Health and Healthcare

Thermo Fisher Pays $4.2 Billion for Microscope Maker

Published:

Last Updated:

Scientific instrument maker and supplier Thermo Fisher Scientific Inc. (NYSE: TMO) said Friday morning that it has agreed to acquire FEI Co. (NASDAQ: FEIC) for $107.50 per share in cash, or approximately $4.2 billion. The price represents a premium of about 13.7% to Thursday’s closing price of $94.58 for FEI shares.

The transaction is expected to close by early next year, subject to FEI shareholder approval and other customary closing conditions and regulatory approvals. Thermo Fisher said it plans to use proceeds from committed debt financing and cash on hand to fund the acquisition.

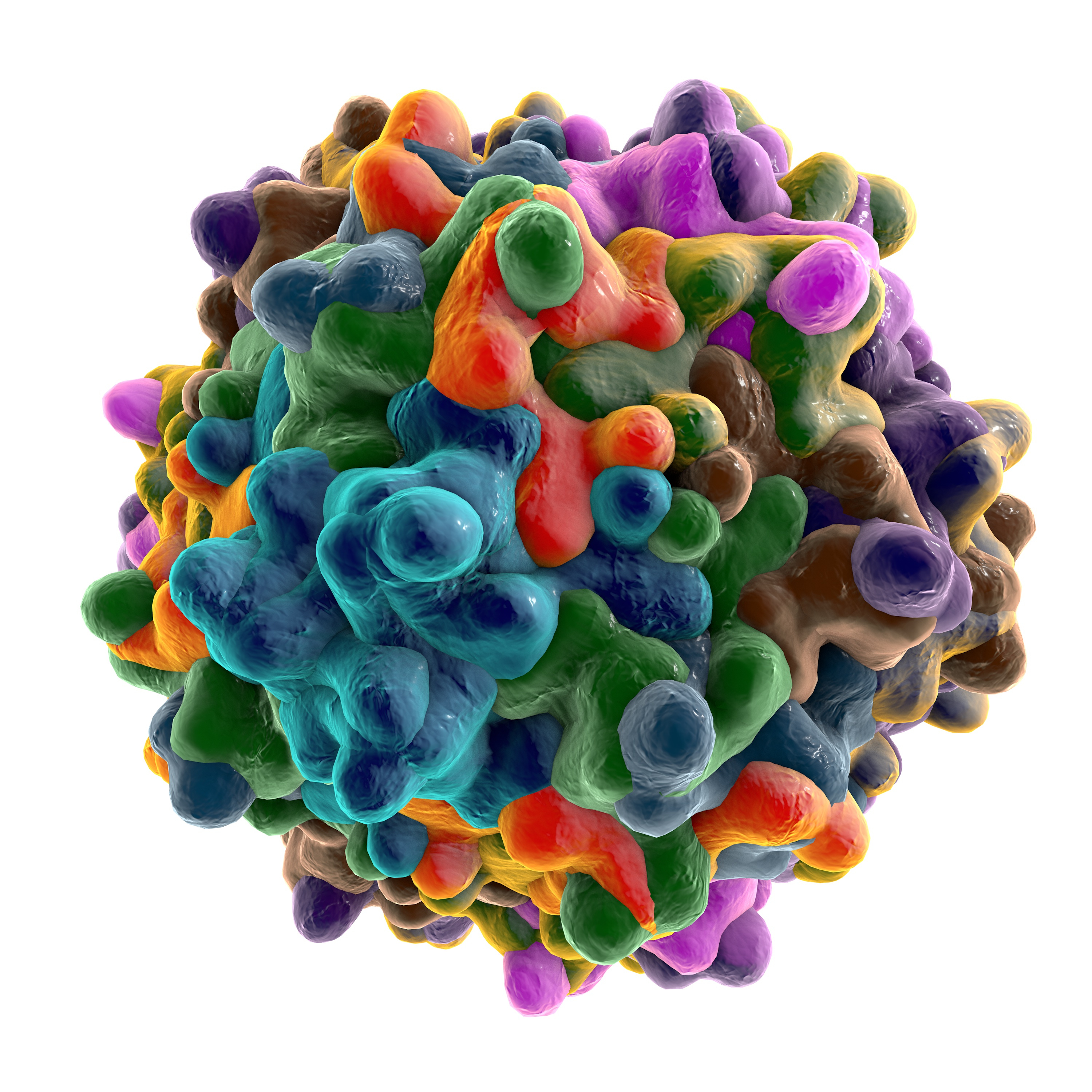

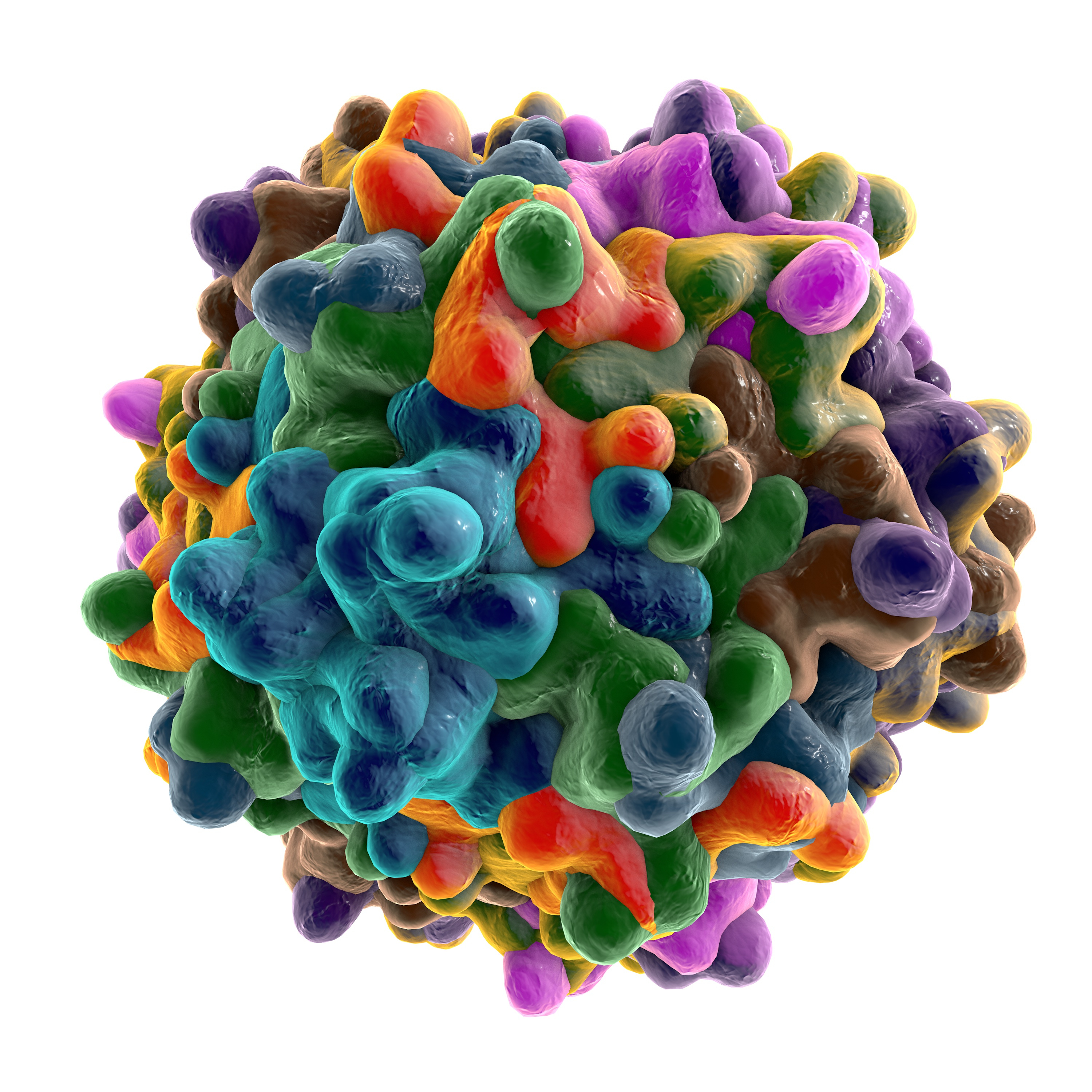

FEI designs, manufactures and supports high-performance electron microscopy workflows that provide images and information at micro-, nano- and picometer scales. The company posted 2015 revenues of $930 million.

Marc Casper, president and CEO of Thermo Fisher said:

In life sciences, there is growing adoption of electron microscopy to study the structure of proteins. The technologies we gain with FEI will complement our mass spectrometry leadership, putting Thermo Fisher in the best position to capitalize on this important trend.

Thermo Fisher expects the acquisition to add $0.30 per share to earnings in the first full year after the deal closes. In addition, the company expects total synergies of about $80 million by the third year following the close, consisting of $55 million in cost synergies and about $25 million in adjusted operating income benefits.

Analysts at Janney called Thermo Fisher the “Amazon of Life Science” in a note Friday morning. Here’s their take on the deal:

[Thermo Fisher] is the largest on-line supplier of lab products in the world and this is an easy add to the analytical instrument division. [Thermo Fisher] and Agilent are the world leaders with coverage of every major instrument category (excluding [nuclear magnetic resonance (NMR)]) and this will be a good adjunct for [Thermo Fisher].

Shares of FEI traded up more than 13% Friday morning to $107.55, above a prior 52-week range of $64.93 to $94.90. The previous high was posted Thursday.

Thermo Fisher shares hit a new 52-week high $152.14 Friday morning, topping the previous high from Thursday. The 52-week low is $117.10.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.