Forecasts

Advanced Micro Devices Inc. (AMD) Price Prediction and Forecast 2025-2030 (March 2025)

Published:

Shares of Advanced Micro Devices (NASDAQ:AMD) fell by -8.78% over the past month, brining the chipmaker’s year-to-date losses t0 -13.54%. Since AMD’s five-year high on March 8, 2024, the stock has lost 49.722%.

Shareholders received some encouraging news recently when the company announced its gaming chips have been selling well in Japan, with market share reaching 45% and maintaining a target goal of achieving 70% market share.

According to PC Gamer, “The AMD Ryzen 7 7800X3D is simply the best gaming GPU around right now. It’s certainly the best gaming chip that AMD has ever made, but it’s also capable of outperforming Intel’s top CPU when it comes to gaming frame rates and is doing so for a lot less cash. It’s also a lot less power-thirsty, too.” Rave reviews such as this would have been considered unthinkable over a decade ago.

After 50 years of playing second best to rival Intel (NASDAQ:INTC), Advanced Micro Devices surpassed it, thanks to CEO Dr. Linda Su, who took the reins in 2014 with AMD able to unveil the Ryzen in 2017, which became a game changer. Based on a principle of multiple microscopic CPUs working in tandem, AMD’s Ryzen CPU outperformed Intel’s CPUs in speed and efficiency, and most importantly, cost only half as much. Ryzen and its later updates subsequently added tens of billions to AMD’s revenues, and in 2022, AMD surpassed Intel in market cap, although not in chip market share.

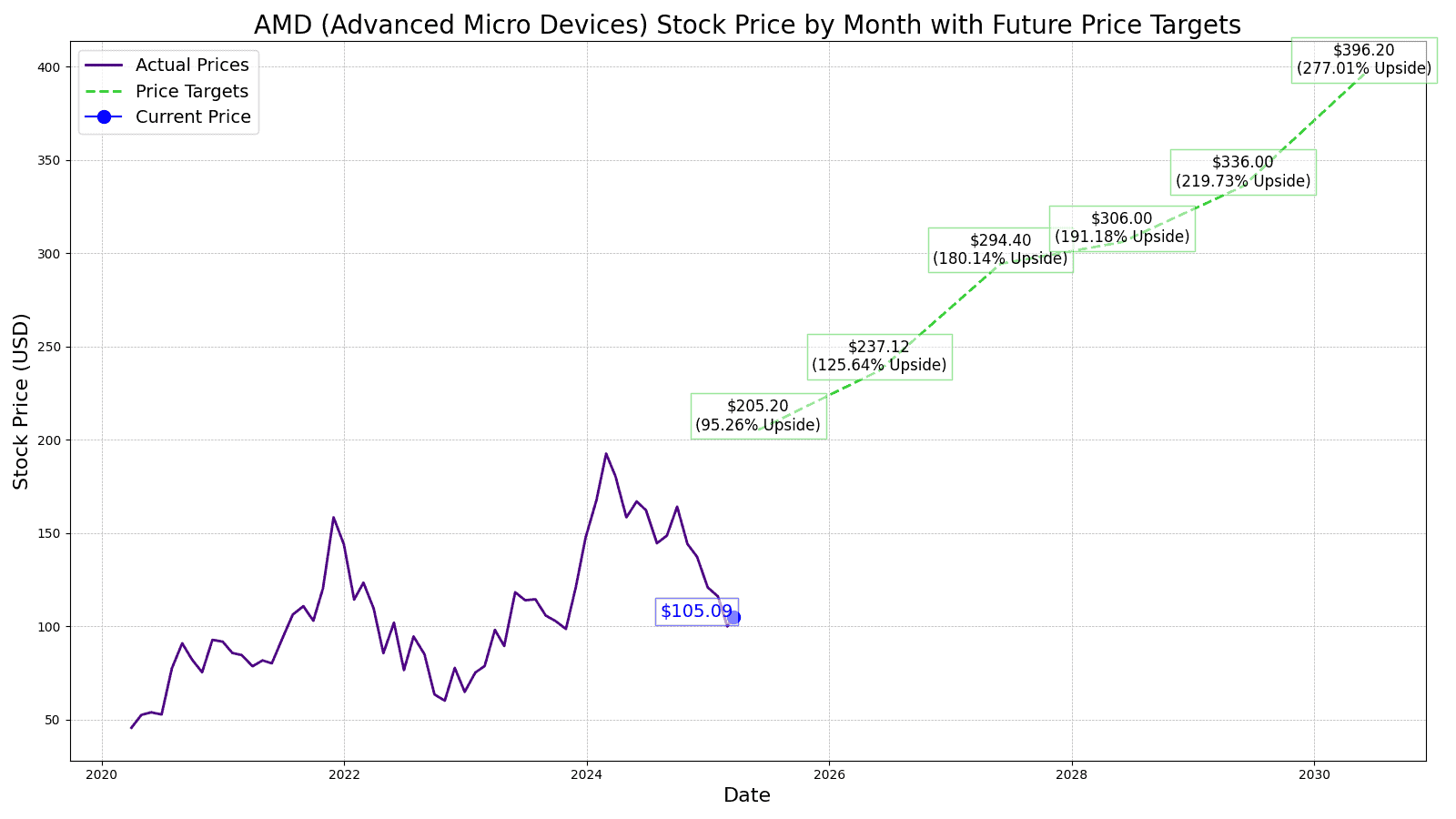

To know where the stock may be heading, 24/7 Wall Street dove into the company’s past performance and its forward projections to establish price targets from now through 2030.

