Forecasts

Super Micro Computer (SMCI) Price Prediction and Forecast

Published:

Last Updated:

As the artificial intelligence-fueled tech rally continues, companies that can diversify to address the manifold demands the industry faces are poised to profit. Super Micro Computer Inc. (NASDAQ: SMCI) is one of those companies. The San Jose, Calif.-based tech firm specializes in high-performance and high-efficiency servers, but it also provides software solutions as well as storage systems for data centers and enterprises focusing on cloud computing, AI, 5G, and edge computing.

Nonetheless, analysts expect big upside potential for the tech stock. Hindsight is 20/20, and all that matters now is how Super Micro Computer will perform going forward. So 24/7 Wall Street has performed analysis to provide investors — and potential investors — with an idea of where shares of SMCI could be headed over the course of the next five years.

11/25/2024

Super Micro Computer’s stock is continuing to rally today, surging 15.9%. The company appears to be recovering from recent downturns as the stock reclaims its 50-day moving average.

11/22/2024

Super Micro Computer’s stock price increased 9.7% today, trading as high as $34.37.

11/21/2024

Shares of companies that partner with Nvidia, which includes Super Micro Computer, increased today following Nvidia’s impressive third-quarter earnings report. Super Micro Computer’s stock price rose 15%.

11/20/2024

Super Micro Computer is experiencing a decline in its stock price today, following an incredible 30% surge yesterday. This drastic change was triggered by the company’s announcement regarding its continued listing on the Nasdaq exchange. Super Micro Computer has also confirmed its ability to complete the necessary forms for the fiscal year ending in June and the third quarter

11/19/2024

Super Micro Computer’s shares are soaring today and up more than 30%. The sudden increase follows the company’s announcement of a new auditor and filing plan to avoid delisting by the Nasdaq.

11/18/2024

Super Micro Computer’s stock price is up 23.22% today, a surprising rally filed by hopes that the company will soon meet Nasdaq’s listing requirements. However, investors remain cautious as they await the company’s official compliance plan.

11/15/2024

Super Micro Computer’s stock price dropped by 1.8% today. Trading volume was also lower than average.

11/14/2024

Super Micro Computer’s stock continues to decline today. The company declared that it cannot file its 2025 fiscal-year first-quarter earnings on time and has filed a FormNT 10-Q with the Securities and Exchange Commission.

11/12/2024

Super Micro Computer is racing to secure a new auditor after Ernst & Young’s sudden resignation. However, there are few potential firms capable of auditing a company of its size, and an auditor must be secured by the November 16th deadline to avoid delisting from the Nasdaq stock exchange.

11/8/2024

Super Micro Computer’s stock price dropped by 3.1% today, reaching as low as $23.76. Trading volume was also significantly lower than average.

Shares of SMCI have been particularly rewarding to shareholders in the recent past, as they exploded by gaining 3,096% in the five years between August 2019 and August 2024. The following table summarizes Super Micro Computer’s share price, revenues, and profits (net income) from 2014 to 2023:

| Year | Share Price (pre-split) | Revenues* | Net Income* |

| 2014 | $36.39 | $1.467 | $.054 |

| 2015 | $24.66 | $1.954 | $.092 |

| 2016 | $28.05 | $2.225 | $.072 |

| 2017 | $20.93 | $2.484 | $.067 |

| 2018 | $13.90 | $3.360 | $.046 |

| 2019 | $24.65 | $3.500 | $.072 |

| 2020 | $31.66 | $3.339 | $.084 |

| 2021 | $43.95 | $3.557 | $.112 |

| 2022 | $82.19 | $5.196 | $.285 |

| 2023 | $284.26 | $7.123 | $.640 |

*Revenue and net income in $billions

In the last decade, Super Micro Computer’s revenue grew by more than 385% while its net income increased by just over 1,085%. Despite seeing a minor revenue contraction in 2020 with a decrease of 4.6%, shares of SMCI still managed to increase year-over-year on still-growing net income. As the IT services provider looks forward to the second half of the decade, we have identified three key drivers that are likely to impact its growth metrics and stock performance.

The current consensus median one-year price target for Super Micro Computer is $65.00, which represents a nearly 69.23% potential upside over the next 12 months based on the current share price of $38.41. Of all the analysts covering Super Micro Computer, the stock is a consensus buy, with a 2.38 ‘Outperform’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

