Before winning the streaming wars, Netflix (NASDAQ:NFLX) was already transforming the home entertainment industry.

It was founded in 1997 by Reed Hastings as a DVD-by-mail subscription service. At the time, the movie rental market was dominated by physical rentals from giants like Blockbuster. Netflix’s business model disrupted the traditional movie rental model by offering convenience and eliminating late fees.

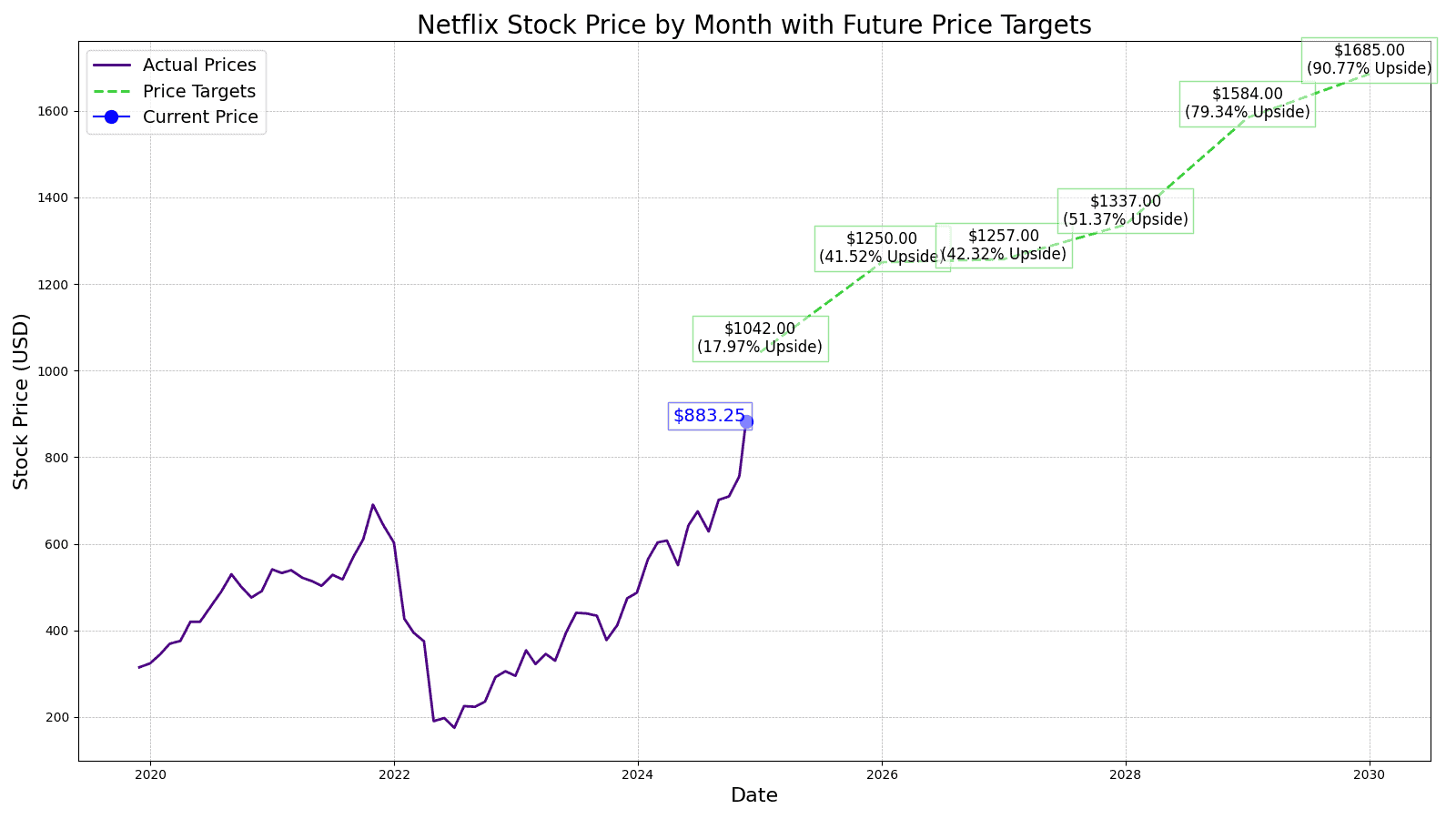

Hastings took the company public five years later on May 23, 2002, at a split-adjusted $1.16 per share. Today, the stock trades at $883.25 per share, a 76,042% gain, for a compounded annual growth rate of over 35.20%. That means every $1,000 invested in the streamer in 2002 is worth $761,422 today.

When Netflix began streaming in 2007, the industry was in its infancy with competitors like Hulu and Amazon Prime Video only emerging afterward. By leveraging its vast movie catalog it quickly became the industry leader before pivoting to original content in the 2010s.

Today Netflix has 283 million paid subscribers and has reshaped entertainment consumption worldwide.

But the question is what will Netflix do for investors today. While Wall Street offers one-year price projections, investors want to know where it will be many years from now and 24/7 Wall St has you covered.

We applied some assumptions about its business and opportunities for growth and did some numbers-crunching to offer insights about where NFLX stock will be in future years.

