Forecasts

Super Micro Computer (SMCI) Price Prediction and Forecast

Published:

Last Updated:

As the artificial intelligence-fueled tech rally continues, companies that can diversify to address the manifold demands the industry faces are poised to profit. Super Micro Computer Inc. (NASDAQ: SMCI) is one of those companies. The San Jose, Calif.-based tech firm specializes in high-performance and high-efficiency servers, but it also provides software solutions as well as storage systems for data centers and enterprises focusing on cloud computing, AI, 5G, and edge computing.

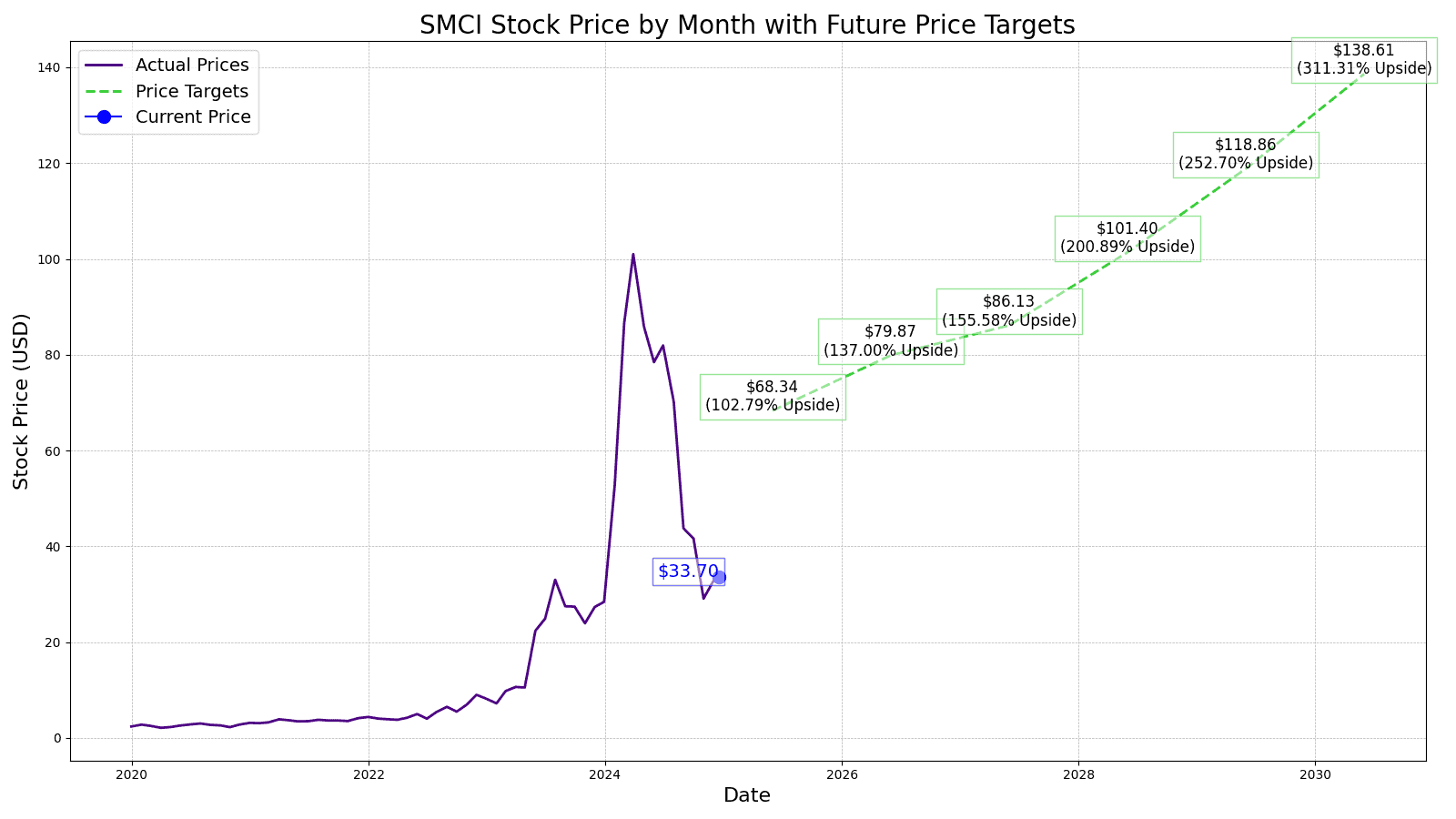

Nonetheless, analysts expect big upside potential for the tech stock. Hindsight is 20/20, and all that matters now is how Super Micro Computer will perform going forward. So 24/7 Wall Street has performed analysis to provide investors — and potential investors — with an idea of where shares of SMCI could be headed over the course of the next five years.

12/16/2024

Super Micro Computer has officially been removed from the Nasdaq 100 index, just five months after its initial inclusion. The news sent the company’s stock price plummeting by 8%.

12/13/2024

Super Micro Computer is reportedly exploring various capital raising options, including equity and debt, with the help of Evercore Inc.

12/12/2024

Super Micro Computer’s stock is going through a period of volatility after two consecutive days of decline. However, despite potential concerns of delisting from the Nasdaq 100 index, the stock’s price overall remains relatively stable, hovering around $38.29.

