Forecasts

Lumen Technologies (LUMN) Price Prediction and Forecast 2025-2030 (March 2025)

Published:

Last Updated:

There have been some lingering concerns about the future prospects for Lumen Technologies Inc. (NYSE: LUMN). However, its fourth-quarter results suggested a positive shift in its financial health due to a focus on strengthening its balance sheet and improving liquidity by reducing debt. It also has focused on improving customer satisfaction. However, it still faces challenges with declining revenue and with free cash flow.

The Louisiana-based telecommunications company has been around a long time, so it was a surprise to some that stock was at risk of being delisted from the New York Stock Exchange when in 2023, its price per share briefly dipped under $1.00. Those struggles continued into 2024, but by mid-summer, the stock surged when demand for its high-speed fiber-network solutions began to grow. The company secured deals with Microsoft Corp. (NASDAQ: MSFT) and other leading tech companies, like Corning Inc. (NYSE: GLW), that are requiring increased connectivity between their data centers because of the explosive growth of artificial intelligence (AI).

24/7 Wall St. has performed analysis to determine if the company is fundamentally flawed, or if AI demand and strategic partnerships will be enough to see its stock continue on its bull run.

3/7/2025

Lumen Technologies stock popped about 8% due to a Broadcom earnings report that included record revenues for the quarter and a forecast that suggested very strong growth in the AI infrastructure market. That was seen as good news for Lumen.

2/25/2025

Lumen confirmed that it had selected Ciena as its preferred optical vendor to enhance its network infrastructure for AI workloads. The partnership will enable the implementation of WaveLogic 6 Extreme (WL6e) technology, and Lumen will be better equipped to provide highly customized, scalable connectivity services to leading cloud and data center providers trying to keep up with the rise in workloads related to artificial intelligence traffic.

2/4/2025

Lumen posted fourth-quarter results that exceeded expectations on the top and bottom lines. It said the results were driven by rising demand for data centers, and also that it had reduced its debt load by $1.6 billion in 2024. The share price rose about 2% afterward.

1/17/2025

Lumen’s financial performance is weakening, with concerns about the future of the company’s business serving the general public. If Lumen sells its mass-market business, it could potentially receive up to 10 times its earnings before interest, taxes, depreciation, and amortization (EBITDA). However, given the company’s declining revenue, a lower valuation is more likely.

1/15/2025

Lumen’s stock price increased 9.2% today, trading as high as $5.89. The stock has also experienced a surge in trading of options, particularly in options that expire on January 25th.

1/14/2025

Lumen has announced that it will release its fourth-quarter financial results on February 4th.

1/13/2025

Lumen’s stock entered oversold territory today, with an RSI reading of 29.3 This suggests that recent heavy selling pressure may be nearing exhaustion.

1/10/2025

Lumen has hired Allen Ashbey as the new Vice President of Federal Civilian Sales. Ashbey will be responsible for leading sales efforts within the federal civilian government sector.

1/6/2025

Wall Street analysts are not very bullish on Lumen right now, with nine research firms giving the stock an average recommendation of “reduce” (three “sell” and six “hold”). Analysts also don’t expect the stock price to go up much in the next year.

12/27/2024

Last quarter, five analysts reviewed Lumen Technologies and offered a mix of bullish and bearish opinions. Their 12-month price targets range from $4.25 to $8.00, averaging $5.55. This represents a 6.73% increase from the previous average of $5.20, suggesting a more positive outlook.

12/20/2024

Lumen has officially initiated a sales process for its consumer fiber operations, potentially valuing the deal between $6 billion and $9 billion.

12/18/2024

Lumen and Prometheus Hyperscale have partnered to improve connectivity for energy-efficient data centers. This partnership aims to meet the growing demand for AI, big data, and cloud computing while also addressing environmental concerns within the AI industry.

