Forecasts

Lucid Group Stock (LCID) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Luxury electric vehicle maker Lucid Group (NASDAQ:LCID) was a highly anticipated startup in 2021 when it went public through a reverse merger with the special purpose acquisition company (SPAC) Churchill Capital IV.

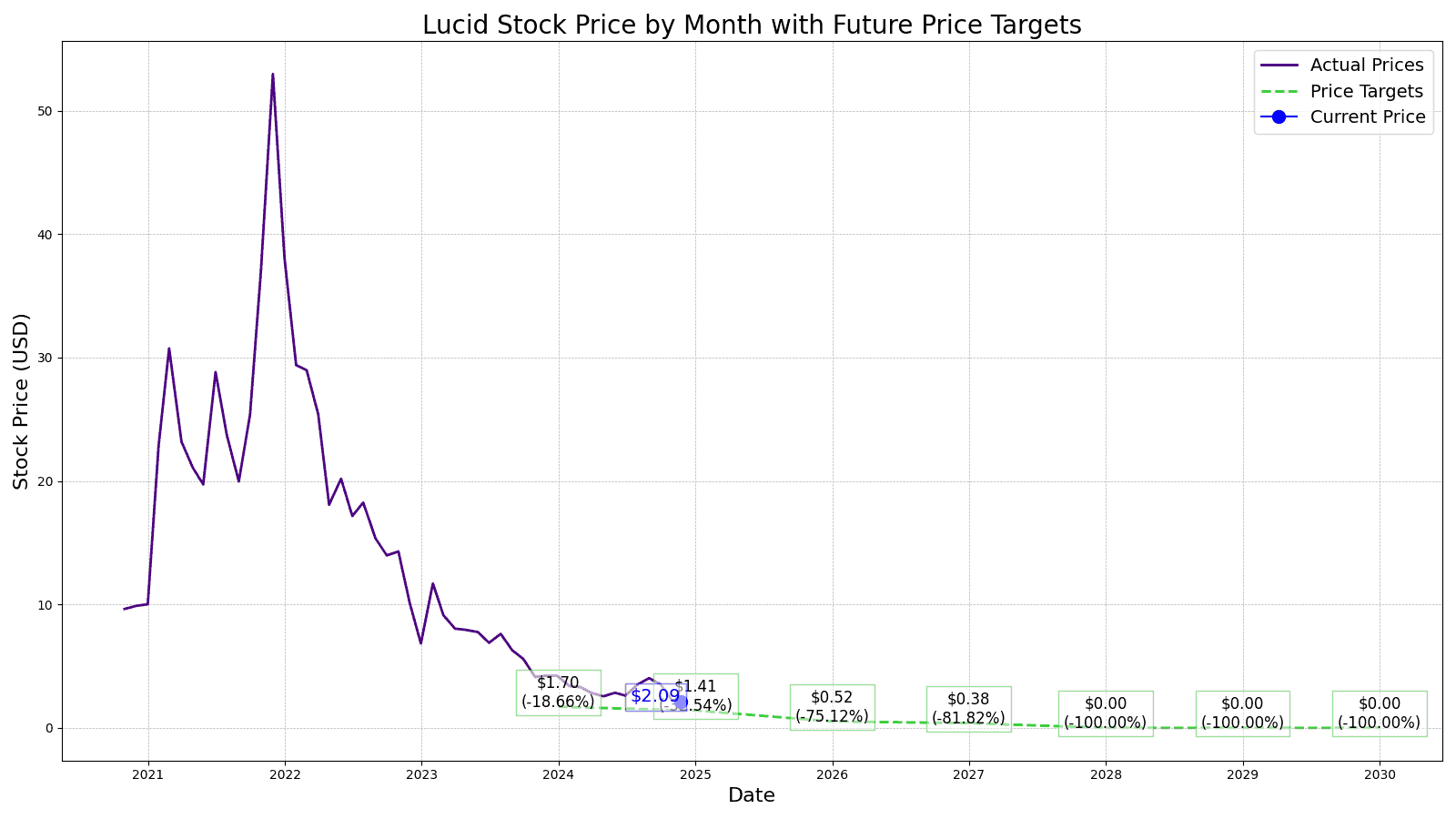

Bank of America called it the next “Tesla/Ferrari” and Lucid promised to make the world’s most luxurious EVs. Majority-owned by the Saudi government’s Public Investment Fund (PIF) sovereign wealth fund, the merger attracted $4.5 billion in new capital. LCID stock quickly ran up from its opening price of $25.24 on July 26, 2021, to an intraday high of $56.70 on Nov. 30, giving it a market cap of $90 billion. It made Lucid more valuable than Ford (NYSE:F).

However, almost exactly three years later, Lucid trades at $2.10 per share, a loss of 96% of its value. The decline is the result of production issues, sharply falling demand for EVs, and a sticker price that was far greater than the market would bear.

Lucid’s grandiose plans to produce 49,000 EVs by 2023 and half a million by 2025 quickly fell apart. So far it has made just 21,251 vehicles and sold even less. Only 17,152 EVs have been delivered to customers.

The question is, where does LCID stock go from here. 24/7 Wall Street offers readers insights into our assumptions about the stock’s prospects, what sort of growth we see in LCID stock for the next several years, and our best estimates for Lucid’s stock price each year through 2030.

The following is a table of LCID’s revenues, operating income, and share price for its first three years as a public company.

