Health and Healthcare

AbbVie Slumps on Late-Stage Lymphoma Trial

Published:

Last Updated:

AbbVie Inc. (NYSE: ABBV) shares dipped on Wednesday after the company gave a less than impressive update from its late-stage lymphoma trial.

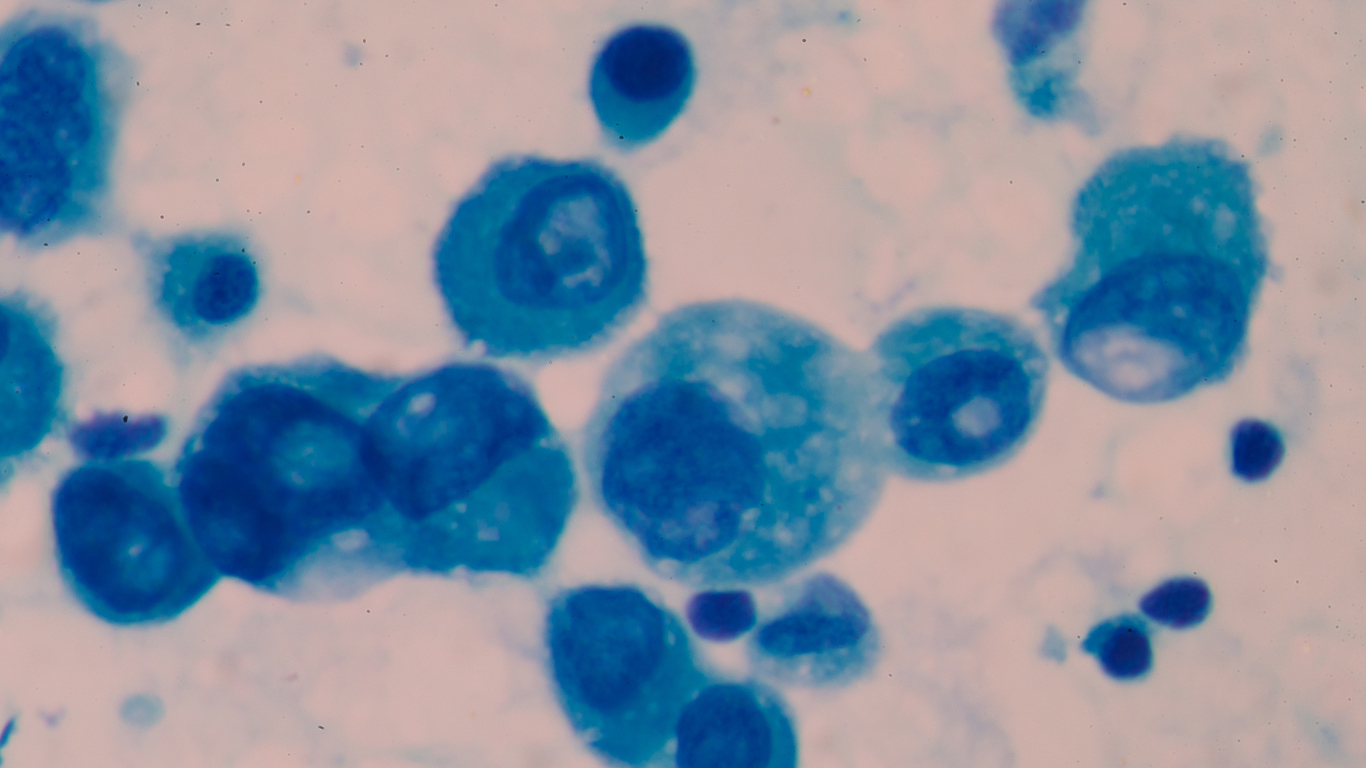

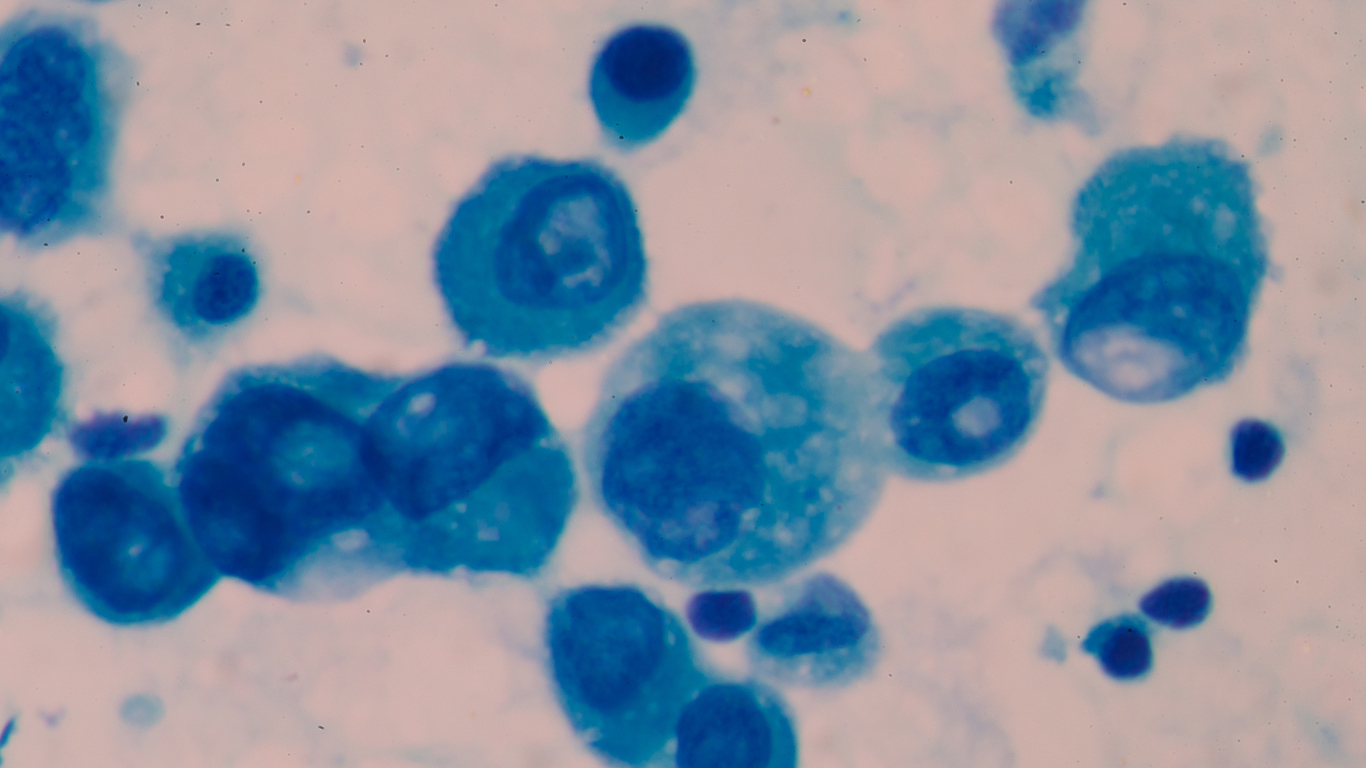

Essentially, the company updated its Phase 3 study (DBL3001) of ibrutinib (Imbruvica) in untreated diffuse large B-cell lymphoma, an aggressive form of non-Hodgkin lymphoma.

For some quick background: Imbruvica is a first-in-class Bruton’s tyrosine kinase inhibitor jointly developed and commercialized by Pharmacyclics, an AbbVie company, and Janssen Biotech. Imbruvica has been available in the United States since 2013 and is FDA-approved for use in five B-cell blood cancers, as well as in chronic graft-versus-host-disease for a total of eight FDA-approved indications.

At conclusion of the study, data collected found that ibrutinib plus the chemotherapy regimen, R-CHOP, was not superior to R-CHOP alone, and that the study did not meet its primary endpoint of improving event-free survival in the targeted patient population.

However, clinically meaningful improvements were observed in a patient sub-population that warrant further analysis.

Thorsten Graef, M.D., Ph.D., Head of Clinical Development at Pharmacyclics LLC, commented:

Since its first U.S. FDA approval in 2013, IMBRUVICA has redefined standard of care in many different blood cancers – several of which had little to no treatment options available to patients before. These medical achievements reflect our objective of focusing research where there is great unmet patient need and understanding that the nature of research is such that some studies succeed and others do not. We continue to believe that ibrutinib has great untapped potential as a cancer treatment alone or in combination. Together with our global partner Janssen, we are advancing our robust ibrutinib scientific development program and anticipate results from several studies in the future.

Shares of AbbVie were last seen down about 3% at $95.91, with a consensus analyst price target of $113.62 and a 52-week range of $69.38 to $125.86.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.