Forecasts

General Motors (GM) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Once upon a time, during the post-WWII Eisenhower administration, CEO Charles Wilson of General Motors (NYSE: GM) was nominated for Secretary of Defense. During confirmation hearings before a Senate Committee in 1952, Wilson responded to a question about conflicts of interest by Senator Robert Hendrickson as follows: “For years I thought that what was good for our country was good for General Motors, and vice versa.”

Detroit-headquartered GM’s ascent to the pinnacle of US manufacturing clout and excellence during that period made Chevrolet and Buick household names, with Cadillac hailed as the Holy Grail of luxury cars. General Motors’ supremacy has since been supplanted by rivals, both foreign and domestic, but the company continues to maintain a global presence in the automotive industry.

The Fed’s interest rate hikes and the escalation of inflation that began in 2021 severely impacted car-loans industry-wide. According to USAToday, car loans were at 3.86% in 2021, and the average five-year rate at present is 7.82%, based on a 700 FICO score. The average rate for used car buyer financing with deep subprime credit — someone with a credit score in the range of 300 to 500 — was as high as 21.57%, according to data from Experian. Unique to General Motors were the following legal, financial, and compliance landmines:

Nevertheless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on GM’s own numbers, along with business and market development information that may be of help to our readers’ own research.

11/5/2024

General Motors announced another recall, this time for the 107 Bolt EV and EUV due to a fire risk. The recall includes models from 2020-2022 due to a potential failure in the installation of advanced diagnostic software, which could result in a fire risk when charged to full or near-full capacity.

11/4/2024

General Motors is recalling over 50,000 vehicles in Canada due to a faulty transmission control valve. This issue can cause harsh shifting and in severe cases, rear wheel lockup, increasing the risk of accidents.

11/1/2024

General Motors saw a notable increase in short interest during October. As of October 15th, the number of shares sold short rose by 6.8%, reaching 32.76 million shares. This translates to a days-to-cover ratio of 2.4 days, indicating that it would take roughly 2.4 days to cover all short positions given the average daily trading volume. Approximately 3% of GM’s outstanding shares are currently short sold.

10/31/2024

The U.S. Department of Energy has awarded General Motors an $8 million grant to improve its electric vehicle battery recycling. The funding is intended to aid GM as the company develops more efficient recycling methods for EV batteries.

10/29/2024

A recent statewide poll shows that Michigan citizens are split on the issue of federal subsidies for General Motors. The poll was conducted to gauge public opinion on the company’s plan to retool a Cadillac sedan plant in Lansing for future electric vehicle production.

10/28/2024

GM Defense has finished building the first batch of armored SUVs for the U.S. State Department’s Diplomatic Security Service (DSS). These heavy-duty SUVs are designed to protect high-ranking officials during their travels.

10/25/2024

Bernstein has raised its price target for General Motors from $53 to $55 while maintaining a “Market Perform” rating.

10/24/2024

Argus Research has increased its price target for General Motors from $53 to $60 and maintained a “Buy” rating on the stock. The higher price target is based on GM’s strong third-quarter earnings, which were driven by increased revenue and opening profit in North America, cost-saving initiatives, and lower vehicle incentives.

10/23/2024

GM released its Q3 earnings report, revealing a fantastic third quarter that beat analysts’ estimates and boosted its outlook for 2024. The company earned $2.96 per share (adjusted), well above the expected $2.43. Revenue totaled $48.76 billion, exceeding the projected $44.59 billion.

