Health and Healthcare

Concerns Persist on Mylan EpiPen Price Gouging -- or Do They?

Published:

Last Updated:

24/7 Wall St. wanted to review several analyst reports covering the EpiPen fiasco. Not all analysts feel that Mylan will be hammered for this price hike. Still, it is without argument that Mylan and its management team may have made the wrong assumption in thinking that their price hikes would go largely unnoticed.

It is important to consider that not all analysts see the current week’s pricing news as a disaster. It’s also important to understand that opposing views help to create a fair market for buyers and sellers.

Merrill Lynch’s Sumant Kulkarnia has maintained a Buy rating and kept the firm’s $70 price objective. The take here is that the news will blow over without too much damage. That report said:

Given renewed public interest in EpiPen pricing, we are taking a more detailed look at Mylan’s largest product. Competitive threats exist but Mylan’s diversification means EpiPen contributes about 10% of our discounted cash flow value per share of $70. We do not see EpiPen pricing risk as a reason to avoid Mylan and the recent pullback is a particularly good opportunity.

With significant acquisitions, Mylan transformed itself from a US-only, generic-only story into a global, diversified, vertically-integrated one. We are encouraged by several quarters of robust execution, and the company has built a platform on which to grow. We believe continued execution and potential business development activity in redomiciled Mylan’s new, more tax-efficient structure could be the keys to future stock performance.

Guggenheim’s Louise Chen and Brandon Folkes addressed this Mylan issue back on August 17. They said at that time in a much larger sector review, while maintaining only a Neutral rating, that Mylan is getting over the anaphylactic-shock value. They said:

Relative to its competitors, Mylan’s stock appears inexpensive, at 6.9x EV/EBITDA. Mylan has a durable, global business and investment grade debt. If the company can execute, the stock could trade higher, but we think hitting the objectives is not that easy. We see a few potential catalysts for Mylan in the second half of 2016: 1) Lack of competition for Epipen, which has been positive for Mylan this year; 2) An approval for generic Advair in ’17; and 3) Biosimilar pipeline advancements in 2016.

Wells Fargo’s David Maris has a Market Perform rating on Mylan, despite having a specialty pharma sector rating of Overweight. His valuation range is $43.00 to $45.00, based on a weighted average cost of capital 8.5% and eight times enterprise value to EBITDA.

Maris sees the potential upside to its valuation range being insufficient to warrant a higher analyst rating. He now believes that other pharma players have better risk-return profiles. Wells Fargo put up seven risks in its valuation range:

(1) U.S. generic drug market dynamics will likely be less favorable in 2016 than prior years;

(2) generics companies may have less political cover in the U.S. going forward;

(3) generic drug penetration may have already peaked;

(4) EpiPen concentration of sales and profits;

(5) governance risk;

(6) SEC investigations and lawsuits;

(7) integration risk tied to the Meda deal.

Maris said in his investment thesis:

We remain Market Perform as overhangs include the integration of the Meda transaction, two large non-strategic shareholders, and lack of meaningful earnings upside on the core base business.

Maris also brought up the social media backlash. He pointed out that Bernie Sanders tweeted out Mylan criticism to his 2.5 million followers on Twitter, with the tweet being liked over 20,000 times and retweeted more than 8,000 times. Another note was that even Mark Cuban tweeted to his 5.4 million Twitter followers that regulation will cost pharma far more than empathy for life-saving drugs.

S&P Global’s Jeffrey Loo maintained his Buy rating on August 20 on Mylan. His report said:

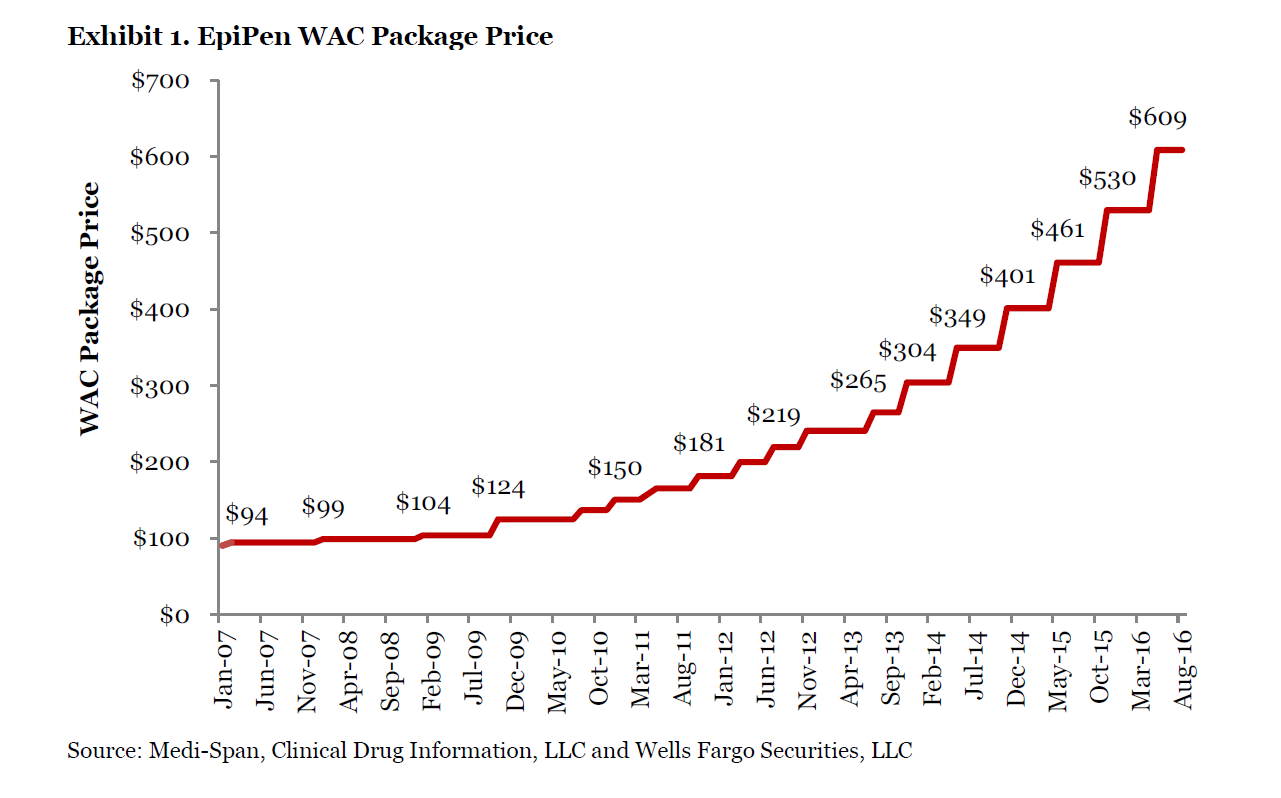

Mylan shares were down significantly after Senator Chuck Grassley sent a letter to Mylan’s CEO regarding the price of allergic reaction injector, EpiPen, which has increased 400% since 2008 to $500. Separately, Senator Amy Klobuchar asked the FTC to investigate if contracts Mylan has with insurers deny patients alternatives such as Adrenaclick. But we note Adrenaclick has a similar price point at $400. We believe EpiPen has over a 90% market share and accounts for just under 10% of Mylan sales. Although we see near term price pressure we do not anticipate any impact to EpiPen sales.

Mylan shares were last seen trading down 11 cents on Wednesday, at $45.50, in a 52-week range of $37.59 to $55.51. The consensus analyst target is $58.31, according to Thomson Reuters. On August 18, Mylan shares were trading north of $49. That was then.

An image from Wells Fargo’s EpiPen price history has been included below.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.