Energy

Energy Articles

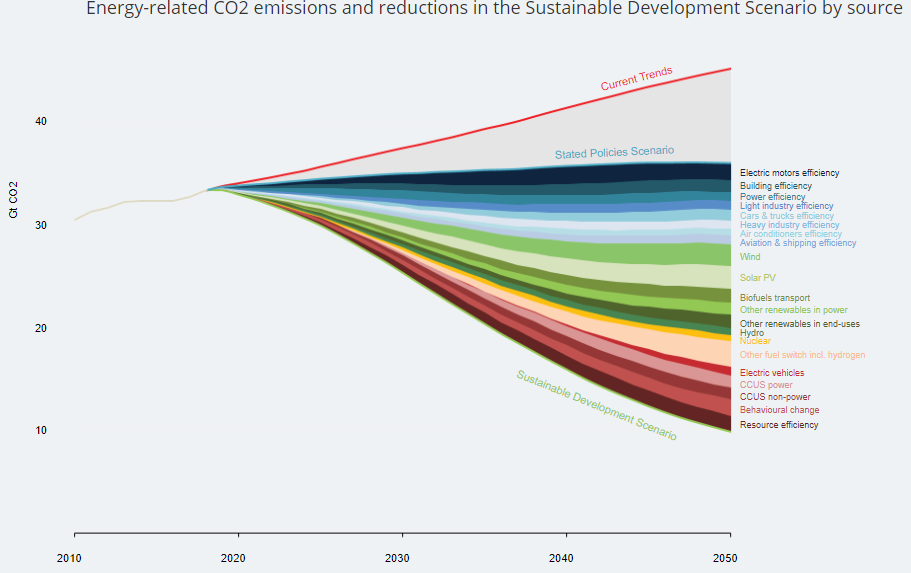

In its 2019 World Energy Outlook, the International Energy Agency paints a bleak picture for cutting emissions quickly enough and by a large enough amount to meet the goal of keeping global warming...

Published:

Last Updated:

In the world of nothing lasts forever, Merrill Lynch has said enough is enough on at least some opportunities in the oil patch.

Published:

Last Updated:

Short interest moves among solar and alternative energy stocks were mixed during the two-week reporting period that ended on October 31.

Published:

Last Updated:

Short interest in oil and gas stocks increased during the two-week reporting period to October 31.

Published:

Last Updated:

The IPO of Saudi Aramco will commence its book-building period on Sunday, ahead of its December pricing and sale.

Published:

Last Updated:

SunPower shares shot up on Monday after the company announced that it plans to separate into two independent, complementary, strategically aligned and publicly traded companies: SunPower and Maxeon...

Published:

Last Updated:

These five solid energy picks trading under $10 from the Stifel team were all pounded during 2019 and offer investors massive upside potential to the assigned price targets.

Published:

Last Updated:

The state of Rhode Island has denied a construction permit for a new natural gas-fired power plant saying that it's no longer needed and, besides, it's too dirty.

Published:

Last Updated:

Analysts at IHS Markit expect U.S. shale oil production growth to decline by half next year. How investors (who are demanding a bigger share of profits) respond is the big question.

Published:

Last Updated:

Exxon Mobil is extending a joint-development agreement with FuelCell Energy to work on a solution for industrial carbon emissions. That's a good thing, but it also raises other issues about how...

Published:

Last Updated:

Merrill Lynch is very positive on three mega-cap energy stocks that offer not only a degree of stability but outstanding dividends. All are rated Buy and make sense for more conservative accounts...

Published:

Last Updated:

There are good mergers, and there are not so good mergers. The reality is that big mergers often take years to unfold before real verdict can be made over whether they were successful or not....

Published:

Last Updated:

How can an auction for the right to produce billions of barrels of oil be a flop when the government running the auction realizes revenue of $17 billion?

Published:

Last Updated:

The U.S. commercial crude oil inventory rose by nearly 8 million barrels last week and oil prices are sliding as a result.

Published:

Last Updated:

Oil and gas producer Chesapeake Energy missed already low estimates for revenues and a net loss. Production fell sharply with oil prices rising only modestly and natural gas prices falling again.

Published:

Last Updated: