Forecasts

Super Micro Computer (SMCI) Price Prediction and Forecast

Published:

Last Updated:

As the artificial intelligence-fueled tech rally continues, companies that can diversify to address the manifold demands the industry faces are poised to profit. Super Micro Computer Inc. (NASDAQ: SMCI) is one of those companies. The San Jose, Calif.-based tech firm specializes in high-performance and high-efficiency servers, but it also provides software solutions as well as storage systems for data centers and enterprises focusing on cloud computing, AI, 5G, and edge computing.

Since its March 2007 IPO, when shares debuted at $8.00, shares have gained 5513.75%. That means that a $1,000 investment on the day the company went public would be worth $56137.50 today. But after hitting its all-time high of $1140 per share on March 8, 2024, the stock has dropped 60.61%.

Nonetheless, analysts expect big upside potential for the tech stock. Hindsight is 20/20, and all that matters now is how Super Micro Computer will perform going forward. So 24/7 Wall Street has performed analysis to provide investors — and potential investors — with an idea of where shares of SMCI could be headed over the course of the next five years.

9/16/2024

Super Micro Computer is under increasing pressure to file its delayed annual report. The company has exhausted its 15-day extension and must now submit the report by today. This deadline follows the high-profile attack from short-seller Hindenburg Research, which accused Super Micro Computer of fraudulent accounting and misleading investors.

9/13/2024

Super Micro Computer’s stock price has increased by about 6.64% in the past five days, and by about 55.54% in the past year.

9/12/2024

Super Micro Computer’s shares have experienced a significant decline from their early 2024 peak, but analysts are predicting a rebound in 2025. The consensus forecast remains positive, projecting a 22% sequential growth in revenue and a significant YoY increase in both revenue and earnings. Super Micro Computer is estimated to hold 10% of the AI market share current, but analysts predict this figure will increase to over 17% within the next two years.

9/11/2024

Super Micro Computer’s shares rose by 0.5% today. The stock reached a high of $425.47 and closed at $414.75.

9/10/2024

Super Micro Computer’s stock price fell slightly today, reaching a low of $400.80 and closing at $409.18. Trading volume was much lower than usual, with only around 1.9 million shares changing hands.

9/6/2024

Super Micro Computer’s stock closed the week at 12% lower than its Tuesday opening. This downturn was fueled primarily by investor concerns surrounding the company’s accounting practices and a recent delay in an SEC filing.

Analysts from JP Morgan, reacting to these recent developments, have downgraded SCMI’s stock recommendation from a “buy” to a “hold”, following a similar downgrade from another Wall Street analyst earlier this week. Both JP Morgan and Barclays have also lowered their target price for SMCI shares.

9/5/2024

Over the past month, Super Micro Computer has experienced more than a 30% drop in its shares due in part to the recent Hindenburg Research report. Many investors are also betting that Super Micro Computer will see its stock price fall soon based on the unusually high number of put options being traded, especially for a strike price of $400 that expires on September 6th.

9/4/2024

Super Micro Computer’s stock price fell 2.9% today, trading as low as $408.40. 3,574,500 shares changed hands during mid-day trading, which is a 58% decrease from the average session volume of 8,437,252 shares.

9/3/2024

Super Micro Computer’s stock price rebounded nearly 3% this morning after the company addressed concerns raised in a recent Hindenburg Research report. The company firmly denied the allegations made in the report, calling them misleading and inaccurate. Super Micro Computer reassured its customers and partners that it would provide a detailed response to the accusatory report in the near future.

Shares of SMCI have been particularly rewarding to shareholders in the recent past, as they exploded by gaining 3,096% in the five years between August 2019 and August 2024. The following table summarizes Super Micro Computer’s share price, revenues, and profits (net income) from 2014 to 2023:

| Year | Share Price | Revenues* | Net Income* |

| 2014 | $36.39 | $1.467 | $.054 |

| 2015 | $24.66 | $1.954 | $.092 |

| 2016 | $28.05 | $2.225 | $.072 |

| 2017 | $20.93 | $2.484 | $.067 |

| 2018 | $13.90 | $3.360 | $.046 |

| 2019 | $24.65 | $3.500 | $.072 |

| 2020 | $31.66 | $3.339 | $.084 |

| 2021 | $43.95 | $3.557 | $.112 |

| 2022 | $82.19 | $5.196 | $.285 |

| 2023 | $284.26 | $7.123 | $.640 |

*Revenue and net income in $billions

In the last decade, Super Micro Computer’s revenue grew by more than 385% while its net income increased by just over 1,085%. Despite seeing a minor revenue contraction in 2020 with a decrease of 4.6%, shares of SMCI still managed to increase year-over-year on still-growing net income. As the IT services provider looks forward to the second half of the decade, we have identified three key drivers that are likely to impact its growth metrics and stock performance.

The current consensus median one-year price target for Super Micro Computer is $693.00, which represents nearly 54.31% potential upside over the next 12 months based on the current share price of $449.10. Of all the analysts covering Super Micro Computer, the stock is a consensus buy, with a 2.31 ‘Buy’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

