As a serial entrepreneur pushing the technology envelope with spacecraft, satellites, cryptocurrency, and celebrity, Elon Musk defies easy categorization. His appearances on the TV shows Saturday Night Live and The Big Bang Theory personalized his odd sense of humor.

Musk is most known as the CEO of Tesla (NASDAQ: TSLA) and its rise to becoming the biggest auto manufacturer by market capitalization was nothing short of amazing. Tesla’s IPO was on June 29, 2010 for $17 per share, or roughly $1 when adjusting for stock splits. To put into perspective how much the company has grown since 2010, a $1,000 investment would be worth $216,749.05 today, based on the current share price of $342.03.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, and 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Tesla’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article

- Tesla has continued to generate record revenues in spite of softness in the EV industry due to its vertically integrated expansion into related sectors.

- Besides EVs, Tesla has a robust and profitable battery and storage division, 6,000 locations, a growing chain of charging stations across the US, and a menu of AI developments large enough to qualify it for analyst inclusion in the AI category.

- Tesla’s Full Self Driving (FSD) AI-powered driverless cars are getting closer to an actual launch for Tesla’s Robotaxi, which would dramatically impact the transportation industry.

- For our best market-beating stock tips, check out “The Next NVIDIA”. It includes 3 Top Stock Picks poised to take off from the next breakthroughs in AI. One company is a ‘10X Moonshot’ that could become the dominant software play in AI.

Tesla Stock News and Updates

11/20/2024

In a recent X post, Elon Musk revealed his confidence in SpaceX sending uncrewed Starships to Mars in just two years, and possibly ships with crews in four years.

11/19/2024

Protestors in Gruenheide, Germany, have gathered in treehouses as they protest the expansion of Tesla’s plan near Berlin. Despite the cold temperatures and rainy conditions, many protestors from the Disrupt Tesla group are continuing to fight against Tesla’s expansion and the damage it will do to the environment.

11/18/2024

A recent study by iSeeCars has raised concerns about the safety of Tesla vehicles, particularly the Model Y and Model S. Based on NHTSA data, the research indicates that these models have much higher fatality rates compared to the average car. While Tesla vehicles have been known for their advanced safety features, the recent study suggests that the use of Autopilot and Full-Self Driving systems may lead to great driver distraction, contributing to greater risks on the road.

11/15/2024

Billionaire investor Ron Baron has shared that he believes Tesla could skyrocket to a $5 trillion market cap within the next decade.

11/14/2024

Tesla has issued another recall on its electric cybertruck. This is the sixth recall just this year. The defect could potentially cause a loss of driver power, but the company says they will fix it for free.

11/12/2024

Tesla will be releasing a “2024 Holiday” update that promises to improve driving capabilities and overall vehicle safety for winter. The update aims to address cold weather issues and introduce new features for a positive user experience.

11/11/2024

Tesla’s shares continue to soar and are currently at the highest level the company has seen since April 2022.

11/8/2024

According to recent reports, Elon Musk was part of two important calls made by President-elect Donald Trump this week. Musk allegedly spoke to Ukrainian President Volodymyr Zelenskyy as well as Turkish President Recep Tayyip Erdogan.

11/7/2024

Tesla’s shares continue to ride high following Donald Trump’s victory in the U.S. presidential election. In just five days, the company’s shares have soared 20% to hit a new all-time high of over $298. This added $15 to Elon Musk’s net worth, boosting his fortune to an estimated $280.3 billion.

11/6/2024

Tesla’s stock rose 15% today following the U.S. presidential election. Tesla’s CEO, Elon Musk, has been a public supporter of President Trump and has even campaigned with him recently.

5 to 10 Year Review

After some messy beginnings, which wound up with Musk taking control of Tesla from founders Martin Eberhard and Marc Tarpenning, Musk spearheaded additional fundraising rounds in order to produce the Tesla Roadster. The Roadster’s initial sales were sufficient market proof for Tesla to go public. Over the past 10 years, the company has grown its top line by 44% and EBITDA by 74%, advocating long-term growth and strong fundamentals. Tesla’s progress would hit the following milestones, leading it into profitability in 2020, and never looking back since.

