Long before there was Venmo and Cash App, there was PayPal Holdings, Inc. (NASDAQ: PYPL). The pioneer of online payments was founded in 1998 in San Jose, Calf. Four years later, it went public and was then acquired by eBay, Inc. (NASDAQ: EBAY) later in 2022. But in 2015, eBay spun the company off to its shareholders, and PayPal has been an independent company ever since.

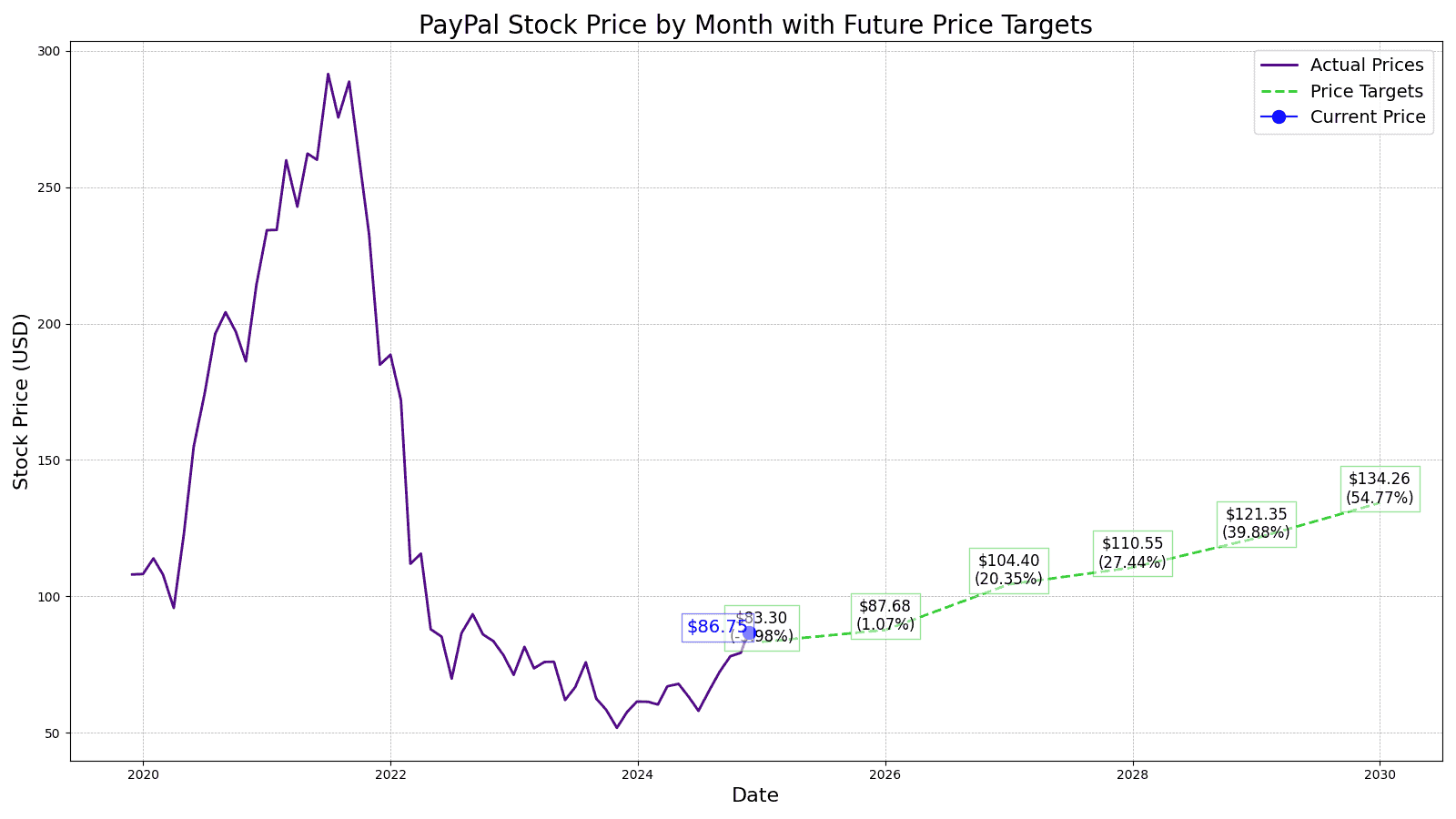

Since then, the company’s online payments services have exploded in popularity, with its market cap peaking at $356.75 billion in July 2021. That coincided with the stock reaching its all-time high of $308.53. However, the company has enduring some growing pains since then, which have resulted in its market cap being reduced to the current $88.78 billion and shares having fallen nearly 71% from their peak. However, for prospective investors looking for growth opportunity, PayPal sits in the midst of an industry undergoing explosive growth. According to Grand View Research, the global fintech service market is forecast to grow at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030.

This expected industry growth bodes very well for shareholders. And despite the stock being down significantly from its all-time high, PayPal has gained 43.68% in 2024, outpacing the benchmark S&P 500 index. 24/7 Wall Street has performed an analysis that suggests there is still a big-time upside potential for the fintech company before the end of the decade. Here is where prospective investors and current shareholders might expect from PayPal over the course of the next five years.

Key Points in This Article:

- Globally, the fintech service market is expected to grow at a CAGR of 17.5% from 2023 to 2030, and in the U.S. alone, that growth is forecast for 16.6% over the same time. PayPal isn’t simply processing payments between friends or businesses, but participating in a major shift that involves “fintech solution providers that consistently introduce novel technologies like AI, blockchain and data analytics, with the potential to reshape financial services and streamline operational effectiveness,” according to Grand View Research.