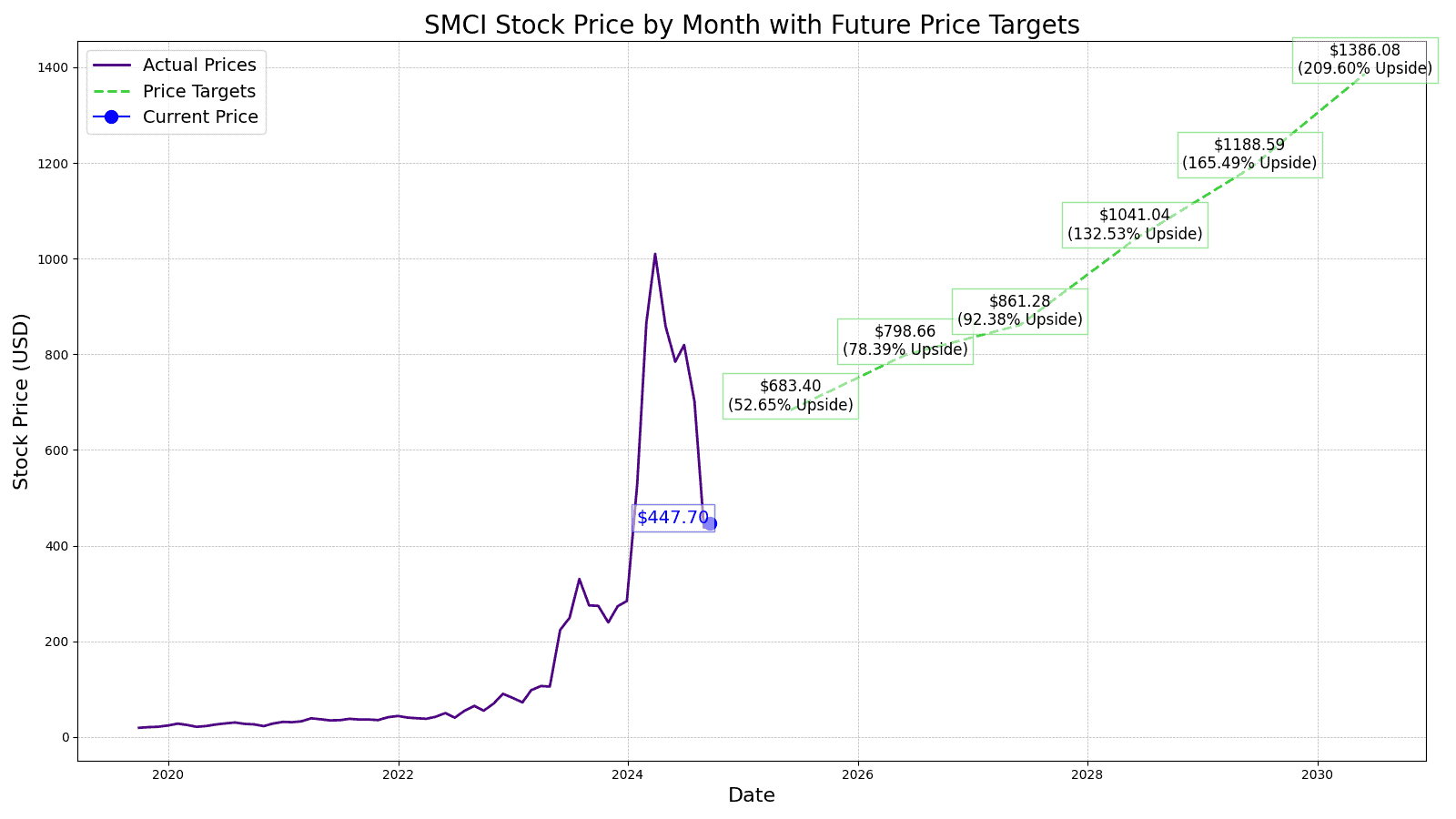

24/7 Wall Street’s 12-month forecast projects Super Micro Computer’s stock price to be $683.40 based on a projected EPS of $34.17 in 2025. Adjusted for the company’s Oct. 1, 2024, stock split, that figure will be $68.34 per share.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $28.265 | $1.974 | $34.17 |

| 2026 | $31.634 | $2.548 | $44.37 |

| 2027 | $37.116 | $1.458 | $53.83 |

| 2028 | $42.631 | $1.881 | $67.60 |

| 2029 | $50.154 | $2.428 | $84.89 |

| 2030 | $59.005 | $3.134 | $106.62 |

*Revenue and net income in $billions

At the end of 2025, we expect to see revenue, net income, and EPS rise by 89.16%, 63.41%, and 70.08%, respectively. That would result in a per-share price of $683.40 (or $68.34 on a post-split-adjusted basis), which is 52.17% higher than where the stock is currently trading.

When 2026 concludes, we estimate the price of SMCI to be $798.66 (or $79.87 on a post-split-adjusted basis), which is 77.84% higher than where shares are trading today. This is based on modest revenue gains, an assumed EPS of $44.37, and a healthy projected P/E ratio of 18.

At the conclusion of 2027, we forecast a sizable jump in the stock price to $861.28 (or $86.13 on a post-split-adjusted basis) driven by $37.116 billion in revenue and $1.458 billion in net income, which will result in shares trading for 91.78% higher than the current share price.

By the end of 2028, we expect to see shares trading for $1041.04 (or $101.40 on a post-split-adjusted basis), or 131.81% higher than the stock is trading for today on revenues of $42.631 billion, net income of $1.881 billion, and an EPS of $67.60.

And at the end of 2029, Super Micro Computer is forecast to achieve revenue of $50.154 billion and net income of $2.428 billion, resulting in a per-share price of $1188.59 (or $118.86 on a post-split-adjusted basis), which is 164.66% higher than the stock’s current price.

By the conclusion of 2030, we estimate an SMCI share price of $1386.08 (or $138.61 on a post-split-adjusted basis), good for a 208.64% increase over today’s share price, based on an EPS of $106.62 and a P/E ratio of 13.

| Year | Price Target | % Change From Current Price |

| 2025 | $683.40 (or $68.34 on a post-split-adjusted basis) | Upside of 52.17% |

| 2026 | $798.66 (or $79.87 on a post-split-adjusted basis) | Upside of 77.84% |

| 2027 | $861.28 (or $86.13 on a post-split-adjusted basis) | Upside of 91.78% |

| 2028 | $1,041.04 (or $101.40 on a post-split-adjusted basis) | Upside of 131.81% |

| 2029 | $1,188.59 (or $118.86 on a post-split-adjusted basis) | Upside of 164.66% |

| 2030 | $1,386.08 (or $138.61 on a post-split-adjusted basis) | Upside of 208.64% |

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.