Forecasts

Salesforce Inc. (CRM) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

One colloquial phrase from the business world that has uniquely developed in the 21st century is “Customer Relationship Management” or CRM, which was coined by the Gartner Group in the late 1990s. Both CRM, as well as “Software as a Service” (SaaS), have since become synonymous with a San Francisco software management company that has become an industry behemoth, even taking “CRM” as its stock ticker.

Salesforce Inc. (NYSE: CRM) is the world’s largest provider of cloud-based customer relationship management (CRM) services. Its SaaS platforms bridge the gap between companies and customers around the world, facilitating and personalizing sales management, customer service, and marketing. Its acquisitions of complementary software companies have filled gaps demanded by its customers, and have subsequently fueled Salesforce’s extraordinary growth over the past decade.

From fiscal 2014 to fiscal 2024 (January 2024), Salesforce’s revenue grew at a compound annual growth rate (CAGR) of 24%. Although a good part of the growth came from organic, big acquisitions — including Demandware, Mulesoft, Tableau, and Slack. These additions contributed substantially to expand the Salesforce ecosystem. After going into the black in fiscal 2017, Salesforce’s net income continued to expand, notching a 44% CAGR from 2017 to 2024. The company also announced a $10 billion stock buyback and its first-ever dividend in 2024.

Although it was one of the earliest players in the CRM and SaaS arena, Salesforce would inevitably see competition, and not just from start-ups, as well as internal issues.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near term projections irrelevant. 24/7 Wall Street aims to present some further looking insights based on Salesforce Inc.’s own numbers, along with business and market development information that may be of help to our readers’ own research.

9/17/2024

Salesforce is investing another $500 million in its venture fund, Salesforce Ventures, to support AI startups. This brings the total amount of money the fund has available for investing in AI companies to $1 billion.

9/16/2024

Salesforce’s stock price has risen by 4.3% in the past week. Institutional investors hold a significant majority of Salesforce’s shares, suggesting they have a strong influence on board decisions. however, this group lacks a single majority shareholder, suggesting a more balanced power structure.

Salesforce’s phenomenal growth over the past decade has been fed by strategically savvy acquisitions that have filled critical gaps in their SaaS package offerings. Starting in mid-2013, the company spent $2.5 billion for ExactTarget, which supplied cloud marketing tools to integrate Salesforce management technology with digital marketing campaigns.

2016 saw the $2.8 billion purchase of Demandware, now rebranded as Salesforce CommerceCloud. It is the company’s e-commerce platform, fully integrated with Einstein AI. The need to sync the different cloud based operations and data metrics was satisfied by the $6.5 billion acquisition of MuleSoft for digital integration in 2018. Analytics software platform Tableau followed in 2019 for $15.7 billion. Finally, intraoffice and company personnel collaboration and communication platform Slack was added to Salesforce in 2021 for the sum of $27.7 billion.

The large expenditures have benefitted Salesforce’s growth but have understandably made earnings erratic, which has raised the ire of some activist investors.

