Forecasts

Palantir Technologies (PLTR) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Big Data is big business. According to platform provider Edge Delta, the market for data services is projected to grow from $220.2 billion in 2023 to $401.2 billion by 2028 — an increase of 82.2%. Palantir Technologies Inc. (NYSE: PLTR) is a major player in the space. The company was co-founded by entrepreneur and venture capitalist Peter Thiel, who was also the co-founder of PayPal and the first outside investor in Facebook.

Since going public on Sept. 30, 2020, the stock’s price has risen over 646.21%, and it has seen a gain of more than 312.87% so far in 2024. At that growth rate, a $1,000 investment in Palantir’s IPO price of $9.50 would be worth $7462.11 today.

Palantir stands as one of Big Data’s industry dominators. However, finding data-driven assessments of where the company’s stock will be in the medium and long term can be complicated. With Wall Street analysts only going as far as providing one-year price targets, it can be difficult for investors to accurately gauge predictions for stocks like these over longer horizons. But for buy-and-hold investors who want to know where Palantir’s stock might be several years down the road, 24/7 Wall Street has done the legwork and can provide insights around the numbers coming from the company, and which market segments the company is operating in that are most exciting to us.

12/11/2024

Palantir is poised for a potential stock surge this Friday due to its possible inclusion in the Nasdaq 100 index later this month. With a market capitalization exceeding $155 billion, Palantir could potentially rank as high as the 25th largest stock on the index.

12/10/2024

Palantir is among the top contenders for inclusion in the Nasdaq 100 index, with the official announcement expected on December 13th. Palantir’s recent move to the Nasdaq Stock Exchange and its large market valuation of $152 billion position it as a strong candidate.

12/9/2024

Palantir’s shares declined today following the company’s record-breaking session. The stock had surged to an all-time high of $80.91 at the market’s open, driven by the company’s announcement of a new AI consortium with Anduril. However, shares reversed course and traded down around 4%.

12/6/2024

Palantir’s stock is continuing its upward trajectory, rising 5.6% and trading as high as $75.93.

12/5/2024

Palantir’s stock saw a 2.7% increase today, reaching a high of $72.05.

12/3/2024

Palantir’s stocks are rising following a recent security clearance upgrade from the federal government. The higher authorization for Palantir’s cloud computing services allows the U.S. government to process highly sensitive unclassified data.

11/27/2024

Bank of America has increased its price target for Palantir from $55 to $75 and maintained its “Buy” recommendation. However, this update has sparked mixed reactions from the analyst community. Various firms maintain a wide range of price targets for Palantir, from $9 to $75.

11/26/2024

Microsoft and Palantir are teaming up to deliver advanced AI and analytics services to the U.S. defense and intelligence community. The partnership will combine Microsoft’s Azure OpenAI Service with Palantir’s AI-powered security analytics tools.

11/25/2024

Palantir’s stock price increased by 1.5% to $65 today after Wedbush Securities upgraded its price target to $75 while maintaining an “Outperform” rating.

11/22/2024

Palantir’s stock price increased today by 1.3%, trading as high as $63.04.

11/21/2024

Palantir’s shares declined 0.4% today following an inside sale of company shares.

The following is a table that summarizes the performance in share price, revenues, and profits (net income) of PLTR from its inception in 2020 through the second quarter of 2024:

| Share Price | Revenues | Net Income | |

| 2020 | $23.55 | 1.092 | 1.166 |

| 2021 | $18.21 | 1.541 | .520 |

| 2022 | $6.29 | 1.905 | .373 |

| 2023 | $17.17 | 2.225 | .209 |

| TTM | $26.32 | 2.479 | .404 |

Revenue and net income in $billions

Since going public, Palantir saw its revenue grow by 35.44%, while net income fell by 65.35%. That drop in net income can be easily attributed, though. The company’s IPO in 2020 raised $2.6 billion, but that was shortly followed by 2022’s year-long bear market. Nonetheless, by 2023, the Big Data firm was able to reach profitability for the first time in its then 20-year history.

The momentum has continued with a series of earnings beats, most recently on Aug. 7, 2024, when the company reported earnings per share (EPS) of $0.09, which beat analysts’ estimates by 10.55%, and revenue of $678.23 million, which beat by 3.94%. The EPS beat was Palantir’s fourth consecutive and marked the sixth quarter in the last seven when it outperformed consensus. The company ended fiscal 2023 with around $3.7 billion in cash and liquid investments and — notably — no debt.

The current consensus median one-year price target for Palantir’s stock is $37, which represents a downside potential of -47.52%.

24/7 Wall Street’s 12-month forecast projects Palantir’s stock price to be $47 with earnings per share coming in right at $0.43. We see strong CAGR growth in sales of government contracts, upwards of 26% annually, and have factored for $3.186 billion in forecast revenue.

