Health and Healthcare

This Is How Many Rural Hospitals Could Close in Every State

Published:

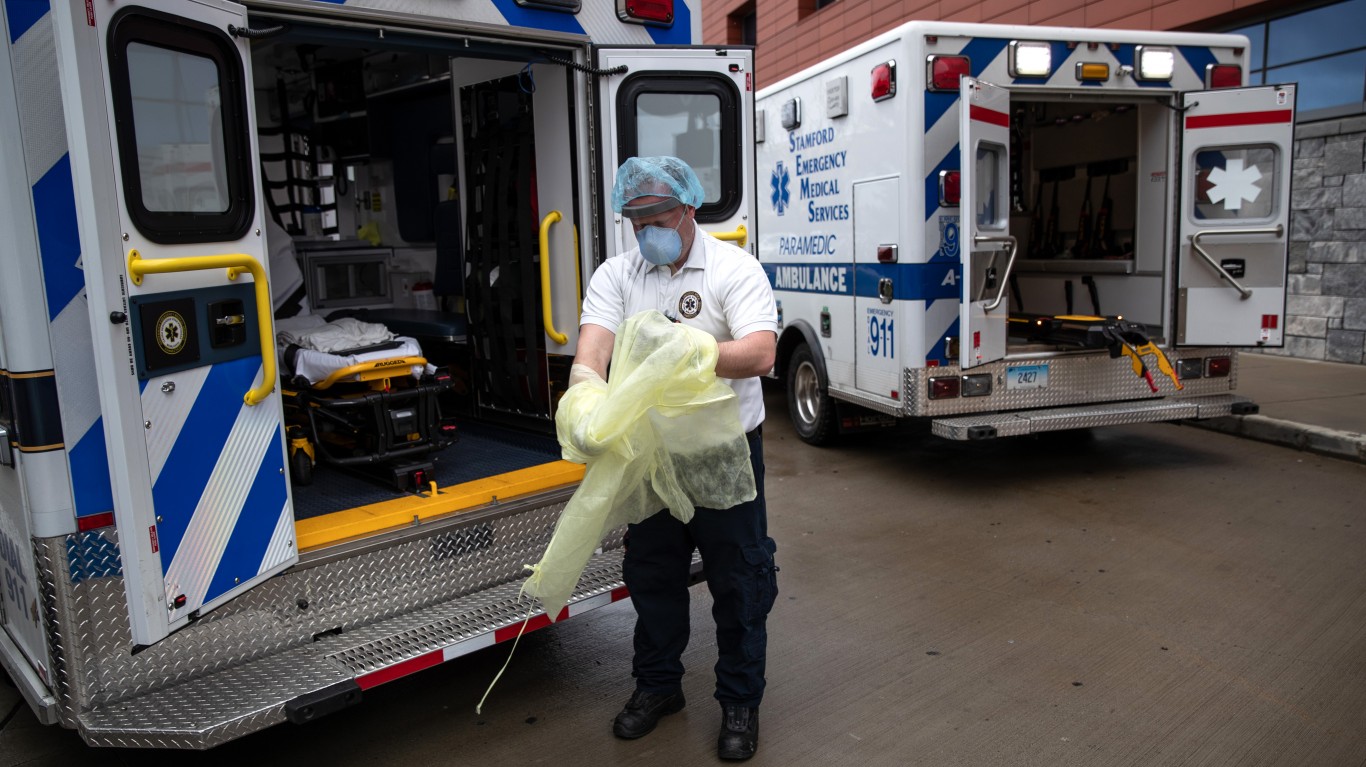

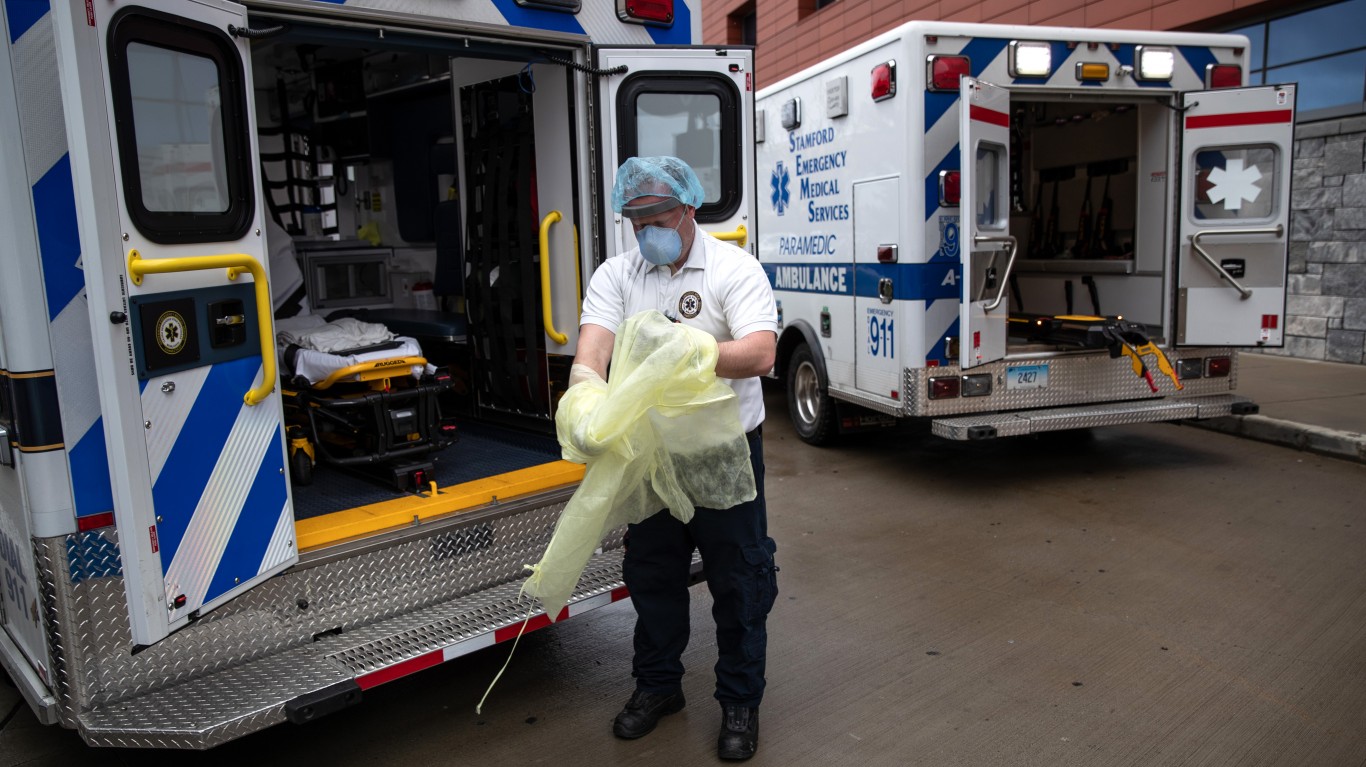

The strain of caring for the COVID-19 has financially threatened hospitals across the country. Their services have swung away from profitable procedures for other diseases and conditions and from more traditional emergency room visits to beds overflowing with critically ill coronavirus cases. Many rural hospitals have little or no financial reserves and have posted financial losses that have gone on for a long time. A substantial number of these may close, and close very soon. That will leave their communities without traditional medical facilities.

According to a new study by the Center for Healthcare Quality and Payment Reform, over 500 rural hospitals faced a high risk that they would “immediately close” even before the pandemic. This was measured against two yardsticks. The first is a “cumulative negative margin” over the most recent three-year period for which data are available. The other is that liabilities exceed assets when the value of building or equipment is backed out. Based on these measures, in 22 states, over 25% of rural hospitals are at immediate risk of closing.

The reason for the trouble, according to the study, is “The smallest rural hospitals are facing closure because the payments they receive for services are less than the. cost of delivering care to patients in rural communities.” This disparity is unlikely to go away in the foreseeable future.

The Center for Healthcare Quality and Payment Reform points out that most hospitals at risk are in communities isolated enough that they will have no emergency services or inpatient care at all. The extremely ill will need to be taken elsewhere.

