Forecasts

Super Micro Computer (SMCI) Price Prediction and Forecast

Published:

Last Updated:

Though the artificial intelligence-fueled tech rally has sputtered, it is likely to continue. Companies that can diversify to address the manifold demands the industry faces ultimately are poised to profit. Super Micro Computer Inc. (NASDAQ: SMCI) is one of those companies. The San Jose-based tech firm specializes in high-performance and high-efficiency servers, but it also provides software solutions as well as storage systems for data centers and enterprises focusing on cloud computing, AI, 5G, and edge computing.

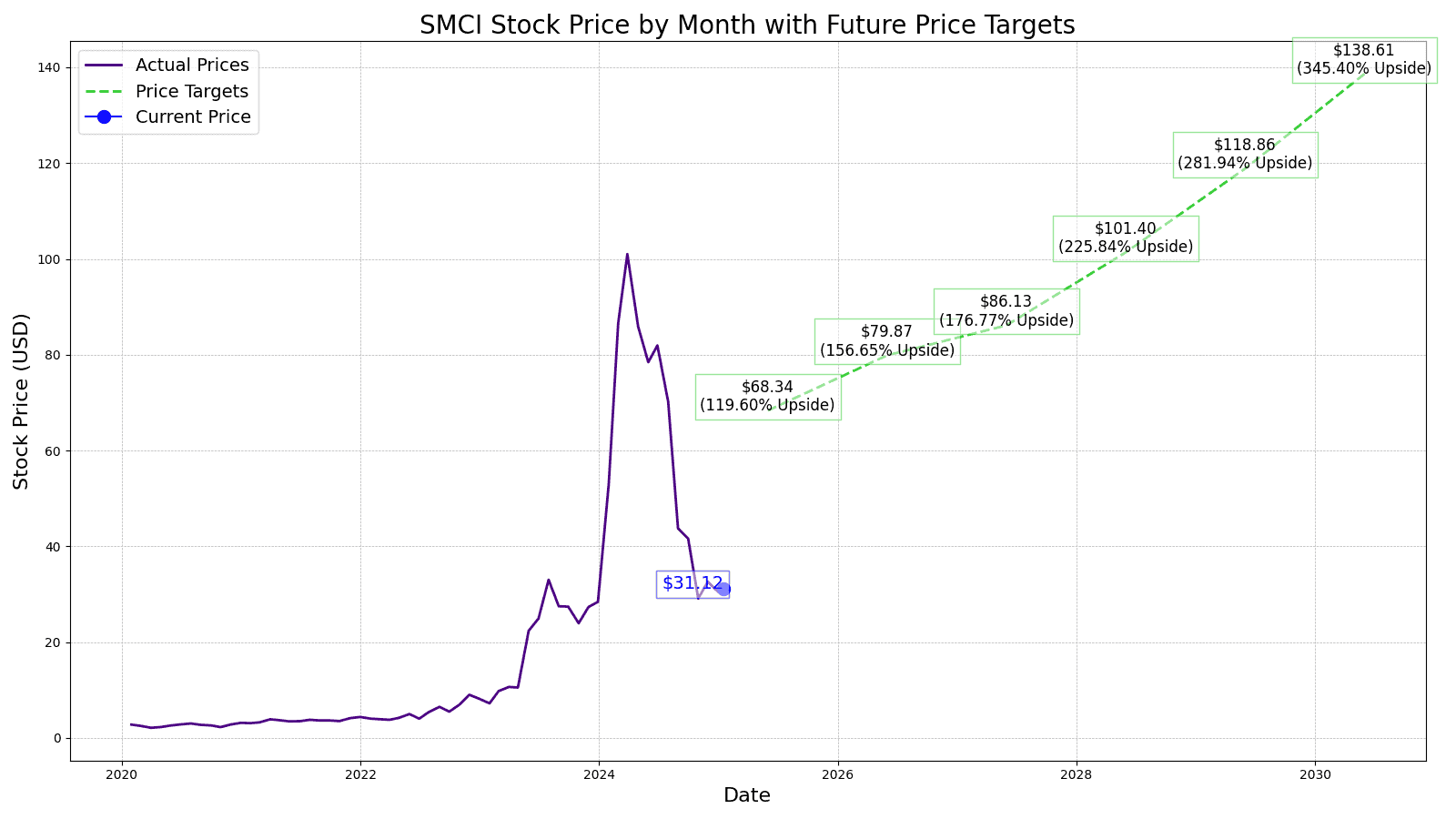

Nonetheless, analysts continue to expect big upside potential for the tech stock. Hindsight is 20/20, and all that matters now is how Super Micro Computer will perform going forward. So 24/7 Wall St. has performed analysis to provide investors — and potential investors — with an idea of where shares of SMCI could be headed over the next five years.

