Forecasts

Taiwan Semiconductor (TSM) Price Prediction and Forecast

Published:

Last Updated:

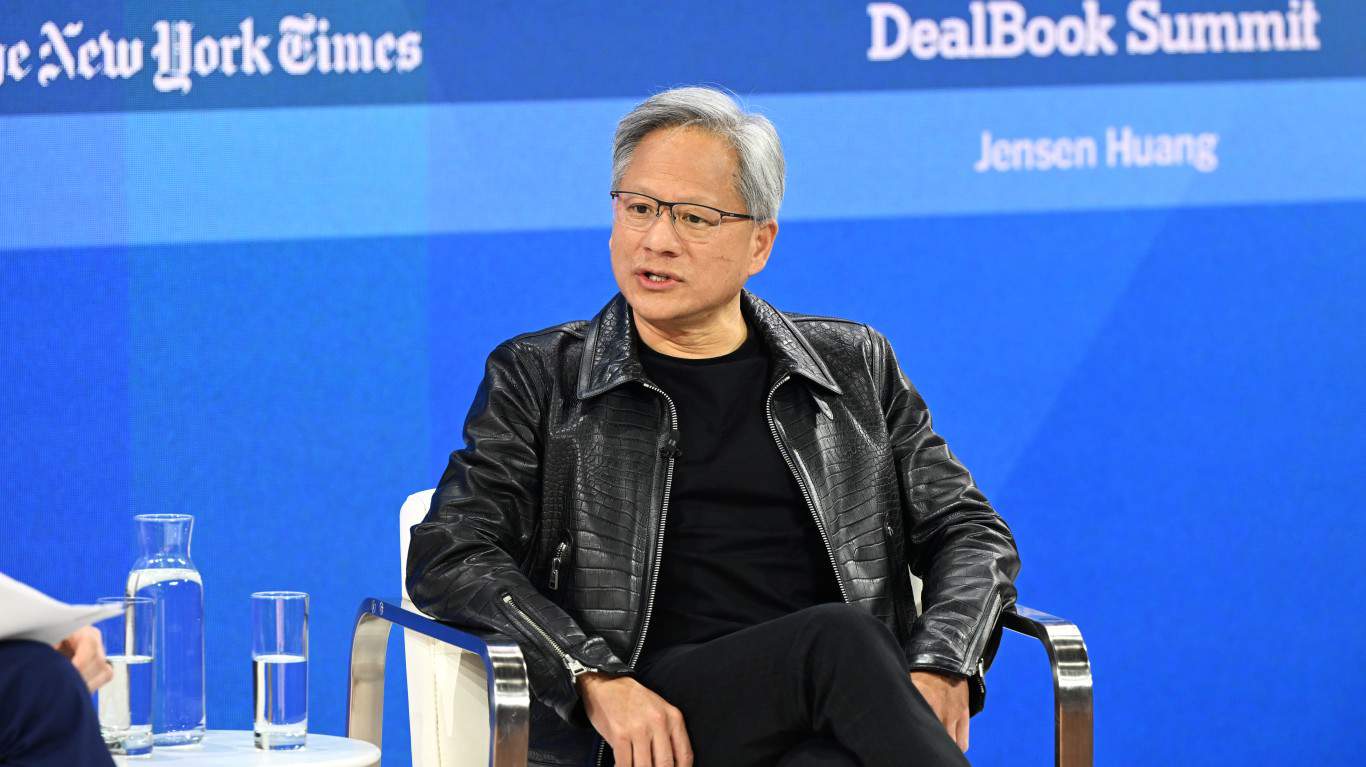

In the high-tech universe, there is a single common road that top-flight companies like Nvidia (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), Apple (NASDAQ: AAPL), Qualcomm (NASDAQ: QCOM), Broadcom (NASDAQ: AVGO), and many others must travel to get their chips made, no matter where they hail from. That road inevitably leads to Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM), the largest semiconductor foundry on the planet.

When a company like Nvidia designs a new chip, it takes it to Taiwan Semiconductor to actually print the design on a silicon wafer. Taiwan Semiconductor is the top choice for Nvidia, AMD, and many other chip designers, thanks to its precision, quality control, and innovative technical capabilities. At the time of this writing, Taiwan Semiconductor commands over 60% of global spending at chip foundries.

