According to World Population Review, Coca-Cola is the world’s most popular branded drink. WPR cites: “It is not only the most popular soft drink in the United States, but also the most popular soft drink on the planet. Even though the can has gone through a few changes over the years, it still retains its same, delicious formula. There is even a Coca-Cola factory in Atlanta where people can take a tour and learn how Coca-Cola is produced today and how it has evolved over the years.”

Pharmacist Dr. John Pemberton created the Coca-Cola syrup recipe, circa 1886, and it remains one of the most highly protected trade secrets in history.

In addition to its iconic Coke Classic, The Coca-Cola Company (NYSE: KO) has drastically expanded its menu of selections over the decades to include other popular brands, such as Sprite, Fresca, Smart Water, Dasani Water, Minute Maid lemonade and juices, Barq’s Root Beer, Monster Energy Drinks, Seagram’s Ginger Ale, teas, and many others, totaling over 300.

Stock History

Coca-Cola continues to be an institutional investor favorite, with Warren Buffett and Berkshire Hathaway a longtime fan and major shareholder. According to some accounts, Buffett’s affinity for Coke Classic extends to it being readily available throughout Berkshire’s offices, and this is after decades of being a Pepsi drinker. It has maintained a solid 4.98% CAGR over the past 5 years, and continued to stay ahead of rivals Keurig Dr. Pepper (NASDAQ: KDP) and PepsiCo (NASDAQ: PEP).

Underlying recent events

- Coca-Cola has focused of late on high-growth brands across its beverage portfolio, including Fuze Tea, Minute Maid Zero Sugar, and Powerade, and introducing products like Coke Lemon and Reformulated Sprite. Expansion of its other flavors has led to Coca-Cola gaining a 40% market share in the non-alcoholic beverage sector.

- Seeing international markets as a market share territory ripe for further opportunity, Coca-Cola has raised its profile at major European events, such as promotional investments in the Euro 2024 Football Championship, the Paris Olympics, and various music festivals. Forming partnerships with local food service providers to promote combo meals also contributed to further sales.

- Marketing-wise, digital technology has given Coca-Cola another growth tool, with its Studio X global network marketing platform, which measures real-time reactions to newly produced content, and e-commerce, which has grown in double digits in a number of countries.

Coca-Cola has been a public company for over a century (IPO was $40 in 1919). It has undergone 10 forward-stock splits between 1935 and 2012. A 1-for-1 stock dividend was declared in 1927. A $1000 Coca-Cola IPO investment would have bought 25 shares in 1919. A 1 share has grown through splits to 9,216 shares, that investment would equate to 230,400 shares, which would be worth $14.420 million today.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Coca-Cola’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article

- Morgan Stanley and other major Wall Street analyst departments are bullish on Coca-Cola.

- Coca-Cola’s impressive dividend track record has endeared its stock to institutional and individual investors alike.

- For years, a dearth of non-fizzy drinks gave its rivals an edge. In the past decade, Coca-Cola’s continued expansion to non-carbonated beverages continues to be a winning ticket. The company recently acquired Costa Coffee to fill a popular beverage gap in its menu offerings.

- Cultivation and application of digital assets are also proving beneficial to the company’s bottom line, by streamlining efficiencies, rapid improvement of response times, and cutting costs.

- Passive income is simple- own quality dividends that pay you for doing nothing. Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “7 Things I Demand in a Dividend Stock”, plus get our 2 best dividend stocks to own today.

Recent Coca-Cola Stock News and Updates

12/16/2024

Coca-Cola announced that Henrique Braun, a long-time company executive, will assume the role of Chief Operating Officer (COO) starting January 1, 2025. Braun has been with Coca-Cola since 1996 and currently serves as the company’s President of International Development where he oversees operations in regions like Africa, Southeast Asia, and Latin America.

