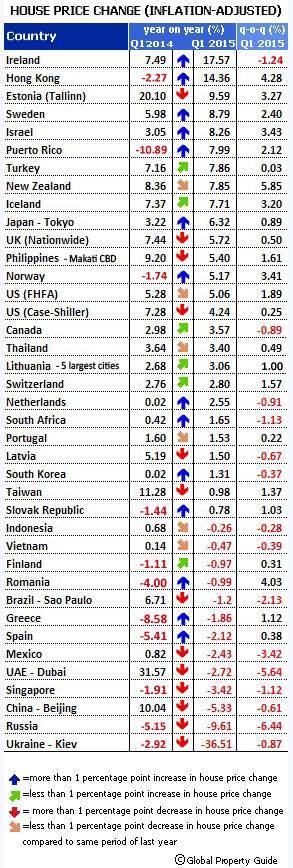

On a nominal basis, 31 of the 38 countries included in the survey posted price gains, while 25 posted gains based on inflation-adjusted data.

According to the latest survey by Global Property Guide, the strongest housing markets in the world are in Europe, with three of the top five. Of the 19 European markets the firm surveyed, 13 experienced year-over-year price increases. Estonia (Tallinn) and Sweden ranked third and fourth with increases of 9.6% and 8.8%, respectively.

As measured by the Federal Housing Finance Agency (FHFA), U.S. house prices rose 5.06% year over year, and as measured by the Case-Shiller index, U.S. housing prices rose 4.24%. The U.S. ranked 14th by the FHFA measure and 15th on the Case-Shiller index.

At the bottom of the rankings, Russia was second-worst with price decline of 9.6% and Beijing ranked third-worst with a decline of 5.3%.

ALSO READ: The Happiest Countries in the World

The stronger dollar played a role in the rankings, especially in Europe, where the euro fell by nearly a quarter with respect to the dollar. Buyers paying in dollars were getting a better deal than buyers paying in euros. Currency devaluation in Ukraine and Russia hit housing markets hard.

In Asia the two markets that saw sharp increases in housing prices were Hong Kong, ranked second overall with a price hike of 14.4%, and Japan (Tokyo), ranked 10th, with a jump of 6.3%. Japan’s economic stimulus package has helped boost housing prices, and with the country’s economy touted to post a 1% GDP gain in 2015, the price increases are likely to continue.

In China the government tapped the brakes last year and then tapped the accelerator. In Beijing the price index of existing residential buildings fell 5.3% year over year. Singapore saw its sixth consecutive quarter of falling housing prices.

The following table lists the ranking of the 38 countries that have published housing statistics so far.

ALSO READ: Countries With the Widest Gap Between the Rich and the Poor

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s made it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.