Forecasts

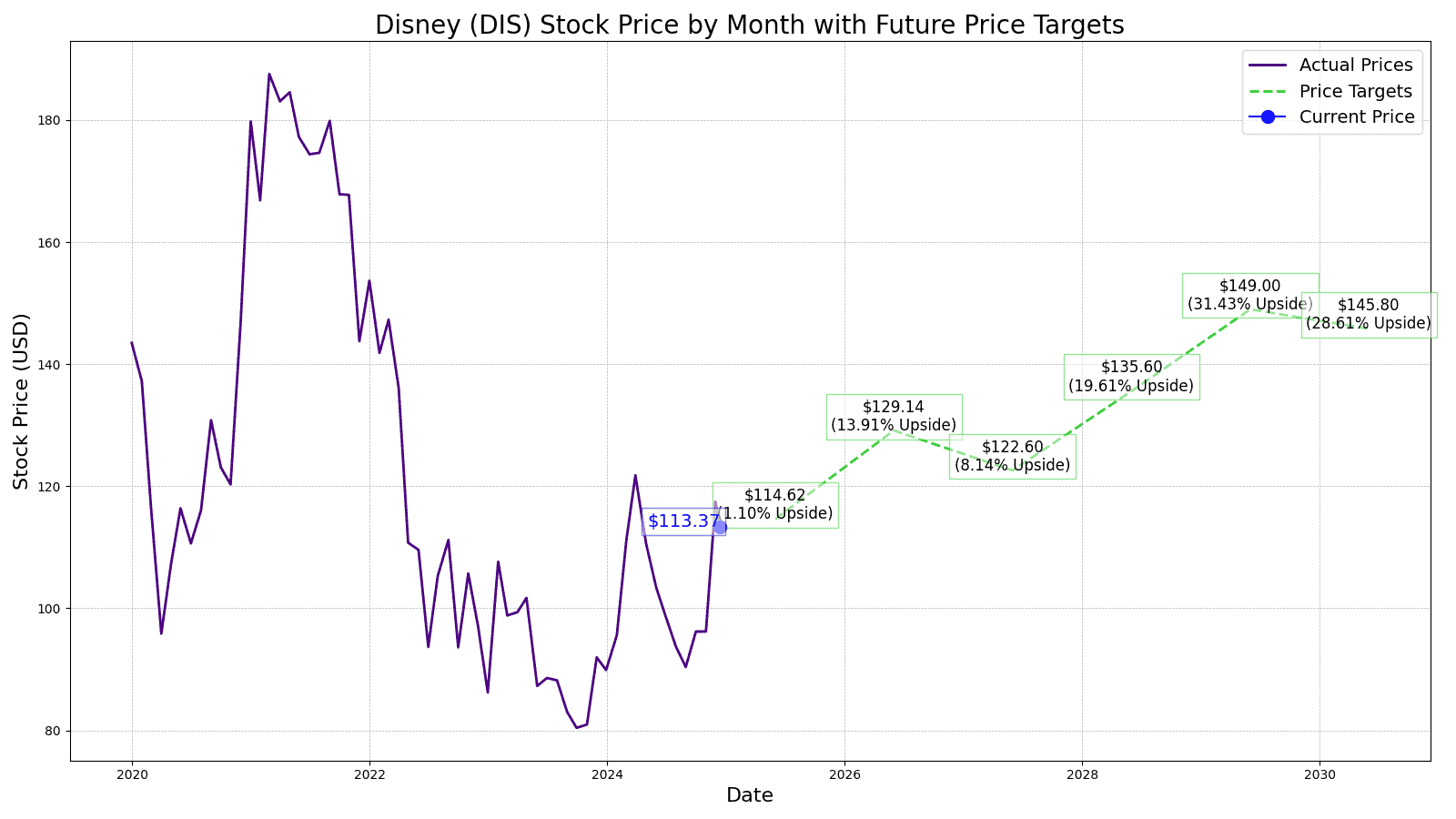

Walt Disney Company (DIS) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

For the past century, the Walt Disney Company (NYSE: DIS) has been an entertainment pioneer in international branding, animation, films, television, merchandising, and theme parks. Although the media empire holds some of the most cherished brands, the stock is currently 40.64% off its 2021 high of $191.