The explosion of growth in the artificial intelligence and data center arenas have led to a commensurate demand acceleration for Graphics Processing Unit (GPU) chips and a panoply of similar ones for those fields. By focusing on precision foundry work, Taiwan Semiconductor has become the premier “go-to” player, for chip designers, even among those competing in various sectors.

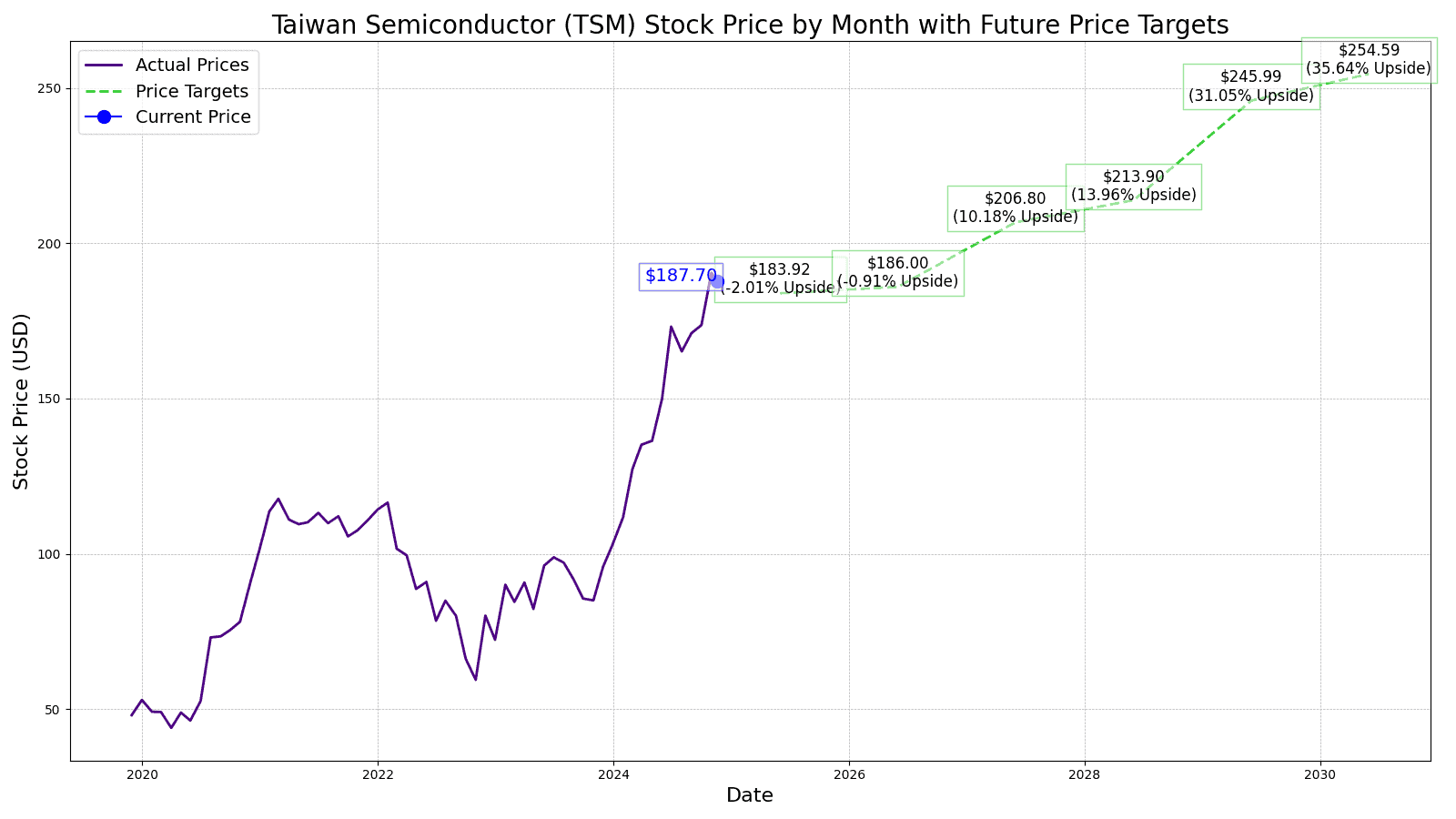

Nevertheless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. Although most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near term prognostications irrelevant. 24/7 Wall Street aims to present some farther looking insights based on Taiwan Semiconductor’s own numbers, along with business and market development information that may be of help to our readers’ own research.

