Forecasts

Advanced Micro Devices Inc. (AMD) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

According to PC Gamer, “The AMD Ryzen 7 7800X3D is simply the best gaming CPU around right now. It’s certainly the best gaming chip that AMD has ever made, but it’s also capable of outperforming Intel’s top CPU when it comes to gaming frame rates and is doing so for a lot less cash. It’s also a lot less power-thirsty, too.” Rave reviews such as this would have been considered unthinkable over a decade ago.

After 50 years of playing second best to rival Intel (NASDAQ: INTC), Advanced Micro Devices (NASDAQ: AMD) surpassed it, thanks to CEO Dr. Linda Su, who took the reins in 2014 and AMD was able to unveil the Ryzen in 2017, which became a game changer.

Based on a principle of multiple microscopic CPUs working in tandem, AMD’s Ryzen CPU outperformed Intel’s CPUs in speed and efficiency, and most importantly – cost only half as much. Ryzen and its later updates subsequently added tents of billions to AMD’s revenues, and in 2022, AMD surpassed Intel in market cap, although not in chip market share.

Despite AMD’s phenomenal turnaround over the past decade, not everything has been smooth sailing and concern-free.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some further-looking insights based on AMD’s own numbers, along with business and market development information that may be of help to our readers’ own research.

12/16/2024

Advanced Micro Devices’ stock price dipper 1.3% in midday trading today, reaching a low of $123.12. Trading volume was also much lower than average, with only 15.7 million shares changing hands.

12/12/2024

Advanced Micro Devices’ stock experienced a slight decline of 0.2% during today’s midday trading, fluctuating between $129.13 and $129.92. Trading volume was also much lower than average.

12/11/2024

Advanced Micro Devices’ CEO Lisa Su has been named Time Magazine’s CEO of the year. Since taking over in 2014, Su has orchestrated an incredible turnaround for the company, driving AMD’s stock price up by a staggering 3700%.

12/9/2024

Vivek Arya, an analyst with Bank of America, downgraded Advanced Micro Devices stock from “Buy” to “Neutral” and lowered its price target from $180 to $155. This downgrade follows Amazon’s executives reports of weak demand for AMD’s AI accelerators and led to a decline in AMD’s stock today.

12/6/2024

AMD’s stock price has gone down today. This decrease followed an Amazon executive’s report that the company hasn’t observed enough demand for AMD’s AI accelerators to warrant their sale through Amazon Web Services.

12/5/2024

Mizuho has lowered its price target for Advanced Micro Devices from $185 to $180, but still maintains a “Buy” rating on the stock. This revised target price suggests a potential upside of 26.64% from AMD’s current market price.

12/3/2024

Advanced Micro Devices stock declined 0.3% today, trading between $141.23 and $141.61.

11/27/2024

Advanced Micro Devices has solidified its commitment to Indian by inaugurating a new research and development center. This move aligns with the company’s previously announced $400 million investment in the country.

11/26/2024

Advanced Micro Devices is planning to acquire ZT Systems for $4.9 billion in a strategic move to bolster its position in the AI market and challenge Nvidia’s dominance. ZT Systems will bring expertise to AMD and encourage accelerated deployment of AI infrastructure at scale.

11/25/2024

Advanced Micro Devices is investing $400 million in India, highlighting the importance of its Bengaluru R&D center to its global operations and India as a key market and vital hub for technological innovation and growth.

After stints at IBM and Texas Instruments, Dr. Lisa Su became COO of AMD, assuming the CEO position in 2014. Soon afterwards, she started her overhaul of the company by splitting it into 2 divisions:

Dr. Su oversaw the release of the Radeon 300 and Fury series, the last of the Bulldozer derivatives, and then the RX 400 series of GPUs in 2016.

Based on AMD’s Zen architecture, both Epyc for servers and workstations Ryzen for laptops and desktops debuted in 2017. They innovatively took multiple micro CPUs to work as a team for superior computing power and speed. Ryzen, in particular, took the computing world and Intel by surprise, as it catapulted AMD to previously uncharted levels.

2020 saw AMD announce the acquisition of Xilinx for its field programmable gate arrays (FPGA). AMD would discontinue Xilinx production of its complex programmable logic devices (CPLD) in early 2024.

