Headquartered in Issaquah, WA, Costco Wholesale Corporation (NASDAQ: COST) sells high volumes of foods and general merchandise at discounted prices through membership warehouses. With 602 locations in the U.S. across 47 states, and a total of 874 locations worldwide, it is the largest warehouse club, ahead of rivals Sam’s Club, Wholesale Club and BJ’s, and boasts nearly 130 million members.

2024 has so far been a great year for Costco, with the stock is up roughly 35%. Inflation from 2021 to the present has dramatically escalated the prices of food, fuel, and other essentials. Costco’s volume discount warehouse pricing model has been a life preserver for many families pooling resources to buy in bulk and divide afterwards. This has been a key driver of recent growth. However, the stock’s streak of record high prices is in overbought territory, and the underlying conditions that have fueled this unexpected growth may be impacted by recent events.

Headwinds and Challenges

- Another wave of inflation from Fed Funds rate cuts could completely sink the pooling option for those households already barely hanging on. The result would be canceled memberships, which comprise nearly half of Costco revenues.

- The late investment guru Charlie Munger was a big Costco fan, but cautioned that the stock would become problematic if its P/E ratio exceeded 40. It is currently 55.

- Rivals like Sam’s Club have announced the launch of new strategic initiatives to better compete with Costco in the upcoming future.

Nevertheless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near term projections irrelevant. 24/7 Wall Street aims to present some farther looking insights based on Costco’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article:

- Costco’s e-commerce platform, already displaying 15% growth, should be a continual growth driver in the future.

- Costco’s successful business model is not expected to change its fundamentals, although new areas, like A.I., will likely see further development.

- Despite membership price hikes, global renewals have still notched a 90% clip.

- International expansion and stronger loyalty towards Costco’s private Kirkland brand are expected to become physical growth drivers in the next half decade.

- Increased international presence will enhance supply chain efficiencies to maintain margins.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

5 to 10 Year Review

- Costco stock has run up nearly 7.5X (not including dividends) since 2014.

- Memberships worldwide have consistently renewed at 90%.

- In the last 10 years, the store count expanded at a compound annual rate of 3%.

- Management opened 23 net new locations in fiscal 2023, with plans to open 31 in the current fiscal year.

| Fiscal Year (Aug) | Price | Total Revenues | Net Income |

| 2014 | $121.08 | $112.640 B | $2.058 B |

| 2015 | $140.05 | $116.199 B | $2.377 B |

| 2016 | $162.09 | $118.719 B | $2.350 B |

| 2017 | $156.74 | $129.025 B | $2.679 B |

| 2018 | $233.13 | $141.576 B | $3.134 B |

| 2019 | $294.76 | $152.703 B | $3.659 B |

| 2020 | $347.66 | $166.761 B | $4.002 B |

| 2021 | $455.49 | $195.929 B | $5.007 B |

| 2022 | $522.10 | $226.954 B | $5.844 B |

| 2023 | $549.28 | $242.290 B | $6.292 B |

| 2024 TTM | $892.38 | $253.695 B | $7.173 B |

Key Drivers for Costco’s Future

- “If it ain’t broken…” It’s reasonable to expect Costco to continue growing its revenue and earnings within its 10-year mean range. Costco’s massive scale makes the threat of disruption minimal. Similar to Walmart, It’s hard for smaller chains to compete with Costco’s ability to obtain optimum discount pricing from its suppliers.

- Costco’s durability is fueled by its loyal membership base. Memberships carry a 90% renewal rate worldwide, driving repeat purchase behavior. As long as management doesn’t rock the boat with its policy of putting the customer first, Costco will maintain its industry standing.

- A.I. and e-commerce will become key components of Costco’s international expansion strategy.

- Broadened international relationships should open the doors for more localized supply chain opportunities. This will help to maintain margins and reduce shipping and other costs to international outlets and their customers.