12/9/2024

Coca-Cola has announced ambitious new environmental goals to be achieved by 2035. These goals focus on reducing packaging materials, optimizing water usage, and lowering emissions. The company’s CEO, James Quincey, emphasized that these sustainability initiatives are not just corporate social responsibility but also essential for the company’s long-term business success.

12/3/2024

Coca-Cola is facing criticism from environmental groups after scaling back its recycling and reuse targets. Yesterday, Coca-Cola announced that it has revised its target for recycled material in primary packaging from 50% by 2030 to 35-40% by 2035.

11/25/2024

Coca-Cola teamed up with AI companies to create a new version of their iconic 1995 “Holidays Are Coming” ad. In its latest commercial, traditional images of Coca-Cola trucks, snowy landscapes, and festive townspeople were all generated by AI. However, this advertisement was not well-accepted by the public.

11/18/2024

Coca-Cola’s stock price rose slightly by 0.3% today, trading as high as 62.12. Trading volume was much lower than average, with only 2,722,420 shares changing hands, representing an 80% decrease from the usual daily volume.

11/11/2024

Coca-Cola’s shares decreased 0.3% today, trading as low as $63.65 with around 4,100,766 shares traded.

11/8/2024

Coca-Cola is planning to introduce its popular brand, Vitaminwater, to the Indian market. The company aims to bolster its premium hydration portfolio in the non-sparkling beverage segment. Vitaminwater is expected to be launched in major cities in India at the end of this year.

5 to 10 Year Review

The Food Institute estimated the global soft drink market at $237 billion three years ago, with an expected growth of 4.7% annually. The US market is estimated at $285.9 billion going into 2024 and growing 7.5% annually, according to Grand View Research. Coca-Cola’s international sales already comprise 31% of total beverage revenues, it holds a commanding 46% of the US market.

A company the size of Coca-Cola has largely grown its menu of product offerings through acquisition. Some of these are well-known brands, such as Minute Maid juice, Dasani Water, Sprite, Fanta, Seagram’s Ginger Ale sodas, Vitaminwater, Powerade sports drinks, and many others. Some Coca-Cola milestone acquisitions of the past decade that have contributed to these statistics include:

- 2017: Coca-Cola relaunched Coke Zero with an updated flavor and new name, Coke Zero Sugar, and purchased the Topo Chico brand of sparkling waters.

- 2018 saw Coca-Cola acquire Organic & Raw Trading T/A MOJO Beverages, a Kombucha tea company from Australia. It unfortunately did not catch on to a larger market and Coca-Cola closed down its MOJO factory in 2022.

- 2019: Coca-Cola bought the Costa Coffee company and added coffee-infused soda beverages to its lineup, called Coca-Cola Coffees.

- 2019: Coca-Cola acquired CHI Ltd. of Lagos, Nigeria. Its products include juice under the Chivita brand and value-added dairy under the Hollandia brand, among many other products.

- 2020: Coca-Cola welcomed its first dairy company to its portfolio with its acquisition of Fairlife. The company also debuted Flashlyte, an advanced hydration drink formulated with six electrolytes, in Mexico.

Recent highlights include:

- Expansion of the Cappy juice platform to Europe, Africa, and the Middle East, with new reduced-sugar and vitamin-fortified varieties.

- Introduction of SmartWater alkaline 9.5+ pH with antioxidants in North America.

- Doubling sales of the Authentic Tea House lineup of unsweetened, cold-brewed teas in China.

- Experimentation and expansion into the Alcohol Ready-to-Drink (aRTD) category. Recent launches include Jack Daniel’s & Coca‑Cola and Jack Daniel’s & Coca‑Cola Zero Sugar in Latin America, Europe, Asia, and North America; Absolut Vodka & Sprite and Absolut Vodka & Sprite Zero Sugar in Europe; and Peace Hard Tea and Minute Maid Spiked in North America.

