Forecasts

Novo Nordisk A/S (NVO) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

When it comes to weight loss drugs, Ozempic has become a phenomenon. With nearly $14 billion in sales in 2023, it shows no signs of slowing down, much to the delight of its Danish manufacturer, Novo Nordisk A/S (NYSE: NVO). A Scandinavian economic behemoth, Novo Nordisk is the highest-valued company in Europe at over $500 billion, which exceeds Denmark’s entire GDP. Ironically, Ozempic and Wegovy, as with many of Novo Nordisk’s other products, were created primarily for treating diabetes. The weight-loss factor has become a very profitable and unintended side-effect.

Founded a century ago, Copenhagen-based Nordisk originally made insulin. After coming to the US in 1982, it underwent several corporate changes until becoming Novo Nordisk in 1989. In addition to diabetes drugs, the company also makes drug treatments for wound healing, menopausal hormone replacement, and human growth hormone.

While Novo Nordisk has built itself into a pharmaceutical giant, it has seriously run afoul of regulatory laws on several occasions. Novo Nordisk’s practices have raised red flags in Denmark as well as in the US and UK for years, with the more recent ones being:

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Novo Nordisk’s own numbers, along with business and market development information that may be of help to our readers’ own research.

12/20/2024

Novo Nordisk’s stock price plummeted by as much as 24% today. This was due to disappointing late-stage trial results for its experimental weight-loss drug, CagriSema.

12/18/2024

Novo Nordisk has partnered with Photys Therapeutics to develop a novel therapeutic targeting an undisclosed cardiometabolic disease. The partnership leverages Photy’s proprietary PHICS technology, which holds promise for addressing unmet medical needs in the cardiometabolic field.

12/16/2024

Novo Nordisk announced a large investment of $1.2 billion to build a new production facility in Denmark. The new state-of-the-art facility, located in Odense, will focus on manufacturing medications for rare diseases.

12/13/2024

A recent study published on medRxiv, though not yet peer-reviewed, suggests a possible link between Novo Nordisk’s weight-loss drug Ozempic and a rare eye condition called non-arteritic anterior ischemic optic neuropathy (NAION). This finding also aligns with research from Harvard University earlier this year.

12/12/2024

Novo Nordisk has received European approval for a new indication of its drug, Ozempic. The European Medicines Agency (EMA) has authorized a label expansion to include the treatment of chronic kidney disease in adults with type 2 diabetes. This decision follows a study demonstrating a 20% reduction in the risk of kidney-related death for patients taking Ozempic.

12/11/2024

Novo Nordisk is partnering with the Sher-i-Kashmir Institute of Medical Sciences (SKIMS) to drive clinical research in India. The collaboration will focus on addressing critical medical needs in nephrology, rare diseases, cardiology, and obesity.

12/9/2024

Novo Nordisk has received European approval to acquire Catalent, a U.S. drug manufacturer responsible for producing a large portion of Novo Nordisk’s popular obesity drug, Wegovy. However, the deal still needs to be cleared by the U.S. Federal Trade Commission before it can be finalized.

12/6/2024

Novo Nordisk announced a major price reduction for two of its insulin products. Starting in January 2026, the list price of Fiasp will drop by 75%, while Tresiba will see a 72.2% reduction. Novo Nordisk will also discontinue unbranded versions of Tresiba by the end of 2025.

12/5/2024

Novo Nordisk announced a large investment of DKK 2.9 billion ($411 million) to construct a new quality control laboratory in Hillerød, Denmark. The new 53,000-square-meter facility is expected to be operational by 2027 and will be Novo Nordisk’s largest quality control investment to date.

12/3/2024

Novo Nordisk’s India team wants to launch the weight-loss drug Wegovy sooner than planned. They’re concerned about falling behind the company’s rival, Eli Lilly, whose similar drug Mounjaro is expected to launch next year.

11/27/2024

Health Canada has granted approval for Novo Nordisk’s weight-loss drug, Wegovy. Wegovy now becomes the first treatment in Canada to address both obesity and the risk of heart-related issues in adults with pre-existing cardiovascular disease.

