Forecasts

Crowdstrike Holdings, Inc. (CRWD) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

With the advent of the digital age, tech-minded thieves, scammers, and hackers found a panoply of new prospective victims. As digital tools became routine within the government and industrial sectors, the inherent security vulnerabilities from skilled antagonists armed simply with a computer created the birth of the cybersecurity industry.

Founded in 2011, Austin-headquartered Crowdstrike Holdings (NASDAQ: CRWD) became a leader in the global cybersecurity sector, thanks to a number of high-profile hacking and cyber-espionage investigations on both the corporate and government levecols. Providing endpoint security, threat intelligence, and cyber attack response services, Crowdstrike’s valuation has exploded, from $1 billion in 2017 to a 2024 market cap of $88.03 billion.

While Crowdstrike has strong ties to the US government and multibillion-dollar conglomerates, its public reputation has been built on its identification of government-level military and espionage hacker groups.

To date, Crowdstrike’s biggest setback has been from July 2024. The company released an update to its Falcon detection and response software agent. Unfortunately, code flaws caused millions of Microsoft Windows OS-powered computers to crash all around the world. The downtime caused a widespread global impact, grounding commercial airline flights, temporarily taking Sky News and other broadcasters offline, and disrupting banking and healthcare services as well as 911 emergency call centers. Subsequent problems arose requiring multiple boots or other cumbersome, software key command fixes.

As a result, Crowdstrike stock dropped from a high of $398.00 per share to a low of $208.10 in only 4 trading sessions. The stock has since clawed back from that loss.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some further-looking insights based on Crowdstrike’s own numbers, along with business and market development information that may be of help to our readers’ own research.

12/16/2024

Crowdstrike has been recognized as a Leader and Outperformer in the 2024 GigaOm Radar Report for Ransomware Prevention. The CrowdStrike Falcon platform received high praise for its innovative approach and strong performance in key areas like data exfiltration protection, predictive analytics, automated response, user-friendly management, and seamless integration with security ecosystems. Crowdstrike achieved the highest average score among all vendors evaluated in the report.

12/12/2024

Crowdstrike continues to lead the Managed Detection and Response (MDR) market. The company has been recognized as a Customers’ Choice in the 2024 Gartner Peer Insights Voice of the Customer report, achieving a 96% Willingness to Recommend score.

12/11/2024

Crowdstrike has obtained C5 certification in Germany. Issued by the German Federal Office for Information Security (BSI), this certification validates the company’s commitment to robust security standards and its ability to protect sensitive data for public sector organizations.

12/6/2024

Crowdstrike has once again been recognized as a leader in cloud security. For the third year in a row, the company has been named a leader in the 2024 Frost Radar for Cloud-Native Application Protection Platforms (CNAPP).

12/5/2024

Crowdstrike has been recognized by AWS with three prestigious awards: Global Security Partner of the Year, North America Marketplace Partner of the Year, and LATAM Public Sector Technology Partner of the Year.

12/3/2024

Crowdstrike’s stock gained 1.2% today, reaching a high of $351.95.

11/27/2024

Crowdstrike’s shares fell today following the company’s unexpected third-quarter loss, which was attributed to the impact of a large outage in July. Despite the setback, however, analysts remain optimistic about the company’s long-term prospects. Mizuho maintained its “outperform” rating and increased its price target to $375. Wedbush also raised its price target to $390, while Citi increased its price target to $400.

11/26/2024

Crowdstrike reported third-quarter earnings today, driven by robust demand for its cybersecurity solutions. The company’s revenue growth of 29% and earnings per share exceeding expectations underscore its strong market position.

Crowdstrike’s identification of highly publicized cybersecurity breach perpetrators is the bedrock of its reputation. The following milestone events were all significant milestones:

From 2020 on, Crowdstrike enacted a number of acquisitions that both grew the company’s valuation, as well as expanded its capabilities. These include:

Crowdstrike went public in 2019. It finally became profitable in 2024, after years of losses as it built its cybersecurity business.

| Fiscal Year (Jan 31) | Price | Revenues | Net Income |

| 2015 | n/a | n/a | n/a |

| 2016 | n/a | n/a | n/a |

| 2017 | n/a | $52.70 M | ($91.30 M) |

| 2018 | n/a | $118.80 M | ($135.50 M) |

| 2019 | IPO: 6-2019) | $249.80 M | ($140.01 M) |

| 2020 | $61.09 | $481.40 M | ($141.80 M) |

| 2021 | $215.80 | $874.40 M | ($92.60 M) |

| 2022 | $198.33 | $1.451 B | ($234.80 M) |

| 2023 | $105.90 | $2.241 B | ($183.20 M) |

| 2024 (10/2024) | $291.77 | $3.055 B | $89.30 M |

The consensus rating from 50 Wall Street analysts is ‘buy/outperform’. Their average price target in 12 months is $331.31, which is -12.12% from today’s price of $388.00.

