The artificial intelligence-fueled rally has been the foremost contributor to the major market indices’ sizable gains over the past several years. And one company in particular is at the vanguard: NVIDIA Corp. (NASDAQ: NVDA). NVIDIA is the premier manufacturer of components critical to the surge in AI; namely, semiconductors, microchips, and graphics processing units (GPUs).ca

As a result, the Santa Clara, Calif.-based company has seen its stock skyrocket in the recent past. Since the first day the market opened in 2023, shares have gained 792.47%, and in the decade from August 2014 to the present, they are up a preposterous 27642.55%.

Despite those mind-boggling gains, analysts still expect enormous upside potential in the medium and long term. 24/7 Wall Street has performed analysis to provide prospective investors and current shareholders with an idea of where NVIDIA’s stock might be headed over the course of the next five years.

Key Points in This Article:

- NVIDIA’s track record of strong earnings suggests an ability to remain at the forefront of its industry, as competitors fight for the leftovers.

- Between NVIDIA’s client list of Magnificent Seven companies and the burgeoning trend in AI, growth in both revenue and net income is projected to continue its steep climb.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

NVIDIA News and Updates

12/16/2024

Nvidia’s stock price has fallen by more than 10% from its recent peak, officially sending it into correction territory. The decline was partially trigger by Chinese regulators’ announcement of an investigation into potential antitrust violations. While the stock has experienced a recent downturn, however, analysts maintain a long-term bullish outlook for the company.

12/12/2024

Nvidia has officially denied rumors suggesting a potential reduction or halt in its exports to China. The company reaffirmed its commitment to the Chinese market, emphasizing its ongoing support for customers in the region.

12/11/2024

The U.S. Supreme Court has rejected Nvidia’s appeal, allowing for a lawsuit to move forward that accusing the company of misleading investors about its reliance on cryptocurrency mining revenue.

12/9/2024

Nvidia’s shares declined today. This action follows China’s initiated antitrust investigation into the company over its 2019 acquisition of Mellanox. China’s State Administration for Market Regulation (SAMR) is investigating Nvidia for potential violations of China’s anti-monopoly law.

12/6/2024

The European Union is scrutinizing Nvidia’s business practices and is looking into potential unfair sales tactics like bundling. This investigation could escalate into a formal inquiry, particularly as Nvidia controls 84% of the AI chip market share.

12/5/2024

Nvidia is looking to begin manufacturing its Blackwell AI chips at Taiwan Semiconductor’s new facility in Arizona (which is still under construction).

12/3/2024

Nvidia has announced a new partnership with the Thai government with the aim of developing cutting-edge AI infrastructure for the country.

11/27/2024

Nvidia is reportedly prioritizing Samsung’s GDDR7 memory for its upcoming GeForce RTX 50 series of graphics cards for desktops and AI notebooks.

11/26/2024

Nvidia has been working with a team of global researchers on a groundbreaking AI model, Fugatto (short for Foundational Generative Audio Transformer Opus 1). This versatile tool can generate or transform audio in countless ways: it can create music from simple text prompts, alter a singer’s emotion or accent, and add or remove instruments from existing songs.

11/25/2024

Nvidia’s stock declined by nearly 4% today, reaching a three-week low.

NVIDIA’s Recent Stock Success

Unless you have been living under a rock, chances are you have caught wind of the very well-documented and rather exponential surge in NVIDIA’s share price since 2022. But before 2022’s price-per-share explosion, it was steadily appreciating as it underwent a series of stock splits.

| Year | Share Price* | Revenue** | Net Income** |

| 2014 | $0.51 | $4.130 | $0.588 |

| 2015 | $0.82 | $4.681 | $0.800 |

| 2016 | $2.67 | $5.010 | $0.929 |

| 2017 | $4.88 | $6.910 | $1.851 |

| 2018 | $3.24 | $9.714 | $3.085 |

| 2019 | $5.98 | $11.716 | $4.143 |

| 2020 | $13.06 | $10.918 | $3.580 |

| 2021 | $29.64 | $16.675 | $6.277 |

| 2022 | $14.61 | $26.914 | $11.259 |

| 2023 | $49.52 | $26.974 | $8.366 |

*Post-split adjusted basis

**Revenue and net income in $billions

Over the course of the last decade, NVIDIA’s revenue grew by more than 553% while its net income increased by just over 1,323%. The company experienced a slight contraction in revenue and net income in 2020 due to the COVID-19 pandemic, but it rebounded soundly the following year and has continued to steadily grow both metrics since. Meanwhile, shares were able to increase by 9,610% from 2014 to 2023.