In three states, the rural hospitals at immediate risk of closing are over half of the total for the state. These are Connecticut at 67%, Alabama at 56% and Mississippi at 53%. Four states have no rural hospitals at risk: Delaware, New Jersey, Massachusetts and Rhode Island.

This is the number of rural hospitals at risk of immediate closure by state:

| State | Total Rural Hospitals | At Immediate Risk of Closing |

|---|---|---|

| Alabama | 48 | 56% |

| Alaska | 13 | 31% |

| Arizona | 18 | 17% |

| Arkansas | 48 | 33% |

| California | 52 | 12% |

| Colorado | 41 | 12% |

| Connecticut | 3 | 67% |

| Delaware | 2 | 0% |

| Florida | 20 | 30% |

| Georgia | 61 | 36% |

| Hawaii | 12 | 25% |

| Idaho | 28 | 14% |

| Illinois | 73 | 19% |

| Indiana | 53 | 26% |

| Iowa | 90 | 27% |

| Kansas | 105 | 45% |

| Kentucky | 69 | 17% |

| Louisiana | 49 | 29% |

| Maine | 25 | 36% |

| Maryland | 4 | 25% |

| Massachusetts | 5 | 0% |

| Michigan | 63 | 21% |

| Minnesota | 91 | 21% |

| Mississippi | 66 | 53% |

| Missouri | 57 | 30% |

| Montana | 51 | 18% |

| Nebraska | 72 | 14% |

| Nevada | 13 | 15% |

| New Hampshire | 17 | 6% |

| New Jersey | 1 | 0% |

| New Mexico | 24 | 13% |

| New York | 51 | 24% |

| North Carolina | 53 | 17% |

| North Dakota | 37 | 24% |

| Ohio | 70 | 20% |

| Oklahoma | 73 | 38% |

| Oregon | 32 | 13% |

| Pennsylvania | 43 | 28% |

| Rhode Island | 0 | 0% |

| South Carolina | 25 | 40% |

| South Dakota | 45 | 20% |

| Tennessee | 51 | 47% |

| Texas | 147 | 21% |

| Utah | 21 | 5% |

| Vermont | 13 | 8% |

| Virginia | 28 | 43% |

| Washington | 40 | 20% |

| West Virginia | 24 | 25% |

| Wisconsin | 73 | 14% |

| Wyoming | 23 | 26% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.