3/10/2025

On the same day the Nasdaq slipped into correction territory, Rosenblatt analysts reinitiated coverage of the stock with a Buy rating. They cited the company’s strong position in the AI space, its accelerating AI revenues, and its increased visibility. The firm also has a 12-month price target of $60.

2/28/2025

Super Micro announced that it would expand in Silicon Valley with a third campus, reaching almost 3 million square feet to support liquid-cooled data centers for AI and high-performance computing.

2/26/2025

Super Micro regained compliance with Nasdaq listing requirements after submitting its delayed financial reports to the U.S. Securities and Exchange Commission just before the deadline. Though internal governance issues may still exist, the company remains financially robust.

2/11/2025

Preliminary second-quarter results included revenues that grew 54% year over year but just fell short of Wall Street expectations. The company said it is expanding its manufacturing capacity in the United States, Taiwan, and Europe to meet increasing demand, particularly for liquid-cooled data center solutions.

Shares of SMCI have been particularly rewarding to shareholders in the recent past, as they exploded by gaining 3,096% in the five years between August 2019 and August 2024. The following table summarizes Super Micro Computer’s share price, revenues, and profits (net income) from 2014 to 2024:

| Year | Share Price (pre-split) | Revenues* | Net Income* |

| 2014 | $36.39 | $1.467 | $.054 |

| 2015 | $24.66 | $1.954 | $.092 |

| 2016 | $28.05 | $2.225 | $.072 |

| 2017 | $20.93 | $2.484 | $.067 |

| 2018 | $13.90 | $3.360 | $.046 |

| 2019 | $24.65 | $3.500 | $.072 |

| 2020 | $31.66 | $3.339 | $.084 |

| 2021 | $43.95 | $3.557 | $.112 |

| 2022 | $82.19 | $5.196 | $.285 |

| 2023 | $284.26 | $7.123 | $.640 |

| 2024 | $304.80 | $14.940 | $1.210 |

*Revenue and net income in $billions

In the past decade, Super Micro Computer’s revenue grew by more than 385% while its net income increased by just over 1,085%. Despite seeing a minor revenue contraction in 2020 with a decrease of 4.6%, shares of SMCI still managed to increase year-over-year on still-growing net income. As the IT services provider looks forward to the second half of the decade, we have identified three key drivers that are likely to have an impact on its growth metrics and stock performance.

The current consensus median one-year price target for Super Micro Computer is $52.34, which represents a nearly 25.07% potential upside over the next 12 months based on the current share price of $41.85. Of all the analysts covering Super Micro Computer, the stock is a consensus hold recommendation, with just four out of 14 analysts with Buy ratings.

24/7 Wall St.’s 12-month forecast projects Super Micro Computer’s stock price to be $68.34 based on a projected EPS of $3.35 in 2025.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $28.265 | $1.974 | $3.35 |

| 2026 | $31.634 | $2.548 | $4.31 |

| 2027 | $37.116 | $1.458 | $5.49 |

| 2028 | $42.631 | $1.881 | $6.76 |

| 2029 | $50.154 | $2.428 | $8.49 |

| 2030 | $59.005 | $3.134 | $10.62 |

*Revenue and net income in $billions

At the end of 2025, we expect to see revenue, net income, and EPS rise by 89.16%, 63.41%, and 70.08%, respectively. That would result in a per-share price of $683.40 (or $68.34 on a post-split-adjusted basis), which is 2096.02% higher than where the stock is currently trading.

When 2026 concludes, we estimate the price of SMCI to be $798.66 (or $79.87 on a post-split-adjusted basis), which is 2466.39% higher than where shares are trading today. This is based on modest revenue gains, an assumed EPS of $44.37, and a healthy projected P/E ratio of 18.

At the conclusion of 2027, we forecast a sizable jump in the stock price to $861.28 (or $86.13 on a post-split-adjusted basis) driven by $37.116 billion in revenue and $1.458 billion in net income, which will result in shares trading for 2667.61% higher than the current share price.

By the end of 2028, we expect to see shares trading for $1041.04 (or $101.40 on a post-split-adjusted basis), or 3245.24% higher than the stock is trading for today on revenues of $42.631 billion, net income of $1.881 billion, and an EPS of $67.60.

And at the end of 2029, Super Micro Computer is forecast to achieve revenue of $50.154 billion and net income of $2.428 billion, resulting in a per-share price of $1188.59 (or $118.86 on a post-split-adjusted basis), which is 3719.38% higher than the stock’s current price.

By the conclusion of 2030, we estimate an SMCI share price of $1,386.08 (or $138.61 on a post-split-adjusted basis), good for a 4,353.98% increase over today’s share price, based on an EPS of $106.62 and a P/E ratio of 13.

| Year | Price Target |

| 2025 | $68.34 |

| 2026 | $79.87 |

| 2027 | $86.13 |

| 2028 | $101.40 |

| 2029 | $118.86 |

| 2030 | $138.61 |

Prediction: Super Micro Will Hit $100 in 2025

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.