Forecasts

Lumen Technologies (LUMN) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

After struggling for years, shares of Lumen Technologies (NYSE: LUMN) skyrocketed in 2024, more than doubling through the first three quarters of the year. But as the company continues operating with a negative price-to-earnings (Pbu/E) ratio, there are lingering concerns about the tech company’s future prospects.

Lumen Technologies has been around a long time, so it was a surprise to some that stock was recently at risk of being delisted from the New York Stock Exchange when in 2023, its price per share briefly dipped under $1.00 on Nov. 1, 2023. Those struggles continued into 2024, but by mid-summer, the stock surged when demand for its high-speed fiber-network solutions began to grow. The company recently secured deals with Microsoft Corporation (NASDAQ: MSFT) and other leading tech companies, like Corning Inc. (NYSE: GLW), that are requiring increased connectivity between their data centers because of the explosive growth of artificial intelligence (AI).

But after posting positive earnings to end FY 2022 and and repeat that success in the first two quarters of 2023 — including a sizable beat on earnings per share (EPS) of 43 cents to analysts’ expectations of 23 cents in Q4 of 2022 — Lumen has gone on to post negative EPS in four of the following five quarters as the company’s revenues have fallen steadily over the same period. So 24/7 Wall Street performed analysis to determine if the company is fundamentally flawed, or if AI demand and strategic partnerships will be enough to see its stock continue on its bull run.

12/11/2024

Investors are showing increased bullish sentiments toward Lumen. A notable surge in call option volume, particularly for January 25th expiration dates at strike prices of $8 and $5, has been observed recently. Many traders are anticipating potential upward movement in Lumen’s stock price, especially leading up to the company’s earnings report in February.

12/9/2024

Lumen Technologies is focusing heavily on AI and forging partnerships with major tech giants. The company’s recent Q3 earnings report sparked a significant rally, and its strong connectivity infrastructure positions it to capitalize on the increasing demand for AI-powered solutions.

12/5/2024

Lumen Technologies and Quantum Fiber have introduced a new internet plant called Simply Fiber. This new, low-cost plan offers speeds of up to 200 Mbps for just $30 per month, including free installation and 360 Wi-Fi for broader home coverage.

12/3/2024

Lumen received a positive outlook from Citigroup, which raised its target price from $6.50 to $8.00. Citigroup maintained a “Neutral” rating on the stock.

11/26/2024

Lumen and its subsidiary, Level Financing, have successfully completed their cash tender offers for unsecured 2028 Notes. The settlement for these tender offers is expected to be finalized by November 26, 2024.

11/22/2024

Lumen’s current P/S ratio of 0.6x is lower than the average P/S ratio for U.S. telecompanies, which is around 1.3x.

11/20/2024

Lumen’s stock continues to decline today, falling 3.10% during the afternoon trade. If it continues to fall, the stock may reach seven straight sessions of losses.

11/19/2024

Lumen’s stock declined 8.2% today, reaching a low of $7.42 during the trading session. Trading volume was also much lower than average, with only 3,415,937 shares changing hands, an 83% decrease from the average session volume.

11/18/2024

Analysts have given Lumen a consensus rating of “Reduce” based on an assessment from eight research firms. Three analysts recommend a “Sell” and five suggest a “Hold”. The average 12-month price target for the stock is $4.02.