Novo Nordisk has spared no expense in expanding its pharmaceutical reach and scope. In addition to adding new factories to ramp up production to meet demand for Ozempic and Wegovy, the company’s expansion towards treating other afflictions saw billions spent in acquisitions. The past decade has seen the following events:

| Fiscal Year (DEC) | Price | Revenues | Net Income |

| DKK (=US$0.15) | DKK (=US$0.15) | ||

| 2015 | $29.04 | 107.927B/$16.19B | 34.860B/$5.23B |

| 2016 | $17.93 | 111.780B/$16.76B | 37.925B/$5.69B |

| 2017 | $26.83 | 111.696B/$16.75B | 38.130B/$5.72B |

| 2018 | $23.03 | 111.831B/$16.77B | 38.628B/$5.79B |

| 2019 | $28.94 | 122.021B/$18.30B | 38.951B/$5.84B |

| 2020 | $34.92 | 126.946B/$19.04B | 42.138B/$6.32B |

| 2021 | $56.00 | 140.800B/$21.12B | 47.757B/$7.16B |

| 2022 | $67.67 | 176.954B/$26.54B | 55.525B/$8.33B |

| 2023 | $103.45 | 232.261B/$34.84B | 83.683B/$12.55B |

| 2024 LTM (as of June) | $142.74 | 258.003B/$38.70B | 89.898B/$13.48B |

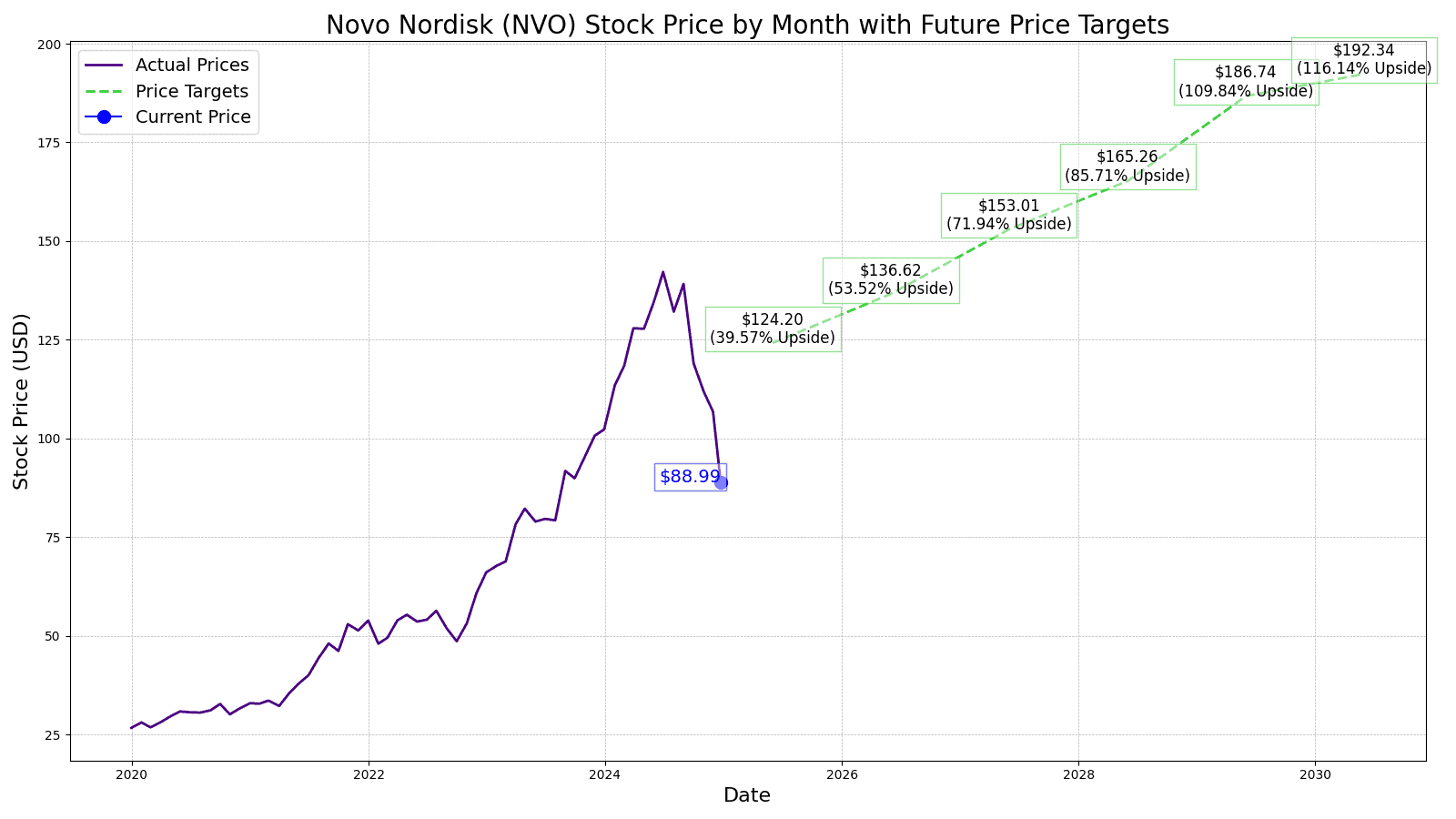

Out of 11 Wall Street analysts, their consensus recommendation is “outperform/hold”, based on 5 buy, 2 outperform, 2 hold, and 2 sell. Their consensus 12-month target price for Novo Nordisk is $140.07, which is a 57.90% gain over today’s stock price. The 24/7 Wall Street 12-month projected target is a more conservative $124.20. This would be 40.01% above today’s price.

Novo Nordisk’s median P/E ratio has been 26.40 from 2010 to the present. The following price predictions are based on a 25 P/E. In the subsequent 5 years to follow, Novo Nordisk’s newest products, presently in FDA trials, are targeting the obesity market.

It is anticipated to reach $100 billion by 2030. Obesity drugs competing against offerings from Eli Lilly and other rivals require drugs that meet the following criteria: Sufficient efficacy to fulfill the medical needs of a large population of patients;

With Wegovy gaining acceptance for China in Q2 2024, this opens the door for Novo Nordisk to gain a foothold in a potentially larger market than the entirety of its European share. China’s middle and wealthy classes have multiplied exponentially as China’s GDP has grown. Obesity, heart diseases, and other ailments common in the West have escalated in China as diets and lifestyles adapted to mimic Western tastes and trends. Our price target for 2026 is $136.62.

