Apple Inc. (NASDAQ: AAPL) has long held an attraction for its ergonomic approach towards computing and communications among students and tech-minded users. Its popularity soared in the 1990s, and its high-growth stock was even referenced in the Tom Hanks movie, Forrest Gump.

Back in 2018, Apple made financial history by becoming the first US company to reach a $1 trillion market cap. The millions of iPhones, MacBooks, iPods and other Apple products have developed rabidly loyal followings, especially in creative fields like music and video production, graphic design, and a host of other industries.

As one of the “Magnificent 7” tech stocks, Apple has been a solid industry leader since its late founder, Steve Jobs, passed the helm onto then COO Tim Cook in 2011. Apple has since been a ubiquitous success story, with even the notoriously Luddite-prone Warren Buffet buying its stock.

Headwinds

Despite new products, developments in artificial intelligence, and an enviably strong balance sheet, Apple has been dealing with some challenges of late. Some of the top ones from the long list includes:

- The DOJ filed an antitrust lawsuit against Apple, alleging it blocks “super” apps, suppresses mobile cloud streaming services, blocks cross-platform messaging apps, limits third-party digital wallets, and limits how well third-party smartwatches work on its platforms.

- Since its recent release, early initial sales indicate that iPhone 16 demand is softer than expected.

- Ethics calls for greater transparency on Apple’s use of A.I. have been rebuffed so far.

- Huawei continues to gain greater Chinese smartphone sales market share, while Apple’s stake continues to shrink.

- Although Apple apparently won the patent infringement suit by AliveCor over the AppleWatch heart rate monitor app, the dispute with Masimo over its pulse oximetry app is still ongoing.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near term projections irrelevant. 24/7 Wall Street aims to present some farther looking insights based on Apple’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article

- Apple Intelligence, which will be available as a free update, is expected to drive a major upgrade cycle for Apple over the next few years. It will require devices with more powerful processors, thus driving more upgrade sales.

- Apple’s Vision Pro virtual reality headset, Apple Watch, and AirPod wireless earphones will all receive upgrades and enhancements that will drive future sales.

- Apple Pay digital payment system and new exclusive streaming content on Apple TV+ will likely continue to expand their subscription bases.

- Mac’s new M4 chip equipped MacBook Pro and MacBook Air computers will supply a sizable portion of Apple sales next wave, as they will offer the widest functionality for AI.

- Continued praise and institutional shareholding from Warren Buffett and other investment gurus will lead investors to support Apple stock during any launch delay or earnings disappointments.

- Apple’s legal issues will be a drag on earnings until they are resolved.

- Apple’s reliance on Taiwan Semiconductor for nearly all of its chip foundry work may be at risk if China militarily invades Taiwan.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change

5-10 Year Review

- Apple acquired Beats Electronics (headphones, speakers, music streaming platform) from Dr. Dre and Jimmy Iovine for $3 billion in 2014, which was the largest Apple purchase at the time.

- In 2017, Apple announced the start of original programming for its Apple TV+ streaming network.

- 2020 saw Apple end its chip relationship with Intel to go into in-house design with its M1 chip and subsequent M2 chip, made in collaboration with Samsung.

- Apple Wallet launched an installment plan payment platform in 2023 in the wake of high inflation as a means to help customers finance Apple product purchases.

- In February 2024, a federal judge ruled in Apple’s favor and dismissed an antitrust lawsuit that claimed that Apple had illegally monopolized the United States market on heart rate apps for the Apple Watch. AliveCor, a medical device and AI company, filed the lawsuit in 2021.

- Apple’s lawsuit with Epic Games over antitrust practices was ruled in Apple’s favor, but unveiled predatory marketing practices from Apple to the general public.

| Fiscal Year (Sept) | Price | Revenues | Net Income |

| 2015 | $27.58 | $233.715 B | $53.394 B |

| 2016 | $28.26 | $215.639 B | $45.687 B |

| 2017 | $38.53 | $229.234 B | $48.351 B |

| 2018 | $56.44 | $265.595 B | $59.531B |

| 2019 | $55.99 | $260.174 B | $55.256 B |

| 2020 | $115.81 | $274.515 B | $57.411 B |

| 2021 | $141.50 | $365.817 B | $94.680 B |

| 2022 | $138.20 | $394.238 B | $99.803 B |

| 2023 | $171.21 | $383.285 B | $96.995 B |

| 2024 LTM (as of 6/30/2024) | $193.97 | $385.603 B | $101.956 B |

Key Drivers for Apple’s Stock in the Future

- Free software update Apple Intelligence is expected to be a huge driver of sales for the next half decade. The processing power requirements for A.I. use will drive users to upgrade to the latest M4 chip or other equipped iPhones, MacBooks, and other devices.