As of the start of 2024, as much as 65% of Coca-Cola’s total revenues were derived from its international business units. While the company does have a currency hedge system, its size, at over $28 billion, can still be a problem. That $28 billion may be compiled from dozens of different countries at the mercy of more extreme currency fluctuation volatility. This risk exists especially from less politically stable third-world nations whose currencies have become increasingly less dependent on the US dollar and more on the Chinese Yuan and possibly other BRICS member nations’ currencies. The costs of hedging can run as high as 3-6% on average.

| Fiscal Year | Price | Revenues | Net Income |

| 2015 | $42.96 | $44.294B | $7.351B |

| 2016 | $41.46 | $41.863B | $6.527B |

| 2017 | $45.88 | $36.212B | $1.248B |

| 2018 | $47.57 | $34.300B | $6.434B |

| 2019 | $54.69 | $37.266B | $8.920B |

| 2020 | $54.84 | $33.014B | $7.747B |

| 2021 | $59.21 | $38.655B | $9.771B |

| 2022 | $63.61 | $43.004B | $9.542B |

| 2023 | 58.93 | $45.754B | $10.714B |

| 2024 (LTM) | $72.47 | $46.465B | $10.648B |

Key Drivers for Coca-Cola’s Future

1. Further Diversification Into Non-Carbonated Beverages

For years, Coca-Cola has been expanding beyond carbonated beverages to non-carbonated sodas and drinks. Among its most famous is its entrance to the bottled water industry (Dasani, Vitaminwater), but it also has growing exposure to tea, coffee, and dairy products. In 2019, Coca-Cola purchased Costa Coffee for $5.1 billion. This was largely a bet on the growth of the coffee market, which is forecast to expand annually at a rate of 4.7% through 2030.

2. Coke As An AI Player?

While one might pigeonhole Coca-Cola products as simply cans of soda, the company has been burnishing its digital technology footprint. In addition to its double-digit growth e-commerce platform and the aforementioned Studio X marketing platform, Coca-Cola can also be viewed as a technology play on AI, big data, and consumer analytics. To gain an edge over competitors, Coke uses artificial intelligence to gather big data insights on consumer behaviors and beverage market trends. Some of the details the AI tracks for Coca-Cola at restaurants may include such data as flavor preferences and amounts sold per day, with which meal combos, and what times of the day.

Coca-Cola’s analysts then process the raw data and advise decisions about which products deserve more investment to expand their market shares, and which ones may be on the decline.

3. Smart Recycling = Cutting Costs

Coke is leading the way in the beverage sector by setting a goal to collect and recycle all of its packaging by 2030. This ecologically responsible stance is helpful not only from a public relations standpoint but also makes for smart business. When handled intelligently and at the volumes of units that Coca-Cola operates, the company cuts costs with the use of recycled materials for its packaging. And recycled packaging is proving to contribute to the Coke bottom line: Q2 2024 gross margins were 59%, higher than the 58% of the energy sector and 53% of the technology sector.

4. When In Rome…

Coca-Cola is very proactive in catering to local tastes and preferences. For example, it offers Inca Kola in Peru and Thums Up in India. From Tanzania to Texas, Coca-Cola has made a splash but management realizes to capture local trends, these adaptations to each market are crucial to build diversified revenue streams that expand the company’s war chest.

For example, Coca-Cola built up a 60.5% share of the India soft drinks market, but discovered that the massive penetration was primarily due to Thums Up. Deleting Thums up would calculatedly sink its share below 30%. Acknowledgment of each geography’s unique cultural predilections further heightens customer and brand loyalty, which in turn increases customer lifetime value.

5. Direct-to-Consumer Channels

While the vast majority of Coca-Cola beverages are purchased from local vendors, chain stores, or supermarkets, the company has launched a direct-to-consumer online store that allows for even better data collection. Using Studio X and other digital marketing tools, Coke can advertise directly to consumers and steer them towards exclusive deals, seasonal products, and other offerings, creating another Coke revenue source.