EV:

- The Model S became the best-selling plug-in electric car in both 2015 and 2016.

- The mass-market Model 3 sedan would follow, and the Model 3 would become the best-selling electric car from 2018 to 2021.

- The Model Y mass-market SUV version of the Model 3 would make its debut in 2019, with deliveries commencing in 2020.

Energy Storage & Gathering:

- Entering the energy storage market in 2015, Tesla released its rechargeable Powerwall lithium-ion home storage battery and Megapack in 2019, which was designed for large-scale businesses and utility projects.

- It acquired SolarCity in 2016 for its battery technology to become a key part of its subsidiary Tesla Energy.

- Tesla Glass became a subsidiary, specifically for providing the glass roofs supplied with the Model 3 and for Tesla’s Solar Shingle panels for solar energy gathering.

Charging Stations:

- Tesla addressed the dearth of charging stations by establishing its North American Charging Standard (NASC).

- Now known as SAE J3400, NACS has since been adopted by all EV manufacturers in North America for the sake of uniformity, much like the Universal Serial Bus (USB) for computers.

- Tesla’s Supercharger networks, which launched in 2012, have since expanded to 6,000 stations with 55,000 chargers worldwide as of the beginning of 2024.

| Fiscal Year | Price | Revenues | Net Income |

| 2015 | $16.00 | $4.046B | -$888.7M |

| 2016 | $14.25 | $7.000B | -$674.9M |

| 2017 | $21.60 | $11.759B | -$1.962B |

| 2018 | $21.18 | $21.461B | -$976M |

| 2019 | $29.53 | $24.578B | -$862M |

| 2020 | $235.23 | $31.536B | $721M |

| 2021 | $352.26 | $53.823B | $5.519B |

| 2022 | $123.18 | $81.462B | $12.556B |

| 2023 | $248.48 | $96.773B | $14.997B |

| 2024 (LTM) | $209.21 | $95.318B | $12.338B |

Key Drivers for Tesla’s Future

- Tesla’s management is cutting manufacturing costs and improving margins, trending with strong revenue and net income gains since 2020.

- Its Shanghai, China, and Berlin, Germany gigafactories should help Tesla cut a chunk of export-related red tape and tariffs for forthcoming EVs that will result in lower overseas sticker prices and enhanced sales.

- Thanks to its R&D with FSD and Robotaxis, Tesla is leading nicely ahead of GM’s Cruise and Alphabet’s Waymo. Chinese companies like Apollo Go and WeRide are viewed as better-equipped Robotaxi competitors, in a field that may explode in the upcoming future.

- Some analysts believe that the Optimus program has been unfairly judged and that its contributions to Tesla will result in additional revenue boosts.

- Tesla’s Supercharger, energy, and battery businesses have taken off strongly and further separated it from its EV peers as a company with many more technology irons in the fire.

- Musk’s further development of Grok and X.AI will ostensibly benefit Tesla with cutting-edge AI tools, keeping its competitive advantage over other automobile rivals trying to incorporate AI into their own cars.

- EV tariffs, regulations, and shifting geopolitical policies and legislation are factors beyond Tesla’s control that can impact the company as well as the EV industry.