- USDA and other US food supply issues will compel Costco towards greater emphasis on other product sector offerings, like healthcare, automotive, and travel, until food prices can fall.

Stock Price Prediction for 2025

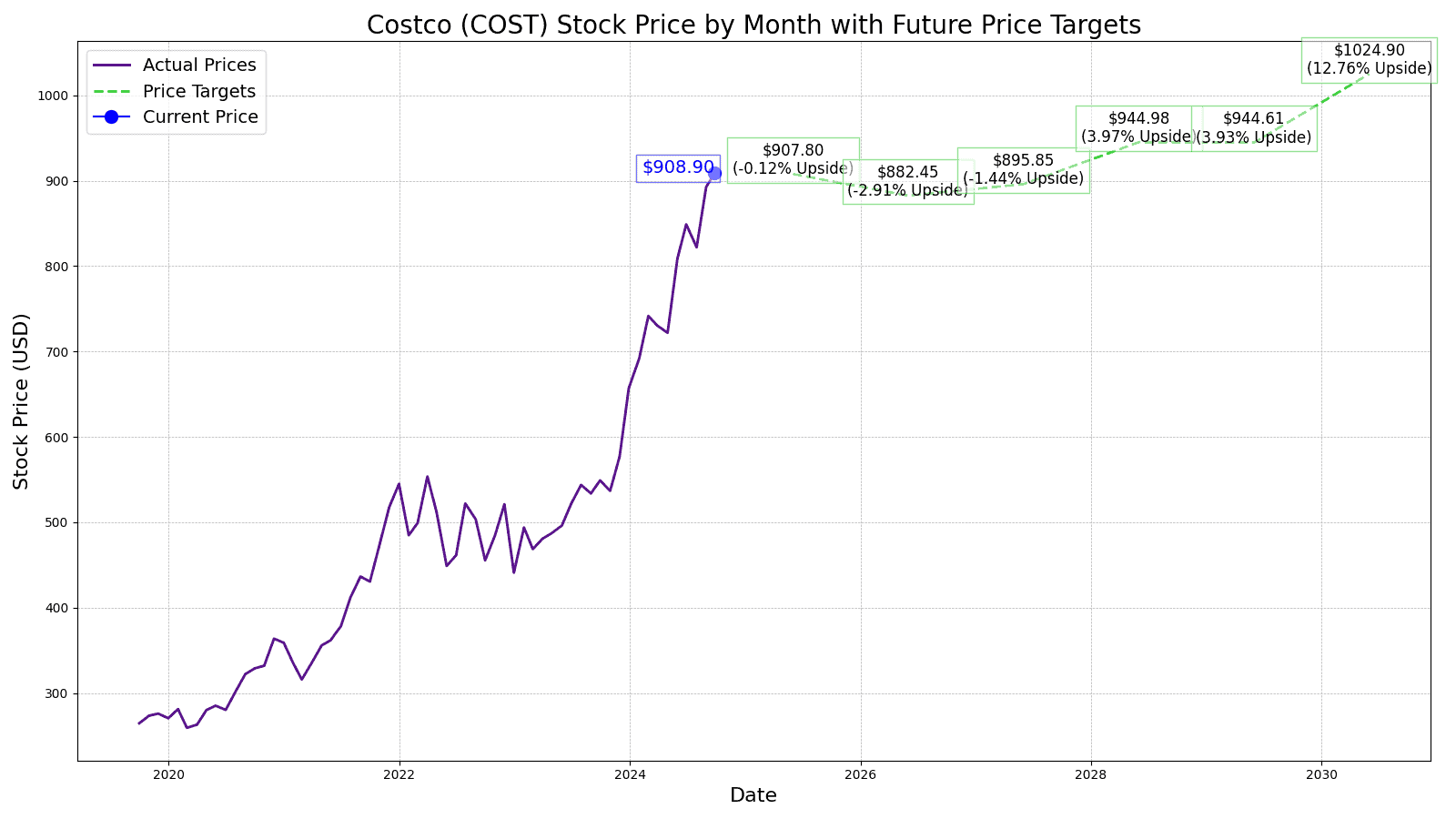

The consensus rating from over 35 Wall Street analysts is “outperform” (17 buy, 7 outperform, 11 hold, 1 sell). The average price target in 12-months is $893.85, which is roughly down -0.76% from today’s stock price. This price factors in 2024’s steep run up and anticipates a correction.