Pensando Systems was added to AMD’s portfolio in 2022, with Mipsology to follow in 2023.

On the AI front, 2023 saw AMD acquire Nod.ai, followed by Silo.AI, Europe’s largest private AI Lab, in 2024.

| Fiscal Year (Dec) | Price | Revenues | Net Income |

| 2015 | $2.87 | $3.991 B | -($660 M) |

| 2016 | $11.34 | $4.319 B | -($498 M) |

| 2017 | $10.28 | $5.253 B | -($33 M) |

| 2018 | $18.46 | $6.475 B | $337 M |

| 2019 | $45.86 | $6.731 B | $341 M |

| 2020 | $91.71 | $9.763 B | $2.490 B |

| 2021 | $143.90 | $16.434 B | $3.162 B |

| 2022 | $64.77 | $23.601 B | $1.320 B |

| 2023 | $147.41 | $22.680 B | $864 M |

| 2024 LTM (Jun 2024) | $$162.21 | $23.276 B | $$1.354 B |

The consensus rating from over 40 Wall Street analysts is “buy/outperform” (31 buy, 7 outperform, 10 hold). Their average price target in 12 months is $186.91, which is 47.77% from the price today.

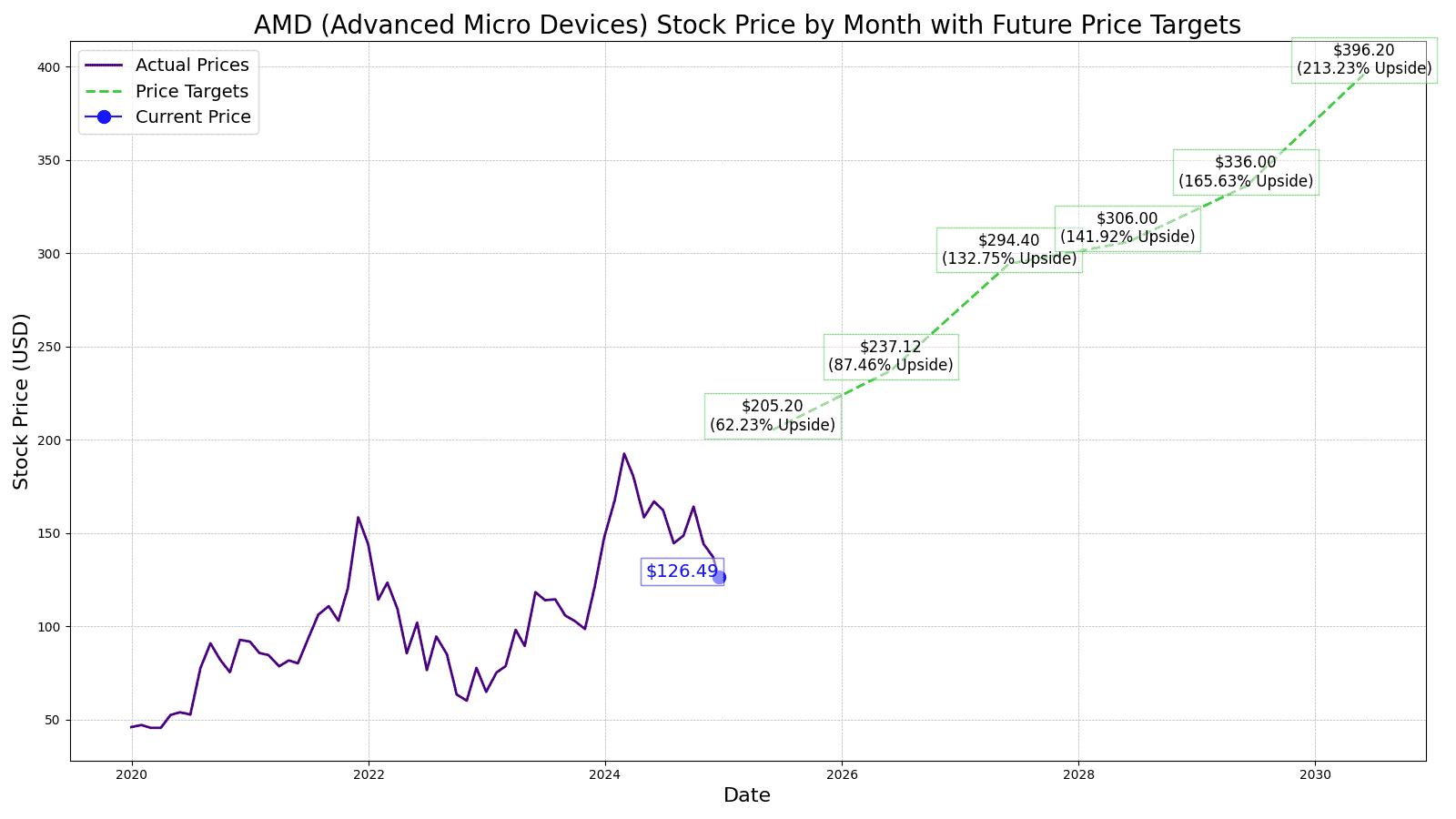

24/7 Wall Street’s 12-month projection for AMD’s price is $205.20, which would be a 62.23% increase. We believe Dr. Su’s goal of end-to-end AI utility is already underway, with AMD competing with Nvidia in a similar fashion and strategy to how it challenged Intel: with comparable or superior speed and performance for lower prices.

The past 10-year median P/E ratio for AMD is 34.27. 24/7 Wall Street is using a more conservative P/E ratio of 30 for the following price predictions. These prices also preclude an invasion of Taiwan from China, which would understandably devastate chip manufacturing worldwide.

For 2026, we predict a price of $237.12, which would be a 15.56% gain year-over-year. AMD’s acquisition of ZT Systems will be a significant contributor to Dr. Su’s AI development agenda. She anticipates that the AI accelerator and GPU chip market will reach $400 billion by 2027. AMD’s Instinct and Epyc accelerators for machine learning will see a major boost in this surge.