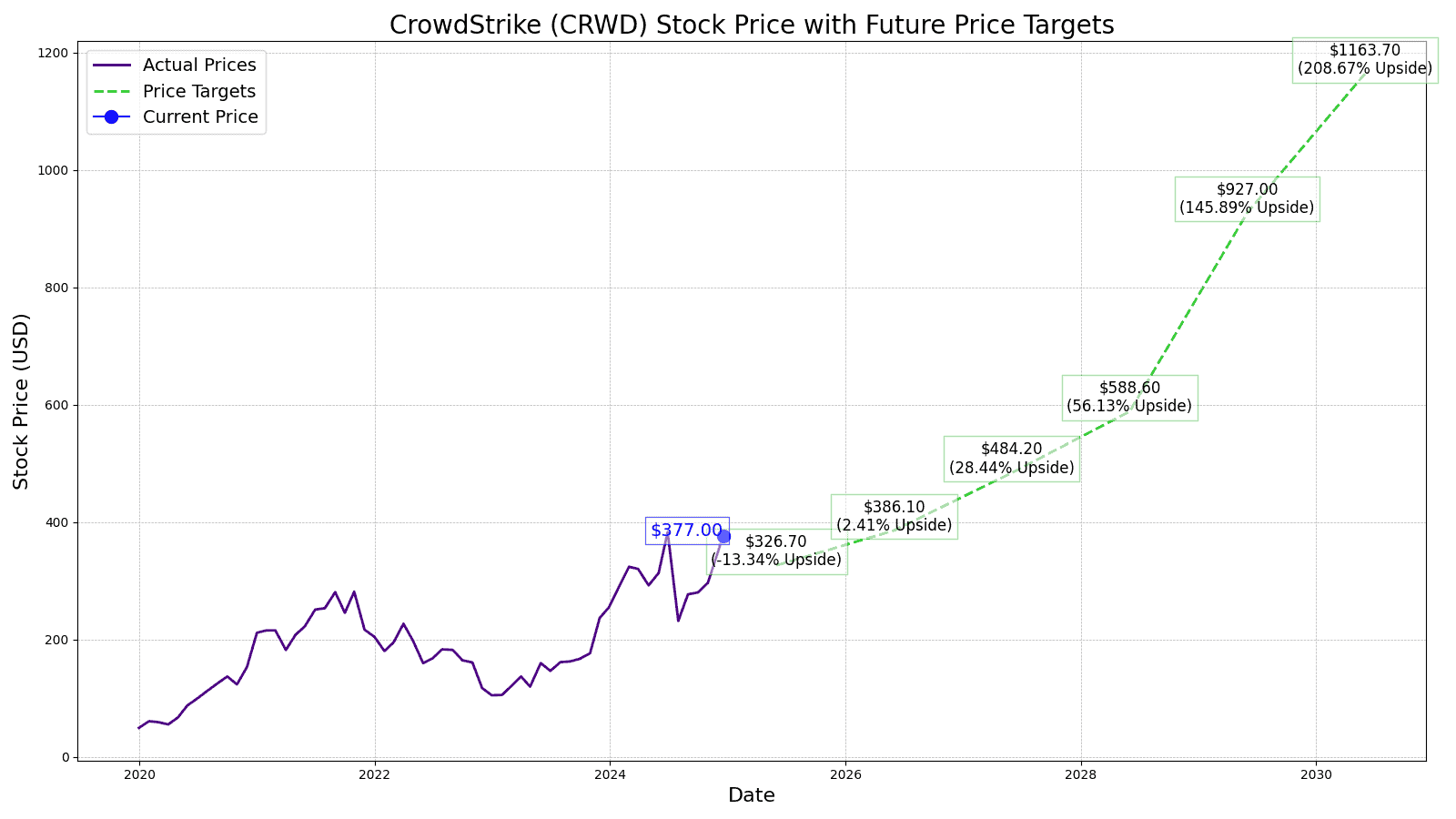

24/7 Wall Street’s 12-month projection for Crowdstrike’s price is a slightly higher $326.70, which would be a loss of -13.34% from today’s price of $388.00. Given that Crowdstrike only went into the black earlier this year and after a near 40% drop in July, the measured regaining of lost ground is certainly not unexpected. The P/E ratio at the time of this writing is over 400, but as profitability is so recent, we are using a P/E of 90 for our projections.

Crowdstrike Horizon cloud security solutions for Microsoft’s Azure will likely be customized and then adopted by Amazon and Google for their platforms. All three already use Crowdstrike Falcon for their conventional web business. We anticipate Crowstrike’s 2026 price to hit $386.10.

As cyberattacks continue to proliferate and cyber blackmail schemes using viruses escalate, we think that Falcon improvements and enhancements from Cardinal Ops, Nagomi and Veriti will drive more subscriptions for premium service packages. We project 2027 to see Crowstrike’s price go to $484.20.

Crowdstrike’s debt-to-equity ratio is 0.79 as of 2024. Additional cash from operations used to redeem bonds and improve the company’s debt-to-earnings ratio to over 1.0 will broaden its appeal for conservative buy-and-hold institutional investor types, which will boost the stock in 2028 to a projected price of $588.60.

Identity Theft continues to attain greater sophistication, being able to to now use some digital copies of biometric security protocols to breach security protection measures. Enhanced 2.0 version of Zero Trust protocols from the SecureCircle and Preempt Security acquisitions should address those issues to better protect systems. The 2029 Crowdstrike price is projected to be $927.00, a big jump that will be led by further Falcon subscription boosts.

Charlotte AI-driven security measures that learn about new threats and immediately update all of the details and successive defensive protocols deployed across the Falcon platform should greatly advance Crowdstrike’s cybersecurity capabilities. The machine learning aspects of Charlotte AI will allow for better anticipation of future threats. This will contribute to a huge jump in 2030 earnings and a commensurate projected price of $1,163.70.

| Year | EPS | P/E multiple | Price |

| 2025 | $3.63 | 90 | $326.70 |

| 2026 | $4.29 | 90 | $386.10 |

| 2027 | $5.38 | 90 | $484.20 |

| 2028 | $6.54 | 90 | $588.60 |

| 2029 | $10.30 | 90 | $927.00 |

| 2030 | $12.93 | 90 | $1,163.70 |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.