Forecasts

Broadcom (AVGO) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

The explosive demand for semiconductors and microchips has grabbed news headlines and led the market higher over the past few years. As the drive towards integrating artificial intelligence (AI) into our everyday lives progresses, there are a handful of mega-cap companies that are capable of meeting that demand. And as much NVIDIA Corp. (NASDAQ: NVDA) may get the lion’s share of attention, it is companies like Broadcom Inc. (NASDAQ: AVGO) that will also be playing a central role in supply.

The San Jose, Calif.-based company, which was founded in 1961, has been a major player in the tech space for decades. But its business sectors focusing on semiconductors and infrastructure software products have been major catalysts in its market cap pushing toward $1 trillion market capitalization — good for a top 15 among all publicly traded companies.

Despite shares of Broadcom gaining over 762.98% in the past five years and 96.32% in 2024, 24/7 Wall Street has performed an analysis that suggests there is still a big-time upside for Broadcom before the end of the decade. Here is where prospective investors and current shareholders might expect the stock to be over the course of the next five years.

1/8/2025

Bernstein recently reaffirmed its “Outperform” rating on Broadcom with a bullish stance on the company’s upcoming performance for the year.

1/7/2025

Broadcom’s President Charlie Kawaas sold 40,000 shares of company stock. This transaction, with an average price of $231.98 per share (approximately $9.28 million total), occurred as the company’s market valuation hit $1.11 trillion. These insider sales led to a 2.6% decline during today’s mid-day trading, but analysts continue to forecast positive trends for the company’s future.

1/6/2025

Broadcom’s shares rallied today and rose 4% today. The company has been demonstrating strong growth in the artificial intelligence sector. In the most recent quarter (ending November 3, 2024), Broadcom reported sales of $14 billion, a 51% increase compared to the same period last year.

1/3/2025

Redwood Technologies LLC has filed two lawsuits against Broadcom in the U.S. District Court for the Western District of Texas, alleging infringement of 15 patents related to mesh networking and Wi-Fi-compliant devices. Redwood claims Broadcom’s alleged infringement was willful, as it notified the company of the patents in November 2021.

12/30/2024

Broadcom’s shares declined by 3.1% today following an insider sale. The stock reached a low of $231.62. Trading volume was much lower than average, with 8,794,323 shared traded (a 71% decrease from the average session volume).

12/27/2024

The Nasdaq Composite fell 2.4% today, while the Dow Jones Industrial Average lost as much as 500 points. Broadcom’s shares declined by nearly 2% during what is typically the bullish “Santa Claus rally”, which has yet to materialize this year.

12/20/2024

J.P. Morgan analysts have identified Broadcom as one of the key drivers of innovation in 2025. Along with a handful of other technology stocks, Broadcom is poised to benefit from the growth of industries like AI, cybersecurity, and digital infrastructure.

12/18/2024

Broadcom’s shares experienced a downturn today, dropping 6.9%. However, despite the Federal Reserve’s decision to reduce the federal funds rate by 25 basis points to a range of 4.25% to 4.50%, the market’s reaction was primarily driven by the central bank’s indication of a more cautious approach to future rate cuts.

12/16/2024

Broadcom’s stock price surged by 10% today, fueled by optimism surrounding the company’s AI chip business. Investors have responded positively to recent strategic forecasts from Broadcom, driving the significant increase in share price.

12/13/2024

Broadcom’s market capitalization surpassed the $1 trillion mark today. The company’s AI sales growth of around 65% significantly exceeded expectations, driving a 20% surge in its stock price.

Broadcom’s incredible growth has been reflected in the price of its shares, which have surged since 2014 to the tune of a 3,170% gain. This culminated on July 15, 2024, when the company announced a 10-for-1 stock split that made its shares more accessible to all investors by driving the stock’s price down to $167 at the time. Beyond its role in AI and semiconductors, Broadcom is also a major supplier for Apple Inc. (NASDAQ: AAPL), providing the Magnificent Seven mainstay with critical wireless connectivity components and other hardware. According to the company, Broadcom expects 20% growth in wireless revenue just in the final quarter of 2024. Between its semiconductor, software and smartphone business segments, the stock has experienced sizable growth in the recent past:

