Forecasts

Super Micro Computer (SMCI) Price Prediction and Forecast

Published:

Last Updated:

As the artificial intelligence-fueled tech rally continues, companies that can diversify to address the manifold demands the industry faces are poised to profit. Super Micro Computer Inc. (NASDAQ: SMCI) is one of those companies. The San Jose, Calif.-based tech firm specializes in high-performance and high-efficiency servers, but it also provides software solutions as well as storage systems for data centers and enterprises focusing on cloud computing, AI, 5G, and edge computing.

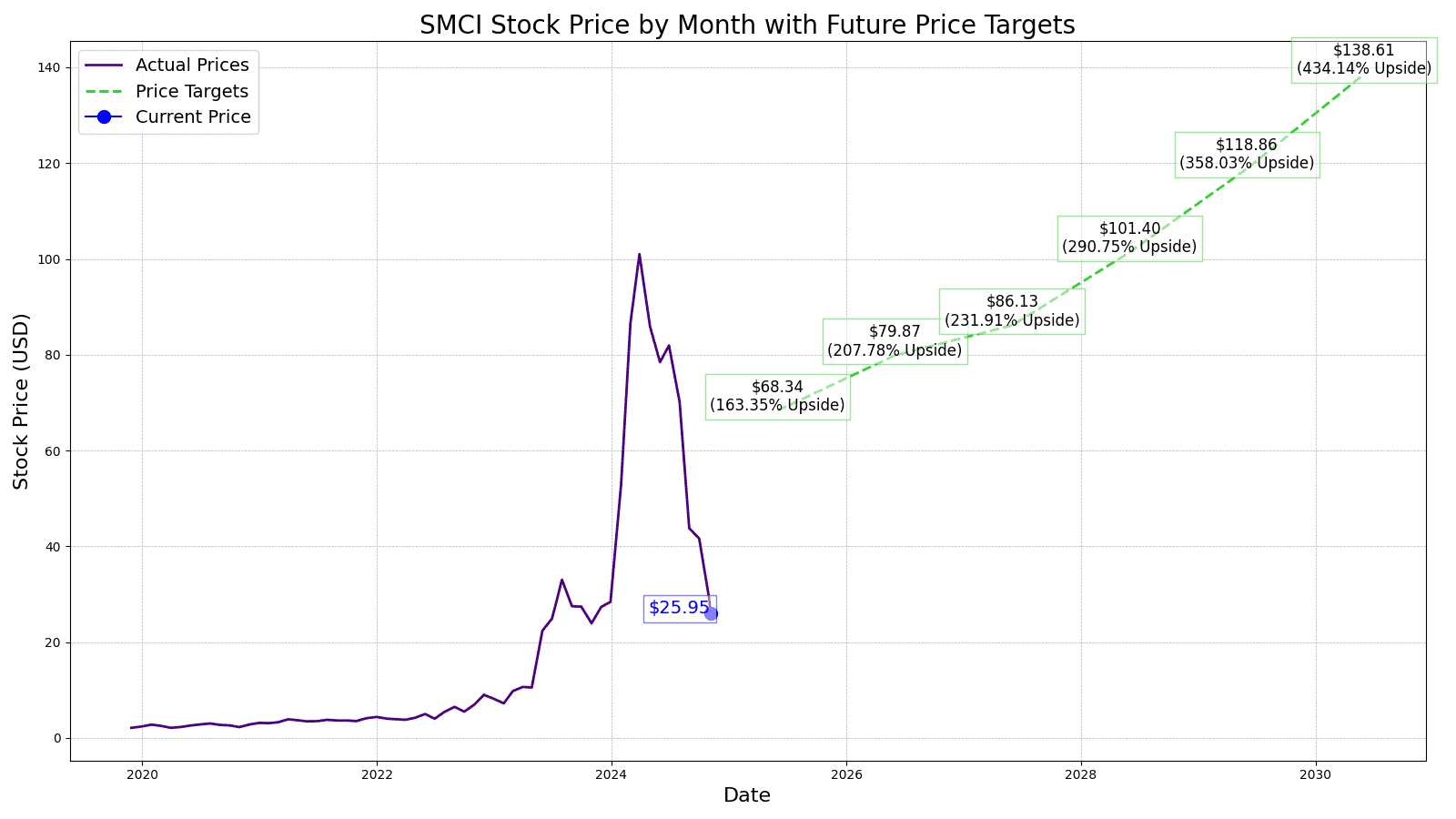

Nonetheless, analysts expect big upside potential for the tech stock. Hindsight is 20/20, and all that matters now is how Super Micro Computer will perform going forward. So 24/7 Wall Street has performed analysis to provide investors — and potential investors — with an idea of where shares of SMCI could be headed over the course of the next five years.

11/5/2024

Super Micro Computer has announced its preliminary financial results for the first quarter of fiscal year 2025. The company expects net sales to be between $5.9 billion and $6.0 billion, falling short of its previous forecast of $6.0 billion to $7.0 billion.

11/4/2024

Super Micro Computer is set to provide a business update on Tuesday, but market attention is primarily focused on the company’s potential delisting from the Nasdaq Stock Exchange. Despite this, the company’s stock price increased by 5.6% today.