- Apple’s wearables segment, with significant emphasis on Vision Pro, Apple Watch, and AirPods are expected to get a huge marketing push in the upcoming years. All of these products are slated to receive substantial updates and act as key growth drivers for the company.

- Apple services, already past the 1 billion subscription milestone, should continue to grow, thanks to new content like the popular Ted Lasso and flexible virtual credit card installment payments for Apple Wallet, and iCloud storage for AI projects.

Stock Price Prediction for 2025

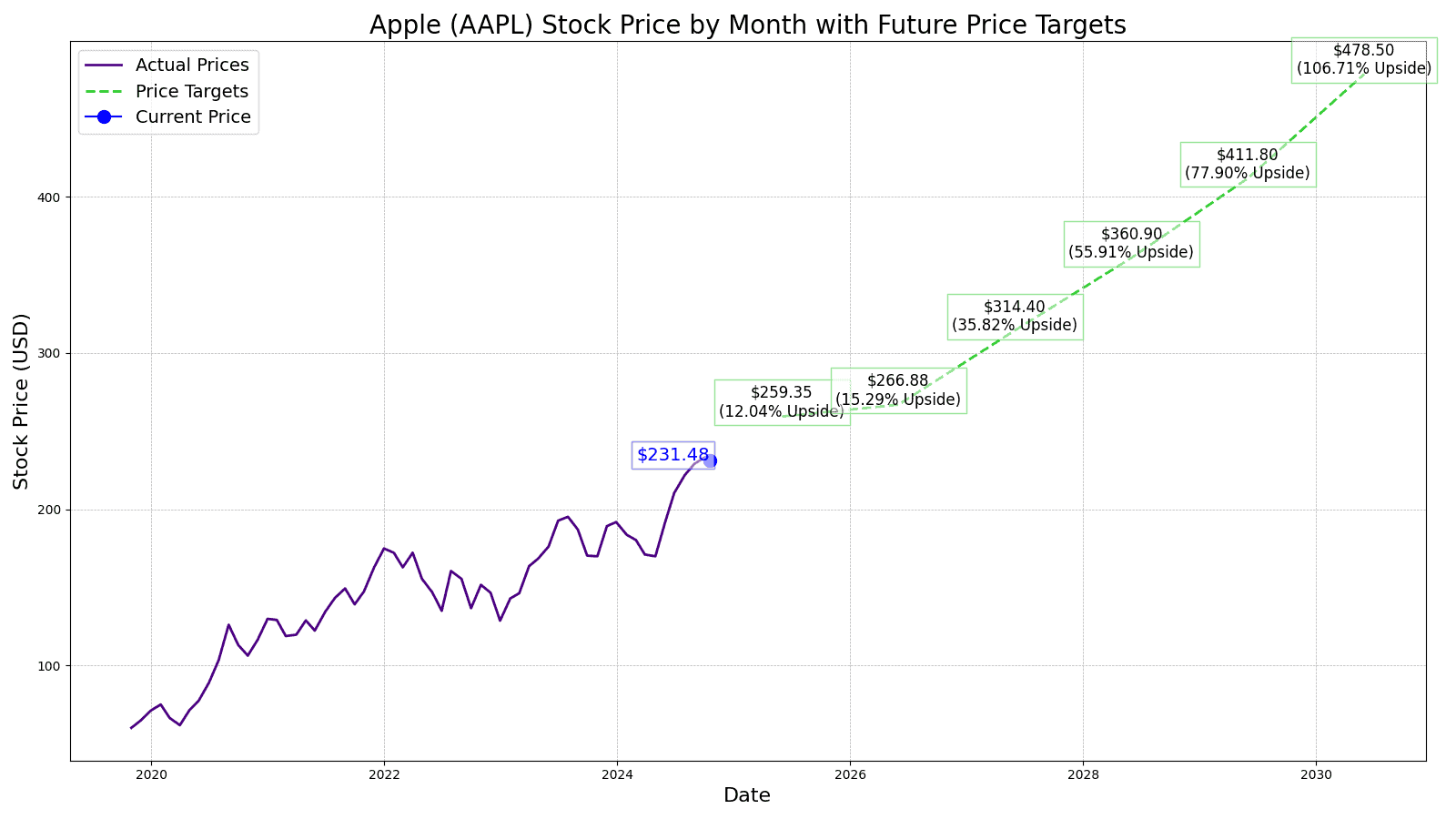

Over 40 Wall Street analysts have a consensus “buy/outperform” rating (24 buy, 8 outperform, 12 hold) for Apple, with a 12-month price target of $240.01. This would be a 7% gain over the current price today. 24/7 Wall Street’s projected price in 12-months is somewhat more bullish: $259.35, which would be a 14% gain.

We believe that the latest National Labor Relations Board complaint investigation, Apple’s soft iPhone 16 sales, and other obstacles will slow, but not reverse, developments with Apple Intelligence, services, and wearables towards greater popularity. Nevertheless, Apple will be able to gather steam to close out for the Christmas season in 2025.

Apple’s Next 5 Years’ Outlook

Apple’s historical P/E ratio for the past decade is 20.72%, so the price numbers are conservatively calculated at a 20 P/E.

24/7 Wall Street projects a 2026 price of $266.88. This would be a 3% year-over-year gain. The initial Apple Intelligence campaign starting in 2024 and continuing through 2025 should have run its course, iPhone sales, which still comprise over half of Apple’s total revenues, as of 2024, as well as iPad MacBook sales will continue, but likely slow down until the next campaign cycle. Towards the end of 2026, we think that Apple will be able to finally get resolution over its Masimo AppleWatch app lawsuit, in addition to its US government labor and DOJ issues, which should help for 2027.

2027 should see Apple TV+ original content build on the popularity of The Morning Show and Ted Lasso with both original TV series as well as feature films, With top notch talent, like Brad Pitt, George Clooney, Nicole Kidman, Javier Bardem, and many others starring in Apple TV+ original programming, subscription growth should offer a boost to revenues. Additional products like AirPods and HomePods, should also see sales growth, commensurate with other media related subscription upswings. We project a 2027 price of $314.40, a 18% year-over-year gain.