| Fiscal Year (Jan. 31) | Price | Revenues | Net Income |

| 2016 | $68.08 | $6.667B | (-$47.4M) |

| 2017 | $79.10 | $8.437B | $323M |

| 2018 | $113.91 | $10.540B | $360M |

| 2019 | $151.97 | $13.282B | $1.110B |

| 2020 | $182.31 | $17.098B | $126M |

| 2021 | $225.56 | $21.252B | $4.072B |

| 2022 | $232.63 | $26.492B | $1.444B |

| 2023 | $167.97 | $31.352B | $208M |

| 2024 | $281.09 | $34.857B | $4.136B |

| 2024 (LTM) | $252.90 | $36.465B | $5.632B |

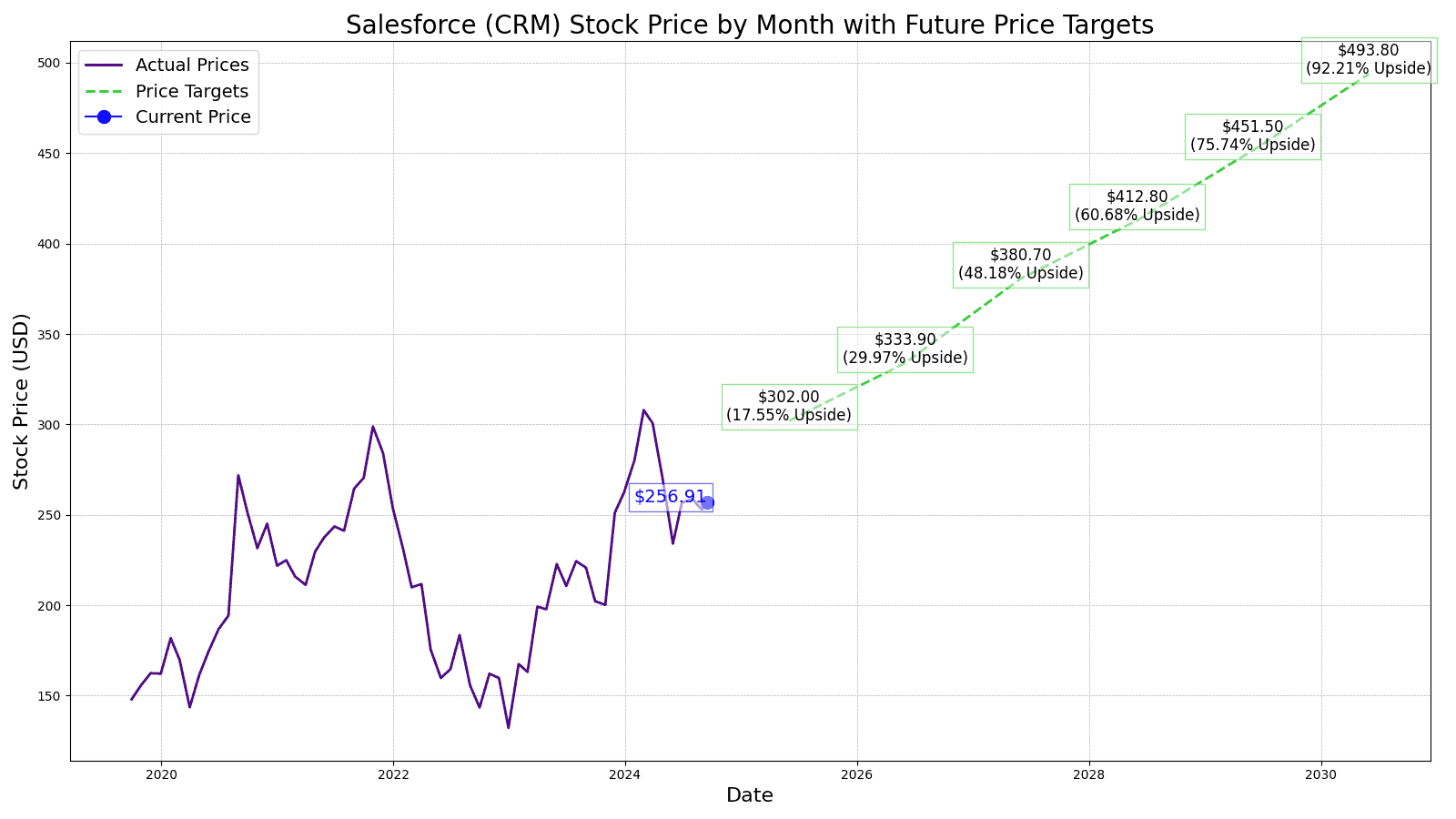

A consensus taken from 44 different Wall Street analysts predicted Salesforce’s price target in 12 months to be $307.64. This calculates as a gain of 19.75% from today’s stock price of $256.91. The overall average recommendation was “outperform”.

Based on our assessment of the financials, 24/7 Wall Street projects a somewhat more conservative target price of $302.00. The departure of the highly regarded CFO, Amy Weaver, is a negative. Her enviable track record managing restructuring efforts and the level of respect she commands on Wall Street cannot be disregarded. Although she will remain as an advisor once her successor has been selected, the comfort of a smooth transition is not guaranteed.