Despite AMD’s phenomenal turnaround over the past decade, not everything has been smooth sailing and concern-free.

Regardless, investors are much more concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some further-looking insights based on AMD’s own numbers, along with business and market development information that may be of help to our readers’ own research.

After stints at IBM and Texas Instruments, Dr. Lisa Su became COO of AMD, assuming the CEO position in 2014. Soon afterwards, she started her overhaul of the company by splitting it into 2 divisions:

Dr. Su oversaw the release of the Radeon 300 and Fury series, the last of the Bulldozer derivatives, and then the RX 400 series of GPUs in 2016.

Based on AMD’s Zen architecture, both Epyc for servers and workstations Ryzen for laptops and desktops debuted in 2017. They innovatively took multiple micro CPUs to work as a team for superior computing power and speed. Ryzen, in particular, took the computing world and Intel by surprise, as it catapulted AMD to previously uncharted levels. 2020 saw AMD announce the acquisition of Xilinx for its field programmable gate arrays (FPGA). AMD would discontinue Xilinx production of its complex programmable logic devices (CPLD) in early 2024.

Pensando Systems was added to AMD’s portfolio in 2022, with Mipsology to follow in 2023. On the AI front, 2023 saw AMD acquire Nod.ai, followed by Silo.AI, Europe’s largest private AI Lab, in 2024.

| Fiscal Year (Dec) | Price | Revenues | Net Income |

| 2015 | $2.87 | $3.991 B | -($660 M) |

| 2016 | $11.34 | $4.319 B | -($498 M) |

| 2017 | $10.28 | $5.253 B | -($33 M) |

| 2018 | $18.46 | $6.475 B | $337 M |

| 2019 | $45.86 | $6.731 B | $341 M |

| 2020 | $91.71 | $9.763 B | $2.490 B |

| 2021 | $143.90 | $16.434 B | $3.162 B |

| 2022 | $64.77 | $23.601 B | $1.320 B |

| 2023 | $147.41 | $22.680 B | $854 M |

| 2024 | $121.65 | $25.785 B | $1.64 B |

1. AMD’s MI300 GPU: These GPUs and similar products are addressing AI workloads for cloud computing, which is stirring up interest. Microsoft (NASDAQ:MSFT) and Oracle (NASDAQ:ORCL) are already using the MI300. As a result, AMD is now on the radar alongside other AI related stocks.

2. The ZT Systems Acquisition: AMD acquired ZT Systems for $4.9 billion, which is now serving as a key building block of Lisa Su’s AI development strategy. By integrating ZT’s expertise in data center infrastructure, AMD will be able to offer complete AI solutions, encompassing hardware, software, and system-level integration. Therefore, AMD will soon provide a one-stop, comprehensive and integrated offering to clients seeking robust AI solutions.

3. Data Center Growth: Already an enormous component of AMD’s revenue, the company’s data center segment generated $12.6 billion in revenue in 2024, representing a 94% increase compared to 2023. In Q3 2024 alone, this slice of the company’s revenue grew by a record 122%. AMD’s data center business is increasingly focused on facilitating demand for AI growth.

The consensus rating from 37 Wall Street analysts is a “Moderate Buy” (25 buy, 11 hold, 1 sell). Their average 12-month price target is $147.81, which represents 40.65% upside potential from today’s price.

24/7 Wall Street’s 12-month projection for AMD’s price is $205.20, which would be a 95.26% gain from today’s price. We believe Dr. Su’s goal of end-to-end AI utility is already underway, with AMD competing with Nvidia in a similar fashion and strategy to how it challenged Intel: with comparable or superior speed and performance for lower prices.

At present, no smartphone utilizes any AMD CPUs. Nevertheless, AMD has already announced the availability of Ryzen chips for mobile devices. By 2030, the growth of AI-powered mobile gaming should reach the point where the demand for Ryzen performance in smartphones by game-oriented users should see Ryzen-powered smartphones. This would be a huge boon for AMD, as the smartphone market is a major one that has long eluded it. The 24/7 Wall Street price target for AMD in 2023 is $396.20, or 277.01% potential upside from today’s price.

| Year | EPS | Price | % Change From Current Price |

| 2025 | $6.84 | $205.20 | 95.26% |

| 2026 | $7.90 | $237.12 | 125.64% |

| 2027 | $9.81 | $294.40 | 180.14% |

| 2028 | $10.20 | $306.00 | 191.18% |

| 2029 | $11.20 | $336.00 | 219.73% |

| 2030 | $13.21 | $396.20 | 277.01% |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.