The table summarizes performance in share price, revenues, and operating losses from 2021 through the first three quarters of 2024.

| Share Price (end of year) | Revenue | Operating Loss | |

| 2021 | $38.05 | $27,111 | ($1,530,446) |

| 2022 | $6.83 | $608,181 | ($2,593,991) |

| 2023 | $4.21 | $595,271 | ($3,099,580) |

| TTM | $2.10 | $730,510 | ($3,024,737) |

Revenue and operating loss in millions.

Now let’s take a look at Lucid’s production and delivery schedule for each quarter:

| Produced | Delivered |

Unsold Inventory

|

|

| Q2 2022 | 1,405 | 679 | 726 |

| Q3 2022 | 2,282 | 1,398 | 1,610 |

| Q4 2022 | 3,493 | 1,932 | 3,171 |

| Q1 2023 | 2,314 | 1,406 | 4,079 |

| Q2 2023 | 2,173 | 1,404 | 4,848 |

| Q3 2023 | 1,550 | 1,457 | 4,941 |

| Q4 2023 | 2,391 | 1,734 | 5,598 |

| Q1 2024 | 1,728 | 1,967 | 5,359 |

| Q2 2024 | 2,110 | 2,394 | 5,075 |

| Q3 2024 | 1,805 | 2,781 | 4,099 |

| Total | 21,251 | 17,152 | 4,099 |

Source: Lucid Group SEC filings.

In the third quarter, Lucid had operating losses of over $770.5 million, meaning it is losing $27,707 for every car it sells. And the more vehicles it makes, the more it loses with little indication it can turn its operation around.

Looked at another way, Lucid Group is losing almost $8.5 million every single day over the first three quarters of 2024.

Building the Saudi Arabian auto industry. The Saudi government is seeking to diversify away from its reliance upon oil for its revenue. It wants to create an auto industry from the ground up and Lucid is the vehicle it is using to develop it. The sovereign wealth fund is willing to invest heavily into the money-losing operation, having provided the EV maker with nearly $8 billion in funding.

Cutting prices. Lucid initiated a series of price cuts to keep pace with the rest of the EV industry amid waning demand, making them more competitive with Tesla (NASDAQ:TSLA).

EV technological superiority. Lucid got its start as a maker of electric drivetrains that it wanted to sell to other EV manufacturers, but changed direction to make the entire car. Its vehicles offer superior performance and range than Tesla, though at a significantly higher cost. Yet as it cut prices to remain competitive, performance declined to become just par with comparable Tesla.

There are nine analysts covering Lucid Group who assign it a 12-month consensus price target of $3.16 per share. That implies 50% upside from where it currently trades, but ranges from a low of $2 per share (or -5% downside) to a market high of $4.50 per share (114% upside). Wall Street, though, has a ‘hold’ rating on LCID stock.

However, 24/7 Wall St’s one-year forecast projects Lucid stock to be $1.70 per share based on its significant ongoing cash burn, the need for further cash infusions, and a weak EV market.

Valuing Lucid’s stock price for the coming years, beginning with forecasted revenue of $1.08 billion for 2025 which represents 39% growth over the current year. As Lucid has cut prices to spur demand, sales have grown, but it still has substantial unsold inventory. It makes it questionable how many new cars dealers will accept.

We’ll assign LCID stock a price-to-sales ratio of 5x as the market continues to assign a higher multiple to the automaker, which puts our price target at $1.41 per share.

Going into 2026, we estimate the price to be $0.52 per share on weak sales growth of just 5% to $1.134 billion and a P/S ratio of 2.3, which puts it closer to its peers.

Yet the new Gravity SUV coming in late 2025 starts at $81,400 for the Touring model and $96,400 for the Grand Touring model, suggests Lucid will find a very small, niche market for its EVs. Particularly because they will not be eligible for any federal tax credits (only SUVs below $80,000 are eligible under current regulations), even if they still exist at that point in President Trump’s second term, it will kill off demand.

Because the Nasdaq exchange will require Lucid to get its stock price up above $1 per share or get delisted, it’s likely LCID shares will undergo a reverse stock split at some point.

If it hasn’t happened before then, 2027 should be where the bottom falls out for Lucid. It had less than $3.5 billion in cash and short-term investments at the end of the third quarter, but the EV maker’s cash burn is some $3 billion a year.

We expect the Private Investment Fund will eventually tire of pouring billions of dollars into an enterprise continuously losing billions. Despite its desire to jumpstart a new auto industry and using Lucid Group to help its workforce develop the necessary skills, further financing will dry up.

LCID stock will undoubtedly retest its pre-reverse split lows. With just an additional 5% increase in sales at best, and a P/S ratio of 2x, it equates to a $0.38 per share stock price.

We suspect Lucid Group will end up getting delisted at some point. It is possible the PIF will acquire the automaker outright and take it private to enable its nascent auto industry to keep operating.

We estimate Lucid’s stock price to be $0 per share as it has been either delisted or taken private by 2030. It will be a complete wipeout for investors who own shares today.

| Year | Price Target | % Change from Current Price |

| 2024 | $1.70 | Downside of 19.05% |

| 2025 | $1.41 | Downside of 32.86% |

| 2026 | $0.52 | Downside of 75.24% |

| 2027 | $0.38 | Downside of 81.90% |

| 2028 | $0.00 | Downside of 100% |

| 2029 | $0.00 | Downside of 100% |

| 2030 | $0.00 | Downside of 100% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.