INSERT TABLE HERE

| Year | Share Price* | Revenue** | Net Income** |

| 2014 | $10.06 | $4.244 | $1.343 |

| 2015 | $14.63 | $6.897 | $2.613 |

| 2016 | $18.19 | $13.269 | $4.672 |

| 2017 | $25.69 | $17.656 | $7.255 |

| 2018 | $25.36 | $20.805 | $9.391 |

| 2019 | $31.65 | $22.548 | $9.452 |

| 2020 | $43.79 | $23.858 | $9.993 |

| 2021 | $66.48 | $27.403 | $12.578 |

| 2022 | $55.24 | $33.169 | $16.526 |

| 2023 | $111.63 | $35.798 | $18.378 |

*Post-split adjusted basis , **Revenue and net income in $billions

Over the course of the last decade, Broadcom’s revenue grew by more than 743% while its net income increased by over 1,268%. Despite a slight contraction in share price in 2022 during an extended bull market that had an outsized impact on the tech sector, on a post-split adjusted basis, shares of Broadcom have climbed 1,009.64% from 2014 through 2023.

As the Silicon Valley mainstay looks towards the second half of the decade, 24/7 Wall Street has identified three key drivers that are likely to positively impact Broadcom’s growth metrics and stock performance through 2030.

1. Exceptional Track Record of Earnings and Revenue Beats: Going back to the first quarter of 2015, Broadcom has beaten earnings in every single quarter except one. That is one earnings miss over the course of 39 quarters. Expectations are that the company will continue to beat on earnings and revenue, with a forecast earnings per share (EPS) of $1.39 for the last quarter of 2024. In the third quarter of 2024, the company posted an impressive 17.65% year-over-year EPS gain, which year-over-year total revenue grew from $8.88 billion in July 2023 to $13.07 billion in July 2024 — an increase of 47.18%.

2. Filling the Gap NVIDIA Cannot Satisfy: For investors concerned about NVIDIA’s possible overvaluation or the company’s inability to single-handedly satisfy the explosive AI-driven semiconductor demand, Broadcom is an alternative that at current prices could be considered a bargain. In September, Barchart.com reported that the “stock looks deeply undervalued … based on its strong revenue, free cash flow, FCF margin, management guidance and analysts’ price targets.” Specifically, that free cash flow has grown markedly between FY 2019 to FY 2023, from $9.27 billion to $17.63 billion good for an increase of over 90%. As demand for semiconductors and microchips continues to grow, Broadcom has an abundance of cash ready to be deployed in order to match that growth.

3. Institutional Ownership: Broadcom is beloved by institutional investors, of which there are 3,382. Of the company’s 4.671 billion shares outstanding, a staggering 3.537 billion of them are held by institutional investors, according to Nasdaq.com. That accounts for 75.74% of the company’s entire stock. The top three largest holders are Vanguard Group with 448 million shares followed by BlackRock at 342 million and Capital World Investors with 224 million shares. Together, those three positions account for $175.432 million in share value. And in the past year, 1,760 institutional investors increased their positions.

