Over the past decade, local computer storage has become a relic, joining the likes of the floppy disk and CD-ROM. Today, Big Data is big business, and the companies that provide cloud storage solutions are on the forefront of an explosive industry. Snowflake Inc. (NYSE: SNOW) is the quintessential example.

Despite having to face cloud-based data warehousing competitors such as Google BigQuery, a subsidiary of Alphabet Inc. (NASDAQ: GOOGL), or Redshift, a business division of Amazon Inc. (NASDAQ: AMZN), the company is well-positioned to take advantage of the $602.31 billion industry’s projected growth. According to Grand View Research, the global cloud computing market size is expected to grow at a compound annual growth rate (CAGR) of 21.2% between 2024 and 2030, with the U.S. cloud computing market forecast to grow at a slightly lower — but still considerable — CAGR of 20.3% over the same time frame.

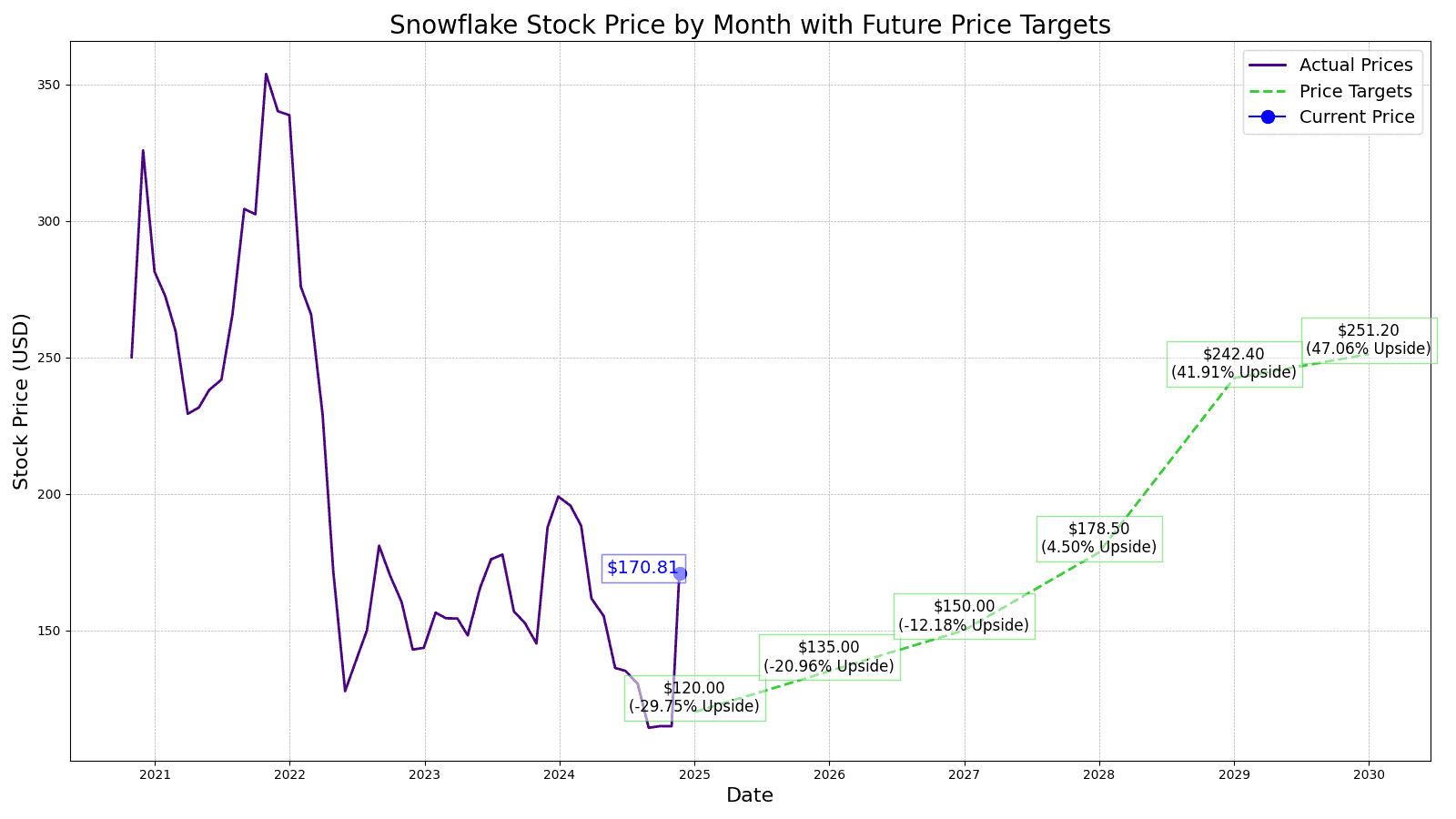

In addition to its data management services, Snowflake provides clients with customized infrastructure solutions, a pay-as-you-go pricing model, scalability, low to no latency as well as analytics capabilities. In doing so, the Bozeman, Mont.-based company has amassed a $57.44 billion market cap. However, its stock has struggled since 2021 when it hit its all-time high of $392.15 per share, falling nearly 56% since.. However, its stock has struggled since 2021 when it hit its all-time high of $392.15 per share, falling nearly 69% since. But with an industry ripe for expansion, 24/7 Wall Street has performed analysis that suggest there is considerable upside potential for the tech company. Here is where prospective investors and current shareholders might expect the stock to be over the course of the next five years.