As the AI lynchpin looks forward to the second half of the decade, 24/7 Wall Street has identified three key drivers that are likely to impact its growth metrics and stock performance through 2030.

Key Drivers of NVIDIA’s Stock Performance

- Stronghold on the GPU Industry: No one makes GPUs like Nvidia makes GPUs, and the industry demanding them is well aware of that. While semiconductor competitors like Advanced Micro Devices Inc. (NASDAQ: AMD) and Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM) do command some attention in their respective corners of the market, simply comparing the three companies’ market caps demonstrates the discrepancies between NVIDIA and, well, every other company. While Advanced Micro Devices and Taiwan Semiconductor Manufacturing have respectable market caps of $203.38 billion and $872.28 billion, respectively, those are dwarfed by NVIDIA’s $3.30 trillion.

- Demand From Unrivaled Tech Customers: The company’s primary clientele are the other members of the Magnificent Seven, which are leading the way forward in the AI revolution. In fact, only four Big Tech rival companies — Alphabet Inc. (NASDAQ: GOOGL), Amazon.com Inc. (NASDAQ: AMZN), Meta Platforms Inc. (NASDAQ: META), and Microsoft Corp. (NASDAQ: MSFT) — account for 40% of NVIDIA’s revenue as they vie with one another to become the front runner of the transition to generative AI.

- The AI Trend Is Just Getting Started: According to Grand View Research, the market size of AI in 2023 was $196.63 billion. As large as that seems, it pales in comparison to where the market is headed. From 2024 to 2030, it is expected that the industry will grow at an astounding compound annual growth rate (CAGR) of 36.6%, with “continuous research and innovation directed by tech giants [that] are driving adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing,” according to Grand View Research’s report.