The new obesity drug CagriSema is presently near completion of FDA phase-2 trials. Assuming there are no negative results to bar initiating clinical phase-3 trials, these would presumably occur throughout 2025 and 2026. Therefore, CagriSema is likely to be cleared for public dissemination and ready for market by 2027. Although it is administered via injection, rather than in pill form, early results show a 200% higher weight loss reduction in 32 weeks, over Wegovy. Our price target for 2027 is $153.01.

Although Novo Nordisk’s pipeline of new drugs under FDA review targets obesity, its revamped product menu has expanded via acquisitions. Revenues from its HGH, estrogen replacement, and wound treatment products, as well as other diabetes variants, should all contribute to the bottom line with full production, marketing, and sales integration by 2028. We predict a price of $165.26.

Obesity pill Amecrytin, which acts as an appetite suppressant without the effects of amphetamines, is presently in FDA phase-1 trials, but should be cleared for market and ready for distribution in 2029. Its weight-loss efficacy doubles that of Wegovy in shorter 3-month periods, and its pill configuration convenience should make it a hit prescription for doctors. Our price target is $186.74.

R&D for a genetic based obesity drug is currently in the works by Novo Nordisk, Eli Lilly, and several other rivals. With the obesity treatment market expected to hit $100 billion in 2030, even the announcement of a genetic-based drug ready to start FDA trials would generate significant buzz. With Novo Nordisk the current market leader, such an announcement in 2030 is not a stretch. Our target price is $192.34.

Cumulatively, 24/7 Wall Street anticipates Novo Nordisk to appreciate 79% over the next 5 years.

| Year | EPS | P/E multiple | Price |

| 2025 | $4.97 | 25 | $124.20 |

| 2026 | $5.46 | 25 | $136.62 |

| 2027 | $6.12 | 25 | $153.01 |

| 2028 | $6.61 | 25 | $165.26 |

| 2029 | $7.47 | 25 | $186.74 |

| 2030 | $7.69 | 25 | $192.34 |

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.