The return of CEO Bob Iger has helped to steady the ship but investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant.

24/7 Wall Street aims to present some farther-looking insights based on Disney’s own numbers, along with business and market development information that may be of help to our readers’ own research.

12/16/2024

Disney has agreed to a $233 million settlement to resolve a class-action lawsuit brought by Disneyland Resort employees. The lawsuit, filed in 2019, alleged that Disney violated Measure L, a local ordinance requiring certain businesses to pay employees a living wage. The wage, which began at $15 per hour and has increased annually, will reach nearly $20.50 per hour in January 2025.

12/9/2024

Disney’s CFO, Hugh Johnston, has indicated that the company plans to increase the prices of its streaming services in the future. This move is part of a broader strategy to enhance revenue streams and offset rising costs, particularly with the increased competition in the digital entertainment market.

12/3/2024

S&P Global Ratings has upgraded its rating to an “A” for The Walt Disney Company due to the improved leverage and positive growth projections for fiscal 2025.

11/25/2024

Disney has announced the return of Destination D23, the ultimate fan event from D23: The Official Disney Fan Club. Scheduled for August 29-31, 2025, this event promises to be twice the size of previous years. It will be held at Disney’s Coronado Springs Resort in Walt Disney World.

11/18/2024

Disney is taking a strategic step to expand its retail presence in the Middle East and Southeast Asia to create a global retail network that complements its theme parks and streaming services.

11/11/2024

Disney is set to release its quarterly earnings report this Thursday, providing a final look at its fiscal year 2024 performance. Analysts anticipate increased revenue and profits, with particular interest in the company’s streaming business profitability and succession plans for Bob Iger. Overall, Wall Street expects Disney to report a revenue of $22.49 billion (up from $21.24 billion in the same period last year) and a net income of $1.73 billion (up from $264 million in the previous year).

11/8/2024

Adeia, a technology company, has filed a lawsuit against Disney, accusing the entertainment giant of infringing on its video streaming technology patents. The patents cover improvements to streaming functionality, which Adeia claims are used in Disney’s streaming services, including Disney+, Hulu, and ESPN+.

Bob Iger’s 15-year initial tenure at Disney is notable for (4) acquisition milestones: Pixar in 2006, Marvel in 2009, Lucasfilm in 2012, and Fox in 2019. Disney’s market cap grew from $56 billion to $231 billion by the time his contract expired in 2020. A look at the top 10 all-time box office-grossing films shows that except for Titanic and Jurassic Park, Disney or its subsidiaries are the exclusive US distributor for those films (or a 25% stake in the case of Sony’s Spider-Man: No Way Home).

Iger’s successor, Bob Chapek, was essentially handed the keys to a well-oiled machine but the company hit a number of rough patches and the stock has been on a long-term slide.

| Fiscal Year (Sept. 30) | Price | Revenues | Net Income |

| 2015 | $103.00 | $52.465B | $8.382B |

| 2016 | $92.47 | $55.632B | $9.391B |

| 2017 | $100.70 | $55.137B | $8.898B |

| 2018 | $114.78 | $59.434B | $12.598B |

| 2019 | $130.27 | $69.607B | $11.054B |

| 2020 | $122.55 | $65.388B | -$2.864B |

| 2021 | $176.01 | $67.418B | $1.995B |

| 2022 | $94.33 | $82.722B | $3.145B |

| 2023 | $81.05 | $88.898B | $2.354B |

| LTM | $90.56 | $90.028B | $4.776B |

While Inside Out 2 demonstrated the resilience of Disney’s animation department, Iger’s repairs to Disney’s floundering segments have regained their fan bases and show promise.

