The Ford Motor Company (NYSE: F) is an iconic brand that helped to define American mechanical design and business supremacy in the 20th century and continues to remain a major player to this day. Founder Henry Ford created the mass production assembly line manufacturing process, and Ford cars and trucks are sold worldwide. It is the second-largest US auto industry builder after General Motors and sixth largest worldwide.

While Ford has a venerable history, the entire automobile industry has taken some lumps in recent years, such as:

- Mandates on electric vehicles, thus creating ballooning R&D budgets in EVs.

- Inflation and high interest rates make new car purchases unaffordable.

In the wake of these obstacles, Dearborn, MI headquartered Ford has remained resilient and has continued to stay competitive and innovative. Looking back, Ford went public in 1956 at $64.50. Including splits, a $1,000 investment in Ford in 1972, if kept to the present, would equal about $4796.12 today.

Nevertheless, investors are much more concerned with future stock performance over the next 1, 5, and 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Ford’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article:

- Ford’s strong cash generation, brand loyalty, and attention to customer service should help it weather the current market turbulence in the motor vehicle sector as it continues to recover.

- The failure of the EV market to go beyond the niche level and Ford’s own decisions to scale back EV production are a prescient read on the pendulum swinging back towards internal combustion engine (ICE) autos, which is Ford’s strong suit.

- To receive a complimentary copy of our brand-new report, “The Next NVIDIA”, click here. It includes 3 Top Stock Picks poised to take off from the next breakthroughs in AI. One company is ‘10X Moonshot’, which could become the dominant software player in AI.

Ford Stock News and Analysis

12/16/2024

Ford and SK On’s plans to build a battery plant in the United States received a major boost today. The U.S. government approved a $9.63 billion loan to support the project.

12/9/2024

Ford is beginning production at its new electric vehicle motor plant in Halewood, UK. Ford has invested much in this facility, aiming to produce 420,000 electric drive units annually.

12/3/2024

Ford has announced another wave of layoffs in its European operations. The company plans to cut 4,000 jobs, with Germany bearing the brunt of the cuts. In Cologne, Ford will shutter most of its development division and eliminate 2,900 positions.

11/25/2024

Ford is cutting 4,000 jobs in Europe and the UK due to economic challenges, increased competition, and slower-than-anticipated electric vehicle sales. At least 2,900 job cuts will occur in Germany.

11/18/2024

The National Highway Traffic Safety Administration (NHTSA) has launched two investigations into the Ford Motor Company. The agency is concerned that Ford’s recent recalls were either insufficient to address the underlying issues or did not include enough vehicles. This news follows the NHTSA’s recent $165 million fine imposed on Ford for delays and inaccurate information in a previous recall.

11/11/2024

Today, Ford’s salary staff has gone on strike due to ongoing disputes with the company over pay and contract changes. The union, Unite, argues that Ford is refusing to address workers’ concerns, including proposed changes to sick pay policies and a new 100% performance-related pay scheme.

11/7/2024

Ford’s shares dipped today following a downgrade from Berstein analyst Toni Sacconaghi. Sacconaghi lowered Ford’s rating from “Outperform” to “Market Perform” and set a price target of $11. Despite this, however, Ford announced record sales growth in the Middle East for 2024, driven by strong performance in key markets and the introduction of its latest vehicle lineup.