2028 is a year of “what-ifs”. On the bullish side, we think that Apple will continue on the trajectory established in 2027 with new programming for Apple TV+ and ancillary media device sales.

However, a number of geopolitical analysts in the US Department of Defense believe that China will be prepared for a potential annexation of Taiwan by the end of 2027. Apple is dependent on Taiwan Semiconductor for its M4 and other chips.

With Huawei successfully dominating the Chinese smartphone market, an invasion of Taiwan could cripple Apple MacBook Air and Pro production, as well as other devices not already being assembled in Vietnam or other nations. The resulting events would severely impact Apple’s operations, forcing it to concentrate on the US domestic and European markets. We project a 2028 price of $360.90, which would be a +15% y-o-y gain, based on China staying its hand. Otherwise, the target price would be half of that if an invasion were to commence.

Apple’s wearables, which include its VisionPro VR devices as well as Apple Watch, and others, should see a popularity jump in 2029. The latest iterations of these devices, equipped with Apple Intelligence, will likely get collaborative marketing deals with celebrities and fashion designers for mass marketing campaigns. Our projected 2029 price is $411.80.

Apple Stock in 2030

Apple Intelligence, which by 2030 could successfully integrate with all of the Apple devices and services in its ecosystem as well as IoT for outside of the Apple Universe, would likely have new updates with added premium features available by subscription. The latest Apple Intelligence iteration will likely demand even greater computing power and speed, conveniently available only with the latest iPhone, iPad and Mac equipped with an even more powerful processor. Intense marketing to demonstrate the lifestyle convenience available for those who are “all-in” with the Apple Digital Universe will drive sales across the board.

24/7 Wall Street predicts a stock price of $478.50 in 2030.

| Year | EPS | P/E multiple | Price |

| 2025 | $12.97 | 20 | $259.35 |

| 2026 | $13.34 | 20 | $266.88 |

| 2027 | $15.72 | 20 | $314.40 |

| 2028 | $18.05 | 20 | $360.90 |

| 2029 | $20.59 | 20 | $411.80 |

| 2030 | $23.93 | 20 | $478.50 |

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.