To follow up on the AI agenda, 2027 should benefit from ZT Systems’ software boost capabilities. During 2023-24, AMD invested more than $1 billion to improve its AI software capabilities and R&D activities. AMD has already made three small software AI-related acquisitions (Silo AI, Nod.ai, and Mipsology) to bolster its mid- and high-level software abstractions and help customers customize LLMs. Dr. Su and Nvidia’s Jensen Huang are blood-relative cousins, and their respective competitive drives and tech savvy make the AMD and Nvidia rivalry in AI all the more compelling when the different components are compared head-to-head. The 24/7 Wall Street price target for 2027 is $294.40. This would be a 24.16% gain year-over-year.

2028 should see AMD get an upswing from its ancillary markets. For example, AMD’s Ryzen is already a big part of the digital cockpits in the automotive market. Its partnerships with Daimler-Benz and Tesla will likely expand to other auto manufacturers as AI becomes more ubiquitous and demand escalates. Our price target is $306, a modest year-over-year gain of 3.94%.

Edge computing would be another ancillary market for AMD that would benefit from AI. 2029 should see a boost in IoT applications using AMD-powered devices and digital architecture. AMD’s Multi-Chip Modules (MCM) will continue to expand, with its Epyc Milan X, the first MCM GPU, leading the way for a range of other configurations. The resulting bump would be a target price of $336, a 9.80% gain from the previous year’s price target.

At present, no smartphone utilizes any AMD CPUs. Nevertheless, AMD has already announced the availability of Ryzen chips for mobile devices. By 2030, the growth of AI-powered mobile gaming should reach the point where the demand for Ryzen performance in smartphones by game-oriented users should see Ryzen-powered smartphones. This would be a huge boon for AMD, as the smartphone market is a major one that has long eluded it. The 24/7 Wall Street 2030 price target is $396.20.

| Year | EPS | P/E multiple | Price |

| 2025 | $6.84 | 30 | $205.20 |

| 2026 | $7.90 | 30 | $237.12 |

| 2027 | $9.81 | 30 | $294.40 |

| 2028 | $10.20 | 30 | $306.00 |

| 2029 | $11.20 | 30 | $336.00 |

| 2030 | $13.21 | 30 | $396.20 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.