6. Dividends

Institutional and individual investors both love Coca-Cola stock. While growth can sometimes seem ponderously slow, its dividend has made it very popular as a buy-and-hold Dow Jones stock to hold in a portfolio. Since Coca-Cola began paying dividends in 1970, the company has had an unbroken streak of making distributions every year, either matching or exceeding the prior year’s amount with the exception of 2000-2001. The current $1.929 dividend in 2024 is estimated to grow to $2.562 by 2030.

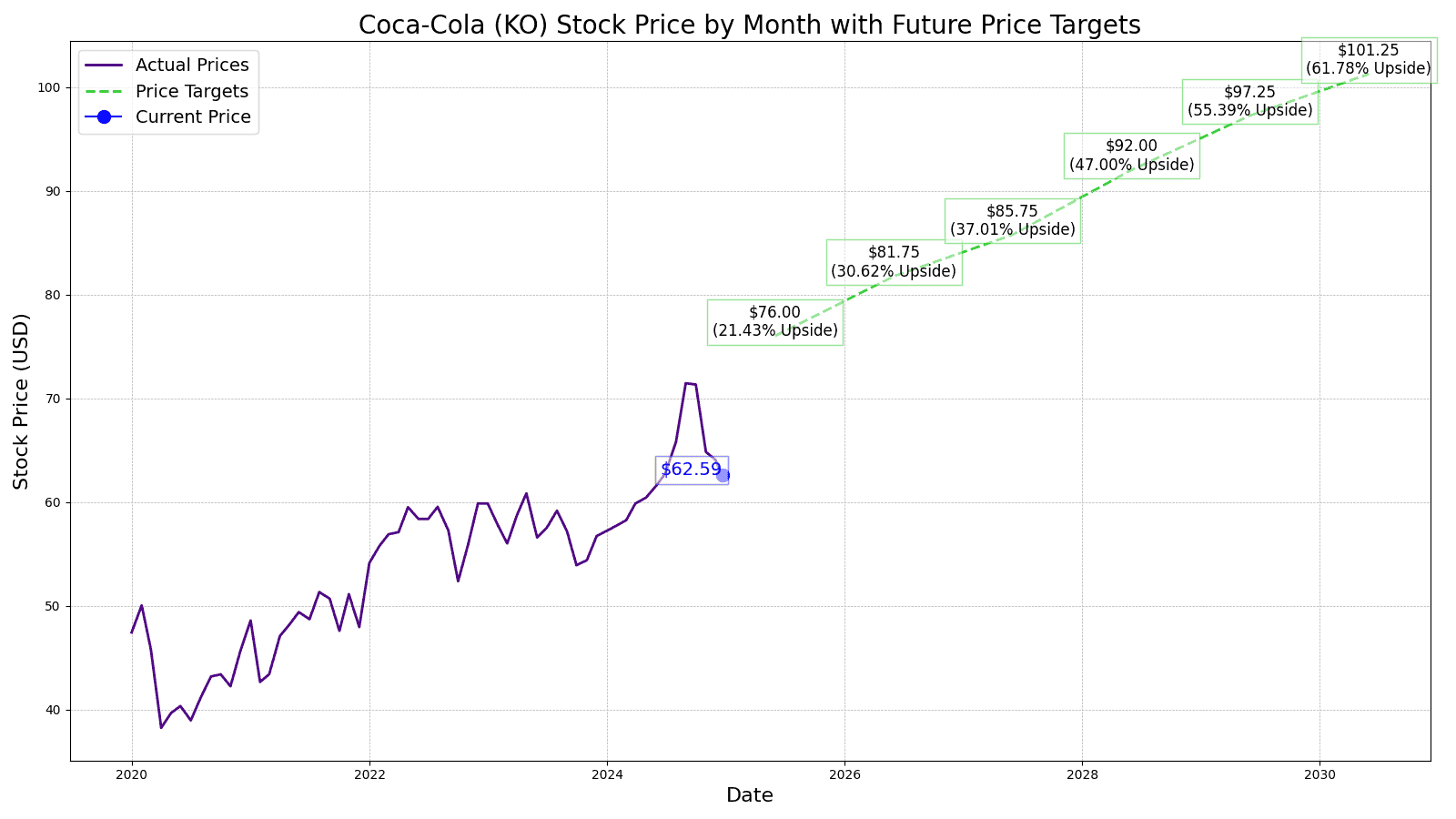

Stock Price Prediction for 2025

A consensus of 25 different Wall Street analysts has predicted an average 12-month price for Coca-Cola of $72.00. This would be 16.73% from its price today. Morgan Stanley, Truist, Citibank, and Barclays are among the bulls. Conversely, 24/7 Wall Street anticipates a 2025 stock price for Coca-Cola of $76.00 per share. This equates to a 23.22% gain.

We hold that Coca-Cola’s ongoing steps to trim operation costs, optimize its supply chain, and invest in digital technology will contribute to improved efficiency and profitability. Moreover, Coca-Cola is leveraging its strong brand loyalty and expanding its presence in new and emerging markets will support its growth in the coming decade. Strategic partnerships like the 2024 Oreo Cookies announcement, which pairs two iconic American brands creating a limited edition drink and cookie, should also bolster growth and may harbinger similar deals in the near future.

Coca-Cola’s Next 5 Years’ Outlook

Coca-Cola’s last 10 quarters have shown steady growth and revenues have ballooned by $3.3 billion from Q1 2021 through Q2 2023. Operating margins continue to increase in proportion, thanks to attention to cost-cutting tools like recyclables and AI.

24/7 Wall Street has a 2026 price target for Coca-Cola of $81.75, a 7.56% gain. We believe the track Coca-Cola has already taken to acquire healthier offerings, like Vitaminwater, Suja Organic plant-based drinks, and Fuze Teas will further gain in popularity as the health concerns over foods and beverages proliferate. The price of recycled packaging materials may also be reduced, which will help to boost Coke’s already hefty margins. Additional strategic brand collaborations like 2024’s Oreo deal should also manifest.