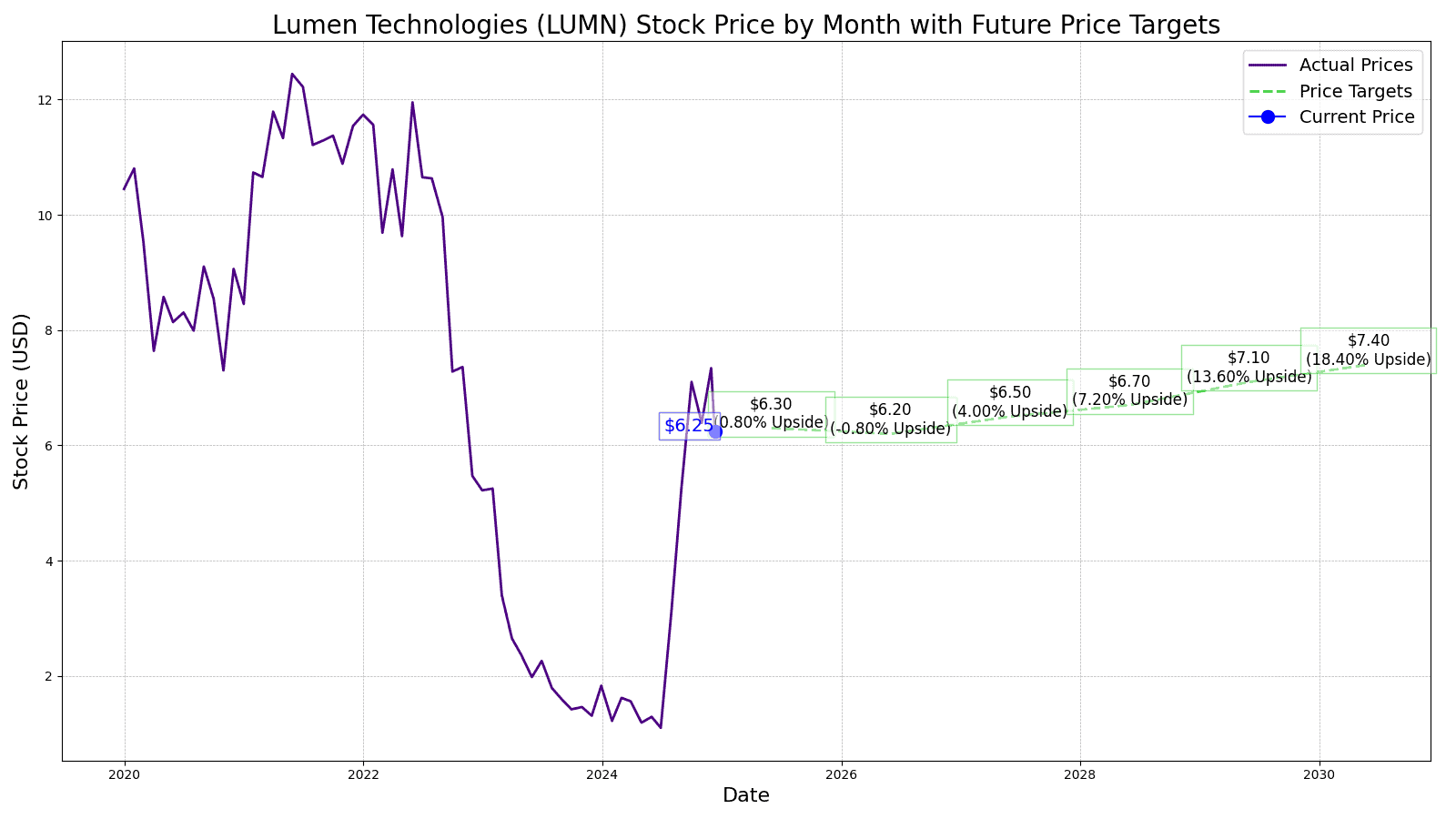

From July 1, 2024, to Sept. 30, 2024, shares of LUMN went on a tear. The stock, which was trading at just $1.11 at the start of the third quarter of 2024, surged 540% by the end of Q3. That was quite the reversal given how the stock has slid 86.49% since hitting its all-time high of $49.45 on June 1, 2007. But market drivers are far different today than they were then, and with the emphasis on AI development, Lumen Technologies’ stock is on a bounce back after falling -40.37% over the past five years:

| Year | Share Price | Revenue* | Net Income* |

| 2014 | $39.70 | $18.031 | $0.851 |

| 2015 | $25.87 | $17.900 | $0.795 |

| 2016 | $24.12 | $17.470 | $0.744 |

| 2017 | $16.99 | $17.656 | $0.356 |

| 2018 | $14.90 | $23.433 | $0.964 |

| 2019 | $13.42 | $22.401 | $5.157 |

| 2020 | $9.75 | $20.712 | $1.351 |

| 2021 | $12.55 | $19.687 | $2.019 |

| 2022 | $5.22 | $17.478 | $1.713 |

| 2023 | $1.83 | $14.557 | $7.334 |

*Revenue and net income in $billions

Over the course of the last decade, Lumen’s revenue decreased by more than 19% while net income gained by over 761.81%. As the company battled through its dated infrastructure and a significant debt load — shares fell significantly from $39.70 in 2014 to $1.83 in 2023. However, Lumen has been able to better balance its books, with total assets and total liabilities nearly aligned in 2023 to the tune of $34.02 billion and $33.57 billion, respectively.

As the 56-year-old tech company looks forward to the second half of the decade, 24/7 Wall Street has identified three key drivers that are likely to positively impact Lumen Technologies’ growth metrics and stock performance through 2030.

1. Strategic Partnerships With Tech Giants: The aforementioned strategic partnerships with Microsoft, the second-largest publicly traded company by market cap at $3.096 trillion, and Corning with its $36.16 billion market cap, should position Lumen for increased revenues and earnings for the foreseeable future. The partnership, announced in early August 2024, will result in Lumen more than doubling its total intercity network miles in order to unlock the next phases and capabilities of AI for cloud data centers (like Microsoft’s), enterprises and public agencies. According to the company’s press release, Lumen expects the deal with Microsoft to improve its cash flow by more than $20 million over the next 12 months.

2. Debt Restructuring: In March 2024, the company announced it had successfully extended its debt maturities, closing an approximately $1 billion revolving credit line maturing in June 2028 and completing the private placement of $1.325 billion due in November 2029. These efforts should free up funds and allow the company to address capital expenditures that will enable it to address the demands of the previously discussed strategic partnerships with Microsoft and Corning.

3. Insider Activity: While insider trading is never an absolute indication of growth, following the money can suggest what company executives’ sentiment is. And over the past 12 months, Lumen Technologies’ insiders have been doing far more buying than they have been selling. In fact, inside buyers have purchased a total of 12,924,936 million shares versus insider sellers offloading just 2,913,990. Put differently, the leadership at Lumen has out out-purchased sellers by more than 343% over the past year.

According to analysts, the current consensus median one-year price target for Lumen Technologies is $4.00, which represents more than -36.00% downside potential over the next 12 months given the current price per share of $6.25. Of 12 analysts covering LUMN, nine rate the stock as a ‘Hold,’ with the consensus rating being 3.15 on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

By the end of 2025, 24/7 Wall Street‘s forecast for shares of LUMN is higher at $6.30, which only represents a downside potential of -0.80%, based on an annualized EPS of -46 cents.

| Year | Revenue* | EPS |

| 2025 | $12.407 | -$0.46 cents |

| 2026 | $12.229 | -$0.26 cents |

| 2027 | $12.369 | $0.05 cents |

| 2028 | $12.473 | $0.39 cents |

| 2029 | $12.862 | $0.38 cents |

| 2030 | $13.070 | $0.69 cents |

*Revenue in $billions

By the end of 2025, 24/7 Wall Street‘s forecast for shares of LUMN is higher at $6.30, which only represents a downside potential of -14.17%, based on an annualized EPS of -46 cents.

However, beginning in 2027 and continuing through 2030, we expect LUMN to post positive EPS growing from 5 cents to 59 cents based on revenue growth from $12.369 billion in 2027 to $13.070 billion in 2030.

By the conclusion of 2030, 24/7 Wall Street estimates that Lumen Technologies stock will be trading for $7.40 per share.

| Year | Price Target |

| 2025 | $6.30 |

| 2026 | $6.20 |

| 2027 | $6.50 |

| 2028 | $6.70 |

| 2029 | $7.10 |

| 2030 | $7.40 |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.