The Ford Motor Company (NYSE: F) is an iconic brand that helped to define American mechanical design and business supremacy in the 20th century and continues to remain a major player to this day. Founder Henry Ford created the mass production assembly line manufacturing process, and Ford cars and trucks are sold worldwide. It is the second-largest US auto industry builder after General Motors and sixth largest worldwide.

While Ford has a venerable history, the entire automobile industry has taken some lumps in recent years, such as:

- Mandates on electric vehicles, thus creating ballooning R&D budgets in EVs.

- Inflation and high interest rates make new car purchases unaffordable.

In the wake of these obstacles, Dearborn, MI headquartered Ford has remained resilient and has continued to stay competitive and innovative. Looking back, Ford went public in 1956 at $64.50. Including splits, a $1,000 investment in Ford in 1972, if kept to the present, would equal about $5427.18 today.

Nevertheless, investors are much more concerned with future stock performance over the next 1, 5, and 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Ford’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article:

- Ford’s strong cash generation, brand loyalty, and attention to customer service should help it weather the current market turbulence in the motor vehicle sector as it continues to recover.

- The failure of the EV market to go beyond the niche level and Ford’s own decisions to scale back EV production are a prescient read on the pendulum swinging back towards internal combustion engine (ICE) autos, which is Ford’s strong suit.

- To receive a complimentary copy of our brand-new report, “The Next NVIDIA”, click here. It includes 3 Top Stock Picks poised to take off from the next breakthroughs in AI. One company is ‘10X Moonshot’, which could become the dominant software player in AI.

Ford Stock News and Analysis

11/18/2024

The National Highway Traffic Safety Administration (NHTSA) has launched two investigations into the Ford Motor Company. The agency is concerned that Ford’s recent recalls were either insufficient to address the underlying issues or did not include enough vehicles. This news follows the NHTSA’s recent $165 million fine imposed on Ford for delays and inaccurate information in a previous recall.

11/11/2024

Today, Ford’s salary staff has gone on strike due to ongoing disputes with the company over pay and contract changes. The union, Unite, argues that Ford is refusing to address workers’ concerns, including proposed changes to sick pay policies and a new 100% performance-related pay scheme.

11/7/2024

Ford’s shares dipped today following a downgrade from Berstein analyst Toni Sacconaghi. Sacconaghi lowered Ford’s rating from “Outperform” to “Market Perform” and set a price target of $11. Despite this, however, Ford announced record sales growth in the Middle East for 2024, driven by strong performance in key markets and the introduction of its latest vehicle lineup.

11/5/2024

Ford Motor Credit Company LLC (a subsidiary of Ford Motor Company) has successfully issued $1 billion in 6.054% notes due November 5, 2031. This transaction was completed today as part of Ford’s existing shelf registration statement.

11/4/2024

The U.S. government’s auto safety regulator has closed a 2.5-year investigation into Ford engine failures. The National Highway Traffic Safety Administration (NHTSA) traced the issue to faulty intake valves in certain 2.7-liter and 3-liter turbocharged engines. Ford has resolved the problem by replacing engines or extending warranties on affected vehicles.

11/1/2024

Ford has announced a promising dividend for its shareholders. On December 2nd, the company will pay a $0.15 per share dividend. This translates to a dividend yield of 7.6%, offering a significant boost to shareholder returns.

10/31/2024

Ford has announced that the company is taking a break from producing its electric F-150 Lightning until January 6th.

10/29/2024

Ford reported mixed results for the quarter yesterday. While revenue exceeded expectations, the company’s net income was significantly impacted by a $1 billion charge-off related to its electric vehicle division, Model e. Despite this, Ford’s adjusted profit and free cash flow showed improvements.

Ford reported an adjusted profit of $0.49 per share and revenue of $46.2 billion. Actual net income was $0.22 per share, down 27% year-over-year. Overall sales grew 5% year-over-year, with Ford Blue up 3%, Model e down 33%, and Ford Pro up 13%.

10/28/2024

According to Ford’s recent survey, over 55% of UAE residents are thinking about buying an electric vehicle within the next year.

10/25/2024

Ford’s share price is down today as investors await the company’s third-quarter earnings report, which is scheduled for release on October 28th. Analysts expect earnings per share of $0.46 on revenue of $45.1 billion.

