Despite the rapidly evolving landscape of the payments industry, Visa (NYSE:V) retains its preeminent dominance. The transaction processing behemoth was founded in 1958, but didn’t go public until 50 years later when it issued 408 million shares at $44 a pop and raised $17.9 billion. It was the largest public offering in history at that time.

Since then, Visa’s dominance has only grown. Linking 100 million merchants and 15,000 banks worldwide, Visa possesses an extremely wide moat with over 4.5 billion cards issued. In comparison, rival Mastercard (NYSE:MA) has some 3.4 billion cards in circulation.

While its business has enjoyed exceptional growth and profitability over the decades, clouds are forming on the horizon. Congressional hearings held recently found surprising bipartisan support for breaking the credit card duopoly, increasing industry competition, and reducing the cost of fees Visa and Mastercard impose. The Justice Dept. also just sued Visa for monopolizing the merchant payments network.

Despite Visa stock trailing the S&P 500 in 2024, over the long haul the payments processor has been an excellent investment, with a total return for the last 10 years in excess of 400%. In contrast, the benchmark index has gained only 250%. And it is a dividend powerhouse.

Visa has increased its dividend at a compound annual growth rate of 18.8% with the payout growing from $0.13 per share in 2013 to $2.36 per share today. It suggests there is still significant upside potential for the payments processor before the end of the decade. Here is what prospective investors and current shareholders might expect from Visa over the next five years.

Key points in this article:

- Visa (V) is the leading global payments processor in what is essentially a duopoly.

- Despite a long record of growth and profitability, closer scrutiny from politicians could slow its growth trajectory, though Washington tends to move at a glacial pace.

- Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks“ now.

Visa’s recent stock success

Even though Visa is trailing the market in 2024, V stock is still up 20% year-to-date, hitting an all-time high.

The growth of electronic payments has been the driving force behind Visa’s historical growth trajectory, and there is no reason to believe that won’t continue to be the case.

Because digital payments globally surpassed cash payments only a few years ago, there is plenty of runway in front of Visa to continue expanding. As much of a mature market as Western markets represent, there is significant growth opportunities in emerging markets.

Since its IPO on March 19, 2008 at $44 per share, Visa stock has enjoyed an incredible run with a total return of 1,852%. The payments processor has only split its stock once in March of 2015, in a 4-for-1 split.

While economic recessions can hurt Visa’s business as consumer spending slows, it is also insulated for the worst impacts of a downturn. Because it doesn’t lend money, but rather it just lends its brand to credit card issuers, it is not exposed to the bad debt and write offs that often accompany a recession.

| Year | Share Price (end of year) | Fiscal Year Revenue | Fiscal Year Net Income |

| 2015 | $77.55 | $13,880 | $6,328 |

| 2016 | $78.02 | $15,082 | $5,991 |

| 2017 | $114.02 | $18,358 | $6,699 |

| 2018 | $131.94 | $20,609 | $10,301 |

| 2019 | $187.90 | $22,977 | $12,080 |

| 2020 | $218.73 | $21,846 | $10,866 |

| 2021 | $216.71 | $24,105 | $12,311 |

| 2022 | $207.76 | $29,310 | $14,957 |

| 2023 | $260.35 | $32,653 | $17,273 |

| 2024 | $311.01 | $35,926 | $19,743 |

Revenue and net income in millions.

Over the last decade, Visa’s annual revenue more than doubled, rising 158% for an 11.15% CAGR. Profits did even better, more than tripling in value for an 11.8% CAGR. While the pandemic did slow Visa’s momentum momentarily — not surprising when the economy was largely shut down — the payments processor soon picked up where it left off when a sense of normalcy returned.