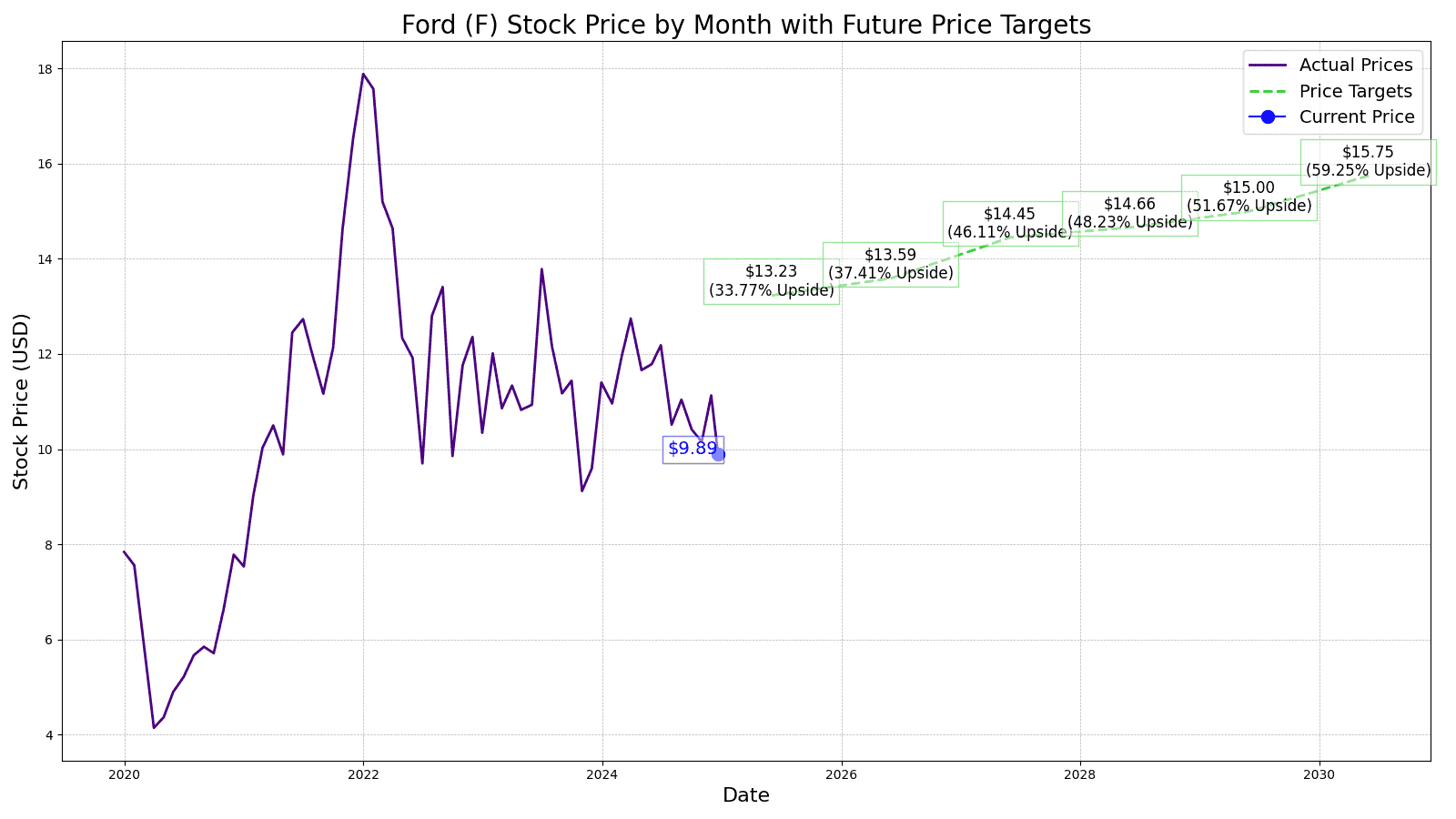

Ford’s Recent Price Movements

While longtime Ford investors may have benefited from Ford’s dividend, its stock price clearly has not experienced the recent exponential growth of Magnificent 7 stocks, like Nvidia or Microsoft. The last time Ford had a strong bull run was during the pandemic in March 2020, when the stock soared from an aberrantly low $4.27 to $25 in January 2022, before settling back into its current range in mid-2022, where it has remained ever since. Apart from that last 500% gain, past comparable periodic rise and falls of Ford stock price can be traced back historically going back decades.