| Year | Revenue | Net Income | EPS |

| 2025 | $3.467 | $1.178 | $0.47 |

| 2026 | $4.198 | $1.465 | $0.56 |

| 2027 | $5.203 | $1.686 | $0.71 |

| 2028 | $6.185 | $2.050 | $0.87 |

| 2029 | $7.300 | $2.496 | $1.06 |

| 2030 | $8.482 | $2.990 | $1.27 |

Revenue and net income in $billions

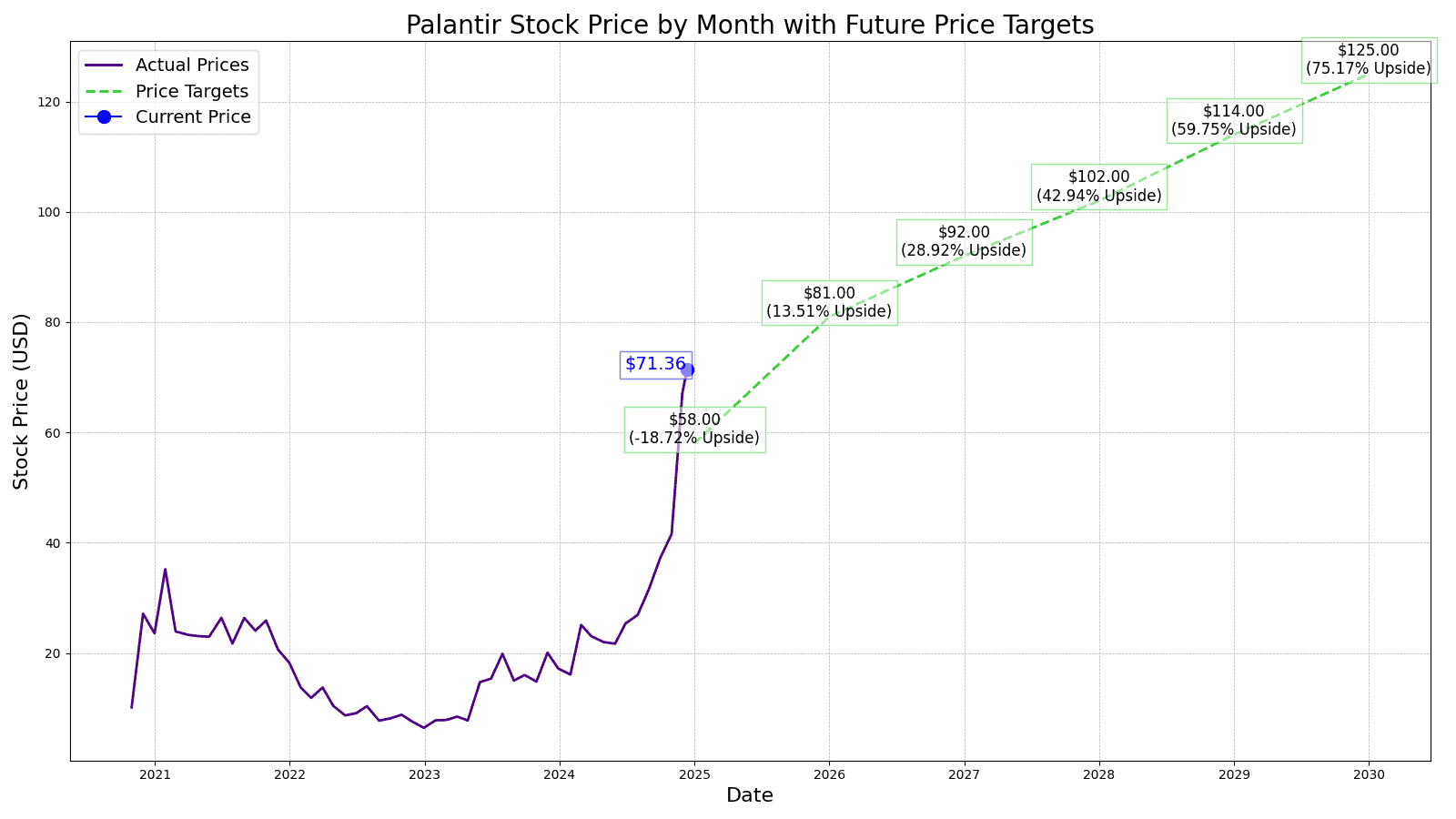

We expect to see revenue growth of just over 20% and EPS of 47 cents for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Palantir at $58 in 2025, which is -18.18% lower than the stock is trading today. We also expect the company to surpass $1 billion in free cash flow in 2025, with $1.052 billion.

Going into 2026, we forecast steady year-over-year increases for both revenue and net income of just over 21% and nearly 24%, respectively. 24/7 Wall Street’s price prediction for 2026 is $81, an upside of 14.26% under today’s stock price.

We expect to see a larger increase in revenue for 2027, and by extension, a larger gain in net income, which could breach $1 billion for the first time. Estimates are for revenue increases of 24% and an EPS increase of 23%, resulting in an annualized EPS of $0.71. We also forecast Palantir to surpass $2 billion in free cash flow by posting $2.380 billion. The stock price prediction for 2027 is $92, up 29.78%.

After breaching $1 billion in net income in 2027, we expect PLTR to take another step forward in 2028 by posting revenue of $6.104 billion, net income of $1.432 billion, and an annualized EPS of $0.79. We also forecast that the company will exceed $3 billion in free cash flow, posting $3.372 billion. The stock price for 2028 comes in at $102, an upside of 43.88%.

We expect revenue to increase to $7.208 billion for an 18% year-over-year gain, with net income growth of 22% and EPS coming in at $1.06, good for a 22.78% year-over-year gain. We also forecast free cash flow to surpass $4 billion by posting $4.566 billion. But our price-to-sales multiple will be lower as growth slows, and the price projection for the year is $114, an upside of 60.81% under today’s stock price.

On the back of forecast revenue in excess of $8 billion, we expect Palantir’s net income to surpass $2 billion for the first time, and post an EPS of $1.27. We expect free cash flow to approach $6 billion by posting $5.895 billion. The price projection for 2030 is $125, an upside of 76.33% over today’s stock price.

| Year | Price Target |

| 2025 | $58 |

| 2026 | $81 |

| 2027 | $92 |

| 2028 | $102 |

| 2029 | $114 |

| 2030 | $125 |

Revenue and net income in $billions

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.