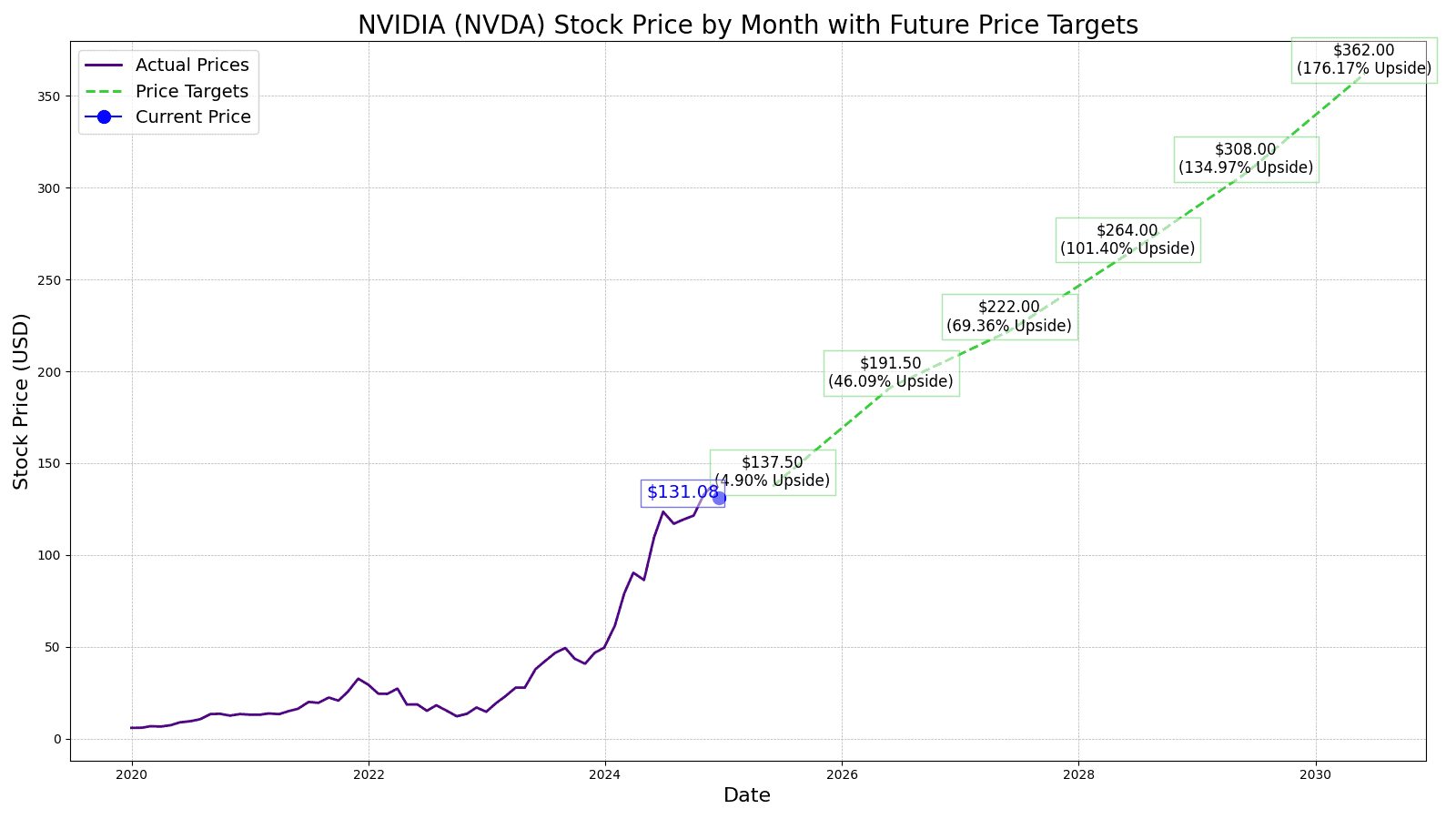

NVIDIA (NVDA) Price Prediction in 2025

The current consensus median one-year price target for NVIDIA, according to analysts, is $150.00, which represents a nearly 15.04% potential upside over the next 12 months based on the current share price of $130.39. Of all the analysts covering NVIDIA, the stock is a consensus buy, with a 1.3 ‘Buy’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

However, by the end of 2025, 24/7 Wall Street‘s forecast projects shares of NVIDIA to be trading for $137.50 based on a projected EPS of $2.75 and a price-to-earnings (P/E) ratio of 50, with a best-case scenario of $192.50 per share and a worst-case scenario of $82.50 per share.

NVIDIA (NVDA) Stock Forecast Through 2030

| Year | Revenue* | Net Income* | EPS |

| 2025 | $121.255 | $68.392 | $2.75 |

| 2026 | $168.151 | $95.246 | $3.83 |

| 2027 | $193.852 | $108.182 | $4.44 |

| 2028 | $225.462 | $130.155 | $5.28 |

| 2029 | $236.498 | $152.001 | $6.16 |

| 2030 | $265.522 | $175.412 | $7.24 |

*Revenue and net income in $billions

How NVIDIA’s Next Five Years Could Play Out

At the end of 2025, we expect to see revenue, net income and EPS rise 99%, 111.66% and 111.54%, respectively. That would result in a share price of $137.50, or 5.45% higher than where the stock is currently trading. Our high-end price target is $192.50, while our low-end price target is $82.50.

When 2026 concludes, we forecast NVIDIA’s revenue to be $168.151 billion resulting in a net income of $95.246 billion. That year would end with a per-share price of $191.50, representing a gain of 46.87% compared to its share price today. Our high-end price target is $268.10, while our low-end price target is $114.90.

When 2027 concludes, we forecast NVIDIA’s revenue to be $193.85 billion resulting in a net income of $108.182 billion. That year would end with a per-share price of $222.00, representing a gain of 70.26% compared to its share price today. Our high-end price target is $310.80, while our low-end price target is $133.20.

When 2028 concludes, we forecast NVIDIA’s revenue to be $225.462 billion resulting in a net income of $130.155 billion. That year would end with a per-share price of $264.00, representing a gain of 102.47% compared to its share price today. Our high-end price target is $369.60, while our low-end price target is $158.40.

When 2029 concludes, we forecast NVIDIA’s revenue to be $236.498 billion resulting in a net income of $152.001 billion. That year would end with a per-share price of $308.00, representing a gain of 136.21% compared to its share price today. Our high-end price target is $431.20, while our low-end price target is $184.40.

NVIDIA Stocks Price Target for 2030

By the conclusion of 2030, 24/7 Wall Street estimates that NVIDIA’s stock will be trading for $362.00, good for a 177.63% increase over today’s share price, based on an EPS of $7.24 and a P/E ratio of 50. Our high-end price target is $506.80 based on an EPS of $7.24 and a P/E ratio of 70. Meanwhile, our low-end price target is $217.20 based on an EPS of $7.24 and a P/E ratio of 30.

| Year | Price Target | % Change From Current Price |

| 2025 | $137.50 | 5.45% |

| 2026 | $191.50 | 46.87% |

| 2027 | $222.00 | 70.26% |

| 2028 | $264.00 | 102.47% |

| 2029 | $308.00 | 136.21% |

| 2030 | $362.00 | 177.63% |

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.