Health and Healthcare

Aurinia Pharma's Dry Eye Study Blanks on Late-Stage Results

Published:

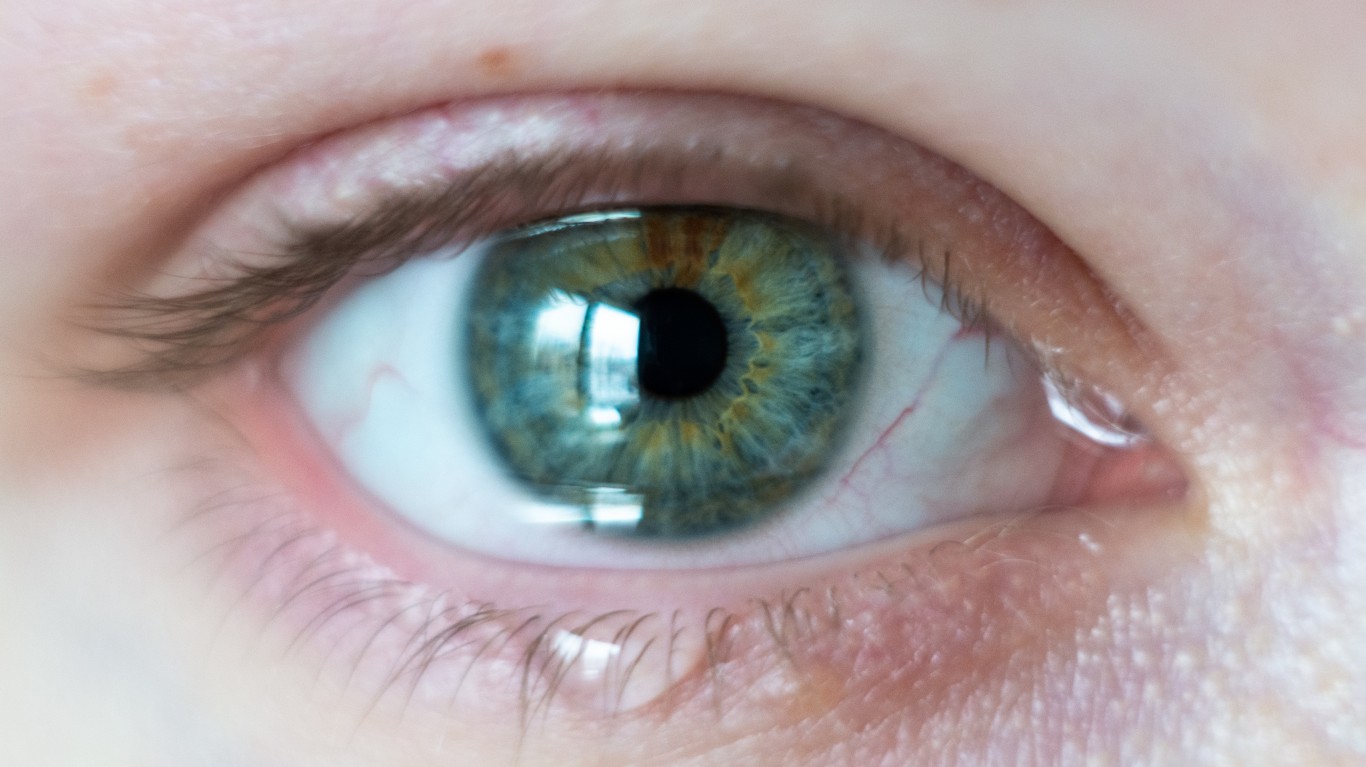

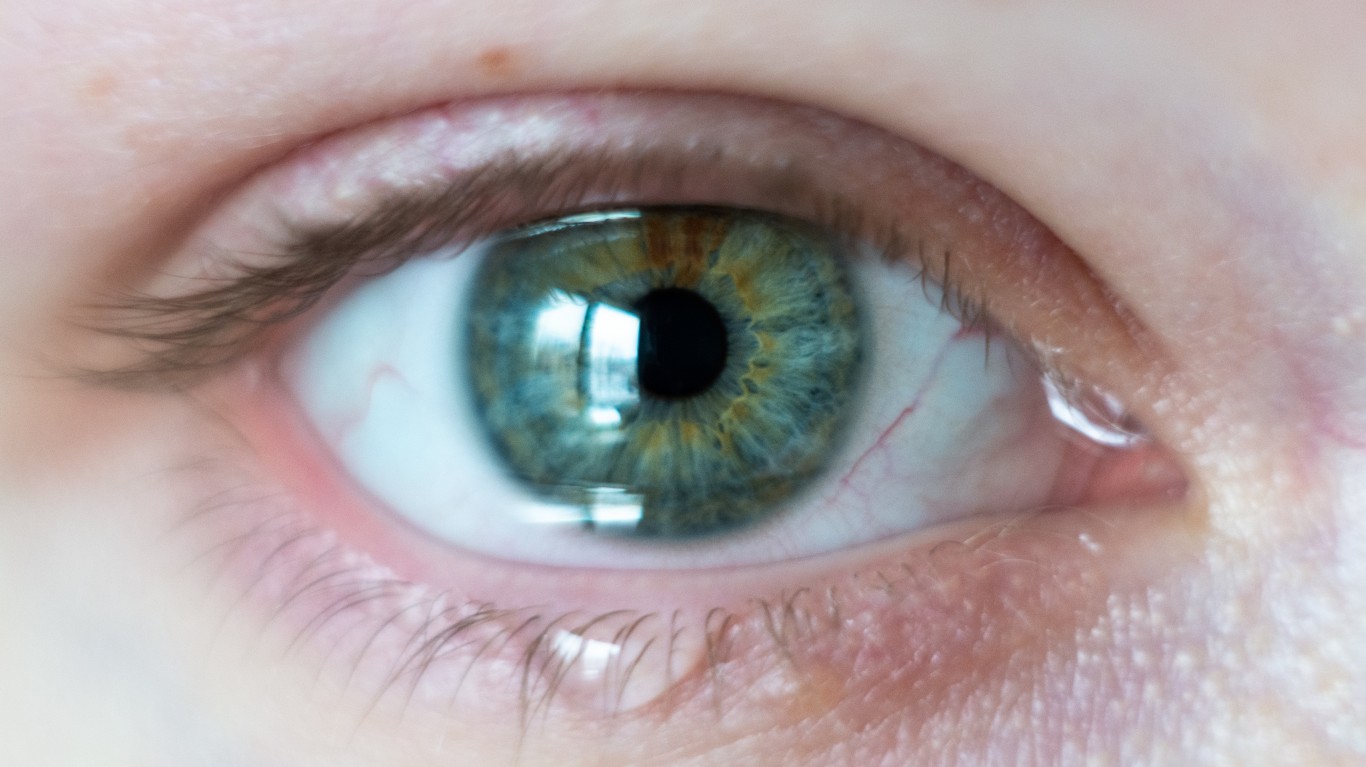

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) shares slid on Tuesday after the company reported results from its midstage study for the treatment of dry eye syndrome (DES). Unfortunately, the topline results did not live up to expectations, and the firm has decided to suspend development of the program.

In terms of the specifics, the firm announced topline data from the Phase 2/3 Audrey clinical study evaluating voclosporin ophthalmic solution (VOS) for the potential treatment of DES.

The trial did not achieve statistical significance on its primary endpoint of a 10mm or greater improvement in Schirmer Tear Test at four weeks between active dose groups of VOS compared to vehicle.

Based on these initial topline results that Aurinia is continuing to interrogate, management is suspending the DES program at this time.

Separately, the initial analysis of these secondary outcomes suggests dose-dependent activity and safety were observed across dose groups compared to vehicle. However, further analysis must be done over the coming weeks.

Ultimately, the firm was surprised by these results, but management has decided to remain focused on preparing voclosporin for a different indication, lupus nephritis. This other indication has a different formulation and delivery mechanism compared to VOS.

Excluding Tuesday’s move, Aurinia Pharmaceuticals stock had underperformed the broad markets with a retreat of 23% year to date. In the past 52 weeks, the share price was actually up 202%.

Aurinia Pharmaceuticals stock traded down about 13% at $13.44 on Tuesday, in a 52-week range of $4.90 to $21.93. The consensus price target is $11.92.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.