Health and Healthcare

Why Accelerated Approval Could Be Huge for This Ovarian Cancer Study

Published:

Last Updated:

ImmunoGen Inc. (NASDAQ: IMGN) shares jumped on Tuesday after the U.S. Food and Drug Administration (FDA) advised that a new single-arm study in platinum-resistant ovarian cancer could support accelerated approval.

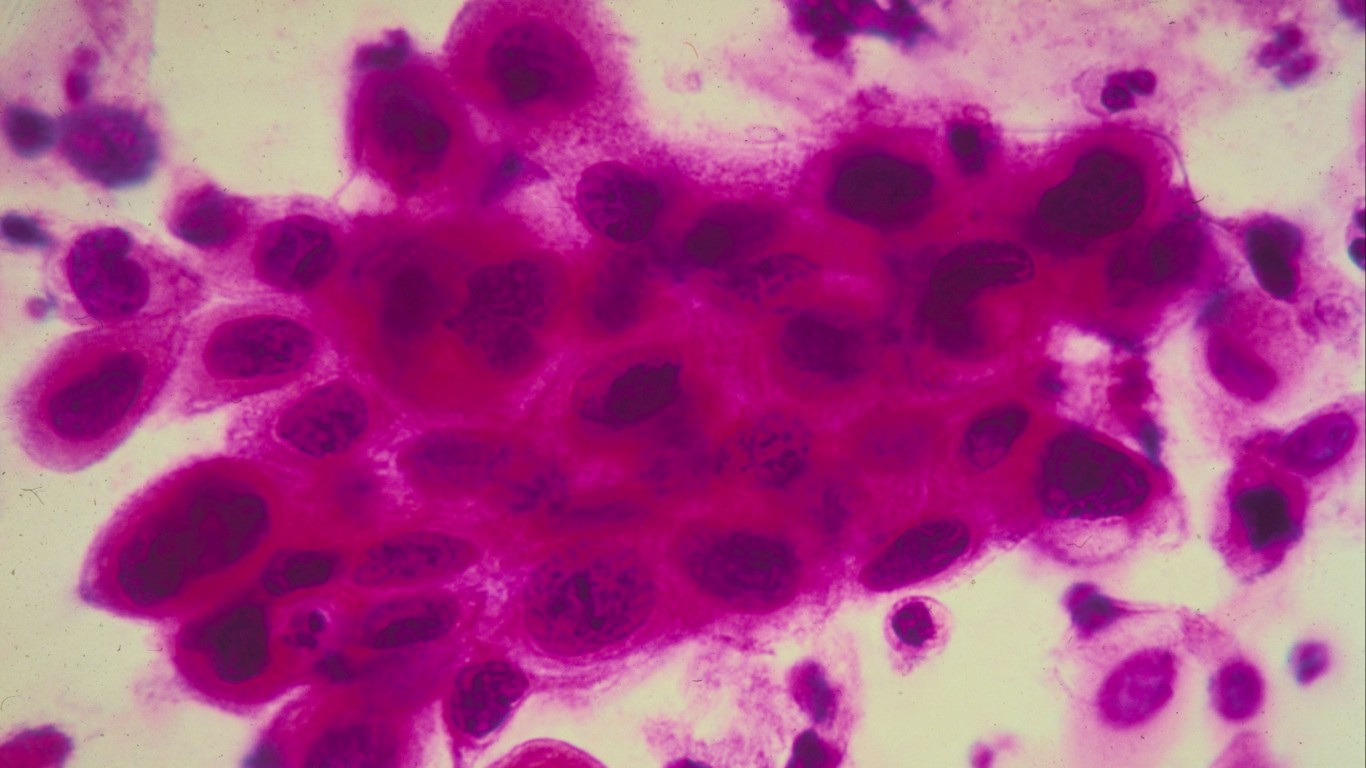

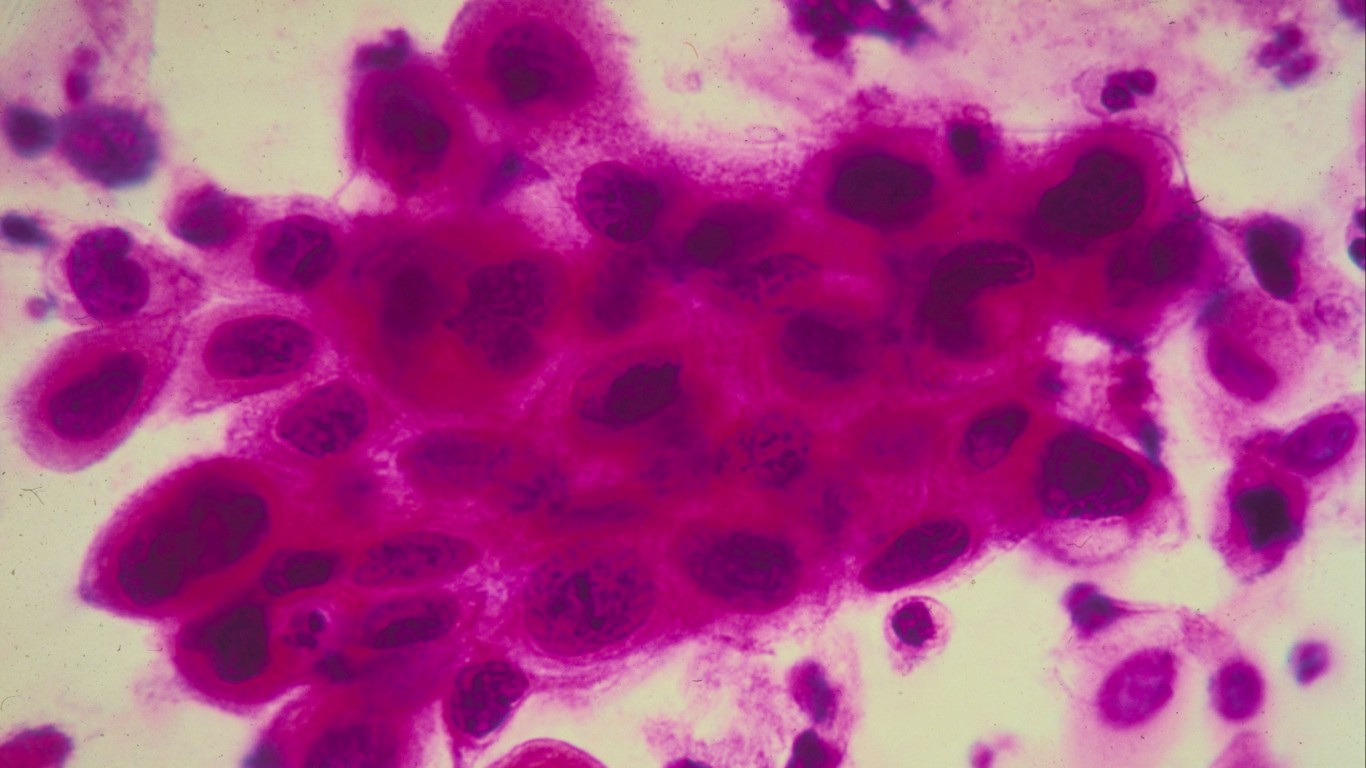

Based on the FDA’s guidance, ImmunoGen will initiate its Soraya trial to evaluate mirvetuximab monotherapy in women with folate receptor alpha (FRα)-high platinum-resistant ovarian cancer who have been previously treated with Avastin (bevacizumab).

Soraya is a single-arm pivotal trial with mirvetuximab that will enroll approximately 100 patients. The primary endpoint of this study is overall response rate by investigator assessment and the key secondary endpoint is duration of response.

Results from ImmunoGen’s previous Forward study saw favorable results in a similar indication, and they compare quite favorably to single-agent chemotherapy. Ultimately, replicating the results from the Forward study in Soraya would support an application for accelerated approval in advance of the completion of the Mirasol trial (investigating mirvetuximab versus single-agent chemotherapy). With all these dominos falling in line, it would provide the randomized data needed for conversion to full approval.

Mark Enyedy, ImmunoGen’s president and CEO, commented:

We have engaged in constructive discussions with FDA and evaluated all avenues to bring mirvetuximab to patients more quickly. Having aligned with the agency that women with FRα-high platinum-resistant ovarian cancer that has progressed after prior treatment with bevacizumab require better therapeutic options, we are pleased to advance mirvetuximab in this patient population with Soraya, which, if successful, would enable us to submit an application for accelerated approval during the second half of 2021. We anticipate enrolling the first patient in Soraya next quarter and expect top-line data from the study in mid-2021.

Shares of ImmunoGen were last seen up about 13% to $4.40, in a 52-week range of $1.76 to $6.13. The consensus price target is $4.67.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.