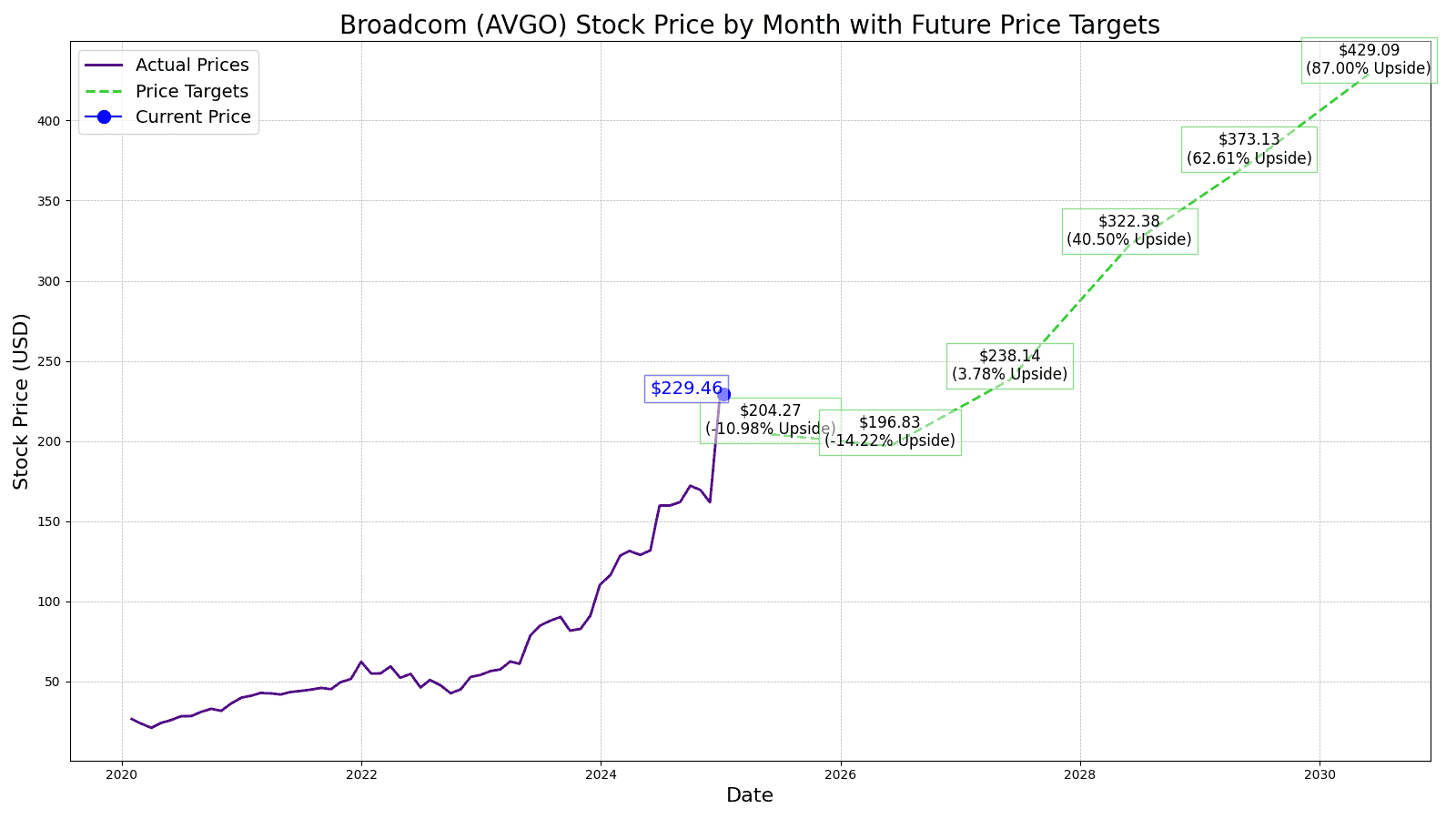

The current consensus median one-year price target for Broadcom is $195, representing a potential downside of -15.02% over the next 12 months. Of all the analysts covering Broadcom, the stock is a consensus buy, with a 1.43 ‘Buy’ rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

By the end of 2025, 24/7 Wall Street‘s forecast for AVGO shares is $20.27, representing a -10.98% potential downside based on an EPS of $6.19 and a PE ratio of 33.

| Year | Revenue* | EPS |

| 2025 | $60.492 | $6.19 |

| 2026 | $67.906 | $7.29 |

| 2027 | $75.850 | $8.82 |

| 2028 | $85.222 | $11.94 |

| 2029 | $84.920 | $14.93 |

| 2030 | $86.618 | $18.66 |

*Revenue and net income in $billions

At the end of 2025, we forecast Broadcom’s stock to be trading for $204.27 based on revenue of $60.492 billion, a net income of $34.224 billion, and an EPS of $6.19. The following year, we estimate earnings per share of $7.29 on over $67 billion in revenue.

Starting in 2027 through 2029, we expect a 13% growth in revenue and a 40% jump in earnings per share, bringing Broadcom’s price target from $238.14 in 2027 to $373.13 in 2029.

By the conclusion of 2030, 24/7 Wall Street estimates Broadcom’s stock will trade at $429.09, representing an 81.12% increase from its current price, based on revenue of $86.618 billion and an EPS of $18.66.

| Year | Price Target |

| 2025 | $204.27 |

| 2026 | $196.83 |

| 2027 | $238.14 |

| 2028 | $322.38 |

| 2029 | $373.13 |

| 2030 | $429.09 |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.