Mary Barra took over as General Motors’ CEO in 2014. Since that time, she has presided over a number of highs and lows for the company, including:

| Fiscal Year | Price | Revenues | Net Income |

| 2015 | $34.01 | $135.725B | $9.687B |

| 2016 | $34.84 | $149.184B | $9.427B |

| 2017 | $40.99 | $145.588B | (-$3.864B) |

| 2018 | $33.45 | $147.049B | $8.014B |

| 2019 | $36.60 | $137.237B | $6.732B |

| 2020 | $41.64 | $122.485B | $6.427B |

| 2021 | $58.63 | $127.004B | $10.019B |

| 2022 | $33.64 | $156.735B | $9.934B |

| 2023 | $35.92 | $171.842B | $10.127B |

| 2024 TTM | $47.76 | $178.093B | $11.078B |

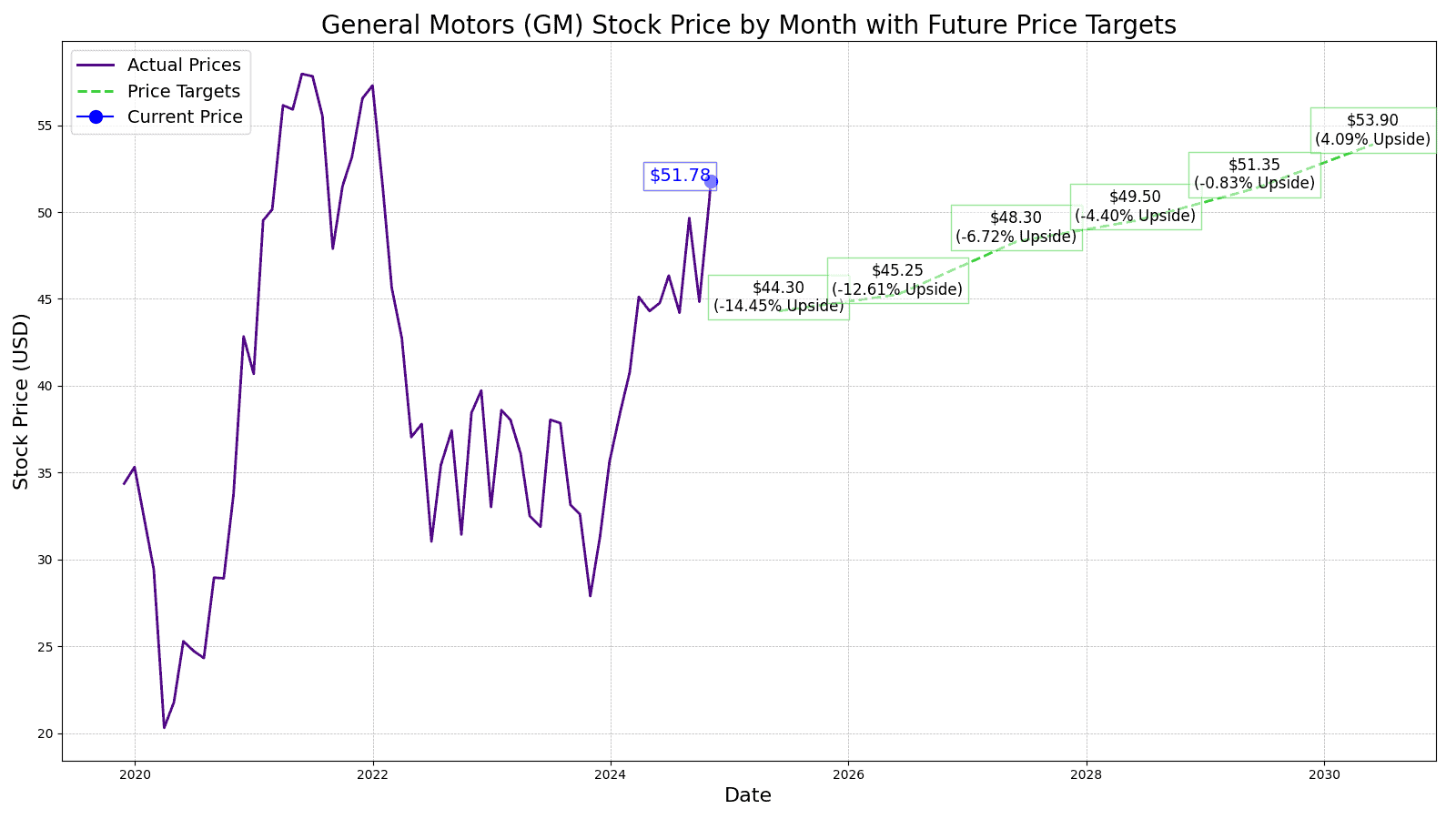

The consensus rating from 27 Wall Street analysts is “outperform”. The average price target in 12 months is $54.00, which is roughly up 1.09% from the price at the time of this writing. 24/7 Wall Street’s 12-month projection for General Motors’ price is General Motors’ price is $44.30, which would be (-3.96%). We believe that this is a conservative estimate based on the Texas and illegal data harvesting and transmission class action suits, which can likely drag the stock price down throughout 2025, despite other GM gains. Additionally, the current EV mandate from Washington, DC may no longer be in effect, based on the results of this November’s presidential election.

General Motors’ Cruise autonomous vehicle technology has undergone a number of growing pains. After a 2023 San Francisco incident involving a Cruise vehicle that resulted in a pedestrian critical injury, Cruise halted production and issued a Cruise recall. Relaunching in Arizona, in Q1 2024, GM pumped an additional $850 million into Cruise for resumption in Texas. Cruise robotaxis are scheduled to supply Uber later on in 2025, and implementation to generate revenue is anticipated by 2026. 24/7 Wall Street projects GM stock to rise in 2026 to $45.25, which would equate to an approximate 2.14% gain year-over-year.

Stronger EV sales with new models added to its line of Hummer EV, Chevy Silverado EV, and Cadillac Lyriq top sellers, along with the release of additional hybrids to meet demand for 2027 should help GM reach our projected stock price of $48.30, a 6.74% gain year-over-year.

