Forecasts

Palantir Technologies (PLTR) Price Prediction and Forecast 2025-2030 For February 18

Published:

Last Updated:

Shares of Palantir Technologies Inc. (NYSE: PLTR) surged 4.58% on Tuesday alongside the S&P 500 setting a new all-time high. CEO Alex Karp’s CNBC interview also acted as a catalyst, during which he praised Elon Musk and the Department of Government Efficiency’s efforts to curtail federal spending. Over the past five trading sessions, the stock is up 7.00% and has gained an astounding 70.55% over the past month.

Tuesday’s big boost continues Palantir’s momentum after it reported strong Q4 2024 earnings on Feb. 3, including an EPS beat of 23.72%. Over the past six months, the stock has gained more than 283%, and over the past year it is up over 432%.

Earlier this year, Palantir announced plans to invest in Shield AI, a startup that develops AI-powered drones. Shield AI is seeking to raise around $200 million in a new funding round, which could nearly double its value to $5 billion. Venture capital firms like Point72 and Andreessen Horowitz, in addition to companies like Palantir, Airbus and L3Harris Technologies, are also likely to participate in the investment.

Big Data is expected to be big business in the years ahead. According to platform provider Edge Delta, the market for data services is projected to grow from $220.2 billion in 2023 to $401.2 billion by 2028 — an increase of 82.2%. Palantir is a major player in the space. The company was co-founded by entrepreneur and venture capitalist Peter Thiel, who was also the co-founder of PayPal and the first outside investor in Facebook.

Since going public on Sept. 30, 2020, Palantir’s stock price has risen over 1,254.57%. Palantir stands as one of Big Data’s industry dominators. However, finding data-driven assessments of where the company’s stock will be in the medium and long term can be complicated. With Wall Street analysts only going as far as providing one-year price targets, it can be difficult for investors to accurately gauge predictions for stocks like these over longer horizons. But for buy-and-hold investors who want to know where Palantir’s stock might be several years down the road, 24/7 Wall Street has done the legwork and can provide insights around the numbers coming from the company, and which market segments the company is operating in that are most exciting to us.

The following is a table that summarizes the performance in share price, revenues, and profits (net income) of PLTR from its inception in 2020 through the second quarter of 2024:

| Share Price | Revenue* | Net Income* | |

| 2020 | $23.55 | 1.092 | 1.166 |

| 2021 | $18.21 | 1.541 | .520 |

| 2022 | $6.29 | 1.905 | .373 |

| 2023 | $17.17 | 2.225 | .209 |

| 2024 | $77.18 | 2.87 | .477 |

*Revenue and net income in $billions

Since going public, Palantir saw its revenue grow experience explosive growth while net income has fallen, although it has ticked up from 2023 to 2024. That drop in net income can be easily attributed, though. The company’s IPO in 2020 raised $2.6 billion, but that was shortly followed by 2022’s year-long bear market. Nonetheless, by 2023, the Big Data firm was able to reach profitability for the first time in its then 20-year history.

The momentum has continued with a series of earnings beats, most recently in early February the its Q4 2024 reporting. That marked the sixth consecutive EPS beat for Palantir, and the eighth in nine quarters.

The current consensus average one-year price target for Palantir’s stock is $88.60, which represents a downside potential of -28.90% from today’s closing price. Of all the analysts covering PLTR, the stock is a consensus “Hold.”