12/11/2024

The NASDAQ-100 index is scheduled to undergo its annual reconstitution this Friday. There is a possibility that SMCI might be replaced with MicroStrategy (MSTR) or Palantir (PLTR) during this reconstitution.

12/9/2024

Super Micro Computer has been granted an extension by the Nasdaq stock exchange to submit its delayed annual and quarterly reports. The company now has until February 25, 2025, to file its 10-K annual report for the fiscal year ending June 30th and its 10-Q report for the quarter ended September 30th.

12/6/2024

Super Micro Computer’s recent stock price has been up and down since its incredible three-day 49% surge on November 26th. However, despite this volatility, the stock has managed to maintain an overall upward trend.

12/4/2024

Super Micro Computer saw a 1.2% decrease in its shares today, reaching a low of $41.14.

12/3/2024

Super Micro Computer took a hit today. Shares sank 7.1% during midday trading, dipping as low as $39.02. Trading volume also rose 34% above the average daily volume.

11/27/2024

Super Micro Computer has been making waves in the stock market this week due to its extreme volatility. Shares rose dramatically 15.9% on Monday but plummeted 9.7% the next day. Investors are concerned about these wild swings.

11/26/2024

Shares of Super Micro Computer took a big hit today, reversing the recent upward trend. The stock price dropped by 8% in early trading.

Shares of SMCI have been particularly rewarding to shareholders in the recent past, as they exploded by gaining 3,096% in the five years between August 2019 and August 2024. The following table summarizes Super Micro Computer’s share price, revenues, and profits (net income) from 2014 to 2023:

| Year | Share Price (pre-split) | Revenues* | Net Income* |

| 2014 | $36.39 | $1.467 | $.054 |

| 2015 | $24.66 | $1.954 | $.092 |

| 2016 | $28.05 | $2.225 | $.072 |

| 2017 | $20.93 | $2.484 | $.067 |

| 2018 | $13.90 | $3.360 | $.046 |

| 2019 | $24.65 | $3.500 | $.072 |

| 2020 | $31.66 | $3.339 | $.084 |

| 2021 | $43.95 | $3.557 | $.112 |

| 2022 | $82.19 | $5.196 | $.285 |

| 2023 | $284.26 | $7.123 | $.640 |

*Revenue and net income in $billions

In the last decade, Super Micro Computer’s revenue grew by more than 385% while its net income increased by just over 1,085%. Despite seeing a minor revenue contraction in 2020 with a decrease of 4.6%, shares of SMCI still managed to increase year-over-year on still-growing net income. As the IT services provider looks forward to the second half of the decade, we have identified three key drivers that are likely to impact its growth metrics and stock performance.

The current consensus median one-year price target for Super Micro Computer is $65.00, which represents a nearly 92.31% potential upside over the next 12 months based on the current share price of $33.80. Of all the analysts covering Super Micro Computer, the stock is a consensus buy, with a 2.38 ‘Outperform’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

24/7 Wall Street’s 12-month forecast projects Super Micro Computer’s stock price to be $68.34 based on a projected EPS of $3.35 in 2025.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $28.265 | $1.974 | $3.35 |

| 2026 | $31.634 | $2.548 | $4.31 |

| 2027 | $37.116 | $1.458 | $5.49 |

| 2028 | $42.631 | $1.881 | $6.76 |

| 2029 | $50.154 | $2.428 | $8.49 |

| 2030 | $59.005 | $3.134 | $10.62 |

*Revenue and net income in $billions

At the end of 2025, we expect to see revenue, net income, and EPS rise by 89.16%, 63.41%, and 70.08%, respectively. That would result in a per share price of $683.40 (or $68.34 on a post-split-adjusted basis), which is 1921.89% higher than where the stock is currently trading.

When 2026 concludes, we estimate the price of SMCI to be $798.66 (or $79.87 on a post-split-adjusted basis), which is 2262.90% higher than where shares are trading today. This is based on modest revenue gains, an assumed EPS of $44.37, and a healthy projected P/E ratio of 18.

At the conclusion of 2027, we forecast a sizable jump in the stock price to $861.28 (or $86.13 on a post-split-adjusted basis) driven by $37.116 billion in revenue and $1.458 billion in net income, which will result in shares trading for 2448.17% higher than the current share price.

By the end of 2028, we expect to see shares trading for $1041.04 (or $101.40 on a post-split-adjusted basis), or 2980.00% higher than the stock is trading for today on revenues of $42.631 billion, net income of $1.881 billion, and an EPS of $67.60.

And at the end of 2029, Super Micro Computer is forecast to achieve revenue of $50.154 billion and net income of $2.428 billion, resulting in a per share price of $1188.59 (or $118.86 on a post-split-adjusted basis), which is 3416.54% higher than the stock’s current price.

By the conclusion of 2030, we estimate an SMCI share price of $1386.08 (or $138.61 on a post-split-adjusted basis), good for a 4000.83% increase over today’s share price, based on an EPS of $106.62 and a P/E ratio of 13.

| Year | Price Target | % Change From Current Price |

| 2025 | $68.34 | Upside of 1921.89% |

| 2026 | $79.87 | Upside of 2262.90% |

| 2027 | $86.13 | Upside of 2448.17% |

| 2028 | $101.40 | Upside of 2980.00% |

| 2029 | $118.86 | Upside of 3416.54% |

| 2030 | $138.61 | Upside of 4000.83% |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.