Health and Healthcare

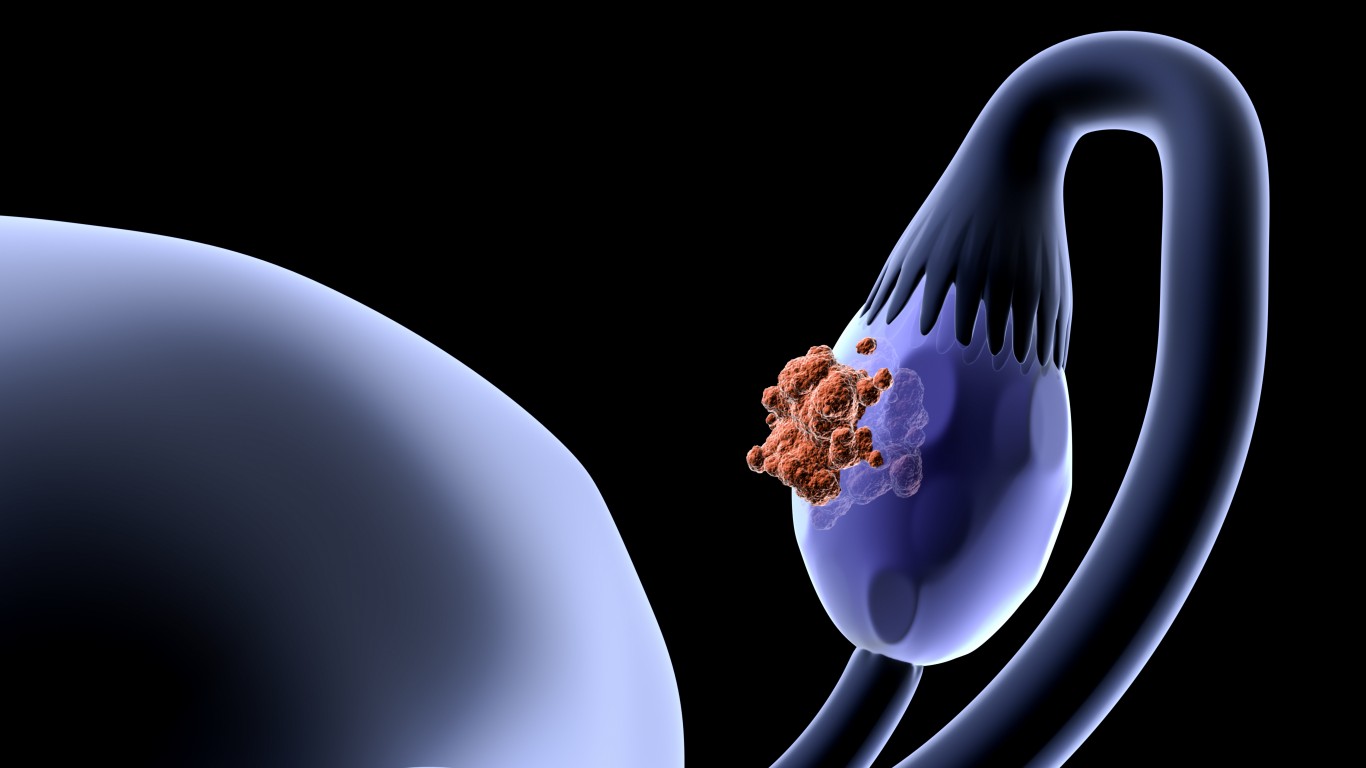

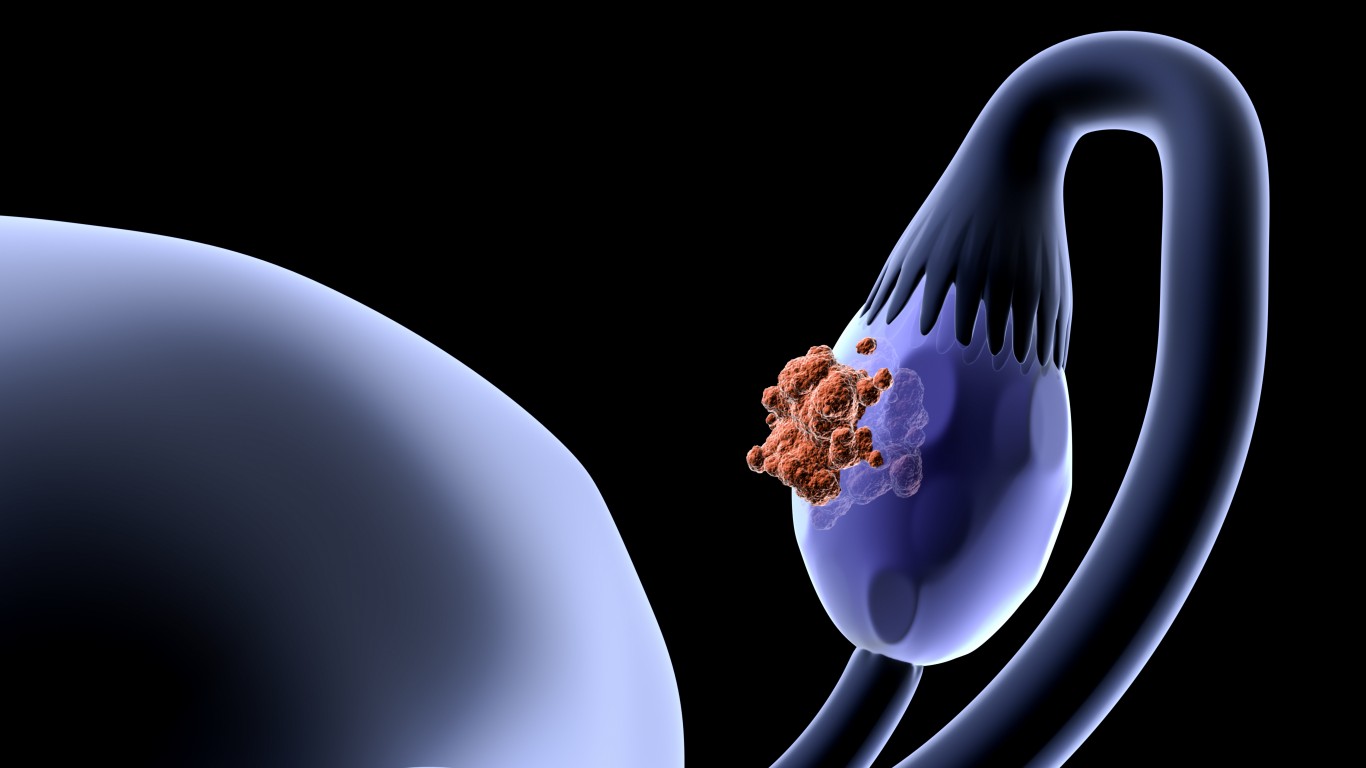

Sutro Bio's Ovarian Cancer Treatment Ready for the Next Level

Published:

Sutro Biopharma Inc. (NASDAQ: STRO) made a huge gain to close out the week after the firm provided an update from its ongoing dose-escalation in its ovarian cancer trial.

In terms of the specifics, the data comes from the Phase 1 study of STRO-002, a folate receptor alpha (FolRα) targeting antibody-drug conjugate, for patients with ovarian cancer.

The dose-escalation portion of the study was fully enrolled with 39 patients in August 2020. Patients were heavily pretreated and had a median of six prior lines of therapy.

Results out of 31 evaluable patients included:

- 10 patients met RECIST criteria for response. Of which, 1 patient achieved a complete response (CR) and 9 patients achieved a partial response (PR). Of the PRs, 3 were confirmed PRs (cPRs) and 6 unconfirmed PRs (uPRs)

- 23 patients (74%) achieved disease control at 12 weeks

- 18 patients (58%) achieved disease control at 16 weeks

- 4 patients (13%) were on treatment for 52 weeks. 3 patients remained on treatment beyond 64 weeks

As it stands, the treatment continues to be well tolerated, and 86% of all treatment-emergent adverse events were grade 1 or 2. The most common grade 3 and 4 adverse events were reversible neutropenia.

Management noted that the women in the study were heavily pretreated and have limited treatment options, as many have received experimental agents and participated in other clinical trials.

Looking ahead, the broad therapeutic index of STRO-002 should allow for long-term dosing and dose intensity. Although a maximum tolerated dose was not reached, the firm has identified dose levels of 4.3 and 5.2 mg/kg that it plans to randomize in the dose-expansion. Sutro plans to dose the first patient January 2021 and will be treating less heavily pretreated ovarian cancer patients.

Sutro Biopharma stock traded up 37% to $23.33 on Friday, in a 52-week range of $6.00 to $23.50. The consensus price target is $21.57.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.