Forecasts

Palantir Technologies (PLTR) Price Prediction and Forecast 2025-2030 For March 17

Published:

Shares of Palantir Technologies Inc. (NASDAQ: PLTR) slipped -0.53% on Monday during the morning session, as traders took some gains after the stock rallied 13.66% over the past five days. Year-to-date, PLTR is up nearly 14%, outperforming many of its Nasdaq peers who have suffered from the broad index’s sell-off that began in mid-February.

The price target for Palantir was recently lowered by analyst Mark Schappel of Loop Capital to $125 from $141, with the firm maintaining its buy rating. However, there is optimism surrounding the AI company, whose strong full-year guidance for 2025 sees a sales forecast between $3.74 billion and $3.76 billion, topping average estimates of $3.52 billion.

Big Data is expected to be big business in the years ahead. According to platform provider Edge Delta, the market for data services is projected to grow from $220.2 billion in 2023 to $401.2 billion by 2028 — an increase of 82.2%. Palantir is a major player in the space. The company was co-founded by entrepreneur and venture capitalist Peter Thiel, who was also the co-founder of PayPal and the first outside investor in Facebook.

Since going public on Sept. 30, 2020, Palantir’s stock price has risen 867.71%. Palantir stands as one of Big Data’s industry dominators. However, finding data-driven assessments of where the company’s stock will be in the medium and long term can be complicated. With Wall Street analysts only going as far as providing one-year price targets, it can be difficult for investors to accurately gauge predictions for stocks like these over longer horizons. But for buy-and-hold investors who want to know where Palantir’s stock might be several years down the road, 24/7 Wall Street has done the legwork and can provide insights around the numbers coming from the company, and which market segments the company is operating in that are most exciting to us.

The following is a table that summarizes the performance in share price, revenues, and profits (net income) of PLTR from its inception in 2020 through the second quarter of 2024:

| Share Price | Revenue* | Net Income* | |

| 2020 | $23.55 | 1.092 | 1.166 |

| 2021 | $18.21 | 1.541 | .520 |

| 2022 | $6.29 | 1.905 | .373 |

| 2023 | $17.17 | 2.225 | .209 |

| 2024 | $77.18 | 2.87 | .477 |

*Revenue and net income in $billions

Since going public, Palantir saw its revenue grow experience explosive growth while net income has fallen, although it has ticked up from 2023 to 2024. That drop in net income can be easily attributed, though. The company’s IPO in 2020 raised $2.6 billion, but that was shortly followed by 2022’s year-long bear market. Nonetheless, by 2023, the Big Data firm was able to reach profitability for the first time in its then 20-year history.

The momentum has continued with a series of earnings beats, most recently in early February the its Q4 2024 reporting. That marked the sixth consecutive EPS beat for Palantir, and the eighth in nine quarters.

The current consensus average one-year price target for Palantir’s stock is $94.27, which represents upside potential of 11.14% from today’s share price. Of all the analysts covering PLTR, the stock is a consensus “Hold,” with 10 of 18 analysts providing a hold rating, four providing a buy rating and four providing a sell rating.