From July 1, 2024, to Sept. 30, 2024, shares of LUMN went on a tear. The stock, which was trading at just $1.11 at the start of the third quarter of 2024, surged 540% by the end of Q3. That was quite the reversal given how the stock has slid 86.49% since hitting its all-time high of $49.45 on June 1, 2007. But market drivers are far different today than they were then, and with the emphasis on AI development, Lumen Technologies’ stock is struggling to hold on to that bounce back after falling 52.6% over the past five years.

| Year | Share Price | Revenue* | Net Income* |

| 2014 | $39.70 | $18.031 | $0.851 |

| 2015 | $25.87 | $17.900 | $0.795 |

| 2016 | $24.12 | $17.470 | $0.744 |

| 2017 | $16.99 | $17.656 | $0.356 |

| 2018 | $14.90 | $23.433 | $0.964 |

| 2019 | $13.42 | $22.401 | $5.157 |

| 2020 | $9.75 | $20.712 | $1.351 |

| 2021 | $12.55 | $19.687 | $2.019 |

| 2022 | $5.22 | $17.478 | $1.713 |

| 2023 | $1.83 | $14.557 | $7.334 |

| 2024 | $5.31 | $13.108 | −$0.550 |

*Revenue and net income in $billions

Over the past decade, Lumen’s revenue decreased by more than 19% while net income gained by over 761.81%. As the company battled through its dated infrastructure and a significant debt load — shares fell significantly from $39.70 in 2014 to $1.83 in 2023. However, Lumen has been able to better balance its books, with total assets and total liabilities nearly aligned in 2023 to the tune of $34.02 billion and $33.57 billion, respectively.

As the 56-year-old tech company looks forward to the second half of the decade, 24/7 Wall St. has identified three key drivers that are likely to positively impact Lumen Technologies’ growth metrics and stock performance through 2030.

1. Strategic Partnerships With Tech Giants: The aforementioned strategic partnerships with Microsoft, the second-largest publicly traded company by market cap at $3.096 trillion, and Corning with its $36.16 billion market cap, should position Lumen for increased revenues and earnings for the foreseeable future. The partnership, announced in early August 2024, will result in Lumen more than doubling its total intercity network miles in order to unlock the next phases and capabilities of AI for cloud data centers (like Microsoft’s), enterprises and public agencies. According to the company’s press release, Lumen expects the deal with Microsoft to improve its cash flow by more than $20 million over the next 12 months.

2. Debt Restructuring: In March 2024, the company announced it had successfully extended its debt maturities, closing an approximately $1 billion revolving credit line maturing in June 2028 and completing the private placement of $1.325 billion due in November 2029. These efforts should free up funds and allow the company to address capital expenditures that will enable it to address the demands of the previously discussed strategic partnerships with Microsoft and Corning.

3. Insider Activity: While insider trading is never an absolute indication of growth, following the money can suggest what company executives’ sentiment is. And over the past 12 months, Lumen Technologies’ insiders have been doing far more buying than they have been selling. In fact, inside buyers have purchased a total of 12,924,936 million shares versus insider sellers offloading just 2,913,990. Put differently, the leadership at Lumen has out out-purchased sellers by more than 343% over the past year.

According to analysts, the current consensus median one-year price target for Lumen Technologies is $5.05, which represents more than 7.22% upside potential over the next 12 months given a current price per share of $4.71. Of 12 analysts covering LUMN, only two recommend buying shares.