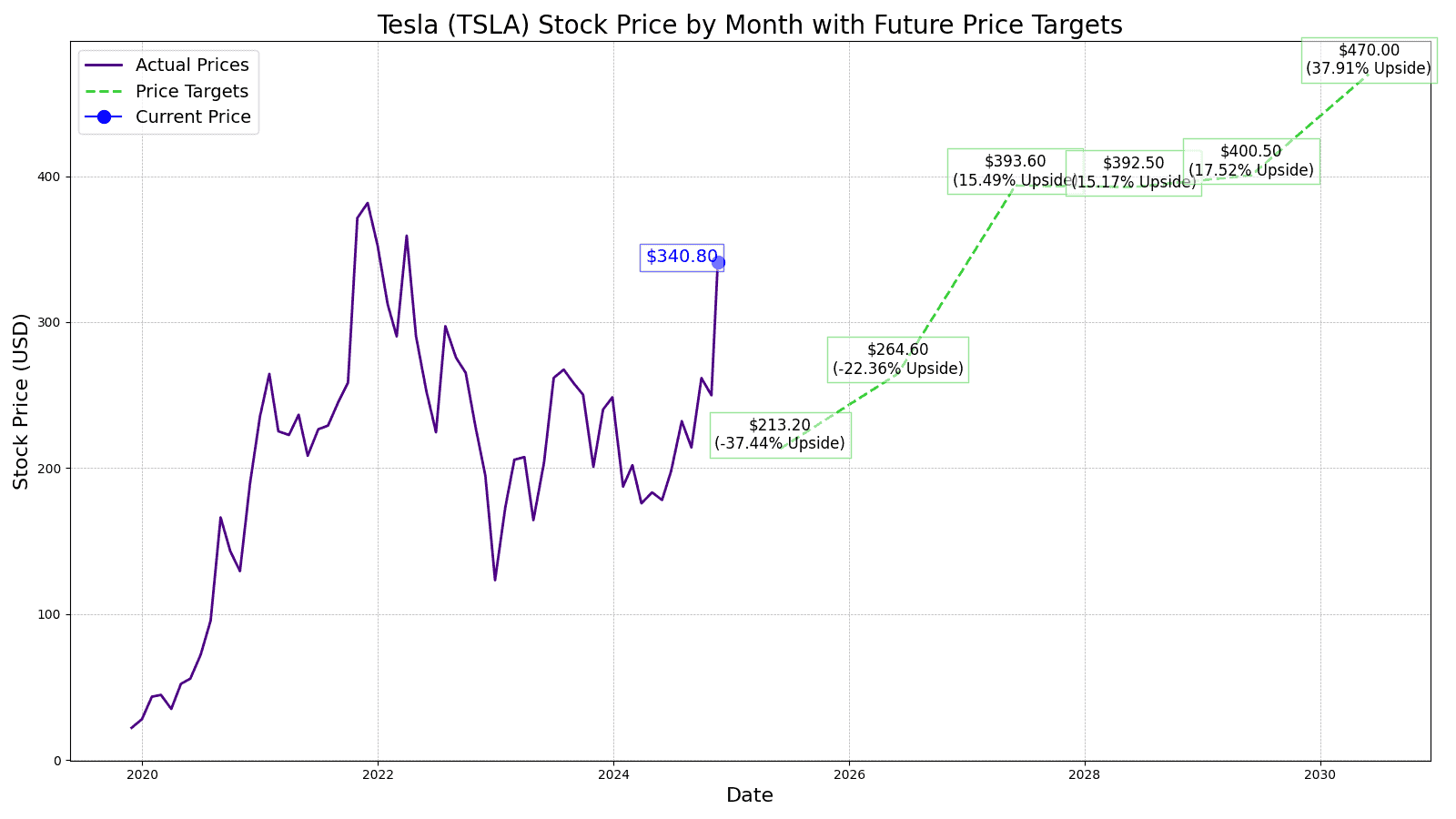

Stock Price Prediction for 2025

The consensus 12-month price target for Tesla from over 50 different analysts is $212.00 per share, which would calculate year-over-year growth estimates at -38.73%. The analysts are mixed: 11 of them rated Tesla a “buy”, 5 were “outperform”, 20 were “hold”, 4 were “underperform”, and 7 pessimists gave Tesla a “sell” recommendation.

24/7 Wall Street’s 12-month Tesla price projection is $213.20, which would be a -38.38% loss. The mixed opinions likely stem from the unconventional way that Musk runs not only Tesla, but all of his companies. Fears over the potential for a domino effect, if negative events impact one to cause a spillover effect due to his mercurial temperament, are not unfounded.

The latter part of 2024 and 2025 looks to be an exciting period for Tesla.

The much ballyhooed Robotaxi unveiling has been bumped to October 2024 (although this can wind up even later in 2024 or early 2025, as Musk is notorious for missing date targets). Additionally, Tesla’s FSD version 12.5 will also make its debut. In order to prime the pump to improve acceptability for its autonomous vehicles, Tesla management has already cut the price of FSD (Supervised) in North America and has launched free trials for interested parties.