The primary issue Disney faces is finding Iger’s next successor. He came out of retirement at the request of Disney’s Board but has made it clear that he doesn’t intend to stay for another long haul.

The consensus 12-month Disney price target from 28 different analysts is $111.57 per share, which would calculate growth estimates at -0.96%. 24/7 Wall Street’s 12-month Disney price projection is $111.93, which would be a -0.64% loss. This is predicated on the anticipation that the forthcoming film and TV slate schedule will proceed as projected.

Children’s favorite Moana, the animated South Pacific adventure heroine whose mythological sidekick was voiced by Dwayne Johnson, will return in Moana 2 going into the 2024 Christmas holidays, which should boost 2025’s revenues as Disney’s fiscal year ends September 30. Mufasa: The Lion King, a sequel to the monster box-office hit The Lion King, will close out 2024’s releases. Zootopia 2 and a live remake of Lilo and Stitch round out the 2025 family entertainment slate.

2025 is expected to also delve deeper into Marvel’s next phase, with Captain America: Brave New World, Thunderbolts, and The Fantastic Four: First Steps.

2026 is expected to see the first Star Wars feature film since 2019 with the return of Jon Favreau directing The Mandalorian and Grogu, yet another Iger reiteration of a winning formula. Additionally, the animated feature franchise Toy Story 5 and the long-awaited live-action Moana should both do big box-office numbers for family entertainment.

High anticipation Blockbuster sequels for 2026 include the third installment of the Avatar saga, Avatar: Fire and Ash. As a follow-up to Avengers: Endgame, 2026 is the target date for the release of the aforementioned Robert Downey Jr.-led Avengers sequel, Avengers: Doomsday. Avatar and Avengers: Endgame are the #1 and #2 all-time worldwide box office champions.

These movies, with huge fan bases and positive word of mouth, should be able to help drive Disney to $129.14, which would be a 13-14% year-over-year gain.

Several analysts believe that 2027-2028 will see the start of the DTC division solidifying its profit engine, and is expected to offer bundled subscription packages that will increase viewership, customers, and revenues, as account churning and costs are further reduced.

Other expected box-office hits include Pixar’s Incredibles 3, Frozen III, and Marvel’s as-of-yet untitled next Spider-Man feature, Avengers: Secret Wars a follow-up to Doomsday, and the next Star Wars feature: Star Wars: New Jedi Order. While 2027 would see Disney’s price retrace slightly to $122.60, we believe the 2028 revenues from DTC and the tentpole films slated for 2027 would have fall and winter box-office revenues credited to fiscal year 2028 and would boost the stock to $135.60.

The theme park industry, of which Disney has a 25% market share, was valued at $64.6 billion at the start of 2024. It is estimated to grow to $82.73 billion by 2032. The 10-year, $60 billion plan to add more attractions to Disney theme parks and cruises will likely involve greater interactive technology, virtual reality, and other experiences that could not be replicated elsewhere.

While stages of this development would certainly make their way to Disney’s bottom line in previous years, we anticipate many of their innovations to be in full operation and available to the public in 2029, which would boost the initial novelty value to a $149 five-year high.

However, high ticket prices that compete with other entertainment platforms might require price reductions. That, combined with uncertainty over Bob Iger’s successor, might cause a slight sell-off. Nevertheless, Disney would still be up 61% in 2030 over its current market price at the time of this writing.

| Year | Normalized EPS | P/E Ratio | Projected Stock Price |

| 2025 | $5.21 | 22 | $114.62 |

| 2026 | $5.87 | 22 | $129.14 |

| 2027 | $6.13 | 20 | $122.60 |

| 2028 | $6.78 | 20 | $135.60 |

| 2029 | $7.45 | 20 | $149.00 |

| 2030 | $8.10 | 18 | $145.80 |

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.