Gilead Sciences Inc. (NASDAQ: GILD) is set to report its third-quarter financial results after the markets close on Thursday. Thomson Reuters has consensus estimates that call for $2.89 in earnings per share (EPS) on $7.82 billion in revenue. The same period from the previous year had $1.84 in EPS on $6.04 billion in revenue.

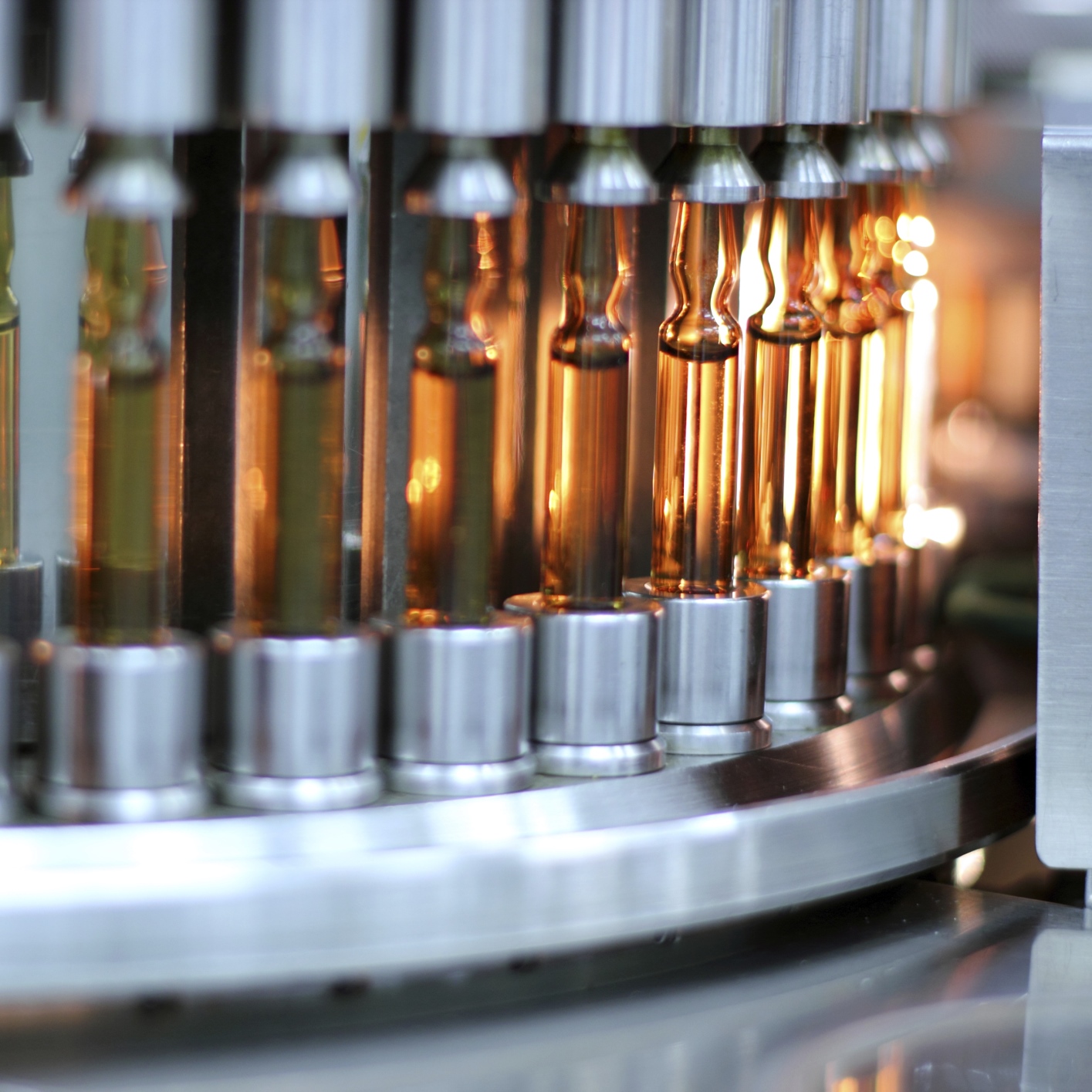

This company discovers, develops and commercializes medicines in areas of unmet medical need in North America, South America, Europe and the Asia-Pacific. Its products include Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults, and Harvoni, Sovaldi, Viread and Hepsera products for the treatment of liver disease.

It recently announced that the FDA has approved Letairis in combination with Eli Lilly’s Adcirca for reducing the risk of disease progression and hospitalization and improving exercise ability in patients suffering from pulmonary arterial hypertension. Both Letairis and Adcirca are approved in the United States, European Union and elsewhere as once-daily treatments for patients with pulmonary arterial hypertension.

Recently, the U.S. Food and Drug Administration (FDA) issued a warning that hepatitis C treatments Viekira Pak and Technivie can cause serious liver injury, mostly in patients with underlying advanced liver disease. The markets reacted very negatively to AbbVie Inc. (NYSE: ABBV) on this news, but Gilead came out on top because it produces a competing hepatitis C vaccine.

As a result, the FDA is requiring the manufacturer to include information about serious liver injury adverse events to the Contraindications, Warnings and Precautions, Postmarketing Experience and Hepatic Impairment sections of the Viekira Pak and Technivie drug labels.

ALSO READ: Short Sellers Become More Selective on Leading Biotechs

Ahead of its earnings report, a few analysts weighed in on Gilead’s position:

- JPMorgan reiterated a Buy rating with a $133 price target.

- Oppenheimer reiterated an Outperform rating but raised its price target to $124 from $120.

- RBC Capital reiterated a Buy rating with a $130 price target.

- Jefferies has a Hold rating but lowered its price target to $107 from $115.

So far in 2015, Gilead has outperformed the market, with the stock up 16% year to date, while over the past 52 weeks the stock is down 1%.

Shares of Gilead were last seen Tuesday trading up 1.1% at $109.80, with a consensus analyst price target of $124.25 and a 52-week trading range of $85.95 to $123.37.

Are You Ahead, or Behind on Retirement?

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.