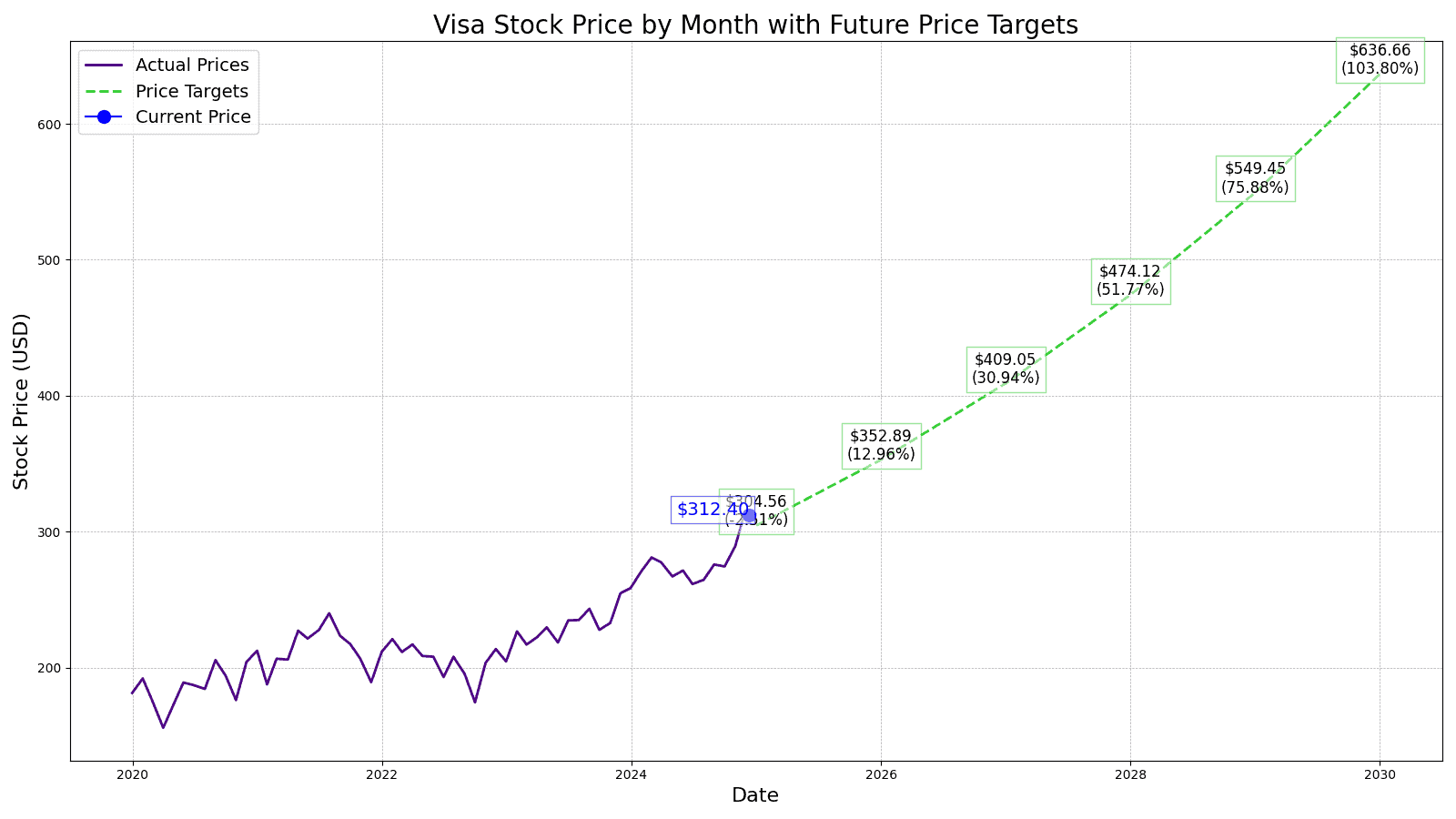

The question is, where does V stock go from here. 24/7 Wall Street offers readers insights into our assumptions about the stock’s prospects, what sort of growth we see in Visa stock for the next several years, and our best estimates for the payments processor’s stock price each year through 2030.

Key drivers of Visa’s stock

Market share dominance. As the largest payments processor with 4.5 billion cards in circulation, Visa benefits from the network effects of its brand accepted everywhere, virtually regardless of where you are in the world. It provides cost advantages and efficiencies virtually unmatched in the industry, particularly with the small, but growing cash transfer and payments industry.

Long-term growth trajectory of electronic payments. Visa enjoys a wide and deep competitive moat and with digital payments surpassing cash transactions globally, there is still room for significant expansion, especially within emerging markets where penetration may not be quite as extensive. Though Visa primarily handles card-based transactions, it has expanded its expertise to accommodate mobile payments, contactless payments, and blockchain-based solutions.

Margin improvements despite regulatory scrutiny. Visa’s business is highly scalable due to its network-based model, where it primarily earns revenue from a small percentage fee on each transaction processed through its global network. That allows it to easily add new users and merchants without significant infrastructure costs as the volume of transactions increases.

Visa (V) price prediction in 2025

The current consensus median one-year price target for Visa is $321.74, representing a potential upside of 3.45% over the next 12 months from its current share price. Of the 29 analysts covering Visa, the stock earns a “buy” or “strong buy” recommendation from 86% of them.

24/7 Wall Street’s 12-month forecast projects V stock price to be $304.56, representing a 2.07% downside potential based on an annualized EPS estimate of $11.28 and a price-to-earnings (P/E) ratio estimate of 27.

| Year | Revenue | EPS |

| 2025 | $39,932 | $11.28 |

| 2026 | $44,384 | $13.07 |

| 2027 | $49,333 | $15.15 |

| 2028 | $54,834 | $17.56 |

| 2029 | $60,948 | $20.35 |

| 2030 | $67,743 | $23.58 |

Revenue in millions.

How Visa’s next 5 years could play out

At the end of 2025, we forecast Visa’s stock to be trading for $304.56 based on revenue of $39.932 billion, a net income of $21.963 billion, and an EPS of $11.28. The following year, we estimate earnings per share of $13.07 on over $44.3 billion in revenue and net income of $24.633 billion.

Because Visa’s business is fairly stable, barring economic upheavals, we expect revenue growth to continue at its historical 11.15% growth rate, though earnings per share will climb as the network effects of Visa’s scalable business drives margins higher. That brings Visa’s price target to $409.05 in 2027. 24/7 Wall Street forecasts similarly steady growth throughout the rest of the decade, with Visa seeing incrementally better net margins over that time, before hitting 58% in 2030.

Visa’s price target for 2030

By the conclusion of 2030, 24/7 Wall Street estimates Visa’s stock to be trading for $636.66 per share, representing a 104.71% increase from its current price, based on revenue of $67.743 billion and an annualized EPS of $23.58.

| Year | Price Target |

| 2025 | $304.56 |

| 2026 | $352.89 |

| 2027 | $409.05 |

| 2028 | $474.12 |

| 2029 | $549.45 |

| 2030 | $636.66 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.