- Online payments is a segment seeing exponential growth, and that has translated into a series of successive earnings beats for PayPal, which are likely to continue as the company gains more market share. Payment service providers, or PSPs, are now being tasked with with expanded service demands, like fraud mitigation, improving collection processes and reconsidering markets where profitable growth may be possible but has previously exceeded most institutions’ risk appetite, such as the gaming industry, according to consultancy firm McKinsey & Co.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

PayPal’s Recent Stock Success

Since officially being spun off from eBay on July 10, 2015, shares of PayPal enjoyed an incredible run before hitting their all-time high in July 2021, gaining over 789%. That surge was largely fueled from the arrival of COVID-19, which saw a dramatic shift to online buying. From its pandemic low on $86.68 on March 20, 2020, the stock rewarded shareholders with gains of 256% over the subsequent six quarters. However, the end of the pandemic coupled with increased competition began to erode the company’s market share since, which has forced PayPal to begin diversifying its business segments in order to expand customer services and differentiate itself from newcomers like Stripe, Amazon Pay, Apple Pay and Square.

| Year | Share Price | Revenue* | Net Income* |

| 2015 | $36.20 | $9.192 | $1.551 |

| 2016 | $39.47 | $10.839 | $1.816 |

| 2017 | $73.62 | $12.983 | $2.281 |

| 2018 | $83.26 | $15.460 | $2.883 |

| 2019 | $109.40 | $17.750 | $3.654 |

| 2020 | $234.20 | $21.418 | $4.519 |

| 2021 | $188.58 | $25.349 | $5.466 |

| 2022 | $71.22 | $27.500 | $4.722 |

| 2023 | $61.41 | $29.614 | $5.521 |

*Revenue and net income in $billions

Since 2015 when PayPal was again a publicly traded company, its total annual revenue grew by more than 222% through 2023. However, the two aforementioned headwinds beginning in 2021 — increased competition and the end of the pandemic — saw its share price careen despite steadily increased revenue and consistent net income. At the same time, PayPal became mired in debt repayment, which jumped from $361 million in 2021 to $1.05 billion in 2023.

Nonetheless, as the Silicon Valley fixture looks towards the second half of the decade, 24/7 Wall Street has identified three key drivers that are likely to positively impact PayPal’s growth metrics and stock performance through 2030.