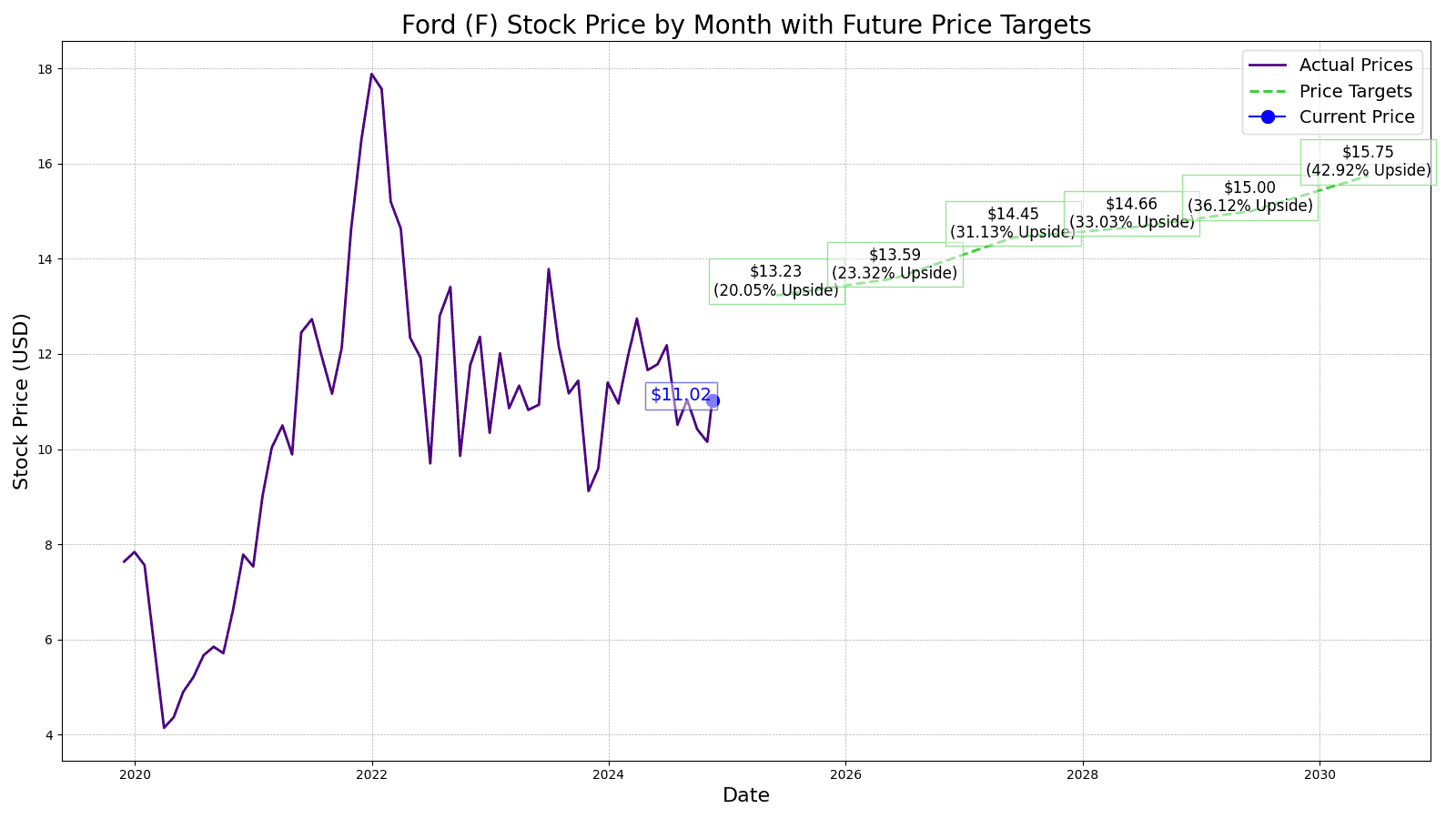

Ford’s Recent Price Movements

While longtime Ford investors may have benefited from Ford’s dividend, its stock price clearly has not experienced the recent exponential growth of Magnificent 7 stocks, like Nvidia or Microsoft. The last time Ford had a strong bull run was during the pandemic in March 2020, when the stock soared from an aberrantly low $4.27 to $25 in January 2022, before settling back into its current range in mid-2022, where it has remained ever since. Apart from that last 500% gain, past comparable periodic rise and falls of Ford stock price can be traced back historically going back decades.