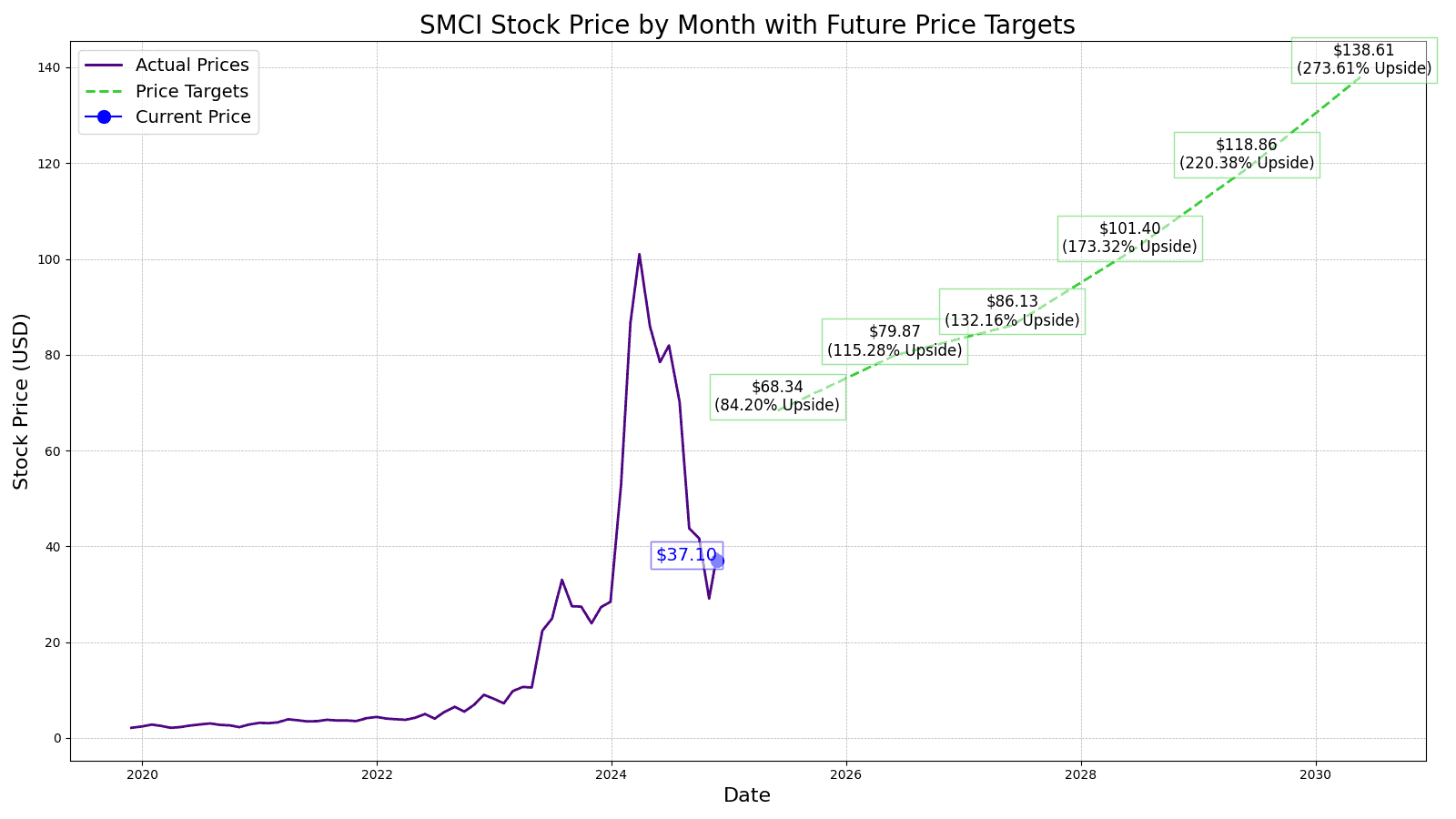

24/7 Wall Street’s 12-month forecast projects Super Micro Computer’s stock price to be $68.34 based on a projected EPS of $3.35 in 2025.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $28.265 | $1.974 | $3.35 |

| 2026 | $31.634 | $2.548 | $4.31 |

| 2027 | $37.116 | $1.458 | $5.49 |

| 2028 | $42.631 | $1.881 | $6.76 |

| 2029 | $50.154 | $2.428 | $8.49 |

| 2030 | $59.005 | $3.134 | $10.62 |

*Revenue and net income in $billions

At the end of 2025, we expect to see revenue, net income, and EPS rise by 89.16%, 63.41%, and 70.08%, respectively. That would result in a per-share price of $683.40 (or $68.34 on a post-split-adjusted basis), which is 1679.22% higher than where the stock is currently trading.

When 2026 concludes, we estimate the price of SMCI to be $798.66 (or $79.87 on a post-split-adjusted basis), which is 1979.30% higher than where shares are trading today. This is based on modest revenue gains, an assumed EPS of $44.37, and a healthy projected P/E ratio of 18.

At the conclusion of 2027, we forecast a sizable jump in the stock price to $861.28 (or $86.13 on a post-split-adjusted basis) driven by $37.116 billion in revenue and $1.458 billion in net income, which will result in shares trading for 2142.33% higher than the current share price.

By the end of 2028, we expect to see shares trading for $1041.04 (or $101.40 on a post-split-adjusted basis), or 2610.34% higher than the stock is trading for today on revenues of $42.631 billion, net income of $1.881 billion, and an EPS of $67.60.

And at the end of 2029, Super Micro Computer is forecast to achieve revenue of $50.154 billion and net income of $2.428 billion, resulting in a per-share price of $1188.59 (or $118.86 on a post-split-adjusted basis), which is 2994.48% higher than the stock’s current price.

By the conclusion of 2030, we estimate an SMCI share price of $1386.08 (or $138.61 on a post-split-adjusted basis), good for a 3508.64% increase over today’s share price, based on an EPS of $106.62 and a P/E ratio of 13.

| Year | Price Target | % Change From Current Price |

| 2025 | $68.34 | Upside of 1679.22% |

| 2026 | $79.87 | Upside of 1979.30% |

| 2027 | $86.13 | Upside of 2142.33% |

| 2028 | $101.40 | Upside of 2610.34% |

| 2029 | $118.86 | Upside of 2994.48% |

| 2030 | $138.61 | Upside of 3508.64% |

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.