Since the dawning of its Depression-era San Francisco roots, Bank of America (NYSE: BAC) has weathered close to a century of wars and financial upheavals to rise as one of the stop financial institutions in the US, ranking #2 behind JP Morgan Chase by asset size.

Bank of America’s massive AUM heft made it a $45 billion “too big to fail” TARP bailout recipient during thesin 2008 subprime banking meltdown. It also acquired Wall Street investment banking stalwart Merrill-Lynch as a kicker. CEO Brian Moynihan has ruthlessly slashed operations to focus on growing assets under management with lower overhead.

Headwinds for Bank of America

After reaching a 10-year high of $50 per share in 2022, Bank of America has struggled to attain that level again. Near-term efforts to climb higher may be thwarted by some recent events:

- “Oracle of Omaha” investment guru Warren Buffett has rapidly dumped $ 6 billion worth of Bank of America shares.

- Bernard Mensah, President, International at Bank of America Corp., registered an insider sale of half of his total holdings.

- Ken Leung, co-head of Bank of America Corp.’s financial sponsors group in Asia Pacific, left to join Hong Kong conglomerate CK Asset Holdings Ltd.

- Basel III international banking regulations requiring higher 16% retained capital levels to prevent another 2008 banking meltdown have both Moynihan and JP Morgan Chase counterpart Jamie Dimon fighting with the Treasury Department and Federal Reserve Bank in an effort to avoid compliance. The deadline for Basel III compliance is October 2024.

- Prevailing high interest rates due to rapidly escalating inflation since 2021 and Jerome Powell’s multiple Fed Funds rate hikes in response have made lending and mortgage businesses prohibitively expensive for many customers, forcing them to seek alternative outlets and undercutting core Bank of America business lines.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Bank of America’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article

- Bank of America’s post-2008 focus has been growing its assets under management. Its future business trajectory is trending towards an increase in wealth management in order to provide a “one-stop shopping” experience for customers requiring standard banking functions as well as brokerage, finance, credit, and other services.

- Bank of America is in the midst of a branch expansion agenda to have a “local” presence throughout the US.

- Digital technology, AI-assisted customer service, and instant payment platforms will see increased use as ways to continue offering top-level service and convenience while also cutting costs.

- To receive a complimentary copy of our brand-new report, “The Next NVIDIA”, click here. It includes 3 Top Stock Picks poised to take off from the next breakthroughs in AI. One company is a ‘10X Moonshot’ that could become the dominant software play in AI.

Bank of America Stock Updates and News

12/16/2024

Bank of America saw a notable decrease in short interest during November. The number of shares sold short declined by 8.1%, resulting in a current short interest of 74.69 million shares. This represents about 1% of the company’s outstanding shares. Given the average daily trading volume, the short-interest ratio is currently 2.1 days.

12/9/2024

Bank of America has received a mixed rating update from Morgan Stanley. Morgan Stanley downgraded BAC from “overweight” to “equal weight”, but raised their price target from $48.00 to $55.00.

12/3/2024

Bank of America has extended its partnership with FIFA. This time, the company signed on as a sponsor for the 32-team Club World Cup, which is set to take place in the United States six months from now.

11/25/2024

Bank of America has been upgraded by CFRA to a “Buy” rating with a raised target price of $53 (previously $44).

11/18/2024

Bank of America’s shares reached a new 52-week high today after Wells Fargo upgraded its price target from $52 to $56 with an “Overweight” rating. The stock has been trading actively, with over 2.9 million shares changing hands.

11/11/2024

Bank of America’s stock rose 2.11% to $46.08 today. This is the second consecutive day of gains for the company.

