There has been a movement to get generic pharmaceutical drugs to market with for years. The notion of “biosimilars” has grown as well. Effectively this is making biotech drugs into something close to the traditional generics, but the complexity of the process has stirred debate over how effective a biosimilar is versus old-school, generic drugs.

Now we have word that a biosimilar application filing from Apotex has been accepted by the U.S. Food and Drug Administration (FDA) for pegfilgrastim, a biosimilar version of Amgen’s Neulasta.

Neulasta is the long-acting formulation of Neupogen, listed as filgrastim, which is taken by cancer patients undergoing chemotherapies in order to help fight infections and fever by boosting white blood cell counts. If you are a cancer patient, would you want a biosimilar or prefer the real drug?

The question to ask is not just what this means for Amgen Inc. (NASDAQ: AMGN) financially. Quite literally there are billions of dollars sales up for grabs here, for Amgen and Apotex alike. One has to wonder if the public will want the equivalent or the real thing. After all, this is a drug used in various cancer treatments.

Fitch Ratings discussed the expected launch of biosimilars against the top five biotech drugs in its outlook earlier in 2015, talking about a lack of interchangeability upon launch and limited inroads. Fitch said it put potential business losses from biotech patent expirations at 20% to 30%, as opposed to 80% to 90% typically seen with patent lapses of small molecule drugs.

ALSO READ: 10 Brands That Will Disappear in 2015

Apotex is said to be the largest Canadian-owned pharmaceutical company, and the product was jointly developed with Intas Pharmaceuticals. Apotex also announced in its release that it believes it is the first company to have a biosimilar filing accepted for review by FDA for the long-acting formulation of the product. Apotex also said that its application was filed under the abbreviated approval pathway created by the Biosimilar Price Competition and Innovation Act.

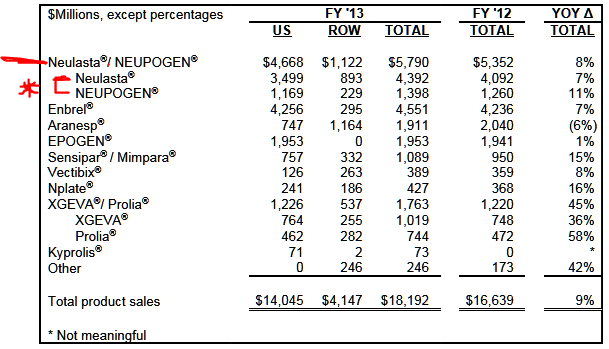

Apotex used a figure from IMS Health that Neulasta had approximately $3.6 billion in sales in calendar year 2013. Amgen’s 2013 annual report showed that combined Neulasta (pegfilgrastim) and Neupogen (filgrastim) sales were up by 8% over 2012 for the fourth quarter and for the full year. 24/7 Wall St. has included a table below in order to highlight Amgen’s total sales to show how large a risk this could pose. Amgen showed the following:

- Global Neulasta sales rose by 10% year-over-year for the fourth quarter and rose 7% for the full year, driven mainly by price.

- Global Neupogen sales fell by 1% year-over-year for the fourth quarter, but sales increased by 11% for the full year due to a $155 million order from the U.S. government that occurred in the third quarter of 2013.

Apotex’s, president and chief executive officer, Dr. Jeremy B. Desai, said:

We are very pleased to be at the forefront of companies who will introduce high quality biosimilar products into the US marketplace. Our entry into this new frontier of medicine in the United States is a watershed event in Apotex’s 40 year history of providing quality, affordable medicines to patients in need around the globe. The benefits for patients, payers and providers from biosimilars will be significant. We are dedicated to playing a leading role in the effort to increase the American public’s access to more affordable versions of these life-saving therapies and generate substantial savings for the US health care system.

ALSO READ: The 7 Worst Investments of 2014

What is interesting here is that Amgen shares were last seen up almost 1% at $161.01 in late morning trading on Wednesday. Amgen’s 52-week trading range is $108.20 to $173.14, and its consensus analyst price target from Thomson Reuters is $168.67.

It is hard to know if a biosimilar on the market will have the same impact as a generic drug, but there has been a desire and trend to get more biosimilars to the market. Other companies have been involved in the biosimilar market for Neulasta as well.

- Coherus BioSciences Inc. (NASDAQ: CHRS) recently said that it was finalizing the development plan for its pegfilgrastim (Neulasta) biosimilar candidate, CHS-1701, based on feedback it had received from the FDA regarding its decision to transition to the 351(k) regulatory pathway.

- Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) lists Lipegfilgrastim in its oncology program as follows: “A randomized, Phase IIIB, open-label, two-arm, multicenter, comparative study on efficacy and safety of Lipegfilgrastim (Lonquex, TEVA) in comparison to Pegfilgrastim (Neulasta, Amgen) in elderly patients with aggressive B cell Non-Hodgkin lymphomas at high risk for R-CHOP-21-induced neutropenia — AVOID Neutropenia.”

Note that an earlier Amgen release discussed its own biosimilars ambition in its plans out to 2018. As its patents expire, Amgen may be able to go out and capture revenues at the expense of its rivals.

The notion of a biosimilar coming out as competition is not new. That being said, there are still billions of dollars in potential drug sales up for grabs.

ALSO READ: America’s Most and Least Healthy States

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.