24/7 Wall Street’s 12-month projection for Costco’s price is $907.80, which would be up 0.78%. We believe that any turbulence in the market caused by heightened inflation will be offset going into 2025 with buzz from international expansion efforts already in effect in commencing installation of new outlets.

Costco’s Next 5 Years’ Outlook

While Costco’s expansion to new countries will launch, local assimilation success will vary depending on regional culture, tastes, and practices. As customer service is a major part of Costco’s member loyalty, the etiquette required for each location will not be a cookie cutter winner across the board. Not unlike Walmart’s growing pains in its China venture, Costco will experience its own challenges. Our 2026 price target of $882.45 would represent a 2.91% drop.

Costco’s investment in automated warehouse technologies should continue to improve efficiency and reduce costs. The Costco private label brand, Kirkland Signature, continues to gain popularity, contributing to enhancing homegrown loyalty and the flexibility to add more products to its catalog for 2027. Resolution of some of the simpler international location issues should see positive revenue action to partially gain back losses from 2026. Our price target is $895.85. This represents a 1.5% gain.

2028 is anticipated to see stronger sales in Costco’s pharma, optical, and other healthcare products, as the warehouse technologies interface with telehealth platforms to process exponentially larger numbers of patient prescriptions. The Chapter 11 filing of Rite Aid and the financial difficulties of Walgreens Boots in 2024 left a growing supply void that Costco started to explore.

As Costco’s $3.5 billion net cash safety cushion has protected it during the pandemic and high inflation years, it gave the company substantial leverage to secure healthcare supply chain items at very attractive and profitable levels. The Costco’s Travel services division is also expected to hit its stride in 2028, making for a stronger complement to its automotive tires and parts segment. The 24/7 Wall Street 2028 target price is $944.98, a 5.48% gain.

The Costco e-commerce segment, already showing a solid 15% year-over-year growth rate in 2024, should take a big leap forward in 2029, thanks to A.I. Greater individualized customization of the purchasing experience in different nations and regions should finally become manifest. Additional enhancements in cold storage and last-mile delivery solutions for maintaining grocery produce freshness should be a winner with customers around the globe. However, this may be offset by potentially higher domestic expenses, due to food supply conflicts between farmers and distributors, like Tyson Foods, as well as the USDA.

Even if current regulatory burdens are rescinded, it may take up to five years to regain production levels at hundreds of US meat and poultry processing plants. The availability of enhanced delivery may be slow in adoption if meat and poultry prices remain prohibitively high. Our 2029 price target is $944.61, a nearly flat differential from 2028.

Costco’s Stock in 2030

Costco’s renewable energy investments and sustainable practices are expected to both cut operational costs and appeal to eco-conscious consumers. The company’s expansion of its business centers should strengthen its position in the B2B market and diversify its customer base, similar to strategies employed by other major wholesalers.

The Costco smartphone app should also have the benefit of A.I. customization to make the enhanced Costco customer experience a mobile one. These developments should be fully integrated into Costco’s global operations by 2030. As a result, we predict Costco’s stock price will reach $1,024.90, equating to a 8.50% gain.

| Year | P/E Ratio | EPS | Price |

| 2025 | 51 | $17.80 | $907.80 |

| 2026 | 45 | $19.61 | $882.45 |

| 2027 | 41 | $21.85 | $895.85 |

| 2028 | 37 | $25.54 | $944.98 |

| 2029 | 37 | $25.53 | $944.61 |

| 2030 | 37 | 27.70 | $1,024.90 |

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.