5-10 Year Review

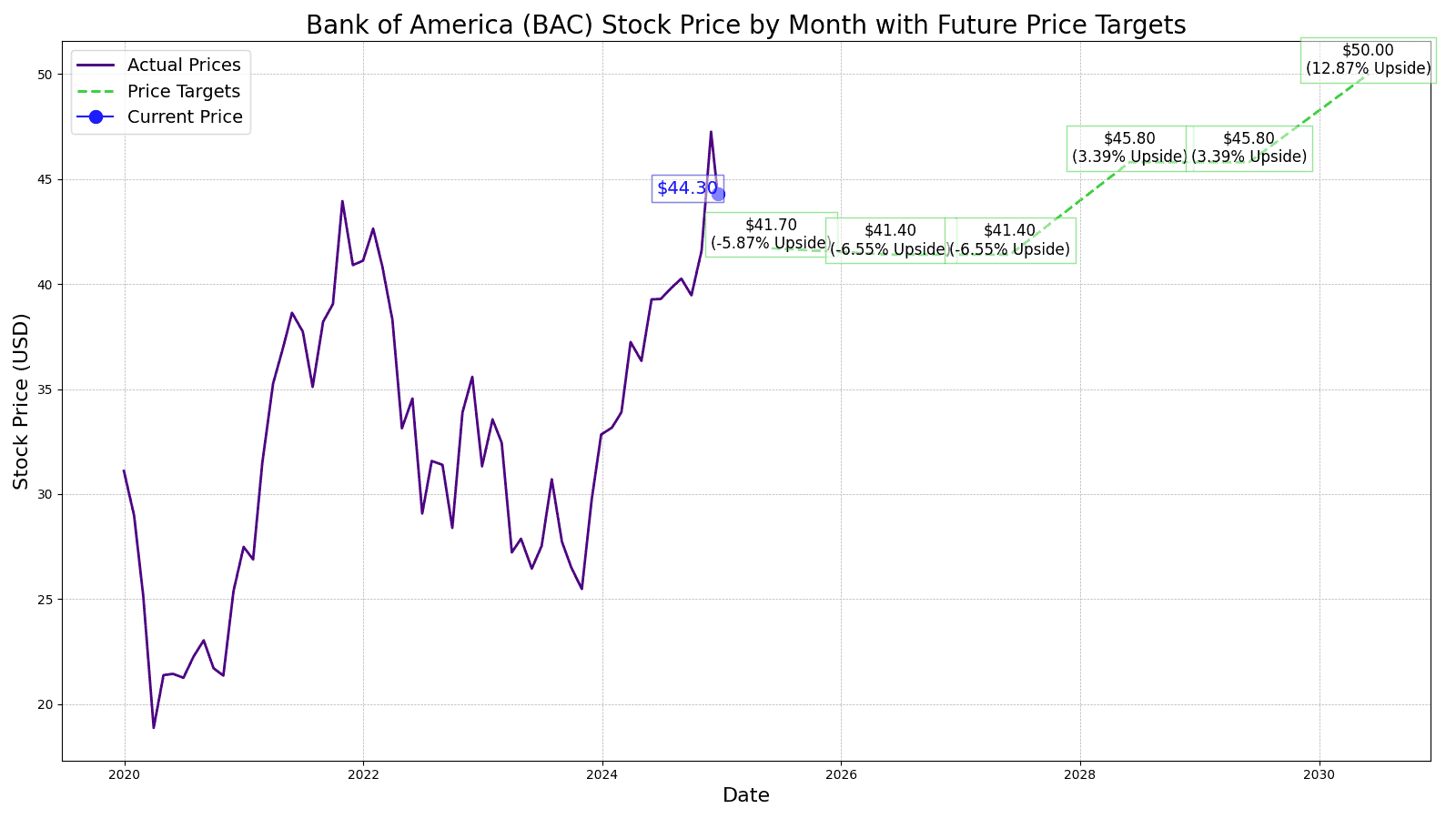

Since 2015, Bank of America stock has gone from the mid-teens to the aforementioned 2021 $50 high (not a coincidence it was also the bank’s highest revenue earning year), and has since dropped as low as $26 in 2023 before coming back to the current price of $44.17.

| Fiscal Year | Price | Revenues | Net Income |

| 2015 | $13.99 | $79.804B | $15.910B |

| 2016 | $18.67 | $80.104B | $17.822B |

| 2017 | $25.50 | $83.730B | $18.232B |

| 2018 | $21.53 | $87.738B | $28.147B |

| 2019 | $31.47 | $85.582B | $27.430B |

| 2020 | $27.81 | $74.208B | $17.894B |

| 2021 | $41.61 | $93.707B | $31.978B |

| 2022 | $31.70 | $92.407B | $27.528B |

| 2023 | $33.23 | $94.187B | $26.515B |

| LTM | $40.75 | $93.156B | $24.517B |

Key Drivers for Bank of America’s Stock in the Future

- Interest Sensitive Balance Sheet: The Federal Reserve’s Fed Funds rate hikes have boosted BAC’s net interest income (NII), but negatively impacted the stock price. Rate cuts might temporarily help lending and mortgage finance, but any renewed inflation signs will be red flags and could trigger further problems.

