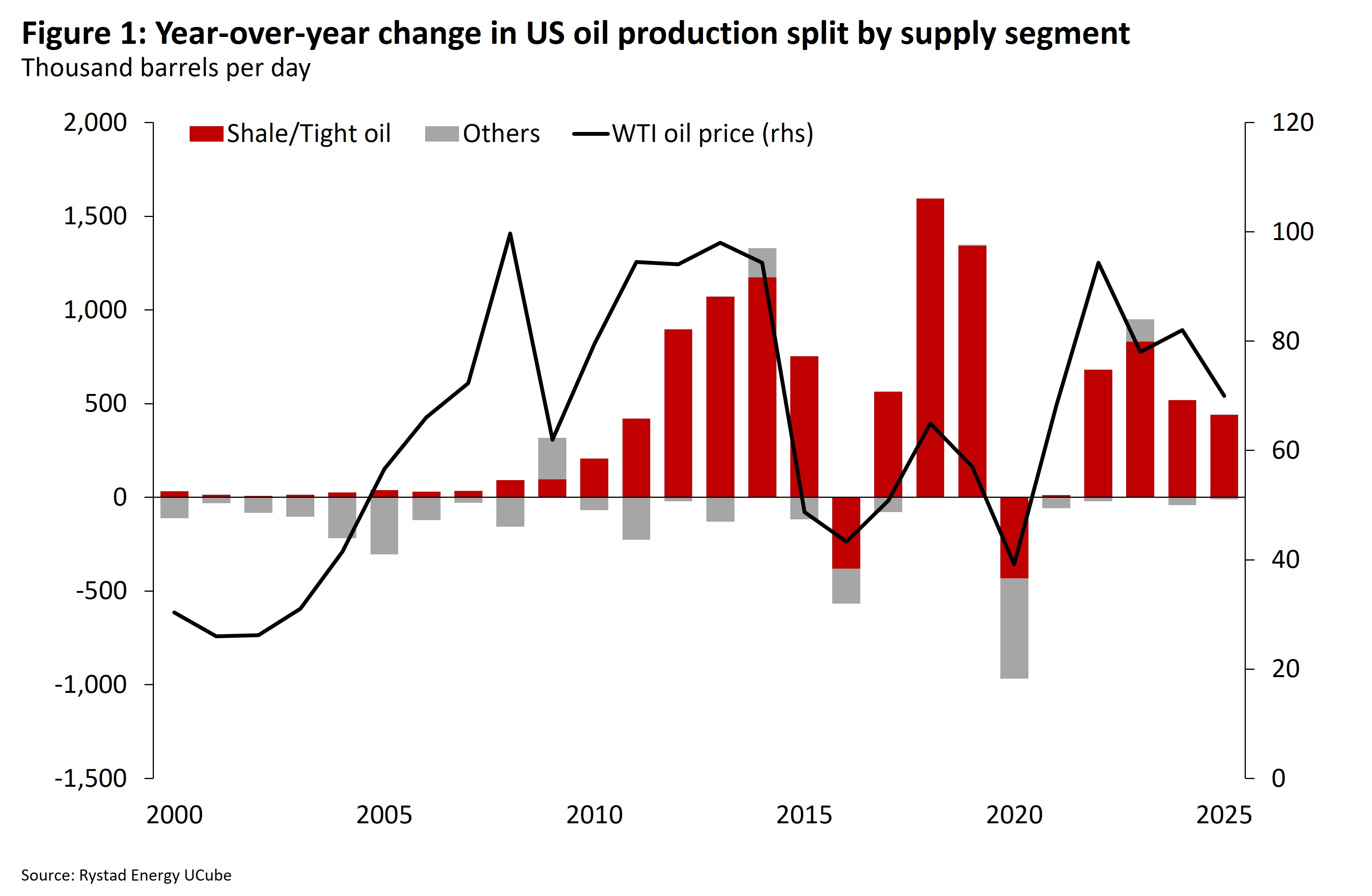

In the past, when the Organization of the Petroleum Exporting Countries (OPEC) or the expanded OPEC+ raised prices, U.S. shale producers ramped up drilling to take advantage of the higher prices. Eventually, prices declined from their heights. From a high of around $140 a barrel in June 2008, prices dropped to below $40 by January of 2009. The Great Financial Crisis had something to do with that, of course, but the size of the drop was still breathtaking. Crude prices climbed back to more than $100 a barrel in June 2014 before falling by more than half six months later.

In both cases, the United States took on the role of the industry’s swing producer. OPEC and the Saudis, though not in checkmate, were certainly put into check more often than they were used to. (These 25 American industries are thriving.)

This time may be different, though. Industry analysts at Rystad Energy believe this is the case:

Tight [shale] oil drilling and completions have declined as larger publicly traded operators remain disciplined, boosting returns instead of chasing output growth. Rystad Energy sees this as evidence that US tight oil is no longer a strong swing producer, and that supply from this source has become less sensitive to oil prices. A lower growth rate from the US opens new opportunities for OPEC member nations, making it easier for this group to regulate the market. In short, OPEC is starting to take back control of the oil market.

In the second quarter of this year, the 18 U.S. companies Rystad tracks posted a reinvestment rate of 72%. The rate is the percentage of cash flow from operations allocated to capital spending. That was the highest reinvestment rate since the second quarter of 2020, when it reached 150%. Reinvestment rates above 100% have been common when producers sniff higher profits.

What it means is production companies are not borrowing in order to invest more in greater production. As Rystad mentioned earlier, U.S. production companies are focused on shareholder growth, not higher production.

Another energy industry advisory firm, RBN Energy, posted a report based on producers’ comments related to capital spending for 2023 and, in passing, 2024. Producers have been hit with higher prices for goods and services, just like the rest of us, but RBN notes that companies are suggesting that costs have flattened out and may even decline in 2024. Some companies are even using the magic word–deflation.

From a low of $34 billion in the pandemic year of 2020, capital spending (capex) rose just 6% to $39.1 billion in 2021 and jumped 54% to $60.1 billion in 2022, due at least in part to inflation. At the beginning of 2022, the 42 exploration and production (E&P) companies RBN tracks guided capex up 24% to $50 billion.

Initial guidance for 2023 pegged capex at $70.7 billion, up 17% year over year and just 3% below the pre-pandemic level of $72.9 billion in 2019. RBN’s Nick Cacchione writes, “The increase largely reflects a combination of inflation and increased organic capital outlays related to acquisition activity.” Cacchione goes on:

[A] recent jump in the reinvestment rate — the percentage [operating cash flow] allocated to capital spending — from an all-time low of 39% in 2022 to 76% in Q2 2023 … [H]igher Q3 realizations are brightening the outlook for rising profits and cash flows … E&P managements indicated in their recent earnings calls that the major factors influencing spending were increased capital efficiency and, most importantly, a strong positive (i.e., downward) trend in the costs of oilfield goods and services.

For next year, only Devon Energy has issued early capex guidance. The E&P firm believes that spending will be flat with its current 2023 guidance of $3.5 billion. RBN notes that Devon’s guidance “matched the rhetoric in nearly all the companies’ reports.”

So, even though crude oil prices are above $90 a barrel (up a third since late June), E&P companies are keeping their powder dry, waiting to see if cost deflation will continue and if there is further change in commodity prices. Overall, E&P firms seem to be looking forward to single-digit production gains even with no additional spending.

Neither Rystad nor RBN sees a burst of capital spending by U.S. shale drillers. If that turns out to be the case, the Saudis and OPEC+ are indeed likely to regain the control of the global oil market that they lost in 2008.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.