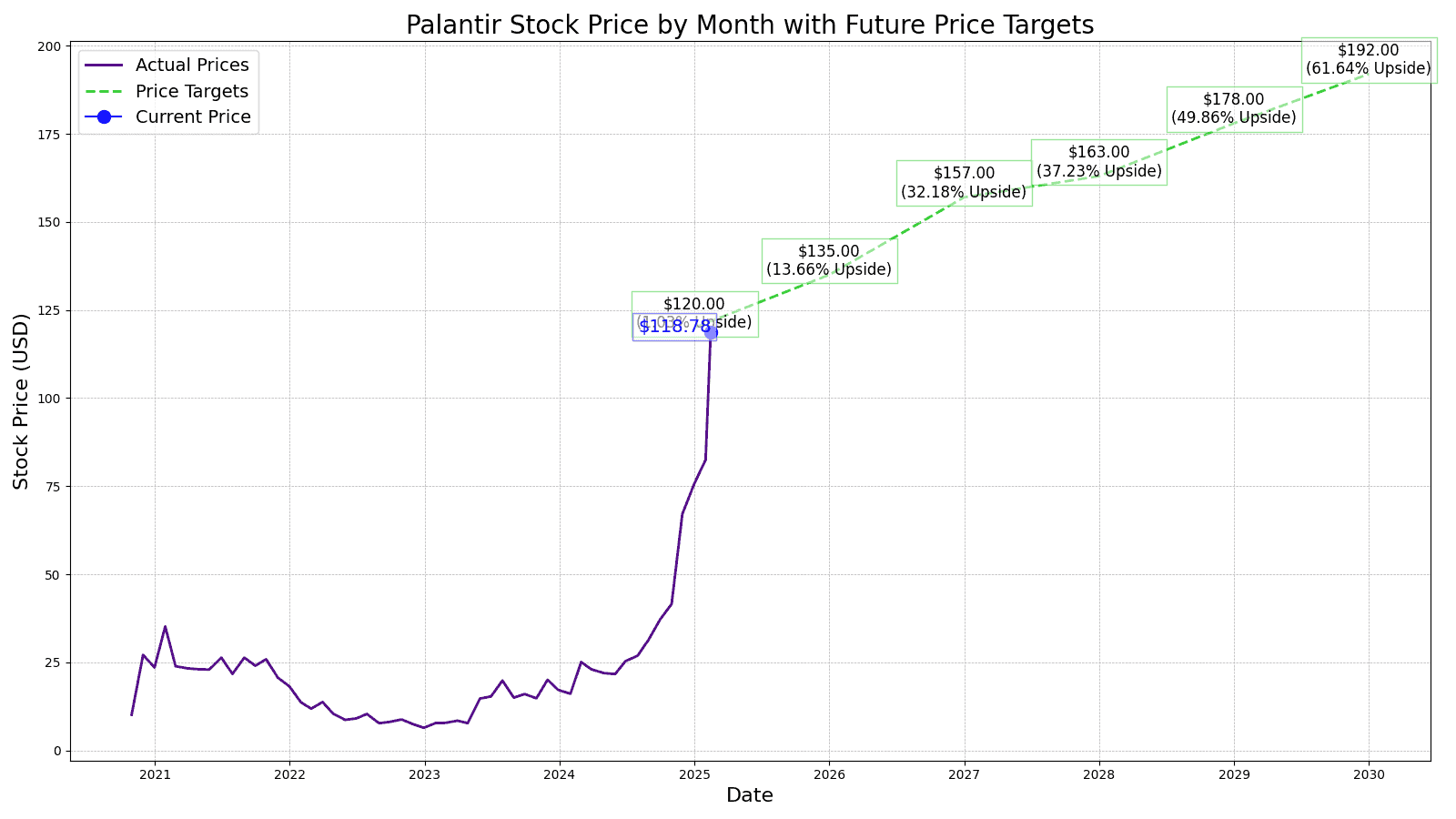

24/7 Wall Street’s 12-month forecast projects Palantir’s stock price to be $120 with EPS coming in right at $0.43. We see strong CAGR growth in sales of government contracts, upwards of 26% annually, and have factored for $3.186 billion in forecast revenue.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $3.467 | $1.178 | $0.47 |

| 2026 | $4.198 | $1.465 | $0.56 |

| 2027 | $5.203 | $1.686 | $0.71 |

| 2028 | $6.185 | $2.050 | $0.87 |

| 2029 | $7.300 | $2.496 | $1.06 |

| 2030 | $8.482 | $2.990 | $1.27 |

*Revenue and net income in $billions

On the back of forecast revenue in excess of $8 billion, we expect Palantir’s net income to surpass $2 billion for the first time, and post an EPS of $1.27. We expect free cash flow to approach $6 billion by posting $5.895 billion. The price projection for 2030 is $125, an upside of 80.53% over today’s stock price.

| Year | Price Target | % Change From Current Price |

| 2025 | $120 | -3.70% |

| 2026 | $135 | 8.32% |

| 2027 | $157 | 25.98% |

| 2028 | $163 | 30.79% |

| 2029 | $178 | 42.83% |

| 2030 | $192 | 54.06% |

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.