As Salesforce’s Fiscal Year 2026 ends January 31, 2026, the events that drive its stock performance occur predominantly throughout 2025. 24/7 Wall Street projects a stock price of $333.90, a gain of 29.97% from today’s stock price of $256.91.

The integration of blockchain technology into Salesforce’s product offerings is expected to be a key driver sometime in 2025. With cybersecurity breaches multiplying by the month, the ability to repel CRM platform hackers is vitally important to enterprise customers. FY 2026 should also see the start of the rewards from its international initiatives, which will likely manifest writ large throughout 2026 for FY 2027.

FY 2027 will likely begin to see the primary fruits from the international sales and marketing initiated during the latter part of FY 2024 and all of 2025. A target price of $380.70 would represent a 48.18% gain from today’s stock price of $256.91.

European business accounted for roughly 23.5% and Asia Pacific 10.1%. It is predicted by several analysts to grow to 21.6% of total revenues by or before FY 2027. Salesforce’s expansion into emerging markets is also likely to accelerate, particularly in Southeast Asia and Africa. This is untapped territory which can be a deep source of new revenue streams that can offset risks from established markets due to geopolitical and economic factors.

Additionally, Salesforce’s investments in edge computing solutions should enhance its competitive advantage in the IoT space. Integration of Einstein AI for hybrid workers who spend half or more of their work time from home may likely become early converts to these additional digital tools.

The 2028 stock price target is anticipated to be $412.80.

Salesforce’s focus on customization towards vertical-specific CRM solutions is expected to bear fruit in 2027. By tailoring its offerings to industries such as healthcare, financial services, and manufacturing, the company expects to capture larger market share and increased customer retention.

Salesforce’s continued development of low-code and no-code platforms will likely also contribute its part to attracting a broader customer base.

FY 2029 is projecting the completion of its integration of advanced natural language processing (NLP) capabilities into Salesforce’s products. This technology may significantly enhance customer service automation and data analysis, providing an additional competitive edge. Salesforce’s R&D in quantum computing research, building on its investments in Q-CNTRL and CQC, should also begin to yield practical applications, thus potentially opening new avenues for growth and innovation.

Digital twin technology with VR is another new vista for Salesforce currently in R&D, but may possibly be prepared to launch during 2028-29. By creating virtual replicas of physical systems, the company may offer unprecedented insights and optimization capabilities to its customers.

$451.50 is 24/7 Wall Street’s projected stock price for FY 2029, a 75.74% gain from today’s stock price of $256.91.

In FY 2030, we predict Salesforce can hit a stock price of $493.80, a 92.21% increase from today’s stock price of $256.91.

By 2029-2030, Salesforce’s R&D investments in Augmented Reality (AR) and Virtual Reality (VR) technologies may be ready for prime time commercialization.

These immersive technologies could revolutionize customer engagement and data visualization, potentially opening new revenue streams. As Salesforce expands its offerings, it may face increased competition from other enterprise software providers like ServiceNow.

One other aspect to Salesforce not yet mentioned, since when its impact may become manifest is unknown, is its venture capital work in tech startups. Salesforce Ventures has a $500 million Generative AI Fund that includes a $200 million investment in Hugging Face, the largest open-source AI community on Earth. Salesforce’s presence in Hugging Face is strategically intended to expose Hugging Face using entrepreneurs to Salesforce’s CRM products in a soft sell approach that can potentially reap billions as these startup companies take off.

| Fiscal Year | Normalized EPS | P/E Ratio | Projected Stock Price |

| 2025 | $10.06 | 30 | $302.00 |

| 2026 | $11.13 | 30 | $333.90 |

| 2027 | $12.69 | 30 | $380.70 |

| 2028 | $13.73 | 30 | $412.80 |

| 2029 | $15.05 | 30 | $451.50 |

| 2030 | $16.46 | 30 | $493.80 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.