|

Fiscal Year |

Price |

Revenues |

Net Income |

|

2014 |

$16.13 |

$135.378B |

$1.23B |

|

2015 |

$11.17 |

$140.56B |

$7.37B |

|

2016 |

$12.38 |

$141.54B |

$4.59B |

|

2017 |

$10.43 |

$145.66B |

$7.73B |

|

2018 |

$8.71 |

$148.321B |

$3.67B |

|

2019 |

$8.31 |

$143.64B |

$47M |

|

2020 |

$11.51 |

$115.94B |

-$1.28B |

|

2021 |

$17.96 |

$126.27B |

$17.93B |

|

2022 |

$13.23 |

$149.08B |

-$1.98B |

|

2023 |

$12.80 |

$165.90B |

$4.34B |

|

TTM |

$11.16 |

$169.09B |

$3.83B |

Key Drivers for Ford’s Future

- Ford’s core ICE vehicles and F-Series Trucks– Ford’s internal combustion engine (ICE) vehicles are its core and are still its best sellers. Its pickup trucks lead the world in total sales, with its popular F-series at the head of the pack. Ford’s Maverick hybrid truck is the best-selling hybrid in the US as well. Ford’s increasing sales are still world-class, and its revenue generation metrics support its dividends (by 20x) as well as its operational changes in addressing a changing market.

- Ford’s EV unit- This division has been slowly growing but has also been gobbling up money like a school of hungry piranhas. ($1.1 billion burned through a single quarter). Recent Ford announcements to delay its EV T-3 trucks and scale back some EV SUV production are in sync with current trends swinging back towards ICE vehicles that can reliably provide safe transport over long distances. The lack of recharging stations that the Department of Transportation had promised to support its EV mandate has disillusioned many former EV advocates.

- Fixed quality issues– Ford’s stock fallbacks were reactions to larger warranty budget allocations and overall auto industry unemployment in the market, which created concerns over quality control. These issues have been addressed as shifting toward newer technologies tied to Ford’s Pro series AV components and towards ensuring more reliable future performance for its customers.

Stock Price Prediction for 2025:

The consensus rating from two dozen Wall Street analysts is ‘Hold’. The average price target in 12 months is $12.00, which is roughly up 22.20% from the price at the time of this writing.

24/7 Wall Street’s 12-month projects Ford’s price to be $20.27. We believe this is a conservative estimate based on the implementation of Ford’s changes and the upcoming Presidential election results, which will determine whether or not EV mandates will be maintained or eliminated. Should the latter occur, then the target price could easily run higher.

Ford’s Next 5 Years’ Outlook:

With the caveat of the November Presidential election results set aside and assuming the status quo is maintained in the market with regard to EVs, we estimate Ford’s 2025 price to be $13.23, which would be up 33.91%. The expenditures for the expanded warranty service for AV technology upgrades, the marketing changes to de-emphasize the T-3 promotions, and the expected easing of labor concerns would all be implemented.

2026 would start to see the results of 2025’s initiatives. We anticipate that revenues would increase by $15 billion, leading to an additional $0.10 EPS, resulting in a slight stock price gain to $13.59, which would be up 37.55% from the current price.

Assuming that inflation finally gets under control and interest rates can come down appreciably, Ford’s Ford Credit unit, which supplies auto purchase financing, should once again be a meaningful bottom-line contributor in 2027. We anticipate another $16.5 billion in boosted revenues, which would subsequently increase EPS to $2.27, and a stock price target of $14.45, which would be up 46.26% from the current price.

Given its size and industry, Ford’s profit margins are not large, so growth comes at a much smaller rate than in the tech industry. Continuing the trajectory of roughly 1.4% annual growth, barring any new initiatives or breakthrough products, we expect Ford to add $2.72 billion in revenues for 2028. 24/7 Wall Street’s target price would be $14.66, up 48.38% from today’s price.

Estimates see 2029 with a $4.5 billion revenue bump and a $15 stock price, up 51.82% from the current price, assuming things stay on course for Ford.

Ford Stock in 2030:

2030 could see some new developments from Ford Pro AV development and non-vehicular markets as well as other R&D, resulting in an approximate $10 billion revenue increase and a commensurate stock price hike to $15.75. This would equate to a nearly 59.41% gain over the present market price for Ford.

|

Year |

Revenue ($B) |

P/S Multiple |

Market Cap ($B) |

Stock Price ($) |

|

2025 |

176.36 |

0.3 |

52.91 |

$13.23 |

|

2026 |

181.2 |

0.3 |

54.36 |

$13.59 |

|

2027 |

192.73 |

0.3 |

57.82 |

$14.45 |

|

2028 |

195.45 |

0.3 |

58.64 |

$14.66 |

|

2029 |

200.00 |

0.3 |

60 |

$15.00 |

|

2030 |

210.00 |

0.3 |

63 |

$15.75 |

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.