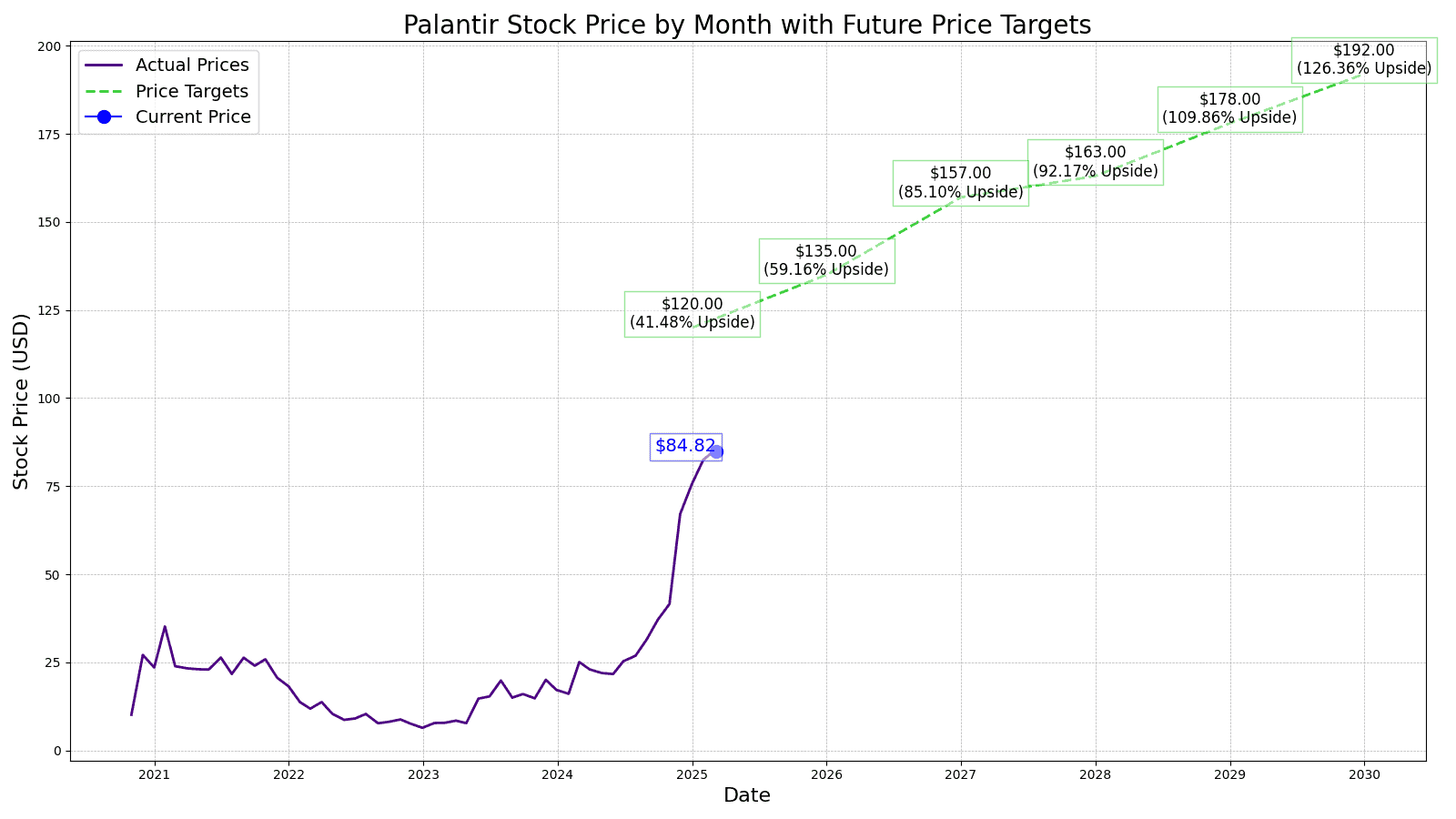

24/7 Wall Street’s 12-month forecast projects Palantir’s stock price to be $120 with EPS coming in right at $0.43. We see strong CAGR growth in sales of government contracts, upwards of 26% annually, and have factored for $3.186 billion in forecast revenue.

| Year | Revenue* | Net Income* | EPS |

| 2025 | $3.467 | $1.178 | $0.47 |

| 2026 | $4.198 | $1.465 | $0.56 |

| 2027 | $5.203 | $1.686 | $0.71 |

| 2028 | $6.185 | $2.050 | $0.87 |

| 2029 | $7.300 | $2.496 | $1.06 |

| 2030 | $8.482 | $2.990 | $1.27 |

*Revenue and net income in $billions

On the back of forecast revenue in excess of $8 billion, we expect Palantir’s net income to surpass $2 billion for the first time, and post an EPS of $1.27. We expect free cash flow to approach $6 billion by posting $5.895 billion. The price projection for 2030 is $125, an upside of 80.53% over today’s stock price.

| Year | Price Target | % Change From Current Price |

| 2025 | $120 | 41.48% |

| 2026 | $135 | 59.16% |

| 2027 | $157 | 85.10% |

| 2028 | $163 | 92.17% |

| 2029 | $178 | 109.86% |

| 2030 | $192 | 126.36% |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.