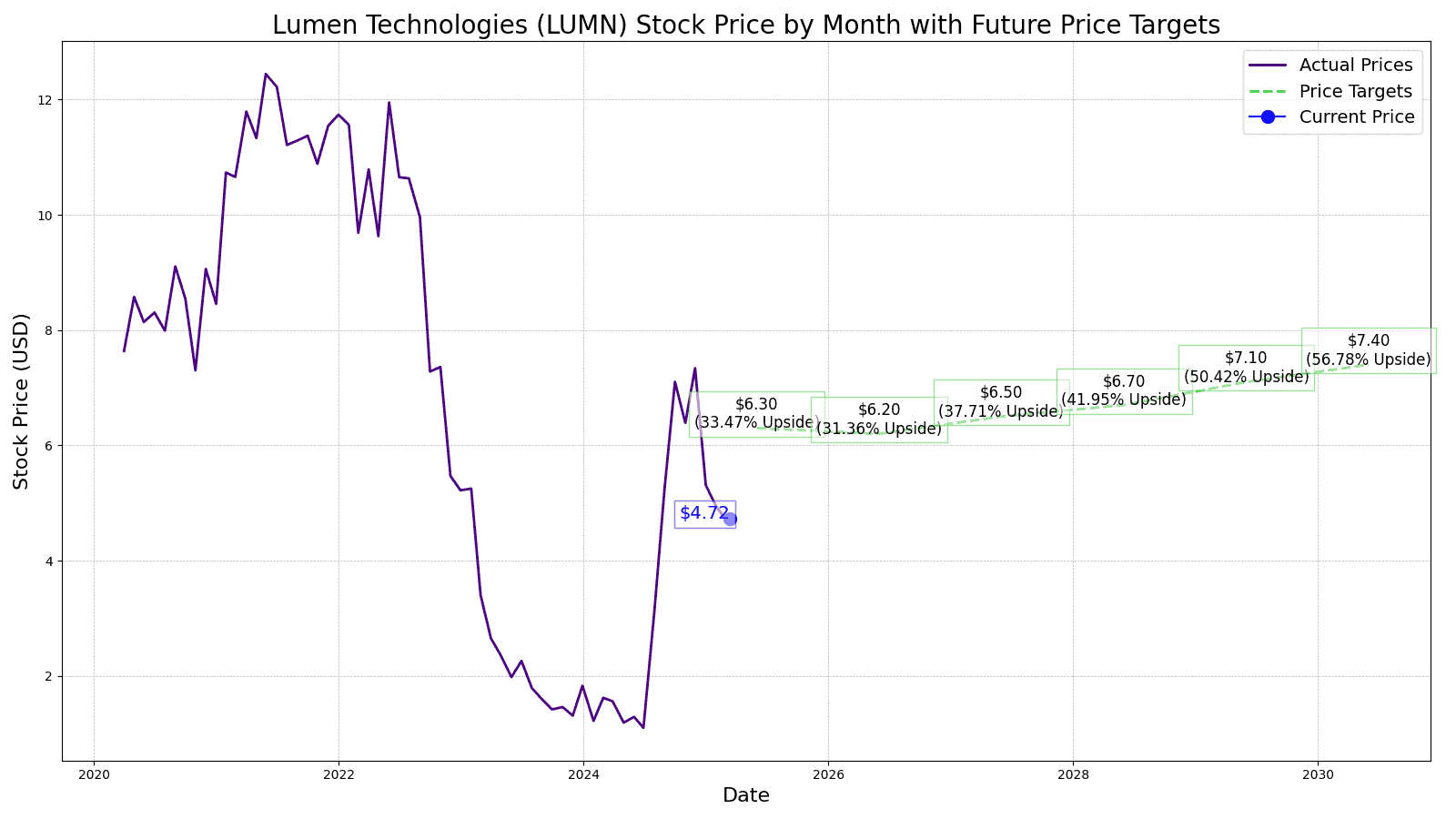

By the end of 2025, 24/7 Wall St.’s forecast for shares of LUMN is higher at $6.30, which only represents an upside potential of 33.76%, based on an annualized EPS of −46 cents.

However, beginning in 2027 and continuing through 2030, we expect LUMN to post positive EPS growing from 5 cents to 59 cents based on revenue growth from $12.369 billion in 2027 to $13.070 billion in 2030.

| Year | Revenue* | EPS |

| 2025 | $12.407 | −$0.46 |

| 2026 | $12.229 | −$0.26 |

| 2027 | $12.369 | $0.05 |

| 2028 | $12.473 | $0.39 |

| 2029 | $12.862 | $0.38 |

| 2030 | $13.070 | $0.69 |

*Revenue in $billions

By the conclusion of 2030, 24/7 Wall St. estimates that Lumen Technologies stock will be trading for $7.40 per share.

| Year | Price Target |

| 2025 | $6.30 |

| 2026 | $6.20 |

| 2027 | $6.50 |

| 2028 | $6.70 |

| 2029 | $7.10 |

| 2030 | $7.40 |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.