Key points in this article:

- Key growth drivers: More and better movies and series; games based on both established IPs and original content; and new opportunities like live events.

- Advertising will become an even more important component of Netflix business model.

- Continued growth and expansion beyond the mature North American market.

- If you’re looking for an AI stock early in the AI growth cycle, grab a complimentary copy of our “The Next NVIDIA” report. It has a software stock that could ride dominance in AI to returns of 10x or more.

Key drivers for Netflix stock

- Content success: Although Netflix had a rocky start when it began producing its own content, it has long since found its stride and routinely produces captivating shows that grab the public’s attention. During Covid, it had Tiger King in 2020 and followed that up with Squid Game in 2021. In the this year’s third quarter it had three popular shows, Perfect Couple, Monsters: The Lyle and Erik Menendez Story, and Nobody Wants This. And because it has good relationships with international creators, it plans on bringing out new programming from Brazil, South Korea, the U.K., and elsewhere in the fourth quarter. For 2025, the second season of Squid Game is scheduled to debut on Dec. 26.

- Games based on content: A fast-growing opportunity is games based on Netflix IP, such as Squid Game, Virgin River Christmas, and The Ultimatum. It also has games based on existing IPs, such as Monument Valley 3. As it all comes included as a package with Netflix streaming, it has the potential to see tremendous growth.

- Live events: The Mike Tyson-Jake Paul boxing match Netflix hosted on Nov. 15 drew in 108 million viewers, with 65 million concurrent households at its peak, making it the “most-streamed sporting event ever.” Its success will likely spur more such programming in the future, such as Christmas Day NFL and weekly WWE wrestling events. It might not reach the 200 billion hours of its on-demand streaming content, but should offer significant growth.

- Advertising: Netflix expects ads to become a significant contributor to revenue in the next few years. It says it is roughly doubling ad revenue each year, but it is starting off a very small base. It will become meaningful beginning in 2025. In the countries where it shows ads, the ad plan accounted for 50% of the new membership sign ups it saw in the quarter and ad plan membership was up 35% quarter-over-quarter.

Netflix (NFLX) stock price prediction in 2025

There are 35 analysts covering Netflix who assign it a 12-month consensus price target of $759 per share. That implies -14% downside from where it currently trades, but ranges from a low of $545 per share (or -38% downside) to a market high of $950 per share (8% upside). Despite that, Wall Street has a ‘moderate buy’ rating on NFLX stock.

24/7 Wall St’s one-year forecast projects Netflix stock to be $1042 per share based on continued, triple-digit growth in advertising revenue and high-double-digit ad plan subscriber growth. The streamer should outperform analyst expectations due to higher-than-expected subscriber growth and margin expansion due to its scale.

Netflix (NFLX) stock forecast through 2030

Valuing Netflix’s stock price for the coming years, beginning with management’s expected revenue of $38.9 billion for 2024 and net income of $8.7 billion. Then we’ll give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue ($ billion) | Net Income | EPS | |

| 2025 | $43.5 | $9.0 | $21.70 |

| 2026 | $48.7 | $10.2 | $26.04 |

| 2027 | $53.6 | $11.5 | $29.94 |

| 2028 | $58.4 | $12.8 | $34.43 |

| 2029 | $63.7 | $14.0 | $39.60 |

| 2030 | $69.4 | $17.4 | $44.35 |

How Netflix next 5 years could play out

In line with management’s expectations, we expect Netflix revenue to grow 12% in 2025, which is the midpoint of its 11% to 13% guidance. That will produce EPS of $21.70 per share, in line with NFLX five-year CAGR of around 20%. We expect the stock to trade at a similar multiple next year of around 48, putting our estimate for the stock price for Netflix at $1041.60 in 2025, which is 17.97% higher than the stock is trading today.

As advertising begins to take off, but subscribership in its more mature markets slows, revenue growth should maintain its 12% growth rate. Netflix should continue to trade at elevated multiples consistent with where it trades today, giving us a price target of $1,250 per share in 2026.

For 2027, we forecast the growth juggernaut will ease slightly to 10% growth in revenue though it will maintain its margins of 21% giving us earnings of $29.94. With a P/E ratio of 42, that translates into a price target of $1,257 per share.

Through 2029, we forecast Netflix will take its foot off the revenue gas ever so slightly at just 9% annually. With a P/E ratio of 40, in line with its five-year average, we get price targets of $1,377 in 2028 and $1,584 per share in 2029.

Netflix stock price target for 2030

At this point, Netflix remains the dominant streaming service, but offering a multitude of gaming options and live events. Although advertising will be a considerable component of revenue, it will have reached critical mass in most of its important growth markets and the maturity of its business will see Netflix’s revenue growth slow to 9%. Margins, however, should continue improving to 25%, which will readily support a price target of $1,685 per share at a P/E ratio of 38.

At some point along the way, it wouldn’t be surprising to see Netflix split its stock to make it more affordable for small, retail investors.

| Year | Price Target | % Change From Current Price |

| 2025 | $1,042 | 19.63% |

| 2026 | $1,250 | 43.51% |

| 2027 | $1,257 | 44.32% |

| 2028 | $1,337 | 53.50% |

| 2029 | $1,584 | 81.86% |

| 2030 | $1,685 | 93.46% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.