General Motors’ proprietary battery manufacturing in MI, OH, and TN will likely augment the completion of its investment in Lithium Americas Corp in Canada. By owning a stake in LAC, GM should have an assured supply of lithium for its Ultium Drive batteries. The cathode supply deal with LG Chem should round out supply chain security for the Ultium platform, which should also proliferate its Ultium 360 charging platform throughout 2028. Our 2028 GM stock price projection is $49.50, a 2.48% gain year-over-year gain.

2029 should begin to see revenues begin to manifest from General Motors’ autonomous driver assistance systems (ADAS), which are based on the same technology developed for Cruise. This is a hands-free driving system installed in privately owned vehicles, which can ostensibly reduce collisions and other vehicular accidents caused by driver-operator error. Dubbed “Super Cruise”, the GM’s ADAS still requires the driver to be attentive to traffic and road conditions, unlike the Cruise robotaxis, which are designed for urban environments, and more congested traffic situations. GM cars equipped with ADAS should sell well, as auto insurance premiums should ostensibly see commensurate reductions from lower collision risks. Our 2029 GM stock price projection is $51.35, a 3.75% gain year-over-year.

General Motors’ R&D work in artificial intelligence extends beyond its ADAS and Cruise robotaxi projects. Applying AI to streamline design and manufacturing efficiencies, GM will be able to utilize AI for better marketing and sales. By expanding data collection and applications for ride-sharing, logistics, urban mobility solutions, and customer satisfaction preferences, GM can customize vehicle models and features for increased demographic targeted appeal. 24/7 Wall Street’s price target for 2030 is $53.90. This would be a 5% gain over 2029 and would mark a 4.09% 5-year cumulative gain.

| Year | EPS | Projected Price |

| 2025 | 7.67 | $44.30 |

| 2026 | 8.35 | $45.25 |

| 2027 | 8.52 | $48.30 |

| 2028 | 8.75 | $49.50 |

| 2029 | 9.94 | $51.35 |

| 2030 | 10.17 | $53.90 |

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.