- Net Interest Income: The rise in NII due to higher interest rates and corresponding robust loan interest rate growth has been a critical factor for that segment, but at the cost of higher default rates and lower transaction volumes.

- Branch Growth: Expanding financial centers and branches into currently untapped demographic markets is a part of Bank of America’s “local” growth strategy.

- Technology: Improved digital offerings and the use of AI and other customer service tools, can boost customer satisfaction and fees that could boost earnings.

- Capital Deployment Strategies: Bank of America’s dividend increases and share repurchase plans reflect a strong capital position, attractive to dividend hawk-oriented investors.

- Valuation: Bank of America has a current lower price/tangible book value ratio than the market average, which analysts may use to justify “buy” recommendations.

- Investor Sentiment: The full impact on investor sentiment from the Buffett and Mendah insider sales has yet to be gauged.

Stock Price Prediction for 2025

23 Wall Street analysts have a consensus “outperform” rating for Bank of America, with a 12-month price target of $46.00. This would be a 4.14% gain. 24/7 Wall Street’s projected price in 12 months is somewhat more conservative: $41.70, which would be a -5.59% loss from the current price of $44.17.

Bank of America’s Next 5 Years’ Outlook

Our 2026 price target is $41.40, a (-0.72%) loss. One grossly overlooked and rarely mentioned issue for Bank of America is its $1.6 trillion of off-balance sheet assets. These include Letters of Credit, exotic and likely illiquid bonds, derivatives, and a litany of other assets and securities, both actual as well as synthetic. This is dangerously similar to the underlying issues that led to the big banks’ insolvency in 2008. The lack of transparency and proactive disclosure can mean that hidden landmines may explode by surprise if management either overlooks them or experiences difficulties in moving them before potential losses or defaults occur.

2027-2029:

24/7Wall Street sees Bank of America treading water in 2027 as its liabilities from its humongous off-balance sheet assets are rectified and settled. Any downturns will be offset by its Wealth Management and Branch expansion program, which should kick in for 2028 and drive 2029 higher. Stock price expectations for 2027 and 2028 are $41.40 (flat growth) and $45.80, a 10.62% gain, with 2029 also at $45.80 (flat growth)

The Wealth Management expansion would be building on the overall market, which is expected to grow to $500 billion by the start of 2030. In 2024, the Global Wealth Division already accounted for 22% of Bank of America’s revenues, as well as 15% of its profits. The policy of accumulating AUM has manifested in the size of new account openings, with those in excess of $500,000 growing from 53% in 2021 to 71% in 2024. Capitalizing on high-net-worth clients to provide fees for brokerage, lending, credit, financing, as well as plain vanilla banking services through a “one-stop shopping” model has been a successful formula. This has been Moynihan’s top racehorse, and he shows no signs of slowing it down.

The other expansion program that has already commenced and has been stealthily at work should meet its goal in 2029. Bank of America also has a Branch Expansion agenda to have a “local” presence in every state. The physical presence results in a 100% increase in digital sales, and looks to expand its 3,800 branches.

Bank of America stock in 2030

By 2030, the Branch Expansion program should have met its targeted location goals, and all of them would be primed for using the latest and most sophisticated Bank of America digital financial tools. Bank of America Erica(c) digital assistant, Zelle, Venmo, proprietary digital payment systems, online brokerage, and other virtual platforms would be fully implemented and income generating. Wall Street’s price target for 2030 is $50.00 per share, a 9.17% gain. Overall, this would represent a 13.20% gain over the next five years.

| Year | EPS | P/E multiple | Price |

| 2025 | $4.17 | 10 | $41.70 |

| 2026 | $4.14 | 10 | $41.40 |

| 2027 | $4.14 | 10 | $41.40 |

| 2028 | $4.58 | 10 | $45.80 |

| 2029 | $4.58 | 10 | $45.80 |

| 2030 | $5.00 | 10 | $50.00 |

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.