11/1/2024

Super Micro Computer is at risk of being removed from the Nasdaq Stock Exchange following the sudden resignation of its auditor, Ernst & Young. The company has been given a deadline of November 16th to submit a plan to regain compliance with Nasdaq listing rules.

10/31/2024

Yesterday, Ernst & Young resigned as Super Micro Computer’s auditor, leading to a 33% drop in the company’s stock price. Today, SMCI’s stock price continued to decline an additional 16%.

10/29/2024

Super Micro Computer’s stock price increased by 2.2% today, reaching a high of $48.70.

10/24/2024

Super Micro Computer’s share price increased 3.6% and traded as high as $47.24 during mid-day trading today.

10/23/2024

Super Micro Computer recently released a new, powerful server for artificial intelligence tasks. The new serve can fit 18 graphics cards and uses Intel’s top-of-the-line Xeon 6900 series processors.

10/21/2024

Super Micro Computer’s share price increased 1.4% today, trading as high as $48.88.

10/18/2024

Super Micro Computer’s share price increased 2.2% today, trading as high as $48.85.

10/17/2024

Super Micro Computer’s share price was down 2% at mid-day trading today, trading as low as $47.43.

Shares of SMCI have been particularly rewarding to shareholders in the recent past, as they exploded by gaining 3,096% in the five years between August 2019 and August 2024. The following table summarizes Super Micro Computer’s share price, revenues, and profits (net income) from 2014 to 2023:

| Year | Share Price (pre-split) | Revenues* | Net Income* |

| 2014 | $36.39 | $1.467 | $.054 |

| 2015 | $24.66 | $1.954 | $.092 |

| 2016 | $28.05 | $2.225 | $.072 |

| 2017 | $20.93 | $2.484 | $.067 |

| 2018 | $13.90 | $3.360 | $.046 |

| 2019 | $24.65 | $3.500 | $.072 |

| 2020 | $31.66 | $3.339 | $.084 |

| 2021 | $43.95 | $3.557 | $.112 |

| 2022 | $82.19 | $5.196 | $.285 |

| 2023 | $284.26 | $7.123 | $.640 |

*Revenue and net income in $billions

In the last decade, Super Micro Computer’s revenue grew by more than 385% while its net income increased by just over 1,085%. Despite seeing a minor revenue contraction in 2020 with a decrease of 4.6%, shares of SMCI still managed to increase year-over-year on still-growing net income. As the IT services provider looks forward to the second half of the decade, we have identified three key drivers that are likely to impact its growth metrics and stock performance.

The current consensus median one-year price target for Super Micro Computer is $65.00, which represents a nearly 149.71% potential upside over the next 12 months based on the current share price of $26.03. Of all the analysts covering Super Micro Computer, the stock is a consensus buy, with a 2.38 ‘Outperform’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

24/7 Wall Street’s 12-month forecast projects Super Micro Computer’s stock price to be $68.34 based on a projected EPS of $3.35 in 2025.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $28.265 | $1.974 | $3.35 |

| 2026 | $31.634 | $2.548 | $4.31 |

| 2027 | $37.116 | $1.458 | $5.49 |

| 2028 | $42.631 | $1.881 | $6.76 |

| 2029 | $50.154 | $2.428 | $8.49 |

| 2030 | $59.005 | $3.134 | $10.62 |

*Revenue and net income in $billions

At the end of 2025, we expect to see revenue, net income, and EPS rise by 89.16%, 63.41%, and 70.08%, respectively. That would result in a per share price of $683.40 (or $68.34 on a post-split-adjusted basis), which is 2525.43% higher than where the stock is currently trading.

When 2026 concludes, we estimate the price of SMCI to be $798.66 (or $79.87 on a post-split-adjusted basis), which is 2968.23% higher than where shares are trading today. This is based on modest revenue gains, an assumed EPS of $44.37, and a healthy projected P/E ratio of 18.

At the conclusion of 2027, we forecast a sizable jump in the stock price to $861.28 (or $86.13 on a post-split-adjusted basis) driven by $37.116 billion in revenue and $1.458 billion in net income, which will result in shares trading for 3208.80% higher than the current share price.

By the end of 2028, we expect to see shares trading for $1041.04 (or $101.40 on a post-split-adjusted basis), or 3899.39% higher than the stock is trading for today on revenues of $42.631 billion, net income of $1.881 billion, and an EPS of $67.60.

And at the end of 2029, Super Micro Computer is forecast to achieve revenue of $50.154 billion and net income of $2.428 billion, resulting in a per share price of $1188.59 (or $118.86 on a post-split-adjusted basis), which is 4466.23% higher than the stock’s current price.

By the conclusion of 2030, we estimate an SMCI share price of $1386.08 (or $138.61 on a post-split-adjusted basis), good for a 5224.93% increase over today’s share price, based on an EPS of $106.62 and a P/E ratio of 13.

| Year | Price Target | % Change From Current Price |

| 2025 | $68.34 | Upside of 2525.43% |

| 2026 | $79.87 | Upside of 2968.23% |

| 2027 | $86.13 | Upside of 3208.80% |

| 2028 | $101.40 | Upside of 3899.39% |

| 2029 | $118.86 | Upside of 4466.23% |

| 2030 | $138.61 | Upside of 5224.93% |

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.