11/18/2024

The U.S. Commerce Department has finalized a $6.6 billion subsidy for Tawain Semiconductor to boost semiconductor production in Phoenix, Arizona. This marks the first major award under the $52.7 billion CHIPS and Science Act of 2022.

| Fiscal Year (DEC ) | Price | Total Revenues | Net Income |

| NYSE | (TWD) | (TWD) | |

| 2014 | $22.38 | $762.806 M | $254.301 M |

| 2015 | $22.75 | $843.497 M | $302.854 M |

| 2016 | $28.75 | $947.983 M | $331.733 M |

| 2017 | $39.65 | $977.947 M | $344.998 M |

| 2018 | $36.91 | $1.031,473 B | $363.052 M |

| 2019 | $58.10 | $1.069,985 B | $353.948 M |

| 2020 | $109.04 | $1.339,254 B | $510.744 M |

| 2021 | $120.31 | $1.587,415 B | $596.540 M |

| 2022 | $74.49 | $2.236,891 B | $1.016,530 B |

| 2023 | $104.00 | $2.161,735 B | $838.497 M |

| 2024 TTM (Jun ) | $173.81 | $2.438,416 B | $923.042 M |

The consensus rating for Taiwan Semiconductor from over a dozen Wall Street analysts is “buy”(11 buy, 4 outperform,1 hold). The average price target in 12 months is $210.79, which is roughly 12.30% above the current price.

24/7 Wall Street’s 12-month projection for Taiwan Semiconductors’ price is $183.92, which is -2.01% below the current price. While Taiwan Semiconductor will start its 2-nm process in 2025, Samsung has a vested interest in developing its own niche advantage and support from the Korean government in that space. As a result, we don’t anticipate as big a 2025 surge from 2-nm as other analysts might.

Since Taiwan Semiconductor consumes as much as 5% of Taiwan’s entire energy output, its Ørsted wind farm energy production should manifest tangible cost savings benefits. Therefore, we project 2026’s stock price to hit $186.00, a modest .74% year-over-year gain.

While its 2-nm process will likely compete favorably at the start against Samsung, the TSM competitive advantage in other avenues of chip manufacturing will ultimately prove to be overwhelming. The anticipated surge of data center spending on chips should fuel larger contracts. Collaborations with research institutions and tech giants in developing next-generation AI chips could open new revenue streams and strengthen its position as an innovation leader in the industry. Our projection for 2027 is $206.80.

2028 should begin to see the rewards from the 2024 R&D surge of $32 billion in advanced process technologies. New products from TSM investments in quantum computing research are expected to bear fruit by 2028, potentially revolutionizing certain computing applications. The company’s focus on developing ultra-low power consumption chips for IoT and edge computing devices could position it as a key player in the growing market for energy-efficient technologies. The 2028 24/7 Wall Street price target is $213.90.

2029 will mark the expiration of Taiwan Semiconductor’s GlobalFoundries cross-licensing agreement, which should double up the revenues from that stream. Further developments in chips for quantum computing, healthcare and other applications can open up more direct government contract opportunities. US and German TSM factories should be operating at full capacity by 2029. We anticipate a price jump to $245.99.

By 2030, Taiwan Semiconductor’s work in quantum computing should pave the way for neuromorphic computing chips at the forefront of AI applications. These would mimic human brain functions more closely than ever before. The company’s involvement in space exploration projects and renewable energy initiatives may also diversify its revenue streams and enhance its global technological influence. We expect a $254.59 stock price, representing a 35.64% gain over today’s stock price.

| Year | P/E Ratio | EPS | Price |

| 2025 | 22 | $8.36 | $183.92 |

| 2026 | 20 | $9.30 | $186.00 |

| 2027 | 22 | $9.40 | $206.80 |

| 2028 | 20 | $10.70 | $213.90 |

| 2029 | 20 | $12.30 | $245.99 |

| 2030 | 18 | $14.14 | $254.59 |

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.