|

Fiscal Year |

Price |

Revenues |

Net Income |

|

2014 |

$16.13 |

$135.378B |

$1.23B |

|

2015 |

$11.17 |

$140.56B |

$7.37B |

|

2016 |

$12.38 |

$141.54B |

$4.59B |

|

2017 |

$10.43 |

$145.66B |

$7.73B |

|

2018 |

$8.71 |

$148.321B |

$3.67B |

|

2019 |

$8.31 |

$143.64B |

$47M |

|

2020 |

$11.51 |

$115.94B |

-$1.28B |

|

2021 |

$17.96 |

$126.27B |

$17.93B |

|

2022 |

$13.23 |

$149.08B |

-$1.98B |

|

2023 |

$12.80 |

$165.90B |

$4.34B |

|

TTM |

$11.16 |

$169.09B |

$3.83B |

Key Drivers for Ford’s Future

- Ford’s core ICE vehicles and F-Series Trucks– Ford’s internal combustion engine (ICE) vehicles are its core and are still its best sellers. Its pickup trucks lead the world in total sales, with its popular F-series at the head of the pack. Ford’s Maverick hybrid truck is the best-selling hybrid in the US as well. Ford’s increasing sales are still world-class, and its revenue generation metrics support its dividends (by 20x) as well as its operational changes in addressing a changing market.

- Ford’s EV unit- This division has been slowly growing but has also been gobbling up money like a school of hungry piranhas. ($1.1 billion burned through a single quarter). Recent Ford announcements to delay its EV T-3 trucks and scale back some EV SUV production are in sync with current trends swinging back towards ICE vehicles that can reliably provide safe transport over long distances. The lack of recharging stations that the Department of Transportation had promised to support its EV mandate has disillusioned many former EV advocates.

- Fixed quality issues– Ford’s stock fallbacks were reactions to larger warranty budget allocations and overall auto industry unemployment in the market, which created concerns over quality control. These issues have been addressed as shifting toward newer technologies tied to Ford’s Pro series AV components and towards ensuring more reliable future performance for its customers.

Stock Price Prediction for 2025:

The consensus rating from two dozen Wall Street analysts is ‘Hold’. The average price target in 12 months is $12.00, which is roughly up 4.26% from the price at the time of this writing.

24/7 Wall Street’s 12-month projects Ford’s price to be $20.27. We believe this is a conservative estimate based on the implementation of Ford’s changes and the upcoming Presidential election results, which will determine whether or not EV mandates will be maintained or eliminated. Should the latter occur, then the target price could easily run higher.

Ford’s Next 5 Years’ Outlook:

With the caveat of the November Presidential election results set aside and assuming the status quo is maintained in the market with regard to EVs, we estimate Ford’s 2025 price to be $13.23, which would be up 18.34%. The expenditures for the expanded warranty service for AV technology upgrades, the marketing changes to de-emphasize the T-3 promotions, and the expected easing of labor concerns would all be implemented.

2026 would start to see the results of 2025’s initiatives. We anticipate that revenues would increase by $15 billion, leading to an additional $0.10 EPS, resulting in a slight stock price gain to $13.59, which would be up 21.56% from the current price.

Assuming that inflation finally gets under control and interest rates can come down appreciably, Ford’s Ford Credit unit, which supplies auto purchase financing, should once again be a meaningful bottom-line contributor in 2027. We anticipate another $16.5 billion in boosted revenues, which would subsequently increase EPS to $2.27, and a stock price target of $14.45, which would be up 29.25% from the current price.

Given its size and industry, Ford’s profit margins are not large, so growth comes at a much smaller rate than in the tech industry. Continuing the trajectory of roughly 1.4% annual growth, barring any new initiatives or breakthrough products, we expect Ford to add $2.72 billion in revenues for 2028. 24/7 Wall Street’s target price would be $14.66, up 31.13% from today’s price.

Estimates see 2029 with a $4.5 billion revenue bump and a $15 stock price, up 34.17% from the current price, assuming things stay on course for Ford.

Ford Stock in 2030:

2030 could see some new developments from Ford Pro AV development and non-vehicular markets as well as other R&D, resulting in an approximate $10 billion revenue increase and a commensurate stock price hike to $15.75. This would equate to a nearly 40.88% gain over the present market price for Ford.

|

Year |

Revenue ($B) |

P/S Multiple |

Market Cap ($B) |

Stock Price ($) |

|

2025 |

176.36 |

0.3 |

52.91 |

$13.23 |

|

2026 |

181.2 |

0.3 |

54.36 |

$13.59 |

|

2027 |

192.73 |

0.3 |

57.82 |

$14.45 |

|

2028 |

195.45 |

0.3 |

58.64 |

$14.66 |

|

2029 |

200.00 |

0.3 |

60 |

$15.00 |

|

2030 |

210.00 |

0.3 |

63 |

$15.75 |

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.