Key Drivers of PayPal’s Stock Performance

1. Demand for Digital Payments Is Exploding. Data from Statista indicates that digital payments from PSPs has exploded from $6.25 trillion in 2017 to $15.46 trillion in 2023 — a 147% increase. That figure is forecast to reach $36.75 trillion in 2029, $23.50 trillion of which will be made in mobile payments alone. PayPal’s seamless integration, which is used in 200 countries and regions and with 25 different currencies, is likely to face increased demand as merchants who rely on it look to capitalize on rapid customer onboarding and user-friendliness, both of which are expected to drive the digital payments market in the near and medium terms. The company is already well-positioned, with its digital financial network accounting for 220 million active customers each month, making it one of the world’s largest PSP in the world.

2. Strong Earnings and Revenue Has Continued. Despite the stock’s slide since midway 2021, PayPal has time and again posted strong quarterly earnings and revenue. Since the fourth quarter of 2020, the company has beat on earnings 16 out of 19 quarters. It is a similar story for reported quarterly revenue over that period. That has left the company with a healthy cash position, with free cash flow exploding in growth from $3.37 billion in 2019 to a current trailing 12-month (TTM) position of $6.71 billion. That is good for an increase of more than 99% in five years.

3. PayPal Credit and Buy Now, Pay Later Is Expanding the Company’s Breadth. Beyond being a PSP, PayPal has branched out to other business sectors that are likely to bolster revenue as they experience similar CAGRs: credit and buy now, pay later. These services are already offered at major retailers and online merchants, like Walmart Inc. (NYSE: WMT), Home Depot, Inc. (NYSE: HD), Temu and eBay, for example. The site provides consumers with a line of revolving credit through Synchrony Financial (NYSE: SYF). In 2023, of PayPal’s nearly $30 billion in revenue, $27 billion came from transaction revenues, with PSP transactions representing more than 90% of the company’s total revenue. Meanwhile, revenues from its other business segments — including interest and fees through its credit offerings — were over $2.91 billion, which represented roughly 9% of the company’s revenue. However, Grand View Research projects the buy now, pay later industry to undergo CAGR of 24.3% from 2023 to 2030, meaning this business segment for PayPal could see its revenue growth outpace the company’s traditional PSP offerings by the end of this decade.

PayPal (PYPL) Price Prediction in 2025

The current consensus median one-year price target for PayPal is $90, representing a potential upside of 1.95% over the next 12 months from its current share price. Of the 45 analysts covering PayPal, the stock is a outperform, with a 2.13 rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

By the end of 2025, 24/7 Wall Street‘s forecast for shares of PYPL is $83.80, representing a 5.07% downside potential based on an annualized EPS estimate of $4.93 and a price-to-earnings (P/E) ratio estimate of 16.

PayPal (PYPL) Stock Forecast Through 2030

| Year | Revenue* | EPS |

| 2025 | $33.663 | $4.93 |

| 2026 | $36.048 | $5.44 |

| 2027 | $39.631 | $6.96 |

| 2028 | $42.668 | $7.37 |

| 2029 | $48.195 | $8.09 |

| 2030 | $52.076 | $9.59 |

*Revenue in $billions

How PayPal’s Next Five Years Could Play Out

Starting in 2027, we expect a 9.93% growth in revenue and a 27.94% jump in earnings per share, bringing PayPal’s price target from $87.68 in 2026 to $104.40 in 2027. 24/7 Wall Street forecasts similarly strong growth in 2028, 2029 and 2030, with PayPal seeing revenues increase 7.66%, 21.61% and 31.40%, respectively, over 2027’s forecasted revenue.

PayPal’s Price Target for 2030

By the conclusion of 2030, 24/7 Wall Street estimates PayPal’s stock to be trading for $134.26 per share, representing a 73.80% increase from its current price, based on revenue of $52.076 billion and an annualized EPS of $9.59.

| Year | Price Target |

| 2025 | $83.30 |

| 2026 | $87.68 |

| 2027 | $104.40 |

| 2028 | $110.55 |

| 2029 | $121.35 |

| 2030 | $134.26 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.