In 2027, 24/7 Wall Street projects an $85.75 target. This would be a 4.89% year-over-year gain. As its international presence gains further ground, Coca-Cola’s international market local bottling and distribution partnerships will become more crucial for a smooth and unencumbered supply chain.

We estimate that Coca-Cola’s 2028 price will hit $92.00. This equates to another 7.64% year-over-year gain. This would be due to AI developments, the Studio X marketing, and e-commerce Direct-To-Consumer verticals finally firing on all cylinders. This will allow more customized targeting marketing of the company’s premium brands.

In 2029, our Coca-Cola price target is $97.25, a 5.7% YoY gain. As 65% of Coke’s revenues were from its international sales in 2024, we think that segment will become more critical and will increase for the company. In 2029, Statista predicts that BRICS GDP will exceed $36.6 billion, surpassing the US, which projects a $34.9 billion GDP. As the digital business from 2028 will already be fueling some additional growth after its initial jump, reduced currency hedging cost requirements due to BRICS international currency stabilization should contribute to a sizable chunk of the 2029 gain.

Coca-Cola stock in 2030

24/7 Wall Street anticipates a $101.25 per share price for Coca-Cola, a YoY gain of 4.11%. Expansion of advanced technologies in blockchain, Internet of Things (IoT), and AI improvements will likely take a bite out of earnings, but will pay off big in future years. Continued sustainability practices and eco-friendly packaging will lead the industry in innovation.

Overall, a 2030 price of $101.25 represents a cumulative 61.78% gain in 5 years for Coca-Cola.

| Fiscal Year | Normalized EPS | P/E Ratio | Projected Stock Price |

| 2025 | $3.04 | 25 | $76.00 |

| 2026 | $3.27 | 25 | $81.75 |

| 2027 | $3.43 | 25 | $85.75 |

| 2028 | $3.68 | 25 | $92.00 |

| 2029 | $3.89 | 25 | $97.25 |

| 2030 | $4.05 | 25 | $101.25 |

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.