Key Points in This Article:

- Snowflake’s strong earnings record suggests the ability to can continue to produce positive earnings while growing alongside the cloud data storage industry. Since the first quarter of 2021, the company has beat on earnings per share (EPS) 14 out of 15 quarters.

- Snowflake has been experiencing explosive revenue growth that reflects the industry in which it operates. After posting total revenue of $264.75 million in 2020, the company saw revenue grow to $592.05 million in 2021, $1.22 billion in 2022, $2.07 billion in 2023, $2.81 billion in fiscal year 2024 — good for an enormous 961.38% increase between 2020 and 2024.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change

Snowflake’s Recent Stock Performance

Shares of SNOW could be considered undervalued given the combination of its recent stock performance, its significantly growing revenue figures and the overall industry’s projected CAGR through 2030. Snowflake’s stock surged after its IPO on Sept. 15, 2020. However, as previously mentioned, it has struggled since hitting its all-time high in November 2021.

| Year | Share Price | Revenue* | Net Income* |

| 2020 | $281.40 | $0.264 | -$0.348 |

| 2021 | $338.75 | $0.592 | -$0.539 |

| 2022 | $143.54 | $1.22 | -$0.679 |

| 2023 | $199.00 | $2.07 | -$0.796 |

| 2024 | $195.64 | $2.81 | -$0.836 |

*Revenue and net income in $billions

Despite that roughly 69% drop, the stock has performed better than usual in the last two quarters of 2024. Despite a negative price-to-earnings (P/E) ratio of -69.51, its total assets of $8.22 billion already outweighs its total liabilities of $3.03 billion while its free cash flow has grown from -$199.41 million in 2020 to $784.29 million in 2024, good for a jaw-dropping 493.31% increase.

These metrics suggests that the company’s underlying fundamentals are strong and could set the table for a turnaround in share performance in the near future.

Key Drivers of Snowflake’s Stock Performance

1. Collaboration With NVIDIA: Snowflake recently announced a partnership with NVIDIA (NASDAQ: NVDA). Snowflake has implemented NVIDIA’s AI Enterprise software, which will allow it to help customers build customized AI data applications. This will allow the company to enjoy twofold growing industry demand between its existing offerings for cloud-based data storage as well as a vast array of AI applications meeting the needs of its tech clientele.

2. A Loyal Customer Base: According to Yahoo! Finance, Snowflake is delivering solid growth while experiencing exceptional customer loyalty evidenced by revenue retention of 127%. Those customers run the games from mega-cap companies like Pfizer Inc. (NYSE: PFE) and small-cap companies like Petco Health and Wellness Company Inc. (NASDAQ: WOOF) to privately held yet popular enterprises such as Orangetheory Fitness and public entities such as the City of San Francisco and the Florida State University.

3. An Industry Primed for Growth: As previously discussed, the CAGR for the U.S. cloud computing market, which stood at $602.31 in 2023, is 20.3%. Grand View Research cites the rise of hybrid and milt-cloud solutions in driving the industry, as well as increased cloud adoption among both private and public (government) enterprises, both in the developed and developing world. Coupled with the rise of AI and machine learning, companies like Snowflake are uniquely positioned to serve as so-called hyper-scalers that allows them to use their flexibility to diversify service offerings that cater to the specific needs of a growing clientele that spans a broad range of industries and sectors.

Snowflake (SNOW) Price Prediction in 2025

Snowflake’s fiscal year 2024 ended on Jan. 31, 2024, so the company is well into fiscal year 2025. By the end of its FY 2025, 24/7 Wall Street‘s median year-end price target for shares of SNOW is $185.00, or 8.31% above its current share price of $170.81. Of all the analysts covering Snowflake, the stock has a consensus 1.96 ‘Outperform’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’) based on an annualized EPS of 60 cents and a projected net income of $214.40 million.

Snowflake (SNOW) Stock Forecast Through 2030

| Year | Revenue* | EPS |

| 2025 | $3.584 | $0.70 |

| 2026 | $4.424 | $0.99 |

| 2027 | $5.409 | $1.44 |

| 2028 | $6.944 | $2.71 |

| 2029 | $8.338 | $3.83 |

| 2030 | $10.512 | $4.12 |

*Revenue in $billions

How Snowflake’s Next Five Years Could Play Out

At the end of its FY 2025, we forecast Snowflake’s stock to be trading for $120.00, or -29.75% lower than its current share price of $170.81. However, we also expect the company’s recent shift to positive earnings to continue to build momentum, beginning with a $0.70 EPS in 2025 growing to an EPS of $4.12 by 2030. That investor return will largely be propelled by the continued and healthy growth of Snowflake’s revenue, which is projected to increase from $3,584.27 million in 2025 to nearly triple that figure by 2030 with $10,512.50 million. That revenue growth will be good for an increase of 193.30% from 2025 to 2030.

Snowflake’s Price Target for 2030

By the conclusion of 2030, 24/7 Wall Street estimates that Snowflake’s stock will be trading for $251.20, or a robust 103.96% higher than its current share price of $123.16, based on the aforementioned $10.461 billion in revenue and an annualized EPS of $6.28.

| Year | Price Target | % Change From Current Price |

| 2025 | $120.00 | -29.75% |

| 2026 | $135.00 | -20.96% |

| 2027 | $150.00 | -12.18% |

| 2028 | $178.50 | 4.50% |

| 2029 | $242.40 | 41.91% |

| 2030 | $251.20 | 47.06% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.