Additionally, Tesla management gave guidance in its July earnings report that the vehicle volume growth rate in 2024 “may be notably lower than the growth rate” last year. The EV giant added that growth in its energy storage business, driven by the buzz over its new 4680 battery cell, which improves vehicle range and lowers costs, should outpace its automotive segment. That trend will likely reverse and balance out in 2025.

Tesla’s Next 5 Years’ Outlook

2026:

Tesla is also looking to become a major player in other parts of the world. It will have to compete with firms like Nissan, Ford, General Motors, VW, Toyota, Nio, and Xpeng to either become the leaders or stay at the top of the EV market in these areas. Tesla’s Shanghai and Berlin gigafactories were built in 2018 and 2019 to circumvent tariffs and other import obstacles in China and Europe.

It appears that Musk’s vision for mass production automation has become a reality in China, where Shanghai gigafactory automation is reportedly up to 95%, and the Berlin gigafactory is building both Tesla Model-Y EVs and batteries at this time. The two factories should be both at full capacity by 2026. EV output should allow Tesla to avoid Chinese and European tariffs, as well as create enough surplus inventory for export to other countries. In fact, the E.U.’s tariff on Chinese EVs has a discount for Chinese-made Model Y imports. Tesla’s Berlin factory is facing some regional friction over the factory’s effect on the environment, with reports of heavy deforestation and water pollution. Tesla will likely need to rectify matters with the German government before it can ramp up to match the China gigafactory’s projections. Assuming that these issues are resolved, 2026 is expected to see Tesla take a jump to $264.20, a -22.76% loss.

2027:

Robotics development became an obvious decision as mass production ramped up, although Tesla’s experience was not without its own minefields. One new creation from its robotics work was the Tesla Bot, dubbed “Optimus”. Musk’s enthusiasm for the potential of Optimus is enormous. He stated in the Q2 2024 report some of the following comments:

“I think the long-term value of Optimus will exceed that of everything else that Tesla combined…I suspect that the long-term demand for general-purpose humanoid robots is in excess of 20 billion units. And Tesla is — that has the most advanced humanoid robot in the world, and is also very good at manufacturing, which these other companies are not…my rough estimate long-term market cap is on the order of $5 trillion for — maybe more for autonomous transport, and it’s several times that number for general purpose humanoid robots….It’s a wild — very wild future we’re heading for.”

The projected commercialization launch of Optimus will likely be 1 of 2 major breakthroughs for Tesla in 2027. The other will be a push towards an official full-scale Robotaxi production and distribution. ARK Invest’s Cathie Woods believes it will start in 2025, but regulatory obstacles will likely not allow it to fully launch until 2027. As a result, EPS is expected to jump almost 50%. A projected price of $393.60 would be a +129 point gain.

2028-29:

Cathie Woods also predicted that as much as 90% of Tesla’s enterprise value and earnings will be attributed to the Robotaxi business by 2028-29. This prediction may anticipate a possibility of Uber and Lyft becoming clients or partners, rather than rivals. Musk’s Supercharger network is crucial to the success of a Robotaxi industry in the U.S. since Secretary of Transportation Pete Buttiigieg has basically spent over $1 billion each on just (7) DOT-built recharging stations to date. This is a huge strategic leverage that Tesla can exercise in its favor.

In the same period, battery developments, and lower-cost budget EVs should also see releases. 2028’s price target of $392.50 and 2029 at $400.50.

Tesla stock in 2030

Assuming that Tesla is successful in navigating international expansion and can weather the geopolitical issues, the company may realize sufficient diversification in its robotics, AI, energy, and taxi businesses to reduce its current 84% reliance on EVs for its revenues. With the growth trajectories anticipated from these various operational segments, a 2030 all-time high price of $470.00 is in order.

| Year | Normalized EPS | P/E Ratio | Projected Stock Price |

| 2025 | $3.28 | 65 | $213.20 |

| 2026 | $4.41 | 60 | $264.60 |

| 2027 | $6.56 | 60 | $393.60 |

| 2028 | $7.85 | 50 | $392.50 |

| 2029 | $8.01 | 50 | $400.50 |

| 2030 | $9.40 | 50 | $470.00 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.